Identify The Negative Accounts

Now that you have your credit report go through it and highlight accounts with a negative status. Highlight any late payments, collection accounts, or any other negative information. Make sure your personal information is correct, including your address, employer, and phone number.

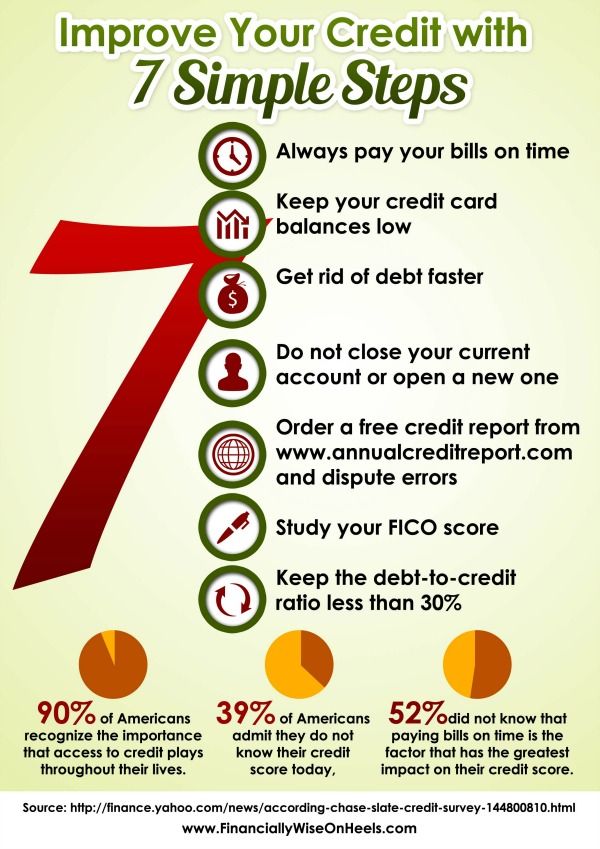

Items to focus on

Increase Your Credit Limit

You can increase your credit limit one of two ways: Either ask for an increase on your current credit card or open a new card. The higher your overall available credit limit, the lower your credit utilization rate . Before asking for a credit limit increase, make sure you won’t be tempted to spend more than you can afford to pay off.

If you are considering opening a new credit card, do your research beforehand. How often you apply for and open new accounts gets factored into your credit score. Each application requires the card issuer or lender to pull your credit report, which results in a hard inquiry on your report and dings your credit score a few points.

“Usually the negative impact of those factors is much less than the benefit to your score of reducing your credit utilization ratio,” Triggs says. Just make sure you don’t apply to too many credit cards over a short amount of time and send a red flag to issuers.

It’s more important now than ever to do your research before applying for new credit because issuers may have stricter terms and requirements in wake of the economic fallout from coronavirus. Check to see what your credit score is beforehand.

Be An Authorized User

Being an means that you will have to ask someone to add you to their existing credit card account. But, you must choose someone close to you who has a high credit limit and satisfactory on-time payment history.

Their credit card account will appear on your . The high credit limit can help your credit utilization improve. Thats why becoming an authorized user is one of the most efficientstrategies to improve your credit score.

You dont have to use the card or even know the account number for this method to help improve your score. Plus, the impact is pretty quick! As soon as youre added, and the accounts reported to the three bureaus, it will appear on your credit report.

Recommended Reading: Does Zzounds Report To Credit Bureau

Check And Understand Your Credit Score

Its important to know that not all credit scores are the same, and that they fluctuate from month to month, depending on which credit bureaus lenders use and how often lenders report account activity. So, while you shouldnt worry if you see your scores rise or fall by a few points, you should take note when a big change occurs.

The two main consumer credit scoring models are the FICO Score and VantageScore. Here are the factors that comprise your FICO Score and how much each factor is weighed:

- Payment history

- Amounts owed

- Length of credit history

- New credit

Here are the factors influencing your VantageScore:

- Total credit usage, balance and available credit

- Payment history

- Age of credit history

- New accounts

There are a variety of options for checking your credit score for free.

For example, consumers can get a free FICO Score from the Discover Credit Scorecard even without having a Discover credit card, and a free VantageScore by creating a LendingTree account. American Express and Capital One also offer free credit scores to both card account holders and the general public, though many other card issuers offer free access only to their cardholders.

Here are the tiers that credit scores can fall into, according to FICO:

| FICO Score tiers |

| Poor credit |

Have A Variety Of Credit Accounts

While you should only borrow money when necessary, having a variety of credit accounts can demonstrate you can manage credit responsibly. You might have one credit card, a home mortgage and a car loan. Each type of account can benefit your credit score differently.

Loans that you repay in full can remain on your credit report for up to ten years. You can have an easier time qualifying for a similar loan in addition to having a higher credit score.

