Bad Service Or Services Not Rendered

The Fair Credit Billing Act a federal law passed in 1974 gives you the right to dispute charges in case you are dissatisfied with the transaction through a process called Claims and Defenses.

Key details for filing your claim:

- File a report on a disputed purchase within 60 days of the statement date on which the charge appeared.

- Before you officially report your issue, the law requires you to try to work out the disagreement directly with the merchant. See if the merchant is willing to provide you with a refund or some sort of store credit.

- Save all documentation that proves you attempted to resolve the issue. This can be an email exchange or a witness to you speaking with the merchant. If this route fails, you can turn to Claims and Defenses.

- It is important that you do not pay for the disputed credit card charge. Contact your issuer immediately, and inform it that you are working on resolving the issue.

- During the course of the investigation, your creditor may lower your credit limit proportionally to the amount being disputed. For example, if you are challenging a $500 credit card purchase and your credit limit is $2,000, the creditor may set your credit limit to $1,500 while that purchase is investigated.

Additionally, complaints about the quality of goods and services can only be made if the following are satisfied:

Send A Dispute Letter

Assuming you meet all of the above qualifications, you should send a letter to your creditor’s billing inquiries department. This address will be different from the one you use to send payments. It’s best to use certified mail and ask for a return receipt so that you have proof your bank received it. The letter should include any and all supporting documentation, including a copy of any sales slips, pictures of damaged goods and any correspondence between you and the merchant. Below you can find a sample letter provided by the FTC.

Dispute credit card charge sample letter:

Attn: Billing InquiriesRe: Notice of disputed charge to Account No. Dear :I am writing to dispute a charge of to my account on . The charge is in error because .. The seller promised to deliver the items to me on , but I never received my order.”]I am requesting that the error be corrected, that any finance or other charges related to the disputed amount be credited to my account, and that I get an accurate statement.Enclosed are copies of supporting my position and experience. Please correct the error on my account promptly.Sincerely,Enclosures:

Fraudulent Or Unauthorized Credit Card Charges

Follow these steps to dispute a fraudulent or unauthorized credit card charge:

Also Check: Why Do You Need A Credit Report

What To Do If Youre A Victim Of Credit Card Fraud

Contact your financial institution immediately if your credit card is lost or stolen. Contact it if you find payments on your credit card statement that you didnt make or approve.

If you think youre a victim of credit card fraud:

- write down what happened and how you first noticed the fraud

- contact your credit card issuer to tell them about the fraud

- take notes of who you talked to and when you spoke to them

- keep all documents that you think might be helpful when the police investigate the fraud

- contact your local police service to file a complaint

- contact other accounts that could be tampered with by the person

Read Also: Does Paypal Credit Report To Credit Bureaus

Be Wary Of Credit Card Protection Offers

This type of insurance is unnecessary because of the federal limits in place. Often times, your bank or credit card company will have identity protection or fraud protection services already in place just by being a customer. Third-party companies that offer credit and identity theft insurance can be expensive and often simply follow the same steps that you would in reporting unauthorized spending on your card.

But beware: some scam artists try to sell $200-300 credit card insurance by falsely claiming that cardholders face significant financial risk if their cards are misused.

