You Have More Than One Credit Report

When you order your free TransUnion credit report, youll also have the option to order your free Equifax and Experian credit reports. The information in these reports can differ, so its good practice to review all three. For example, some lenders choose to report account data to only one or two credit reporting agencies, not all three. Or, when you apply for a loan, a lender may only pull your credit report from one credit reporting agency, which would result in a hard inquiry on your credit report from that agency only.

How Do I Get A Copy Of My Credit Reports

You are entitled to a free credit report every 12 months from each of the three major consumer reporting companies . You can request a copy from AnnualCreditReport.com.

You can request and review your free report through one of the following ways:

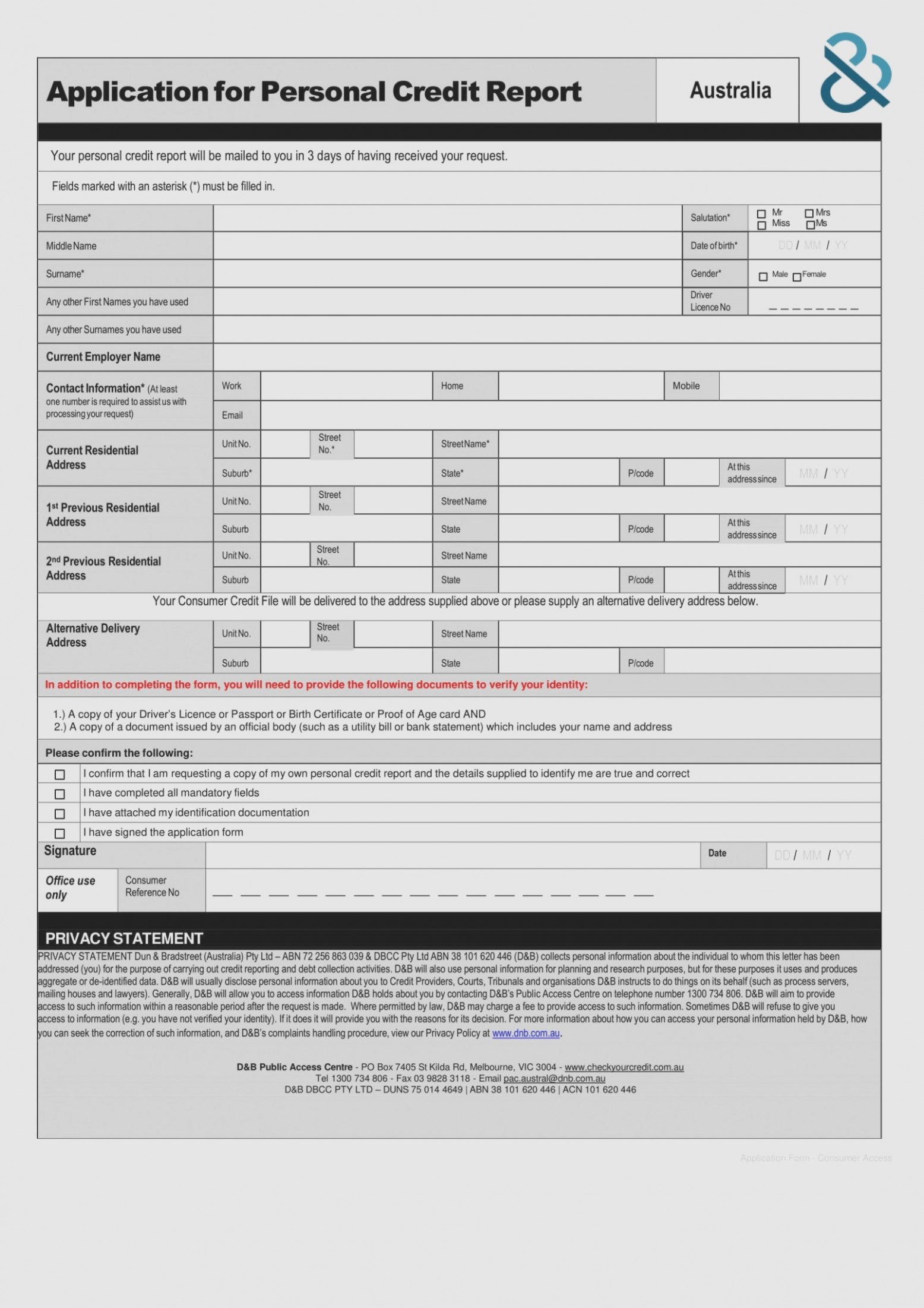

- Mail: Download and complete the Annual Credit Report Request form. Mail the completed form to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

You can request all three reports at once or you can order one report at a time. By requesting the reports separately you can monitor your credit report throughout the year. Once youve received your annual free credit report, you can still request additional reports. By law, a credit reporting company can charge no more than $13.50 for a credit report.