Also Check: How To Remove Repossession From Credit Report

Add Rent Payments To Your Credit Report

If you regularly pay rent on time, add those payments to your credit report to boost the amount of positive information reported to the credit bureaus. You can do so by signing up with a service like RentTrack or PayYourRent. In many cases, getting your landlord or property management company on board will limit the fees you’ll be charged.

Pay Attention To Credit Utilization

Your credit utilization rate is the amount of revolving credit youre using divided by the amount of revolving credit you have available. It makes up 30% of your credit score and is often the most overlooked method of improving your score. For most people, revolving credit just means credit cards, but it includes personal and home equity lines of credit as well. A good credit utilization rate never exceeds 30%. So, if you have a credit limit of $5,000, you should never use more than $1,500.

Don’t Miss: Credit Report Without Ssn Or Itin

Tips To Increase Your Credit Score

If you are like many consumers and dont know your credit score, there are several free places you can find it. The Discover Card is one of several credit card sources that offer free credit scores. Discover provides your FICO score, the one used by 90% of businesses that do lending. Most other credit cards like Capital One and Chase give you a Vantage Score, which is similar, but not identical. Same goes for online sites like Credit Karma, Credit Sesame and Quizzle.

The Vantage Score comes from the same place that FICO gets its information the three major credit reporting bureaus, Experian, TransUnion and Equifax but it weighs elements differently and there could be a slight difference in the two scores.

Once you get your score, as Homonoff suggested, you might be surprised if its not as high as you expected. These are ways to improve the score.

How I Raised My Credit Score Over 100 Points

Raising my credit score with a secured card took some disciplined, conscientious spending.

Here are the rules I followed to maximize the benefits of my secured credit card.

- Spend what you have: After I received my secured card and started spending, I made sure that I would only spend money I already had or would receive, before the next pay period.

- Pay often: I ended up paying off my credit card roughly four times a month to ensure I never carried a balance from one month to the next.

- Know your limits: I would never let my credit limit exceed $800, and I would never pay it off if the card balance was under $300 unless the pay period was coming to an end.

- Make purchases: I would put every penny of my spending on the credit card from the smallest expenses such as a drink from the gas station to major purchases such as airline tickets or hotel rooms.

- Be consistent: I repeated this process for 5 months to establish a credit history of regular use and always paying on time.

Also Check: What Is Syncb Ntwk On Credit Report

Use Less Than 30% Of Your Available Credit

Do your best to keep your balances way below your credit card limit. The amount you owe compared to your credit limit typically has a big impact on your credit score. If your monthly credit card spending is usually close to your credit limit, it can negatively affect your score even if you pay off your credit card bills on time. If you can get your spending down to 20% of your limit, thats a great formula for a real credit rating boost.

Responsibly Add To Your Credit Mix

Lenders look for a mix of accounts in your credit file to show that you can manage multiple types of credit. These include installment loans, for which you pay a fixed amount per month, and revolving credit, which comes with a limit you can choose to charge up to . If you only have one type of credit in your file, adding something different could improve your credit mix. Credit mix accounts for just 10% of your FICO® Score, however, so don’t apply for credit simply to improve your score. That could put you at risk of taking on debt you can’t repay.

Recommended Reading: How Long Do Hard Inquiries Last

Keep Old Accounts Open

Even if you no longer use an old credit card, it’s typically best to keep the account open. That’s because your credit scores benefit from a long credit history and a high total credit limit. Closing established accounts will shorten the average age of your accounts and lower your total credit limit. It will take years before an account closed in good standing drops off your credit report, but the effects on your credit utilization rate are immediate. If a credit card comes with a high annual fee you can’t afford, closing the account could be a good optionor ask your issuer to downgrade the card to a no-fee version if possible.

Factors That Affect Your Credit Scores

As we mentioned above, there are several factors that go into determining your credit scores.

Read Also: Does Zzounds Report To Credit Bureau

Build Your Credit If Needed

If you havent established credit yet, you might not even exist … in the credit report space, that is! If someone has never fallen in delinquency on any subscriptions or utilities or never had collections on anything and they have not utilized credit cards or loans in the past seven to 10 years, they may not have a credit profile at all, Nitzsche said. That presents a challenge when you want to buy a home.

If this sounds familiar, you may have to get a secured credit card where you put down a deposit, he advised. You still have to make payments and use it responsibly. Not all banks offer them but you can usually check with your local bank or credit union.

Report Rent And Utilities To The Credit Bureaus

Try registering with Rental Kharma to get your rent and utilities reported to the credit reporting agencies. For a small fee, theyll process landlord and utility payment data and inform the credit reporting bureaus each month.

Another option is to register with Experian Boost which is a free service for those with an Experian account. According to Forbes, 86 percent of consumers with a thin credit file who used Experian Boost experienced an instant FICO 8 score increase up to 19 points.