Also Check: How To Calculate Credit Score Points

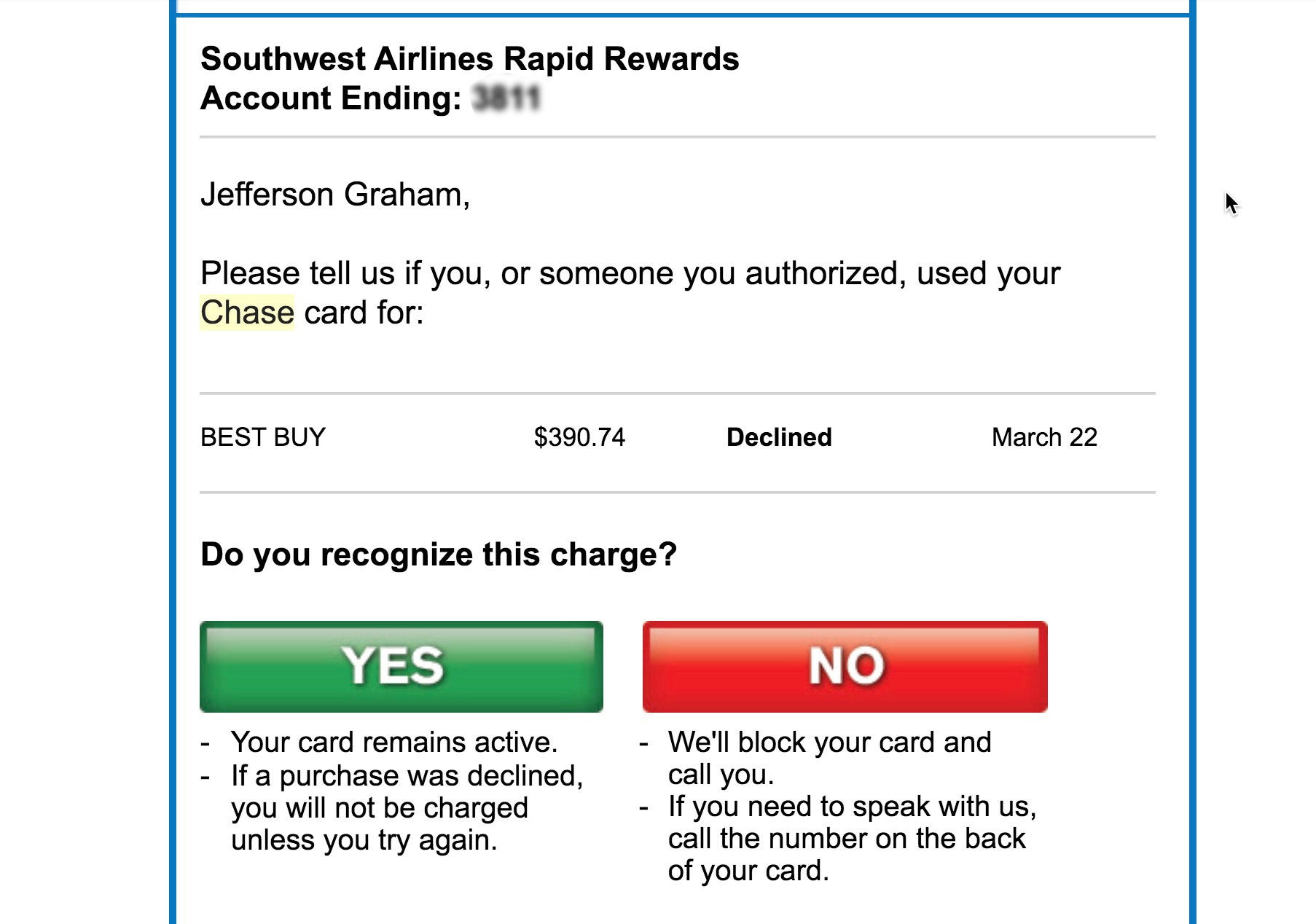

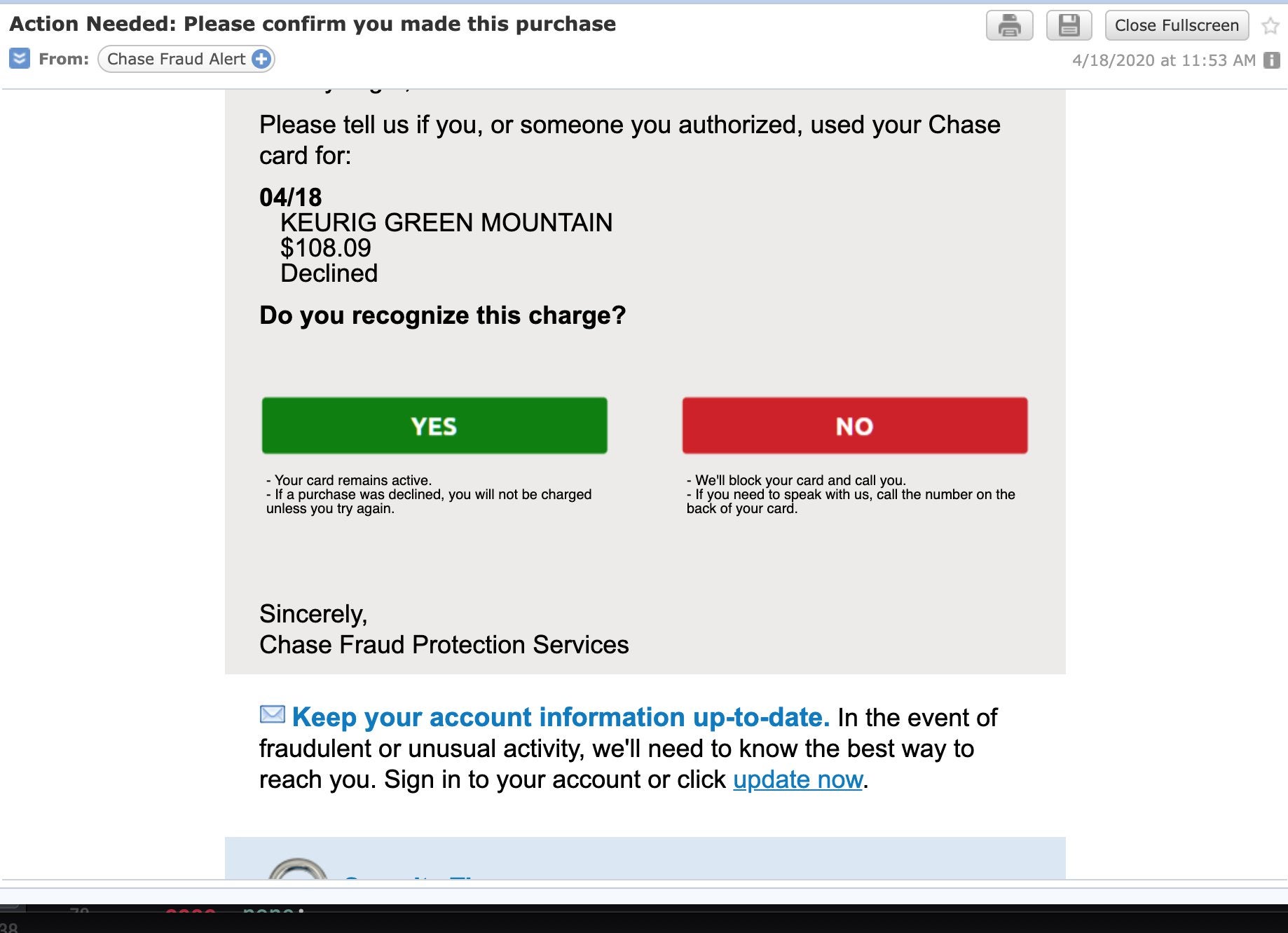

Your Action Steps If You Find Fraud On Your Chase Card

If you spotted fraud but arent sure how it happened, youll take a similar course of action: get in contact with the bank!

Regardless of how the fraud occurred, the most important thing to do now is to contact Chase and work with them to resolve the issue. You dont have to know exactly what happened.

Its not your responsibility to fully investigate. And never put off reaching out to the bank for fear they think you did something wrong or because youre unsure of what will happen next.

Chase is here to help you and your card does protect you against fraud, so again — dont panic!

The best thing you can do is alert Chase so they can start investigating and employing measures to protect your account from further fraud.

Get into action by taking the following steps:

- If youre a Chase Premier Platinum Customer, call 18882624273.

- If the fraud occurred on your personal credit card, call 18004323117.

- If it happened to your business credit card instead, call 18882698690.

You can also dispute charges online. You need to log into your online portal to dispute fraudulent charges and complete the process from within your account.

Your Chase statement should also include information about exactly what channels to use if you spot fraud.

And your card itself includes a 1-800 customer service number on the back that you can call.

Keep all evidence of fraudulent charges, like your statements or bills you didnt authorize.

Types Of Credit Card Fraud

- Lost or stolen cards

A card may be picked up and used after falling from your pocket, or get taken from your wallet or mailbox. Both of these situations are considered fraud.

