How To Maintain Your Credit Score

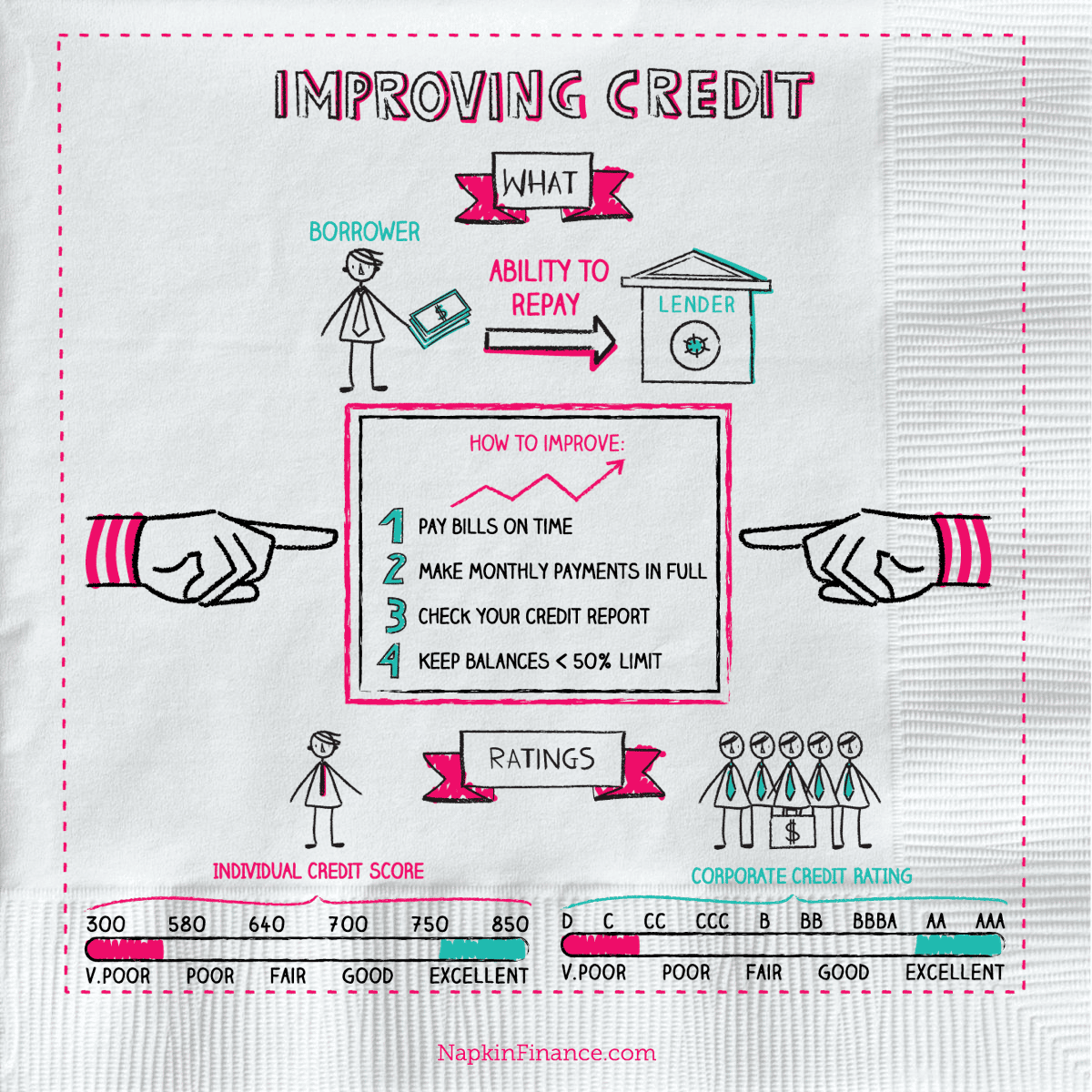

One way to maintain your credit score is to try to stay within the 35% ratio mentioned above.3 Add up all your credit limits and multiply the total by 35%. Thats the amount you should ideally try to avoid exceeding when borrowing money or using credit.3

Avoid applying for too much credit

There are some downsides to having too many credits cards. You may be tempted to use them and spend more.