You are also eligible for reports fromspecialty consumer reporting companies. We put together a list of several of these companies so you can see which ones might be important to you. You have to request the reports individually from each of these companies. Many of the companies in this list will provide a report for free every 12 months. Other companies may charge you a fee for your report.

You can get additional free reports if any of the following apply to you:

Monitor Your Credit For Free

Join the millions using CreditWise from Capital One.

Will Checking My Scores Hurt My Credit?

Checking your scores wonât affect your credit, as long as the service uses a soft inquiryâlike CreditWise does. That means you can check your credit as many times as you want without hurting your scores.

According to Experian, you should do a credit check once a year to keep an eye on your credit score range and check to make sure the information in your credit report is accurate. If you find inaccurate information, you may file a dispute with the credit bureau where you found itâor directly with the lender.

Don’t Miss: How To Dispute Credit Report Online And Win

How Do I Order My Free Annual Credit Reports

The three nationwide credit bureaus have a centralized website, toll-free telephone number, and mailing address so you can order your free annual reports in one place. Do not contact the three nationwide credit bureaus individually. These are the only ways to order your free credit reports:

- complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service P.O. Box 105281 Atlanta, GA 30348-5281

Reasons You May Not Have A Medical History Report

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

Read Also: How Long Does Negative Information Stay On Your Credit Report

How Do I Fix Inaccuracies On My Credit Report

If you see something on your report that you believe is inaccurate, it may be a good idea to contact the business that reported the account, as they are the ones who can provide you more details. Your other option is to start a dispute with the credit reporting agency that issued the credit report. To start a dispute with TransUnion, visit and well start an investigation.

Review Your Credit Report For Errors

If you notice inaccurate information reporting on your credit report, it is important to dispute the inaccurate information with the Credit Reporting Agencies . Start your dispute .

If you are unsure how to read your credit report and you would like help in reviewing your credit report, please contact us at 1-877-FCRA-LAW , and we will be happy to assist you.

Don’t Miss: What’s The Best Way To Check Your Credit Score

How Can I Print A Credit Report From Credit Karma

Iâve been trying to build my credit score for a while so that I can get a lower lease on a new car. I want to print my report so I can better understand how I can improve it. How can I print my credit report from Credit Karma?

directly from the Credit Karma website

- First, log into your account on the Credit Karma website. You wonât be able to print your report from the Credit Karma app.

- Once youâre logged in and on your homepage, you will see both your Transunion and Equifax credit reports. Select either option.

- Scroll to the bottom of the page and click on the button that reads, View credit reports.

- On this page, youâll have access to your entire credit report. To print the report, click the button that reads, Print report. This will put the report in an easy-to-read format for printing.

- Lastly, you will continue printing like normal by clicking File and then Print from your computer.

Read Your Reports And Fix Errors

-

Accounts that arent yours or you didnt authorize.

-

Incorrect, negative information.

-

Negative information thats too old to be included. Most negative information, other than one type of bankruptcy, should be excluded after seven years.

These errors have the potential to hurt your credit score, says Chi Chi Wu, a staff attorney with the National Consumer Law Center. You might see other types of errors, such as out-of-date employment information, she says, but those arent factored into your score.

If you find errors, dispute them. The credit bureaus will investigate and must remove information that they cant verify.

Don’t Miss: When Do Credit Card Companies Report To Bureaus

How To Safeguard Your Identity

If you find accounts listed on your credit reports that you did not open or if you are worried about identity theft, you might consider filing a free fraud alert on your credit file that remains active for one year through the Experian fraud center. The fraud alert notifies lenders pulling your credit report to take extra steps to verify your identity.

You can also freeze your credit reports, another free measure that prevents lenders from issuing new credit in your name altogether. Or try Experian CreditLock, a benefit of your Experian membership, which allows you to lock and unlock your report in real time, with no waiting period.

