Should I Apply For Another Loan

If you have paid off a debt and are looking to keep up your credit score, you may be wondering what you can do. If you close a loan, it may seem like opening another loan will keep your credit score points high. However, applying for another loan may only help your credit score in certain scenarios.

If the loan you closed was held for a while, meaning you had a long credit history with that loan, opening a new loan wont help with any credit score points lost. A new account wont bring you any wins with credit history length.

However, if paying off a loan means you lose some diversity in your credit portfolio, applying for certain types of loans could help your score. You get some points for having different types of credit . If the loan you pay off is the only one you have of its kind, you could gain some points back by opening a new type of loan. For example, if you pay off your car loan and are left with only credit cards, consider applying for a different type of loan.

A bigger contributing factor than credit mix for your credit score is whether you can make payments on time. If applying for a new loan will impact your ability to make any payments on time, you shouldnt risk applying for the new loan.

What Is A Collection Account

A collection account is a credit account that is in default. If an account is in default, it often means the borrower hasnât made a payment on it for 90 days. The creditor will try to collect the debt once itâs in default. It may do so in one of the following ways:

-

The creditor will assign the account to its in-house collections department.

-

The creditor will sell the debt to a debt buyer that may then try to collect the debt.

-

The creditor will hire a third-party debt collection agency to begin debt collection activities.

Regardless of which method a creditor uses, if you have a delinquent credit account, you can expect to get debt collection telephone calls and letters.

The creditor will also report the default to the credit bureaus. It will be listed as a collection on your credit report, which is one of the most serious negative items. Collection accounts are part of your payment history, which has the biggest impact on your score. Your payment history makes up 35% of your FICO .

Just to keep things clear here and in the rest of the article, a contains information about your . Your credit history information is then used to calculate your . A credit score is a shorthand way lenders and creditors determine how risky you are as a borrower. They use your score to predict how likely you are to fully pay a debt or default on it. Your credit score plays a crucial role in your ability to get credit and how much itâll cost to use that credit.

Can Collections Be Removed From Credit Report After Paid

A goodwill deletion is the only way to remove a legitimate paid collection from a credit report. This strategy involves you writing a letter to your lender. In the letter, you need to explain your circumstances and why you would like the record of the paid collection to be removed from your credit report.

Recommended Reading: How To Dispute Items On Your Credit Report

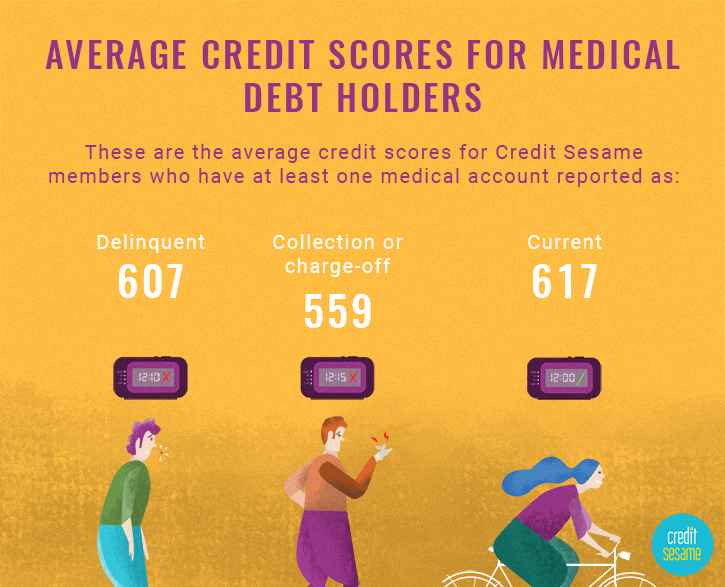

How Will A Debt In Collections Affect My Credit

Unfortunately, a debt in collections is one of the most serious negative items that can appear on credit reports because it means the original creditor has written off the debt completely. So when a debt is sent to collections, it can have a severe impact on your credit scores. Thats why working hard to get current before an account enters collections can help your credit recover faster from a late payment.

Additionally, lenders also may consider frequency of debt collections. For example, someone whos had only one debt transferred to collections may have an easier time getting approved for credit than someone whose credit report shows multiple debt collections.

If you already have debts in collection, the good news is that the impact on your credit scores will diminish over time. And eventually the debt collection will fall off your credit reports completely. Generally, an account in collection will remain on your credit reports for seven years.

How Long Does A Collections Stay On Your Credit Report

A collections account stays on your credit report for 7 years from the date you became delinquent on making payments on your account or bills. For example, if your credit card payment was due on January 1st, 2022, and you missed that payment, the bank may have closed your account and sold the unpaid balance to a collection agency. The collection account could then remain on your credit report until January 1st, 2029.