According to the federal government, you should also avoid applying for too many loans, having too many credit cards and requesting too many credit checks in a short timeframe.3 Thats because it could negatively impact your credit score too.3

Stay within your credit limit

Avoid going over your credit limit. If you go over your limit, it could lower your credit score.3

Overall, having a good credit score can help boost your financial confidence and security. So, congrats on taking the first step by learning how credit scores work and how you can improve yours!

Legal

Also Check: How To Self Report To Credit Agencies

Apply For A Secured Credit Card

A secured credit card requires a security deposit usually around $200 that usually serves as your limit. Because of this, theyre less risky to credit card issuers and are fairly easy to qualify for.

Once you have the secured card, you can use it for small purchases. Each month, youll need to make at least the minimum payment on the card. The card issuer will report your payment activity to the bureaus, resulting in a credit score increase. However, if you fail to make a payment, the issuer will use the deposit instead.

Secured cards usually come with higher interest rates than unsecured cards, so its best to pay off your balance in full each month.

Secured credit cards tend to be less of a risk for issuers since you yourself are providing a security deposit.

Best Secured Card for No Credit

The OpenSky Secured Visa Credit Card is best for no credit borrowers since it doesnt require a credit check. The issuer reports to all three reporting bureaus and is a great way to establish credit.

How A Good Credit Score Can Help You

A credit score is a numeric representation, based on the information in your , of how risky you are as a borrower. In other words, it tells lenders how likely you are to pay back the amount you take on as debt.

In general, the higher your scores, the better your chances of getting approved for loans with more-favorable terms, including lower interest rates and fees. And this can mean significant savings over the life of the loan.

Having a good score doesnt necessarily mean youll be approved for credit or get the lowest interest rates though, as lenders consider other factors, too. But understanding your credit scores could help you decide which offers to apply for or how to work on your credit before applying.

Don’t Miss: How To Update Name On Credit Report

What Is A Good Vantagescore

FICO competitor VantageScore produces a similar score using the same credit report data from the three bureaus.

A good VantageScore lies between 661 and 780, which the company calls a “prime” credit tier. VantageScores 780 to 850 are considered “superprime,” while those between 601 and 660 are “near prime.” VantageScores below 600 are considered “subprime.”

The average VantageScore 3.0 in the second quarter of 2021 was 695.

Is A Credit Score Without A Credit Card Possible

Yes, it is possible to generate credit scores without a credit card because credit card companies are not the only companies that help you build credit.

You may follow these ways to start and build your credit score.

- Become an authorized user.

- Take out a credit-builder loan.

- Apply for a personal loan.

- Clear your remaining loan.

- Apply for a secured credit card.

Read Also: What Information Is On A Credit Report

Are Credit Karmas Credit Scores Accurate

The VantageScore 3.0 credit scores you see on Credit Karma come directly from Equifax and TransUnion, and they should reflect any information reported by those credit bureaus.

Remember that most people have a number of different credit scores. The scores you see on Credit Karma may not be the exact scores a lender uses when considering your application. Rather than focus on your exact scores , consider your scores on Credit Karma a general measure of your credit health.

What Is My Starting Credit Score

If you want to start building your credit score, but have not started the process yet, you are probably curious about what your starting credit score will be. Here is an explanation into what that score is, how its calculated, how you can improve it, so you can build your credit score properly early on.

Also Check: How To Get Annual Free Credit Report

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

How Important Is Your Credit Score In Real Estate

How important is your credit score in real estate?

A quality credit score is one of the most valuable assets a real estate investor can have. This resource has the authority to not only retain attractive mortgage and refinancing rates but amplify an investors negotiating power when seeking a loan. While a lower score will not automatically disqualify potential investors, this all-important number in residential redevelopment could hinder ones ability to access certain loan programs.

Credit scores are a crucial component of the home buying process, impacting everything from the size of a mortgage payment to the interest rate on a home loan, said Senior Vice President for TransUnion, Ken Chaplin.

