Not Eligible To Vote In The Uk Add Proof Of Residency

If you aren’t eligible to vote in the UK so can’t be on the electoral roll , send all three credit reference agencies proof of residency and ask them to add a note to verify this. This should help you get credit.

Some foreign nationals are allowed to vote in local elections, and therefore can be registered on the electoral roll in the normal way.

Update: Despite the UK having left the EU, and the so-called transition period having ended, the rules described above about EU citizens and their right to vote in UK local elections remain the same.

What Is The Difference Between Fico Score And Vantagescore

Two companies dominate credit scoring. The FICO score is the most widely known score. Its main competitor is the VantageScore. Generally, they both use a credit score range of 300 to 850.

FICO and VantageScore pull from the same data, weighting the information slightly differently. They tend to move in tandem: If you have an excellent VantageScore, your FICO is likely to be high as well.

Don’t Withdraw Cash On Credit Cards

This is both expensive to do, as interest is higher and you’re charged it even if you repay in full each month. Crucially, many lenders see it as evidence of poor money management.

The one exception is withdrawing cash on a specialist card abroad. See Overseas Credit Card ATM Withdrawals for full info and why they’re not too bad.

Don’t Miss: When Does Hard Inquiries Fall Off

How To Raise Credit Score By 200 Points

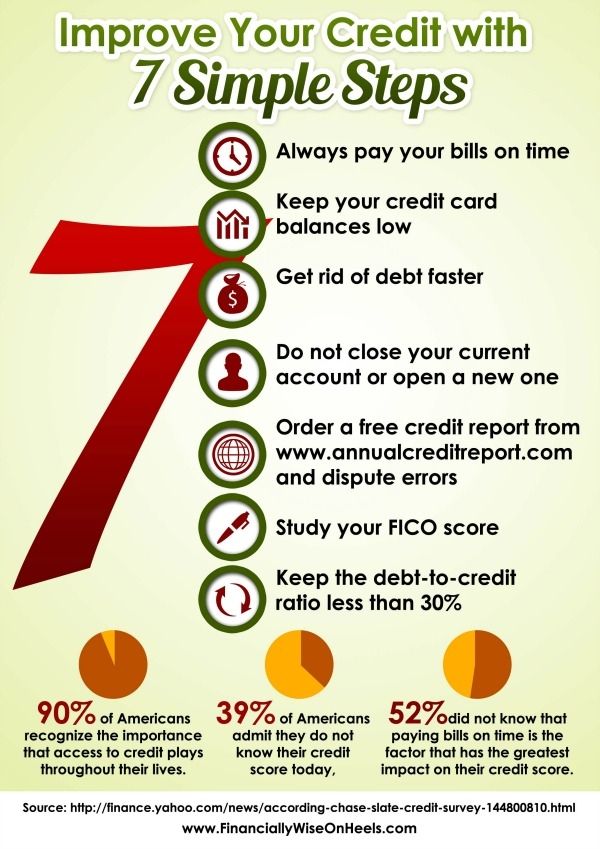

A few points on your credit score can mean the difference between getting approved for a loan at a reasonable interest rate and being denied a loan altogether. If your credit score is currently under the 600-mark, its time to take some steps to give it a boost. Here are some ways you can effectively raise your credit score by 200 points:

Dont use more than 30% of your credit card limit Just because your company allows you to spend a certain amount of money on your credit card doesnt mean you should max out your card every month. To get your credit score up, keep your credit card spending to no more than 30% of your credit limit. Doing so will increase your score as you pay your card on time every month.

Settle old debt Creditors are sometimes willing to negotiate with borrowers to eliminate certain negative items from their credit in order to receive payment. You may be able to do this with your creditors it doesnt hurt to ask. Settling your old debt can do wonders for your credit score and will even help you avoid any issues in the future.

Make all debt payments in full Any secured credit cards or lines of credit should be paid off in full whenever possible. This will help you give your credit score a boost.

Growing Your Credit Limits And Your Financial Skills

Successfully raising your credit limit is a solid step forward for your finances. It’s a sign that you’re managing credit welland that good money management can open doors for you. Even the process of requesting an increase helps to build your relationship with your card provider.

Are you thinking about requesting a credit line increase? Before you do, check your credit score and to avoid any surprises. You can do so for free through Experian. And to make sure your credit stays in fighting shape, consider free credit monitoring that alerts you to changes in your credit file so you always know where your credit stands.

Don’t Miss: How To Unlock Your Credit Report

Find Out More About How National Hunter Works

It works by looking for inconsistencies between your current application form and any past applications you’ve made, trying to spot factual errors. While it can’t block your application itself, it triggers a red warning flag to lenders, and this happens roughly 7% of the time. Lenders can then check the info, and ignore it or do further checks. They’re not allowed to reject you based on the National Hunter red flag alone.

Factors such as a number of applications in a few days can also trigger warnings, though generally that’s more acceptable with mortgages, where it’s more common, than with credit cards.