After the 7 year period is over, the collection account should automatically be removed from your credit report. In the event that the collection account is not removed after the 7 year period is over, you can file a dispute with the credit reporting bureaus to have the collection account removed from your credit report.

After you file a dispute, the credit reporting bureau will conduct an investigation, if they find that the collection account has been on your credit report for more than 7 years, they will remove it for you.

Don’t Miss: How To Increase Credit Score With Credit Card Payments

How To Improve Your Credit Scores After A Collection

The good news about collection accounts on your credit reports? As they age, they count less toward your credit scores. And even while you have a collection or collections on your credit reports, there are many other ways to improve your credit scores.

The best way to start improving your credit score is to prevent new derogatory information from appearing on your credit reports. You can achieve this by making all of your debt payments on time, without exception. If your bills are paid on time, your debts will never go into default and there will never be a need for a debt collector to get involved.

Ensuring that your credit card debt is as low as possible is another great way to improve your credit scores. Credit scoring models consider your , or amount of credit card balances relative to total credit limits, when calculating your scores. Maintaining low balances ensures a low utilization ratio, which can improve credit scores.

Finally, don’t apply for credit unless you need it. Each time you do so, the lender will likely pull one, if not more, of your credit reports. This will result in a hard inquiry on your reports, which can lower your scores temporarily. And while inquiries are the least influential factor in your credit scores, they can still be a red flag to lenders.

The Truth: Should You Never Pay A Debt Collection Agency

George Simons | July 21, 2022

Summary: When a collector contacts you, respond with a debt validation letter. You may not want to pay a collector if you will never have any income or assets, if you don’t owe the debt, if you want to settle for less, if the statute of limitations has expired, or if the collector doesn’t own the debt.

You’ve heard that you should never pay a debt collection agency, and now you want the truth. What happens if you never pay collections? Should you pay the debt collector or the original creditor?

Debt collection agencies can employ a variety of shifty tactics. They may start with harassing phone calls and escalate from there. But depending on your situation, you may never need to pay a debt collector. Not sure where to begin? SoloSuit can help.

Also Check: Does Carecredit Affect Credit Score

As An Alternative Hire A Credit Repair Company

If you go this route, make sure that youre dealing with a reputable company that uses effective, nonfraudulent ways to remove items from your credit report. Check sites like the Better Business Bureau, Trustpilot, the Consumer Financial Protection Bureau or Google Reviews to make sure the services dont engage in unethical, shady practices around .

Ask For Debt Validation

The best dispute reason for removing collections is by asking the collection agency to validate the debt. Most often, documents get lost as debts are shuffled from one collection agency to another in an attempt to recover their money. In such scenarios, original documents get lost, and inaccurate details are passed on to debt collection agencies.

You should use this loophole to ask them to verify if the debt belongs to you. They will have to remove collections from your credit report if they cant validate the debt.

Don’t Miss: How Long Does Negative Credit Information Stay On Your Report

Does Avoiding Hard Inquiries Raise Your Credit Score

Yes, having hard inquiries removed from your report will boost your credit scorebut not drastically so. Recent hard inquiries only account for 10% of your overall score rating. If you have erroneous inquiries, you should try to have them removed, but this step wont make a huge difference by itself.

If You Dont Find Any Errors Ask The Agency To Validate The Debt

In many circumstances, debts can get shuffled around from one third-party debt collector to another, sometimes several times over. Its not uncommon for inaccuracies to get transmitted to the debt collection agency. Also, documents verifying the original debt can get lost, too.

Once a debt ends up in collections, and you start to get communications about owing the debt, its totally acceptable to ask the debt collector to verify that the debt is valid and actually belongs to you.

Heres the information you should include in your request to validate the debt:

- Information about the original creditor and the original account

- Amount and age of the debt

- Supporting documentation like an original invoice, bill, promissory note or similar document to prove the debts validity

- Why the agency believes you owe the debt

- Whether or not they are licensed to collect debt in your state

Note, once you send the debt collector a written dispute or a written request to validate the debt within 30 days, they have to pause collecting the debt until they respond to your dispute or answer your request.

If the personal information attached to the debt, like your name, aliases, phone number, address, etc., cannot be accurately matched with the debt, it must be removed from your credit report. Also, if they cannot provide any proof the debt is valid, it must also be removed from your credit report.

Don’t Miss: How Does A Charge Off Affect Your Credit Report

How Often Should You Check Your Credit Score

You should check your credit score regularly to check for errors, but make sure that you do so through soft inquiries so that your score isnt dinged. Many banks offer free credit monitoring to their customers check with yours to see if you can enroll in their service and get alerts whenever your score changes.

