Can You Get A Mortgage With Disputes On Your Credit Report

But the truth is, when it comes to getting a mortgage, lenders don’t like to see disputed accounts because it shows a potential for future liabilities that may impact your ability to repay the mortgage. Therefore, disputed accounts must be removed from the dispute status before you can seal the deal with the home sale…. see more

Dispute Mistakes With The Credit Bureaus

You should dispute with each credit bureau that has the mistake. Explain in writing what you think is wrong, include the credit bureaus dispute form , copies of documents that support your dispute, and keep records of everything you send. If you send your dispute by mail, you can use the address found on your credit report or a credit bureaus address for disputes.

Equifax

Fixing Credit Report Errors

To ensure mistakes are corrected as quickly as possible, contact both the credit bureau and organization that provided the information to the bureau. Both these parties are responsible for correcting inaccurate or incomplete information in your report under the Fair Credit Reporting Act.

Keep in mind that all three of the credit bureaus now accept the filing of disputes online, with Experian now only accepting online submissions.

Find out how to initiate a dispute online.

Begin by telling the credit bureau what information you believe is inaccurate. Credit bureaus must investigate the item in question-usually within 30 days-unless they consider your dispute frivolous. Include copies of documents that support your position. In addition to providing your complete name and address, your communication should:

- Clearly identify each disputed item in your report.

- State the facts and explain why you dispute the information.

- Request deletion or correction.

You may also want to enclose a copy of your report with the items in question circled. Your communication may look something like this sample.

If mailing a letter, send it by certified mail, return receipt requested, so you can document that the credit bureau did, in fact, receive your correspondence. Also, keep copies of your dispute letter and enclosures. If you want help disputing mistakes on your credit report, myFICO can help you write a free letter in minutes.

You May Like: When Was Credit Score Invented

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Check Your Credit Report

Because your credit score is so important in getting loans, credit, and housing, its important to check your credit reports regularly to make sure they are correct and complete. Checking your credit reports will also alert you to identity fraud because youll see if someone has opened accounts in your name or if late payments have been reported for purchases you didnt know about.

You can get one free copy of your credit report every 12 months from each of the three major credit reporting companies . All three credit reporting companies collect credit information, but different things may show up on the different credit reports. You can monitor your credit for free by getting free copies of your credit report. There are two common ways to do this:

In addition, you can get a free copy of your credit report:

To order a free credit report, go to Annual Credit Report or call 1-877-322-8228. You can also fill out the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

Also Check: How To Maintain A Good Credit Score

What If I Disagree With The Outcome Of My Dispute

If you receive your dispute results and don’t agree with them, you have a few options:

1. Contact the Source of the Information

Your best next step is to contact the entity who originally provided the information to Experian. This is usually the creditor, lender or financial institution that provided the loan or credit initially, but could also be a collection agency or office of the government. The contact details for the source of each piece of information appears on your credit report. View your credit report to get the contact information.

2. Add a Statement of Dispute

A statement of dispute allows you to explain why you believe the information is inaccurate or incomplete. The statement will appear on your Experian credit report whenever it’s accessed or requested by a potential lender or creditor, so they may ask you for more details or documentation as part of their review or application process. To add a statement of dispute, go to the Dispute Center, choose the item in dispute, and select “Add a Statement” from the menu of dispute reasons.

3. Dispute Again With Relevant Information

If you have additional relevant information to substantiate your claim, you can submit a new dispute by uploading the additional documentation through Experian’s Online Dispute Center. Once your dispute has been submitted you will be presented with a link to upload supporting documentation.

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

Recommended Reading: Does Conns Report To Credit Bureau

What Happens If The Disputed Item Is Found To Be Accurate

If the item has been verified as accurate, then the credit bureaus are no longer investigating it. That means the credit bureaus will remove the in dispute label by removing the XB code.

Once the XB code is gone, then the item is fair game in the eyes of FICO because it has been verified and is, arguably, accurate.

This process isnt news, and lenders also know about it, which is why you cant just go and dispute everything thats bad on your credit reports, have your FICO scores shoot through the roof, and then go apply for a loan.

Most lenders, especially mortgage lenders, require that all items DO NOT have the in dispute label before they process an application to closing. They realize the score that has been calculated is likely not the consumers most accurate score because the model is ignoring certain aspects of the credit report.

And FICO isnt the only scoring system that has this specialized treatment of items that are currently being investigated. If you check your credit score using the VantageScore model, you may run into a similar situation.

According to Sarah Davies, Vice President of Analytics and Product Management at VantageScore Solutions, While an account is documented as Account information disputed by consumer under the Fair Credit Reporting Act , it is temporarily excluded from consideration by the VantageScore model.

Check For Updates To Your Credit Report

Updates to your affected credit reports may take some time to appear. It can depend on the specific credit bureaus update cycle and when the furnisher sends the new information to the credit bureau.