- Account takeovers

Takeovers occur when a fraudster contacts your card issuer and pretends to be you, then orders a new card to their address.

- Counterfeit cards

Electronic devices, like skimmers, can be used by fraudsters to copy your card information when they use it to debit your account, and then reprint it on another card.

- “Card Not Present” transactions

If a fraudster acquires your card number and uses it without the physical card present-e.g., in an online purchase-this constitutes a CNP transaction.

- Falsified credit applications

Many card issuers mail out “pre-approved” credit card offers. A fraudster can intercept one of these offers and complete it to get a new card in their name. While credit card applications from major card issuers will require many different proofs of identity to finalize approval and prevent fraudsters from opening these pre-approved lines of credit, victims of identity theft should review their credit report regularly to avoid fraud.

Don’t Miss: Is 654 A Good Credit Score

Chase Loses A Loyal Customer

Chase may have saved themselves $116 but they might have lost something more valuable a loyal customer.

After spending countless hours on the phone with Chase Supervisors he decided to move his money elsewhere. And he makes a good point how can he trust them with his money?

So needless to say, Im closing all my accounts at chase today. Not only where they not willing to look at the case and my argument about the proof, when I told the guy that Im closing my account, he said if thats what you have to do. Over $116. How can I trust that my money is safe there? What if it was $10000. Im sure they would tell me the same story. That its my fault. That Ive been a chase customer for a decade to run a long con to get $116 dollars.

What Else Can Donotpay Do

Managing Amazon credit card fraud is only the tip of the DoNotPay iceberg.

- DoNotPay is a trusted resource for getting victims’ compensation.

- You can file insurance claims or start a refund process.

- We carry a broad array of services that span a range of advocacy services.

If you find yourself in need of fast, streamlined defense, reach out to DoNotPay.

Recommended Reading: How To Clear Your Credit Report

Resolving Claims Outside The Dispute Process

Of course, even if the bank conducts a thorough credit card fraud investigation, they may still reach the wrong conclusion. Our data suggest that 60-80% of all chargebacks may be cases of friendly fraud, not criminal fraud. For instance, this may happen if a cardholder signs up for a free trial, but fails to cancel before regular billing kicks in. An unsupervised child completing an in-app purchase on a parents mobile device would be another example.

These are forms of chargeback abuse. Regardless whether its intentional or not, these chargeback scams carry consequences for everyone:

Merchants

lose revenue and merchandise and pay added fees and penalties. They see higher operating costs and may lose the ability to process card payments in the long term.

Banks

ace higher operating costs as theyre forced to devote more resources to investigating disputes. This can slow down other profit-generating departments within the organization.

Cardholders

can have their money tied up for weeks or months due to the chargeback process. This inability to access funds during this time could cause hardships.

Its best for everyone if the cardholder directly contacts the merchant before filing a chargeback. The two parties may be able to collaboratively resolve the situation and avoid a dispute. This would be a win-win scenario for everyone: the cardholder could see faster resolution, while banks and merchants are spared the cost of the dispute process.

I Get Several Email Messages A Week That Claim To Be From You Why Can’t You Stop Them Why Don’t You Prosecute The People Responsible

We’re able to stop many of those emails. First, we try to have the server sending the messages shut down. Then we work with domestic and international law enforcement authorities to track down and arrest the people responsible.

Many of these attackers, however, are based outside the United States and use many methods to hide their tracks electronically.

Also Check: How To Boost Your Credit Score Fast

Disputing A Credit Card Charge

There are several reasons you may want to dispute a credit card charge, including fraudulent purchases, billing errors or bad service/service not rendered.

- Fraudulent charges on your bill can be disputed by calling your credit card issuer or filing a dispute online. This is typically a quick process where the issuer will cancel the credit card in question and issue a new one.

- Bad service and service not rendered are also eligible reasons to dispute a charge, even if you willingly made the purchase. For example, if you purchase something online that shows up broken, your credit card issuer can assist with getting your money back.

- Billing errors can also be disputed through your credit card issuer, either over the phone or online. Just make sure you reach out to the merchant first to see if you can resolve the error before getting your credit card company involved.