People with subprime credit may face financial barriers to homeownership, making it difficult for their dream home to become a reality, said Chaplin.

The good news is that there are still ways to invest in real estate with bad credit, including several ways to do so without using your personal budget. As an investor, the first stage is to understand your credit scores importance, including ways to improve it.

Recommended Reading: How Long Do Credit Cards Stay On Your Credit Report

What Credit Scores Do I Need To Get Approved For A Credit Card

Theres no universal minimum credit score needed to get approved for a credit card. Credit card issuers have different score requirements for their credit cards, and they often consider factors beyond your credit scores when deciding to approve you for a card.

In general, if you have higher scores, youre more likely to qualify for most credit cards. But if your credit is fair or poor, your options will be more limited and you may receive a lower credit limit and higher interest rate.

Your Starting Score Isnt Your Forever Score

As you start your credit journey, remember there are ways to start positive financial habits right away to help you continue building to a better credit score.

Consider monitoring your credit to see how your most recently reported balance impacts your scores. from Capital One is a free tool that lets you monitor your VantageScore® 3.0 credit score. Using CreditWise to keep an eye on your credit wonât hurt your score. And itâs free for everyone, not just Capital One customers.

You can also get free copies of your credit reports from all three major credit bureausâEquifax®, Experian® and TransUnion®. Call 877-322-8228 or visit AnnualCreditReport.com to learn more. Keep in mind that there may be a limit on how often you can get your reports. You can check the site for more details.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

Don’t Miss: How To Unlock Your Transunion Credit Report

Should You Pay For Credit Monitoring

is a service that tracks your credit score and spending habits. Some services also offer protection from fraud or identity theft. Whenever theres suspicious activity or a notable change, the service will notify you.

Some credit monitoring services are free, such as those offered by most major credit card issuers. But others come with a small monthly charge. A basic service could cost around $8 a month, while a premium service might cost upwards of $35 a month.

If youre just starting out and have little to no credit, you should be able to monitor your own credit reports without a service.

The Purpose Of A Credit Score

Before we dive deep into the factors that shape your credit score, it helps to understand why companies care about credit scores in the first place. Spoiler alert: Its all about the money.

The FICO Score, used by 90% of top lenders in the United States, analyzes the information on your credit report. Then, it predicts how likely you are to pay a bill 90 days late within the next 24 months.

