Do I Need To Contact The Lender

Before we begin: I want to recommend to you that it is not usually in your best interest to contact the lender instead of the credit bureau.

This is because the lenders tend to have a much slower response time, and even if you do jump through their Kafkaesque hoops, theyll just be sending a message to TransUnion or Equifax to remove the inquiry, anyways.

If youve been a little bit of a spicy Miles & Points collector, then you may not want to have eyes on your account activities from lenders youve used creative strategies with but as always, the judgement call is yours to make.

Closing A Line Of Credit That Is Already Behind On Payments

Closing a card thats behind on payments doesn’t eliminate the debt. In fact, it can lower your credit score by increasing your debt-to-credit ratio, also known as credit utilization percentage. This ratio represents the amount of credit you’re currently using divided by the total amount of credit you have available.

For example, if you have two credit cards, each with a maximum credit limit of $5,000, your total available credit is $10,000. Owing $3,000 on one card and $2,000 on the other would mean you’re using 50% of your total available credit.

To improve your credit score, experts recommend keeping your credit utilization under 30%. Following the example mentioned above, that would mean using only $3,000 or less per cycle.

If you close one of your credit cards instead of paying it, you’ll have less available credit. Creditors evaluate your debt-to-credit ratio when you apply for new cards or loans. If your ratio is over that threshold, they might classify you as a high-risk borrower, offer you less attractive interest rates or even deny you credit altogether.

Can I Remove An Inquiry From My Credit Report

You cant remove a legitimate inquiry from your credit report.

The only inquires that can be removed from your credit report are those that are incorrect or erroneous, like if a lender made a hard pull on your credit without proper authorization from you. In these cases, you can submit a request to have the inaccurate details removed from your report.

How long do credit inquiries stay on my credit report?

For a legit credit inquiry, youll simply have to wait two years to have a hard inquiry taken off your credit report though itll only impact your credit score a year at most. On the other hand, a soft pull on your credit can only be seen by you and has no affect on your credit score.

Also Check: When Do Accounts Fall Off Credit Report

Should You Remove Hard Inquiries

The idea of removing hard inquiries from your credit report to improve your credit score may sound appealing. But disputing a genuine hard inquiry on your credit report will likely not result in any change to your scores.

You can, however, dispute ones that are a result of fraud. This can happen when an identity thief uses your Social Security number and other personally identifiable information to open a new account in your name.

For most people, that one extra hard inquiry may drop your credit score by just a few points temporarily, but new lenders likely aren’t going to decline your application for credit just because you have hard inquiries on your credit report. While hard inquiries take two years to fall off your credit report, typically their impact to credit scores lasts just a few months.

However, if you already have several hard inquiries on your credit report from the past couple of years or you have other, more serious, issues that are hurting your credit, one new inquiry could make it more difficult to get approved for a loan or credit card with favorable terms.

Warning About Credit Disputes

Credit disputes dont always work . When our co-founder, Mark Huntley, filed an Equifax dispute, they lowered his score by 72 points that same day! .

But the point is, you may want professional help when dealing with the credit bureaus. Or perhaps youve tried removing the inaccurate hard inquiries yourself but havent had success, then its time to call the professionals. If youve ever searched for a credit repair company, then youll quickly realize there are a lot of choices and some really horrible sounding reviews of many of them.

We like to recommend The Credit Pros. Not only are they super helpful in removing inquiries, but they also offer the lowest monthly credit repair plan cost in the industry, and have a 90-day money-back guarantee.

You May Like: Is 524 A Bad Credit Score

Dispute Inaccurate Items Yourself

You can embark on DIY credit repair by ordering your three credit reports from AnnualCreditReport.com, a source of free credit reports authorized by the federal government. You need all three reports because creditors may report transactions to only one or two credit bureaus.

After receiving the reports, review the four sections for errors:

- Identification: Information identifying yourself, including your address, date of birth, and Social Security number. Incorrect information may be a tip-off that the report covers accounts that dont belong to you.