Recommended Reading: What Card Is Syncb/ppc

Dispute Credit Report Errors

A mistake on one of your credit reports could be pulling down your score. Fixing it can help you quickly improve your credit.

You’re currently entitled to a free report every week from each of the three major credit bureaus: Equifax, Experian and TransUnion. Use AnnualCreditReport.com to request those reports and then check them for mistakes, such as payments marked late when you paid on time or negative information thats too old to be listed anymore.

Once you’ve identified them, dispute those errors to get them removed. The credit bureaus have 30 days to investigate and respond. Some companies offer to dispute errors and quickly improve your credit, but proceed with caution before you choose this option.

Raise Your Credit Limits

If you tend to have problems with overspending, dont try this.

The goal is to raise your credit limit on one or more cards so that your utilization ratio goes down. But again, this works in your favor only if you dont use the newly available credit.

I dont recommend trying this if you have missed payments with the issuer or have a downward-trending score. The issuer could see your request for a credit limit increase as a sign that youre about to have a financial crisis and need the extra credit. Ive actually seen this result in a in credit limits. So be sure your situation looks stable before you ask for an increase.

That said, as long as youve been a great customer and your score is reasonably healthy, this is a good strategy to try.

All you have to do is call your credit card company and ask for an increase to your credit limit. Have an amount in mind before you call. Make that amount a little higher than what you want in case they feel the need to negotiate.

Remember the example in #1? Card A has a $6,000 limit and you have a $2,500 balance on it. Thats a 42% utilization ratio .

If your limit goes up to $8,500, then your new ratio is a more pleasing 29% . The higher the limit, the lower your ratio will be and this helps your score.

Don’t Miss: Syncppc

How Credit Scores Are Calculated

Credit scores are determined by computer algorithms called scoring models that analyze one of your credit reports from Experian, TransUnion or Equifax. Scoring models may use different factors, or the same factors weighted differently, to determine a particular score. However, consumer credit scores generally share a few similarities:

- Scores are calculated based on the information in one of your credit reports.

- Scoring models try to predict the likelihood that a borrower will be 90 days late on a bill in the next 24 months.

- A higher score indicates a person is less likely to fall behind on a bill, and vice versa.

The vast majority of lenders use credit scores calculated by FICO and VantageScore® scoring models. The most recent versions of their generic credit scores use a score range of 300 to 850and a score in the mid-600s or higher is often considered a good credit score. .

Considering how different credit scores use the same underlying information to try and predict the same outcome, it might not be surprising that the steps you take to try to improve one score can help increase all your credit scores.

For example, making on-time payments can help all your credit scores, while missing a payment will likely hurt all your scores. There are several factors that can affect your credit scores. Here, we’ll focus on the actions you can take to help improve your credit scores.

The Truth About Raising Your Credit Scores Fast

While a lucky few may be in a situation where they can raise their credit scores quickly, the bottom line for most of us is that building credit takes time and discipline, especially if youre trying to rebuild bad credit. Thats because your credit scores are complex and made up of several interconnected factors .

So trust us: While some credit repair agencies may promise to raise your credit scores fast, theres no secret that will help boost your credit scores quickly.

But if you start developing healthy habits now, you can build credit over time all by yourself.

Recommended Reading: What Is Syncb Ntwk On Credit Report

What Affects Credit Score Update Timing

The timing of credit score updates is based on the timing of changes to your credit report. Since your credit score is calculated instantly using the information on your credit report at a given point in time, all it takes to raise your credit score is a positive change to your credit report information.

At the same time, having negative information added to your credit report can offset positive changes you might have seen to your credit score. For example, if you receive a credit limit increase but a late payment is also added to your credit report, you may not see your credit score improve. In fact, your credit score could fall.

Seriously negative information can weigh your credit score down, making it take longer to improve your credit score. For example, it can take longer to improve your credit score if you have a bankruptcy, debt collections, repossession, or foreclosure on your credit report.

The more recent negative information is, the more it will impact your credit score.

How To Increase Credit Score Immediately

How to improve credit score fast, try these tips:

Check your credit report. Request a free copy at AnnualCreditReport.com. Correct errors that are lowering your score. Alert the three credit bureaus about any errors you find. Its important to immediately dispute all claims made against you that are false on your credit report, says Steven Millstein, a certified credit counselor with .

If you need errors corrected quickly, ask your lender about a rapid re-score service. Only your mortgage lender can get this for you because rapid re-scorers dont deal directly with consumers.

Reduce your debt. The most effective way to improve your credit score is to pay down your revolving debt, suggests Gardner. Apply your tax refund to pay down your debt. You may be able to improve your score simply by replacing credit card with a personal loan .

Read Also: Does Zzounds Report To Credit Bureau