There is a more formal process you must follow with . In this case, you typically have 60 days from the time you receive your statement to act.

| Type of dispute |

|---|

| Requires specific protocol. See below. |

Select Breaks Down The Steps You Can Take If Your Credit Card Information Is Stolen And How You Can Limit Your Exposure To Fraud

Selects editorial team works independently to review financial products and write articles we think our readers will find useful. We may receive a commission when you click on links for products from our affiliate partners.

happens every day, but its especially prevalent during times of economic hardship. You should consistently take steps to protect your credit so you minimize the chance that youll become a victim of fraud.

If you find that your card has been lost or stolen, its important that you act fast to safeguard your credit card information and alert your card issuer that your account has been compromised.

Below, Select breaks down the steps you can take if your credit card information is stolen and how you can limit your exposure to fraud.

Read Also: How To Remove Items From Credit Report After 7 Years

Don’t Miss: Does Car Insurance Affect Credit Score

How To Protect Yourself From Credit Card Fraud

Most credit cards today come with sophisticated security features, and you can also turn to free credit monitoring services as an easy way to keep an eye out.

The easiest actions you can take include opting for a card with $0 liability protection, monitoring your accounts closely, signing up for transaction alerts and securing your personal information.

Reporting Suspicious Activity To Chase Bank

You can report fraudulent activities to Chase, but the bank also recommends alerting governmental agencies. Chase works with domestic and international law enforcement authorities to shut down servers sending fraudulent content and arrest responsible parties. To ensure your account’s safety:

Don’t Miss: How Long Do Credit Card Inquiries Stay On Your Report

Monitor Your Credit Card Statement

After you report fraud to your card issuer, regularly sign into your online account and check that you received the refund for the fraudulent charges and there are no new signs of fraud.

Under the Fair Credit Billing Act your maximum liability for unauthorized charges is $50. For instance, if someone makes $100 in fraudulent charges with your card, you can only be required to pay $50. However, most major banks, such as Citi and Chase, offer $0 liability on unauthorized charges.

Once your billing cycle closes and you receive your , double check that the information listed is up to date. Verify the details of each transaction, such as the merchant, size of purchase and date, as well as you overall balance and any payments youve made toward your balance or credits youve received .

Next Steps For Amazon Credit Card Fraud If You Can’t Do It Yourself

Federal agencies like the Secret Service and FBI investigate credit card crimes. The FTC counsels on credit card fraud but does not investigate. The DoJ is responsible for mass-market fraud, such as phishing.

Which agency takes charge is based on the severity and type of crime. Someone using your cards or identity may be a major inconvenience, but that’s not a crisis. If a breach affects millions, impacts the market, or finances, and businesses worldwide, that demands unique attention.

You can contact local police and file a report, but they will likely advise you to go to a federal agency. Only under specific circumstances will the police act, such as having evidence scammers are local.

You may also reach out to local political representatives, like the district attorney, your district councilman, or a consumer advocate.

Read Also: What Is Nctue On Credit Report

Review Your Credit Card Statements

The best way to protect yourself from credit card fraud is to review your credit card statements every month. Even if youre the kind of person who regularly logs into your credit card app to check your available credit or review posted transactions, its still a good idea to read your credit card statement every time it hits your inbox or mailbox.

When you review your credit card statement, take a close look at each of the transactions associated with your account. Do any purchases look unusual or suspicious? If you suspect that one or more of the charges on your account might be fraudulent, contact your credit card issuer right away.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Don’t Miss: What’s A Perfect Credit Score

The More You Give The More Youll Get

While swift reporting is advised, so is presenting relevant documentation. Be prepared with credit card statements and credit reports showing the fraud, says Shipley. If you know the perpetrator, speak up. If you can provide that persons contact information, all the better.

Do not, under any circumstances, conduct your own whodunit hunt, experts stress. It might put you, your friends and family members in danger.

You dont know who youre dealing with, says DiDomenica. People who break the law in this way could be capable of even worse crimes. Yes, keep emails and forward them to make it easy for the investigators, but dont go beyond that. No vigilantism.