Send A Goodwill Letter

Once a collection account is reported to the three major credit bureaus, the negative information will remain for seven years. Unfortunately, despite having paid your debt fully, some lenders will consider this information when offering you loans. This affects the interest rate because they consider you uncreditworthy and offer you loans with higher interest rates.

Consider writing a goodwill letter, sending it to the collector or creditor, and politely asking them for a goodwill deletion by pointing out that you have fully paid the debt. If the creditor or collection agency agrees, ask for a written agreement that you can present to credit bureaus just in case the agency fails to update them.

Don’t Miss: What Is Credit Score Out Of

If That Fails Wait For The Collection To Drop Off Your Report

Generally speaking, negative information is removed from your credit report after seven years. The clock starts from the first date your delinquent accounts are reported. This means if you miss one or more payments, then the account is sent to collection, the late payment information will be removed seven years after the first date of delinquency, not when it gets to collections.

Be aware, however, that just because a debt disappears from your credit report doesnt mean you dont have to pay it. If its not past the statute of limitations or the time frame when a creditor can sue you for a debt, then a creditor still has the right to pursue payment and even take you to court to recoup it.

Each state has its own laws that govern the statute of limitation on debt. Make sure you understand your responsibility to pay old debts based on your states laws. If necessary, seek counsel from a lawyer to make sure you are compliant with your debt obligations and will not end up paying more than required.

Should you negotiate a pay-for-delete agreement?

In some cases, you can negotiate what is called a pay-for-delete arrangement. With pay-for-delete, you pay all or a portion of the debt in exchange for the collection agency removing the account from your credit report.

How Long Does Improving Your Credit Score Take

There is no set minimum, maximum, or average number of points by which your credit score improves every month, and there is no set number of points that each action will gain. How long it takes to boost your credit depends on the specifics for why your credit score is low. If the major negatives on your credit score are credit utilization, and then you pay off your balances, your score can improve drastically in a single month. If your credit is low because of multiple collections and poor payment history, then it will take several months of on-time payments to see any positive movement in your score.

Also Check: What Is Your Credit Score

How To Manage Debt In Collections

As a general rule, dont ignore debt collectors. While its OK to take a few days to gather your thoughts and documentation before talking to them, ignoring them entirely only makes your debt problem worse. Working with debt collectors is a process, and youll want to take the time to formulate a plan.

Learning That You Have Debts In Collection Can Add A Lot Of Stress And Anxiety To Your Life

If youve fallen behind on your bills or debts, a debt collector may contact you. Debt collectors are typically people or agencies paid by creditors to collect on certain past due debts.

But dont panic if you have debts in collection and dont ignore the debt collectors either. Instead, educate yourself about your rights, the effects on your credit, and your best options for working with debt collectors. Heres what you need to know so you can move forward.

Recommended Reading: How Long Does A Judgement Last On Your Credit Report

What Happens If I Don’t Pay Off My Debt In Collections

It may be tempting not to pay off a debt in collections because it is already in collections and impacting your credit score, but that’s not the only negative impact it can have. Collection agencies have the full right to pursue the debt you owe them, and they will begin to call consistently and even send letters to your residence until you pay the amount owed.

The impact on your credit report could cause you to get higher interest rates or have to pay a higher down payment for certain services. If you still refuse to pay your debt, the collection agency can sue you for the amount. It’s always better to pay off your debt in collections and communicate with them on how to get that done as you’re able to.

How Long Will It Take For My Credit Score To Improve After I Pay Off Collections

Your credit score changes any time that your credit report is updated. Assuming that the circumstances are right for you to see any improvement at all, you can expect to see it as soon as your creditor or debt collectors notify the credit bureaus that your account has been paid. This usually takes 3045 days, but the exact timeline can vary. 4

All collection accounts fall off your credit report after 7 years

Like most other negative information, collection accounts can stay on your credit report for up to 7 years, even after youve paid them. 5 However, their effect on your credit score will diminish over time, regardless of which model your lender is using.

Recommended Reading: How To Increase Credit Score With Credit Card

Dont Let Collections Hurt Your Credit Score

Unfortunately, paying off collections may not result in an instant improvement to your credit score. However, theres no denying the peace of mind and long-term benefits that come from no longer needing to deal with collections agencies.

Regardless of your debt status, the sooner you pay off late payments and accounts that have gone to a debt collection agency, the better.

If you need help getting a handle on your debt, check out the Tally app. Our convenient app rolls your credit cards into a single payment plan with a lower-interest line of credit so you can pay off high-interest accounts faster and potentially improve credit scoring factors.

To get the benefits of a Tally line of credit, you must qualify for and accept a Tally line of credit. The APR will be between 7.90% and 29.99% per year and will be based on your credit history. The APR will vary with the market based on the Prime Rate. Annual fees range from $0 – $300.