What to watch for

It’s crucial to be consistent, even over long periods, when you fill in application forms. If you have a number of job titles or phone numbers, try to use the same one on every application. Changes to guidance introduced in 2009 mean lenders are supposed to tell you if National Hunter has been a contributing reason for your rejection.

How to check your National Hunter file

To check the info it holds on you, you’ll need to make a subject access request, which is free thanks to the introduction of the General Data Protection Regulation in May 2018. This can also be a useful thing to do if you think you’re a victim of ID fraud.

How To Build Your Credit Score

Every credit user has to start somewhere. If youve never used any kind of credit product, it means you dont have a credit report, , or credit history. These elements are necessary if you want to become a regular credit user and build a solid credit score. Once you have these elements and youve spent some time increasing your , youll eventually come into the position where youll qualify for more expensive credit products.

Where to Start?

Generally, the process goes something like this. You, like most borrowers, would apply for your first credit card shortly after you turn 18. As soon as you activate your credit card , your card company will inform one or both of Canadas two major , Equifax and/or TransUnion. Those agencies will then start compiling a credit report in your name, which is a record of all your credit-related activity over a predetermined number of years. Youll also be given a three-digit credit score ranging from 300-900, which works as a cumulative average that lenders examine when considering you for approval. The higher your credit score is, the more creditworthy youll be in their eyes. According to TransUnion, a score of 650 or will give you the best chances of being approved.

For more information about your Canadian credit score, take a look at this.

Everything Counts

to learn the minimum credit score for mortgage approval in 2018.

You May Like: 524 Credit Score Good Or Bad

Applying For A Guarantor Loan

Guarantor loans can be very helpful you have bad credit or you think your lender might deny your application for some other reason. This is because, during the application process for these loans, your credit will often not be checked. Instead, youll need to recruit a co-signer, who will go through a credit check in your place. By becoming your guarantor, theyll be agreeing to take on your loan payments in the event that you default . If youre approved, however, you should be able to secure a loan with an affordable interest rate. During that time, any good payments you make should show up in your credit history and have a positive effect on your credit score.

Want to know how you can get a guarantor loan in Canada? Find out here.

Just be aware that since your guarantor will be secondarily responsible for your loan payments, youll be putting them in debt if you default for too long. If this occurs and they also are unable to afford the payments, both of your credit and financial profiles will be damaged.

Read this if youre not sure about whether a guarantor loan is right for you.

Does Removing Hard Inquiries Improve Your Credit Score

Yes, having hard inquiries removed from your report will improve your credit scorebut not drastically so. Recent hard inquiries only account for 10% of your overall score rating. If you have erroneous inquiries, you should try to have them removed, but this step wont make a huge difference by itself.

You May Like: Usaa Credit Check And Id Monitor

Ways To Rebuild Credit

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Rebuilding your credit can be tougher than starting from scratch. Youre trying to show lenders and credit card issuers that despite slip-ups on your part or disasters you had nothing to do with, youre very likely to make future payments as agreed.

Before you begin to rebuild credit, its important to know where your starting point is. Your credit score might not be as bad as you think. You can get a free credit score from NerdWallet, and track it. Once you know where you stand, you can begin to set some small, achievable goals for yourself.

The good news is, its possible to make significant progress quickly when youre starting low. Even incremental improvement may give you better financial options than you have now.

-

Go to AnnualCreditReport.com to get a free copy of your credit reports. The three major credit reporting bureaus are offering free weekly reports through April 2022.

-

Make sure the information is correct. Look especially for accounts, amounts or addresses that you dont recognize.

-

If you find an error, dispute it.

Then consider these six basic strategies for rebuilding credit:

Make Your Payments On Time

Lenders look closely at payment history to make sure youâll pay your loans on time and in full. With payment history making up approximately 35% of your credit score, a history of late payments can have a significant impact on your credit rating. Using RBC Online Banking or the RBC Mobile app makes it easy to pay your bill immediately or set up recurring payments. Payments can also be made via phone or mail, and in-person at a branch. RBC makes paying your credit card bill easy, so you can focus on things that matter most to you.

Don’t Miss: Zzounds Credit Check

Why To Manage Credit Score And Credit Reports

Do you think a good Credit Score is essential only for obtaining a banking product? Not surprisingly, it is equally important for less perceptible requirements such as getting an employment offer and even renting a vehicle. Many people are aware of the concept of credit rating system. A credit score is basically a three-digit number that assesses how likely you shall be to repay a mortgage. It utilises data from credit reports to comprehend the risk of bad debts. A credit report is a detailed description of your credit history. There are few more companies in Indian which do the same task- CIBIL TransUnion, Equifax, Experian and High Mark.

How Long Does It Take To Improve Your Credit Score

How long does it take to boost your credit score? Unfortunately, theres no one answer. Credit bureau Experian says it could take a few months to several years depending on how damaged your credit score is. There are no quick fixes. You need to commit to a long-term strategy of on-time payments if you want to fix your score.

Also Check: Does Klarna Boost Credit Score

Option 1 Request A Credit Limit Increase

Another way to reduce your credit utilization ratio if youre carrying high balances is to bump up your credit limits.