Your Annual Credit Report Is Now Available Weekly And Its Still Free

The three national credit reporting agenciesTransUnion, Experian and Equifaxare required by federal law to provide you with a free annual credit report. In fact, AnnualCreditReport.com was created by the credit reporting agencies as a one-stop-shop to provide you with your annual credit reports.

In response to the COVID-19 health crisis, TransUnion is pleased to offer you one free weekly credit report online throughout 2022 at AnnualCreditReport.com. Reviewing your credit reports regularly helps you ensure the information reported is accurate. It also gives you an opportunity to monitor your account history to combat identity theft.

Recommended Reading: How Soon Will My Credit Score Improve After Bankruptcy

Medical Id Reports And Scams

Use your medical history report to detect medical ID theft. You may have experienced medical iD theft it if there is a report in your name, but you haven’t applied for insurance in the last seven years. Another sign of medical ID theft is if your report includes medical conditions that you don’t have.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: How To Grow Credit Score

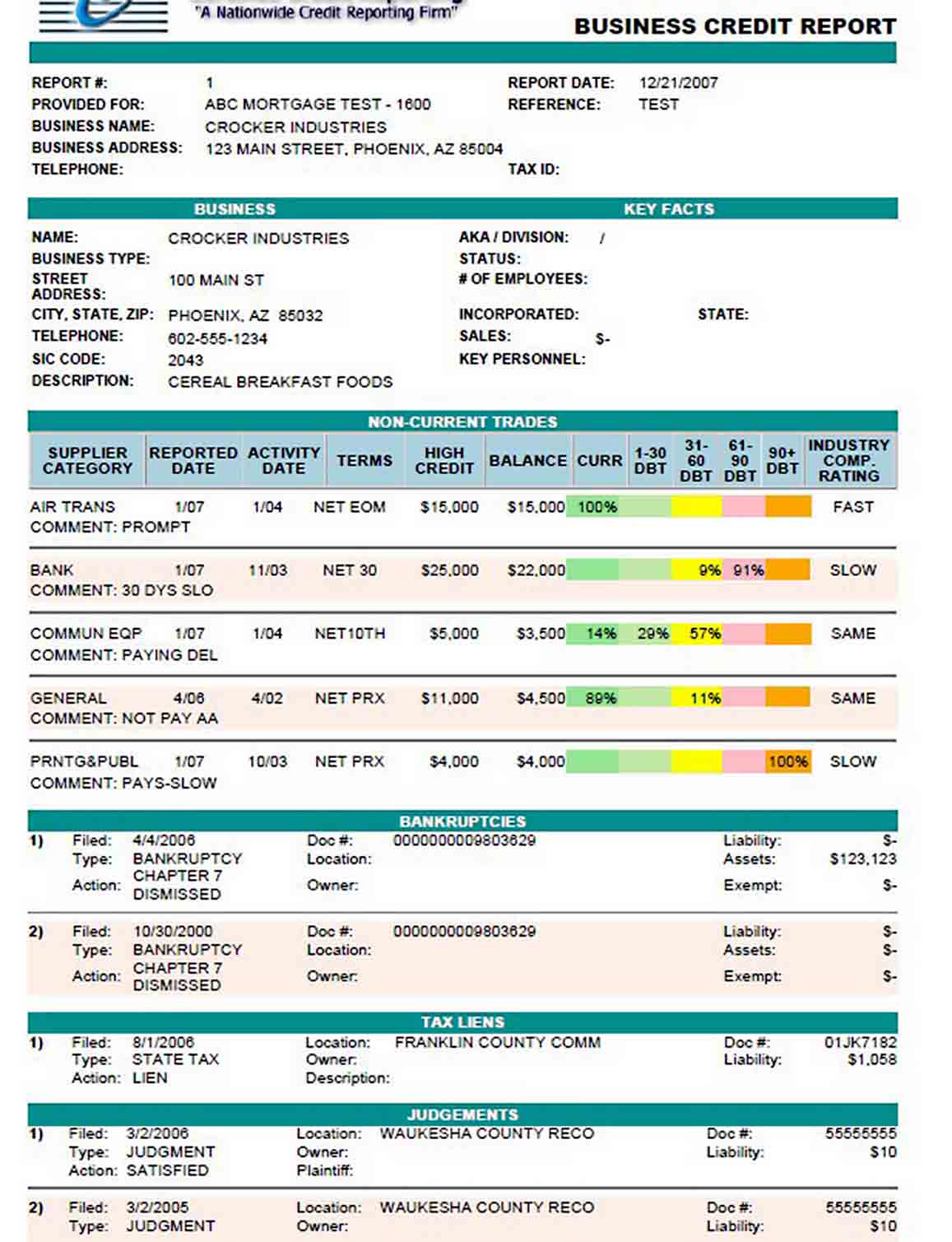

What Should I Look For In My Credit Report

When , check that all the information listed is up-to-date and accurate. Heres a brief breakdown on the kinds of things to verify within each credit report:

- Personal Information: Social Security number, name and address

- Inquiries: everyone who has reviewed your credit report in the past 2 years

- Public Records: bankruptcies, which can stay on a credit report for up to 10 years

Free Equifax Credit Report In Spanish

Additionally you can receive your Equifax credit report in Spanish. Equifax is the first and only credit bureau to offer a free, translated credit report in Spanish online and by mail.

There are two ways to request your Spanish credit report, online or by phone.

You can visit: www.equifax.com/micredito or call Equifax customer service 888-EQUIFAX and press option 8 to begin requesting your free credit report in Spanish.

Also Check: Does Requesting Credit Increase Affect Score

Why Should I Get A Copy Of My Report

Getting your credit report can help protect your credit history from mistakes, errors, or signs of identity theft.

Check to be sure the information is accurate, complete, and up-to-date. Consider doing this at least once a year. Be sure to check before you apply for credit, a loan, insurance, or a job. If you find mistakes on your credit report, contact the credit bureaus and the business that supplied the information to get the mistakes removed from your report.

Check to help spot identity theft. Mistakes on your credit report might be a sign of identity theft. Once identity thieves steal your personal information information like, your name, date of birth, address, credit card or bank account, Social Security, or medical insurance account numbers they can drain your bank account, run up charges on your credit cards, get new credit cards in your name, open a phone, cable, or other utility account in your name, steal your tax refund, use your health insurance to get medical care, or pretend to be you if they are arrested.

Identity theft can damage your credit with unpaid bills and past due accounts. If you think someone might be misusing your personal information, go to IdentityTheft.gov to report it and get a personalized recovery plan.

What Information Do I Have To Give

To keep your account and information secure, the credit bureaus have a process to verify your identity. Be prepared to give your name, address, Social Security number, and date of birth. If youve moved in the last two years, you may have to give your previous address. Theyll ask you some questions that only you would know, like the amount of your monthly mortgage payment. You must answer these questions for each credit bureau, even if youre asking for your credit reports from each credit bureau at the same time. Each credit bureau may ask you for different information because the information each has in your file may come from different sources.

Don’t Miss: What Does Transunion Credit Report Show

Enter Your Personal Information

Once youre on the correct website, click on the button near the top of the page or bottom left that says, Request your free credit reports. Afterward, click on the button with the same words below the line that reads, Fill out a form. Finally, complete the form by entering your name, birthdate, current address and Social Security number .

If you havent lived at your current address for at least two years, youll have to enter your previous address, too.

Order Your Free Credit Report

Consumers can get free copies of their credit report each year. The Fair Credit Reporting Act requires each of the three nationwide consumer reporting agencies Equifax, Experian, and TransUnion to provide you with a free copy of your credit report, at your request, once every 12 months.

At least once a year, review each one of your three credit reports to:

- ensure that the information is accurate and up-to-date before you apply for a loan, lease a car, get a credit card, buy insurance, or apply for a job.

- help guard against identity theft. If identity thieves use your information to open new account in your name, those unpaid accounts get reported on your credit.

To order your FREE reports:

Also Check: How Fast Can Credit Score Go Up

How Do I Get My Free Credit Report

Reading time: 3 minutes

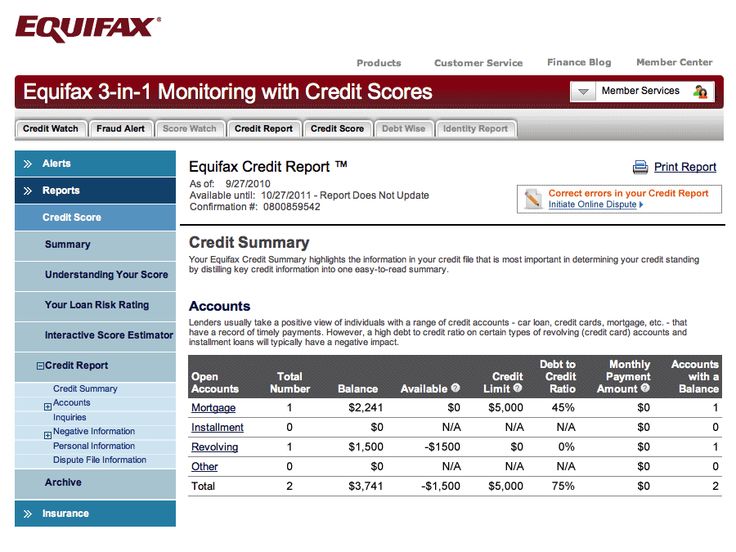

- You can receive Equifax credit reports with a free myEquifax account.

- You can access free credit reports from each of the nationwide credit bureaus at annualcreditreport.com.

- You can request these free annual credit reports online, by phone, or by mail.

- In addition to receiving a free credit report, you can now also receive your credit report in Spanish from Equifax.com or by calling Equifax Customer Care.

If you want to check your credit reports there are several ways that we’ll discuss below.

Review Your Report & Dispute Any Errors

Reading your credit report is one of the most vital steps when it comes to building credit and maintaining it. While reviewing your report, make sure your personal and account information is accurate.

Common credit reporting errors to look for include the following:

- Incorrect name or address

- Paid accounts that are listed as open

- Account balance or credit limit errors

- Accounts that dont belong to you

If you spot an error, dispute it with each credit bureau that lists it on your report or the creditor that reported it. The investigation will typically take 30 days to complete. Once its over, the credit bureau will remove the information if it finds that it is in fact an error.

Read Also: Is 710 A Good Credit Score

Get Your Credit Score

Your credit score comes from the information in your credit report. It shows how risky it would be for a lender to lend you money.

Learn more about how your credit score is calculated.

You can access your credit score online from Canadas 2 main credit bureaus.

Your credit score from Equifax is accessible online for free and is updated monthly. If you live in Quebec, you can also access your credit score from TransUnion online for free.

Other companies may also offer to provide your credit score for free. Some may ask you to sign up for a paid service to get your score.

Are There Other Ways I Can Get A Free Report

Under federal law, youre entitled to a free credit report if

- you get a notice saying that your application for credit, employment, insurance, or other benefit has been denied or another unfavorable action has been taken against you, based on information in your credit report. Thats known as an adverse action notice. You must ask for your report within 60 days of getting the notice. The notice will give you the name, address, and phone number of the credit bureau, and you can request your free report from them

- youre out of work and plan to look for a job within 60 days

- youre on public assistance, like welfare

- your report is inaccurate because of identity theft or another fraud

- you have a fraud alert in your credit file

If you fall into one of these categories, contact a credit bureau by using the below.

Don’t Miss: How To Remove Hard Inquiries From Credit Report Online

Whats The Difference Between A Credit Report And A Credit Score

Although they are interconnected, your credit report and credit score are separate.

Your credit report contains information about your credit accounts, including any balances you owe and your payment history. Your , on the other hand, is a three-digit number that usually ranges from 300 to 850. Credit scoring models, such as FICO, use the information listed in your credit reports to calculate your score.

How Do I Get A Free Copy Of My Equifax Canada Credit Report

How do I get a free copy of my Equifax Canada credit report? You may request a free copy of your Equifax credit report through one of the options below:

1. Click here to order your free credit report online from Equifax Consumer Services LLC , a company based in the United States. ECS securely collects and stores your credit report from Equifax Canada and uses it to provide your product.

2. To order your free credit report directly from Equifax Canada by phone, call 465-7166

3. To order your free credit report directly from Equifax Canada by mail, please download and complete this Canadian Credit Report Request Form and mail it along with photocopies of the required identification to:

Equifax Canada Co.P.O. Box 190Montreal, Quebec H1S 2Z2

4. To order your free Equifax credit report in person, visit one of our three office locations listed below.

Please bring with you at least two pieces of valid government-issued identification, including one piece of photo identification, and proof of current address. Photocopies and electronic versions are not accepted at the office. We require these documents so that we can validate your identity and confirm your information.

The locations, hours of operation and languages available onsite are listed below. Hours of operation are subject to change. Province-specific credit report request forms are available at each office location.

Also Check: When Do Late Payments Fall Off Credit Report