- Tradelines: This contains your account data, which includes your use of credit and your borrowing activity. The data includes loan and credit account balances, payment history, and a collection account or charge-off.

- Public records: Court information regarding adverse legal judgments, bankruptcies, liens, foreclosures, vehicle repos, and money owed for child support.

- Inquiries: Hard inquiries are those you authorize a credit provider to make when you apply for a credit card or loan. These can lower your credit score. Unauthorized soft inquiries have no impact on your score.

The hardest part of DIY credit repair is combing through your report data for accounts or account activity you dont recognize, incorrectly reported negative credit file items , and liens and judgments you have already paid. You also should check for hard inquiries you didnt authorize.

Plan Before Shopping For A Loan

Before shopping for a loan, it’s always smart to proactively plan your finances.

First, learn whether the type of credit you’re applying for can have its hard inquiries treated as a single inquiry. If so, determine the applicable timeframe. Then you can plan your shopping period accordingly.

Second, you may also want to check your credit reports before getting quotes to understand what information is reported. Find out how to request a free credit report from Equifax.

If you’re worried about the effect that multiple hard inquiries may have on your credit reports, it may be tempting to accept an offer early rather than allow multiple hard inquiries on your credit. However, consider your individual situation carefully before cutting your shopping period short. In many cases, the impact hard inquiries have on your credit scores from shopping around will likely be minimal compared to the long-term benefits of finding a loan with a lower interest rate. The more informed you are about what happens when you apply for a loan, the better you can prepare for the process before you start shopping.

Read Also: Does Afterpay Report To Credit

Linda L Jacob Certified Financial Planner Accredited Financial Counselor

@LindaJacob07/18/19 This answer was first published on 03/12/16 and it was last updated on 07/18/19.For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

Can You Dispute Hard Inquiries

Disputing hard inquiries on your credit report involves working with the credit reporting agencies and possibly the creditor that made the inquiry. Hard inquiries can’t be removed, however, unless they’re the result of identity theft. Otherwise, they’ll have to fall off naturally, which happens after two years.

Recommended Reading: Does Credit Limit Increase Hurt Score

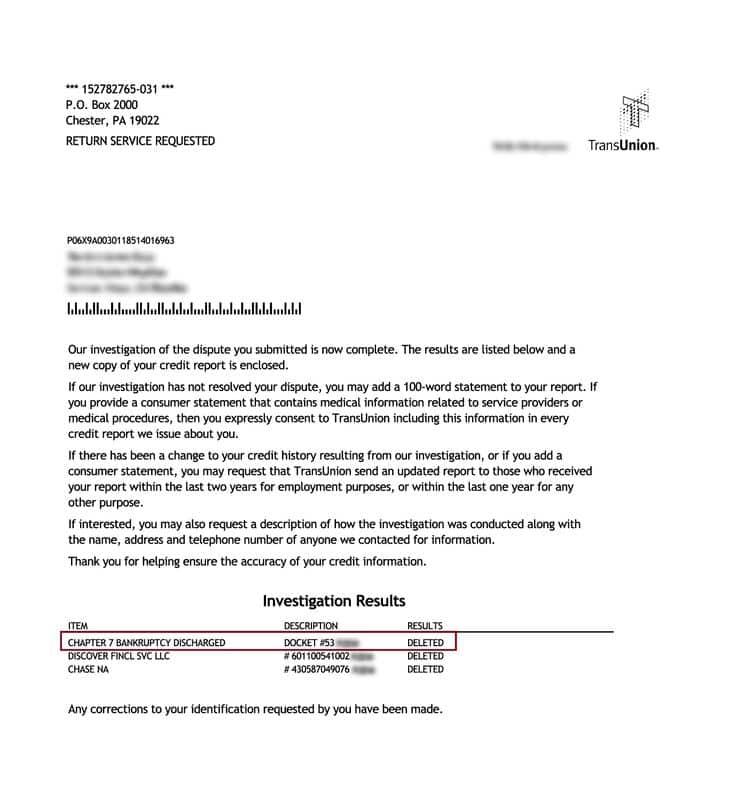

What Happens When An Item Is Deleted From Your Credit Report

Whenever your credit report is altered because of a dispute lodged by you or a credit repair service, the credit bureau must inform you in writing. You are then entitled to a fresh copy of your credit report from the bureau.