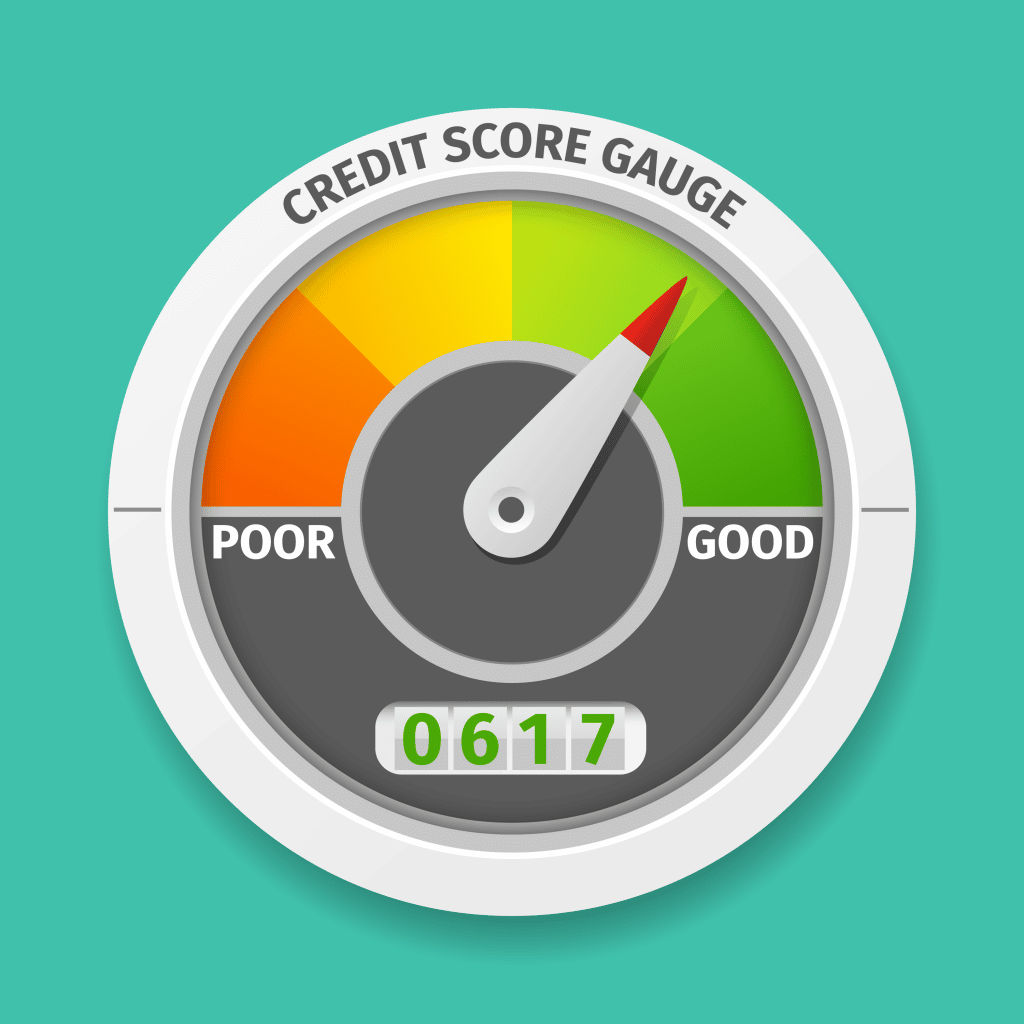

FICO scoring models rank-order credit reports on a scale of 300 to 850. If your score falls on the higher end of that range, you have a good credit score. That higher score tells lenders youre less likely to fall seriously behind on credit obligations. If your score is low, the lender knows that the risk of you paying late is greater.

Related: How To Improve Your Credit Score

Read Also: How Long Do Closed Credit Accounts Stay On Your Report

What Is A Credit Score

A credit score is a three-digit number summarizing your credit risk, based on your credit data. A credit score helps lenders evaluate your credit profile and influences the credit thats available to you, including loan and credit card approvals, interest rates, credit limits and more. For example, most FICO® Credit Scores range from 300-850 based on your credit history and can be viewed as a summary of your credit report.

Does The Credit Score Start At Zero

To calculate the credit score, we use the FICO credit score and the VantageScore models.

When you start to build your credit, you may use a credit card and get personal and auto loans so your credit score improves. You may wonder Does my credit score start at the highest range or in between the ranges?

It is important to note that everyone begins with no credit score, but that does not mean your credit score is zero, it means your credit score is not calculated and therefore nonexistent. Once you start building your credit, your credit score will start with the minimum value, which is 300.

You will always begin with the lowest credit score and you must improve your scores so you enjoy the benefits of a good score while reaching the perfect credit score.

Generally, the credit scores are calculated by:

- Payment history

You must be responsible while building your credit and you start to build your credit score after you open your first line of credit. You can calculate your credit scores in the way you use your credit accounts.

The three credit bureaus provide you with a credit report annually that details your credit history, and you use the information they provide to build your credit score.

You May Like: What Is The Government Credit Report Website

How To Stay On Top Of Your Credit Score

First, keep track of your credit regularly for unexpected changes. As mentioned above, you may be able to do so through your banks or credit card provider, and federal law requires each of the three nationwide credit bureaus to provide one free credit report per year.

Second, set up automatic payments, through online bill pay, to help ensure all your bills are paid on time. Every missed or late payment can have an impact on your credit. Setting up automatic payments helps eliminate human error from the bill payment process while saving time and avoiding late fees.

Finally, use credit smartly. Dont max out your credit cards, and dont apply for credit you dont need. Manage how much of your credit line you use and, if possible, make additional payments to reduce how much of your credit line youve used.