If the update doesnt appear on your credit reports within several months, contact the credit bureaus and the furnisher to verify its reporting your account information to the bureaus.

You May Like: Does One Main Report To Credit Bureaus

What Is A Credit Report And What Does It Include

Credit reports are reports that detail your credit activity. They are sent to lenders by companies called consumer reporting agencies or CRAs. They collect information regarding your accounts, loan repayment history, and other data which determines the risk you pose as a borrower.

Lenders use these reports to assess if they will approve you for loans, how much interest they will charge on those loans, and even the luxury goods they will offer you.

A credit score is a number that summarizes your report. Its based on specific criteria such as debt-to-income ratio , payment history, age of accounts, new accounts opened, and several inquiries.

How To Dispute An Error On Your Credit Report

If you believe errors on your credit report were made in error, then disputing those errors with the reporting bureau is a good idea. It can help to avoid unnecessary mistakes and keep everything accurate as it should be.

There are two main ways to dispute an error on your credit report. The first is to file a dispute with the credit bureau directly. This works best if you have evidence that can help support your case since its up to you to come up with proof for any claims instead of an entire team of people working together.

The second method is through submitting a formal letter via certified mail or fax . This method often yields faster results.

Both methods can take up to thirty days for a resolution, but if it takes longer than that time frame, there may be something wrong. But, of course, the last thing someone with bad credit wants is more mistakes on their report, so its best to do whatever you can to prevent that from happening.

Read Also: How Does A Credit Card Settlement Affect Your Credit Score

The Calculation Of Credit Scores

The FICO score is the most widely used scoring model for determining the qualification of borrowers for financial products and services. Your credit score is a three-digit number ranging between 300 and 850 calculated based on the information on your credit report. It is widely relied upon by lenders and credit card companies to determine your creditworthiness.

FICO credit scores use metrics divided into five categories that hold varying levels of importance:

Payment History

Your payment history carries the most significant weight in your credit score. Payment history on credit cards, auto loans, etc., accounts for 35% of your total credit score. Consistent on-time payments lead to a credit score increase, while late payments and missed payments harm your score.

Amount You Owe

How much you owe on your various accounts makes up 30% of your FICO score calculation. A significant aspect of this metric category is your credit utilization ratio. Your credit utilization ratio is the amount of money you owe compared to the total credit limit of all your accounts.

The length of your credit history accounts for 15% of your credit score. This category focuses on the average age of your credit as well as the age of your oldest and most recent accounts. It is better for your credit score to have an older and more well-established credit history.

New Credit

How Will Accepted Disputes Affect Your Fico Score

Often your score will improve when errors on your credit report are corrected. In some situations, however, your score may not improve when credit information is corrected or updated. For example:

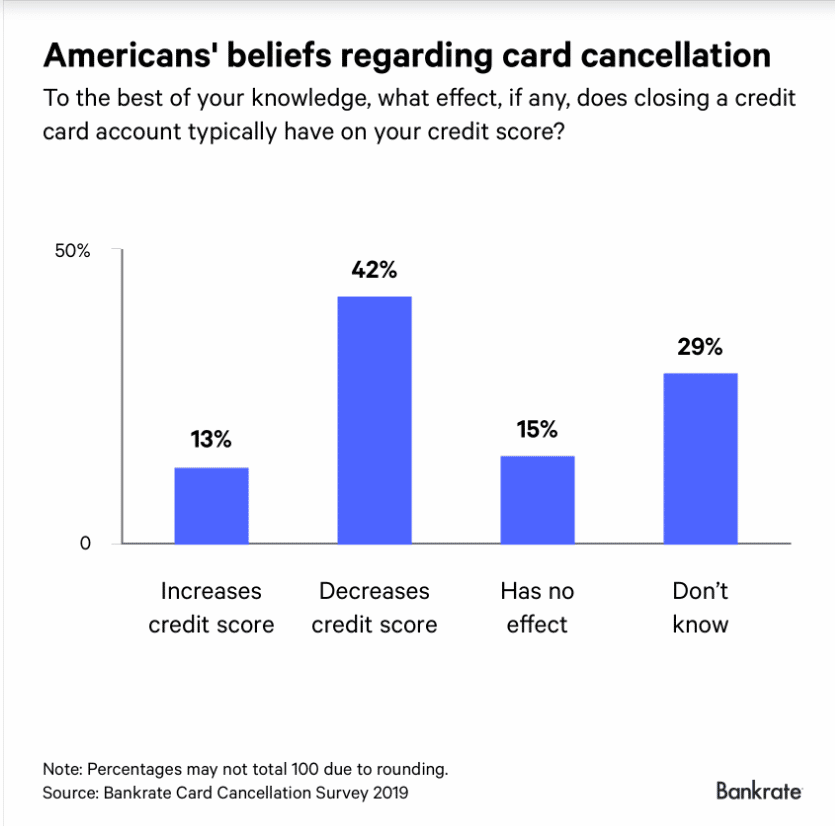

- It is often thought that closing credit card accounts will improve your score. This is not true. Closing an account will neither remove it from your credit report, nor will it prevent the payment history from continuing to be displayed and considered in the calculation of your FICO Score.