Many credit cards offer free alerts that inform you whenever your credit score changes. Thus, if an item deletion results in a change to your score, your credit card company may be the first to inform you of the good news. You also may get a free fraud alert service.

You should see your credit score improve when negative items are removed from your reports. How much it improves, however, depends on the type of item that is removed and its age.

The credit bureau must send you written results about your dispute, which usually arrive within the initial 30-day window. If the results are favorable, you can instruct the bureau to notify anyone who received your report in the past six months.

Can Disputes Hurt Your Credit

There is no reason for a dispute to ever hurt your credit. At worst, it may have no impact on your credit score.

However, your score should rise if a dispute successfully results in the removal of derogatory items from your credit report.

Perhaps the only negative outcome from a credit dispute occurs when consumers abuse the process by submitting frivolous challenges. Eventually, a credit agency will recognize this kind of abuse and just ignore your dispute submissions.

Like the boy who cried wolf, this can come back to bite you when you suffer from a real credit report error.

Read Also: How To Request Credit Report Canada

Combining Multiple Hard Inquiries

Its important not to apply for too many types of credit at one time.

However, the credit scoring models understand that people make multiple hard inquiries to compare terms and rates. So, if youre shopping around for one type of credit, like a mortgage, and make multiple inquiries in a short period of time, they only count as a single hard inquiry.

Lenders have become increasingly lenient in this regard because they know that todays consumers are more likely to perform their due diligence before making a major financial decision. This is true for credit cards or an auto loan as well. They do not impact your credit scores as long as they occur within a 30-45 day period.

How Do I Remove Hard And Soft Inquiries From My Credit Report

When someone pulls your credit, its reported as either a hard or soft inquiry. Hard inquiries can trigger a temporary drop in your score, raising red flags to potential lenders. Soft credit pulls have minimal impact on your credit, and they typically dont factor into a lenders loan or line of credit approval decisions.

Soft credit checks are indisputable since creditors, lenders, and lenders can run them without prior approval. A hard credit check will remain on your profile for two years and could impact your score for up to a year.

If someone runs a hard inquiry without your authorization, this is considered fraud. In that case, you can file a dispute directly with the credit bureaus to remove it from your profile.

Don’t Miss: What Credit Score Do You Need For Amazon Credit Card

How Long Do Inquiries Stay On Your Credit Report

Hard inquiries are taken off of your credit reports after two years. But your credit scores may only be affected for a year, and sometimes it might only be for a few months. Soft inquiries will only stay on your credit reports for 12-24 months. And remember: Soft inquiries wonât affect your credit scores.

Lenders may be concerned if you have too many hard inquiries on your credit report within a short period of time. However, there are some exceptions to this.

For example, if youâre shopping around for a mortgage or car loan, it makes sense that you might be comparing rates with different lenders. For that reason, rate shopping within a certain time frameâgenerally 14 to 45 days, depending on the credit-scoring modelâcould be treated as just a single hard inquiry.

You could keep up with your credit status by pulling your free credit reports from the three major credit bureaus: TransUnion®, Experian® and Equifax®. You can retrieve free copies of your credit reports by visiting AnnualCreditReport.com.

can also help you access your TransUnion credit reports and your weekly VantageScore® 3.0 credit score. Using CreditWise wonât hurt your credit scores, and itâs free for everyone, whether or not you have a Capital One product.

What Types Of Inquiries Can Be Removed From Your Credit Report

To review, soft inquiries dont count against your score, but may still influence decision making. So, is it possible to remove an inquiry? It depends. Like everything that is in your credit file, if something is true and not beyond its expiration date, it generally cannot be removed by the consumer. If you apply for a credit card and get rejected, you might think you should able to remove that inquiry since nothing happened.