Does Income Play A Role In Having A Perfect Fico Score

Income is not a factor in determining your FICO® Score. While access to some credit products can be restricted by your income and financial situation, when it comes to achieving a perfect credit score, income is not a barrier.

In fact, in the fourth quarter of 2018, a little over 38% of perfect FICO® Scores were held by people with an estimated average annual income of $75K or less, according to Experian data.

Obviously, having more money can help you pay your bills, but building a healthy credit score really comes down to the basics of paying your bills on time every month and maintaining low , or the amount of debt you carry compared with total credit available.

Read Also: Can You Get A Mortgage With A 600 Credit Score

Don’t Miss: What Credit Score Does Synchrony Bank Use

Types Of Credit Used And New Credit

Each accounts for 10 percent of your score. All debts are not created equal. A 30-year fixed mortgage is a good debt. A debt consolidation loan from a finance company, on the other hand, is not. A lot of new debt will lower your score. Lenders like to see a nice balance including a home mortgage, a car payment, and no more than two or three credit cards with no sudden increases in borrowing. Scores calculated for other purposes may add or subtract points for other kinds of debt. When you do obtain new credit for an auto or mortgage loan, or from a lender that provides auto or mortgage loans, shop for it within 30 to 45 days so that the inquiries will count as one inquiry instead of many.

What Does It Mean To Have No Credit

Having no credit doesnt mean you have bad credit or a bad credit score. It simply means youve never applied for a loan, credit card or any other form of financing. Thus, you dont have credit history with any of the three major credit reporting agencies Equifax, Experian or TransUnion.

People with no credit are sometimes considered credit invisible because of their limited credit history and lack of score. Some people believe they can build credit by making payments to utility companies or rental agencies. However, these payments are rarely reported to the bureaus, so they dont affect your score.

According to a report from the Consumer Financial Protection Bureau , around 26 million Americans are credit invisible. Another 19 million people have a credit report but dont technically qualify for a credit score. This is because you need at least one account on your profile to start building credit.

For FICO, you must have an account thats 6+ months old to establish a credit history. VantageScore simply requires you to have an account. Unfortunately, without a credit history, you wont meet the minimum requirements to have a VantageScore or FICO credit score.

To learn more about starting credit scores, check out this video:

Don’t Miss: What Are The Credit Score Companies

How Do You Get A Perfect Credit Score

Income, savings, and investments have no bearing on your credit score. It’s simply a measure of your debt management skills. A high credit score can be achieved by showing financial institutions that you are always able to repay your loans on time. Aside from on-time payments and low credit utilization, perfect scores are also distinguished by two other factors, notes the team over at Bungalow.

Perfect credit score holders:

- Have a greater number of credit cards. An average of 6.4 credit cards are owned by people with perfect credit scores, almost twice the national average of 3.8.

- Perfect credit card scores averaged $3,025 in debt. Nationally, the average salary is $6,445.

The Biggest Credit Score Myths

Like any industry, credit and lending is always changing. As the economy fluctuates up and down and federal regulations change to provide new guidelines and protections for consumers, it’s no surprise that credit card issuers change the qualifications for their financial services and products. You’ve probably heard a lot of credit card myths from people who’ve been in the game for a long time. But the truth is you shouldn’t always listen to them.

Below, we outline some of the most persistent credit card myths and explain exactly what’s true for today’s credit card user.

- Myth 1: You should never close your oldest credit card

- Myth 2: You need a perfect credit score

- Myth 3: Carrying a balance helps your credit score

- Myth 4: Checking your credit score will lower it

Also Check: Is 640 A Good Credit Score

What Is New Credit

New credit makes up 10% of a FICO® Score. When you apply for new credit, inquiries remain on your credit report for two years. FICO Scores only consider inquiries from the last 12 months.

People tend to have more credit today and shop for new credit more frequently than ever. FICO Scores reflect this reality. However, research shows that opening several new credit accounts in a short period of time represents greater risk – especially for people who don’t have a long credit history. Your FICO Scores take into account several factors when looking at new credit.