For example, if youre carrying $700 in debt on a card with a $1,000 credit limit, your credit utilization is 70%. If youre successful in increasing your credit limit to $2,000, then your utilization rate drops to 35%.

Some issuers make it easy to request a credit limit increase via your online account. For example, Citi allows cardholders to make such a request on the Credit Card Services page:

You can also call the number on the back of your card to make the request. Know that some issuers may conduct a hard pull on your credit before granting you a higher credit line, which can ding your credit score a few points. Your score will recover, but inquire exactly how your request will be handled before you allow them to proceed so you know what to expect.

Note: If youve only had the card a few months, have a history of late payments or are carrying really high balances, your request may be denied until youre seen as a less risky customer.

How much will this action impact your credit score?

The impact a credit line increase could have on your credit score depends on much of an increase you get. If its enough to bring your utilization under 30%, you should see a reasonable increase in your score. However, it wont improve your score as much as paying off your balance and bringing your utilization to or near zero.

Request Credit Limit Increase

Another part of your credit score is based on how much debt you owe about your available credit, or your .

The ratio of your card balances and your credit limit is called your credit utilization ratio. If you have a credit limit of $5,000 and you currently owe $2,000, your credit utilization ratio is 40%. The lower this ratio, the better, and generally speaking you want a credit utilization ratio under 30%.

Increasing your credit limit is a way to hack this. Although getting a credit limit increase will reduce your credit score in the short term, the reduction to your credit utilization ratio will be beneficial in the long term so long as you dont change your spending habits!

For this reason, many financial advisors dont recommend this because some people may believe that they have more money available at their disposal. You, however, should know that this is not true and that just because you have more credit doesnt mean you should borrow more.

Don’t Miss: Ccb Mprcc

How To Increase Credit Score To 800

Generally speaking, lenders typically like to see a credit score of at least 650 before they qualify a borrower for a loan. However, a score of 650 might not afford borrowers with the best interest rates, making their loans more expensive to pay down.

When it comes to getting approved for loans and securing the lowest interest rate possible, a higher credit score is best. If you can get your credit score to 800, youll likely be able to take advantage of the best rates and should have no problem getting approved for a loan, as long as all of your finances are in order and there are no other red flags that might worry your lender.

In addition to the above-mentioned tactics, consider the following measures to get your credit score to 800:

- Pay down the balance of your credit cards that are currently at or near their limit.

- Pay down higher-interest debt first .

- Consolidate your debt to pay it off more quickly and transfer the balance of a higher interest-rate card to a lower interest rate card.

- Have a mix of debt which can increase your credit score.

For more ways of improving your credit, .

Final Thoughts

Depending on your particular situation, it may take just a matter of a couple of months to inch your credit score back up. Regardless of where you fall on this spectrum, its important to take steps right now to improve your credit score so you can enjoy better rates and an easier time getting approved for a loan.

Rating of 4/5 based on 23 votes.

The Beauty Of Credit Cards

As you probably know, reliance on credit cards can quickly get expensive and lead you into a debt spiral that is hard to get out of. But dont need to be big and scary when used responsibly a credit card is one of the best possible ways to build yourself a strong credit rating and prepare yourself for whatever your future borrowing needs may be.

Read Also: Paypal Credit On Credit Report

Using Your Other Regular Bills

Remember, debt doesnt just come from credit cards. Most people have a slew of other bills that they need to keep up with, such as their monthly internet/digital cable package, their cell phone plan, their utilities and/or rent.

Generally speaking, the providers of such services dont report these kinds of payment activity to Equifax or TransUnion. However, you can request that they do. If youve already been a responsible bill payer, those organizations or individuals might just speak up on your behalf.

Check Out Your Credit File To See Where You Stand

Get a copy of your credit file and see if thereâs an area you need to address. The credit reporting bodies we use are:

Youâre entitled by law to get one free credit report every 12 months, or within 90 days of receiving a credit rejection. For a small fee you can request a report at any time.

Also Check: Navy Federal Check Credit Score

Reduce Your Credit Utilization Ratio

Several factors determine your credit score. Your credit utilization ratio is an influential metric because it is part of a factor that makes up 30% of your score. Credit utilization is simply how much credit you are using divided by the total amount of credit you have access to.

If you charged $10,000 to your credit cards and your total credit limit is $50,000, your utilization is 20%. Credit bureaus use your statement balance in this calculation, so you have utilization even if you pay off your balances in full each month.

A general rule of thumb is to use up to a maximum of 30% of your credit card limit. Many experts suggest keeping it below 10%, if possible. Most credit cards report your credit utilization once a month to the credit bureaus. In many cases, your most recent statement balance is the number that goes onto your credit report.

Here are three ways to keep your credit card utilization ratio below 30%:

- Only charge essential purchases like gas and groceriesor those that earn bonus points

- Split your purchases between multiple credit cards

- For large one-time purchases, make extra payments during the billing cycle

If you wont be making an extra payment each month, you can simply pay cash on purchases that would push your balance above the 30% threshold. If youre going to make additional payments, schedule them to post before the end of the billing cycle. This way your balance on your statement is lower.

Wallethacks.com