But you would be wrong. You did apply and whether you got the card or not makes no difference to the inquiry. While this may seem unfair, looking at it from a creditors position you can see there is value in having this information in your file as it evaluates your creditworthiness.

However, there are cases where an inquiry can and should be removed. If your identity is stolen and used to open a fraudulent account or change an existing account, you are the victim of identity theft and have every right to have those inquiries removed.

Identity theft is a serious problem and is probably the No. 1 reason why it is important to know what is in your credit reports. The damage done to your score and your financial health can be devastating if not caught quickly.

As with all data in your credit report, any information that is not yours can be removed. But everyone makes mistakes and the bureaus are no exception. It is estimated that upwards of 25% of credit reports have errors.

Editorial Disclaimer

Essential reads, delivered straight to your inbox

Read Also: What’s A Credit Score

Check Your Credit Report Regularly

It isn’t common to find inaccurate information on your credit report, but it can happen. To avoid letting fraudulent and other erroneous information go unchecked, make it a goal to check your credit report regularly. Review what’s listed and watch out for anything you don’t recognize.

Also keep an eye on your credit score , and watch out for sudden drops that could indicate fraudulent activity, such as a bogus account opened in your name that’s gone unpaid.

It’s not always possible to prevent identity theft, but as you keep track of your credit history, you’ll be in a better position to stop a difficult situation from getting much worse.

How To Remove Hard Inquiries From Your Credit Report

Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

A hard inquiry is a record of every time that a creditor or lender runs your credit report to help decide what kind of credit or loan to grant you. When someone runs a credit check, it harms your credit score. Given the potential harm, you should look to remove as many hard inquiries as possible. This article takes you through how to remove hard inquiries from your credit report. It discusses which hard inquiries are removable and the specifics of disputing them.

Written byAttorney Todd Carney.

Navigating your credit score can be confusing, since there are many personal finance factors to deal with. One issue is âhard inquiries.â A hard inquiry is a record of every time that a creditor or lender runs your credit report to help decide what kind of credit or loan to grant you. When someone runs a credit check, it harms your credit score. Given the potential harm, you should look to remove as many hard inquiries as possible.

This article takes you through how to remove hard inquiries from your credit report. It discusses which hard inquiries are removable and the specifics of disputing them.

Recommended Reading: How To Check Credit Score Without Lowering It

Will Disputing An Inquiry Improve Your Credit

In the case of fraud, it is always important to take steps to investigate the unauthorized inquiry as this can help prevent future fraudulent activity. There is no guarantee that disputing the inquiry will impact your credit score. FICO estimates that a single inquiry has less than a 5 point impact on your credit score.

Hard inquiries are part of what makes up the New Credit portion of your credit score. However, this factor accounts for only 10% of your overall credit score. Not all hard inquiries are weighted the same way. Newer inquiries have the most significant impact. Once inquiries are 1 year old, they no longer affect your credit score. And after 2 years, they fall off your credit report.

Check Your Credit Report

The first step in removing hard inquiries is to evaluate your credit report. You can get a free credit report from AnnualCreditReport.com. Dont assume they are all the same because each report will have different information. Examine all three credit bureau reports: Equifax, TransUnion, and Experian. Credit reports are free annually, so its a good financial habit to do this once a year.

You May Like: How To Fight Collections On Credit Report

Hard Vs Soft Credit Inquiries

Hard inquiries are the only type of credit pull that can affect your credit score, and they’re the only ones that businesses will see on your credit report. Credit inquiries that don’t affect your score and don’t appear on your report are called soft pulls. Examples of soft inquiries include you checking your own report and a potential employer accessing it during a background check. And credit card issuers may do soft inquiries when they are preparing promotional card offers.

Credit inquiries carried out by insurance companies when you’re seeking quotes for various kinds of policies are considered soft inquiries and do not show up on your credit report.