- Removing negative information from your credit report may not have the impact on your FICO Score that you expect. There could be additional negative information remaining that will prevent an immediate increase in your FICO Score.

- FICO Scores only consider credit-related information on your credit report. If you change personal information , the credit information on your report will not be impacted and your FICO Score will probably not change. The FICO Score only considers credit account, collection, and public record information.

It typically takes the credit bureau 30-45 days to respond to your dispute.

You May Like: Does Checking Credit Score Lower It

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 530086Atlanta, GA 30353-0086

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

What Usually Happens After You Dispute Something On Your Credit Report

Once you file your dispute, credit reporting agencies must tell information provider about it. Information providers are required to verify the data in questionor, if its found inaccurate, they must inform all three bureaus and have the data corrected or deleted. The credit bureaus sites offer you links to check on the status of a dispute, and FAQs that describe possible outcomes and next steps.

Once a dispute investigation is complete, credit bureaus are required to inform you of the results in writing and provide a new free report if there are changes. Further, the bureau must provide information on the data furnisher involved. Data furnisher is the legal term for any entity that provides information to a credit reporting agency. You can request that the bureau notify anyone who received your report over the last six months.

If you are unsatisfied with the results, you can:

- Refile your dispute, potentially with additional documentation.

- File a statement of dispute, about 100 words, that will be affixed to your file and any future reports. You can ask the bureau to get the statement to entities that recently obtained your report. A fee may be involved.5

Also Check: Does Requesting A Credit Increase Hurt Score

What Happens After Heres What To Expect From The 3 Credit Bureaus

You should dispute information on your credit report if you think its not accurate.

Finding a mistake on your credit report can be frustrating. Those errors can have a negative impact on your credit score. Submitting a credit dispute to the reporting bureaus is the first step in the process of correcting inaccurate information and improving your score.

But what comes next? How do credit bureaus fix the error? What effect does a dispute have on your credit score? Heres the whole story on what happens when you submit a TransUnion dispute or a dispute at one of the other credit bureaus.

How do you dispute an inquiry or other negative item on your credit report?

You have the right to a fair and accurate credit report. And you can dispute information on your credit report if you think its not accurate. You can follow steps for DIY or work with professionals to get the job done. Typically, the process starts with a .

What happens after you open a dispute?

While disputed information is being reviewed by a credit bureau, it is not typically labeled as disputed on your credit report. And each of the three credit bureaus has their own process for dealing with disputes. They all reach out to the creditor or entity that provided the information in dispute as part of the investigation.

Experian disputes

+2.76% the agency reaches out to the entity that provided the information. Typically, thats the creditor.

TransUnion dispute

Equifax disputes

Medical Id Reports And Scams

Use your medical history report to detect medical ID theft. You may have experienced medical iD theft it if there is a report in your name, but you haven’t applied for insurance in the last seven years. Another sign of medical ID theft is if your report includes medical conditions that you don’t have.

Recommended Reading: How To Clear Bad Debt From Credit Report

Summary Of Moneys Guide For Getting Negative Items Removed From Your Credit Report

- Order a copy of your credit report through AnnualCreditReport.com and search for inaccurate information, like missed payments or accounts that don’t belong to you.

- If you find any, file a dispute online or through the mail with the credit bureaus Equifax, Experian and TransUnion.

- You should also notify your bank or credit card issuer. They can help you verify that the information in your report is, in fact, erroneous and notify the bureau.

- Be on the lookout for a response from the bureau. It should arrive in around a month or less. If they accept your dispute, request your credit report again to make sure the negative information was removed.

- If your report is riddled with errors or you’re finding the dispute process difficult, consider hiring a .

File A Dispute With The Credit Reporting Agency

Once you have your report, look through each account and see if there are creditors or accounts you dont recognize. Its also important to check whether older derogatory items are still being reported.

If you do find errors in your reports, dispute them directly with the reporting bureau through its website or by mail. This will prompt an investigation on the bureau’s part.

Bear in mind that you have to dispute the entry with each agency to make sure the removal is complete across the board.

How to file a dispute online

Each bureau Equifax, Experian and TransUnion has a section dedicated to walking consumers through the online dispute process. Once you create an account, you can file as many disputes as you need and check their status for free.

How to file a dispute letter

You can also send a dispute letter to the bureaus detailing any inaccuracies you’ve found in your credit file. When writing your letter, provide documentation that supports your claim and be precise about the information you are challenging. The Consumer Financial Protection Bureau recommends enclosing a copy of your report with the error circled or highlighted.

Depending on the information being disputed, these are some of the documents you can provide to help aid the investigation:

- Copies of checks

Include this dispute form with your letter.

Also Check: Does Klarna Show Up On Credit Report