Hardest Items To Remove From Your Credit Report

Some things are easier to remove from your credit report than others because these items are easier to verify. Items that are a matter of public record are more difficult to remove. This includes bankruptcy, foreclosure, repossession, lawsuit judgments, and loan default, especially student loan default. Sometimes its hard to get these removed even when theyre legitimately inaccurate.

If you have inaccurate public records on your credit report, try to work directly with the court or agency that has the item listed on your report. Once theyve updated their records to show whats accurate, it will be much easier to work with the credit bureau to clear things up. Creditors and other businesses that report to the credit bureaus have the same obligation to investigate and clear up errors.

Consider Contacting A Data Furnisher

When disputing credit report errors, the FTC recommends sending a dispute letter to the data furnisher as well. A data furnisher is a financial institution, such as a lender or credit card issuer, that provides data to the credit bureaus. Each credit report that includes the error should list the furnishers name and address. If you dont see an address listed, contact the company.

Once you submit your dispute to the furnisher, it has 30 days to conduct an investigation. If it finds that the information youre disputing is inaccurate, it is required to notify each credit bureau it has reported the information. However, if the information is found to be accurate, it will remain on your credit report.

Can Disputes Hurt Your Credit

There is no reason for a dispute to ever hurt your credit. At worst, it may have no impact on your credit score.

However, your score should rise if a dispute successfully results in the removal of derogatory items from your credit report.

Perhaps the only negative outcome from a credit dispute occurs when consumers abuse the process by submitting frivolous challenges. Eventually, a credit agency will recognize this kind of abuse and just ignore your dispute submissions.

Like the boy who cried wolf, this can come back to bite you when you suffer from a real credit report error.

Also Check: What Is An Acceptable Credit Score

Get A Free Copy Of Your Credit Report

Its important to check your credit report frequently at the very least annually, if not more often to catch any irregularities early on.

Under federal law, you have the right to obtain a free credit report from all three major once a year. However, because of the pandemic, all three bureaus are offering free weekly reports through the end of 2022.

You can request yours through AnnualCreditReport.com, the only free credit report website authorized by the federal government. Make sure to check your reports from all three bureaus since each one can include different information from creditors and lenders.

You can also request them by:

Phone: 322-8228

Mail: Download, print, and complete the request form and mail to:

Annual Credit Report Request Service

P.O. Box 105281

Other ways to get your credit report

In addition to your annual report, you can request additional free copies if:

- You were denied credit, insurance or employment in the past 60 days based on your credit

- There are sudden changes in your credit limit or insurance coverage

- Youre receiving government benefits

- You’re a victim of identity fraud

- Youre unemployed and/or will apply for employment within 60 days from the date of your request

To request additional copies, contact the bureaus directly. Heres how to do it:

For a more detailed guide on how to request copies, make sure to read our article on how to check your credit report.

Be Sure To Include Documents That Support Your Dispute

Alongside your dispute letter, you should include documents supporting the dispute you are making. These documents must prove that you did not make a specific purchase or payment that was reported or that you did, in fact, make a payment on time.

For example, if the dispute you are making is about a late rent payment, you should submit things like an email receipt of your payment or a statement of the payment leaving your bank account on a specific date. These documents prove that you did not neglect a financial obligation or submit a late payment, as the credit report claims.

Also Check: How Many Years Does Something Stay On Credit Report

Donotpay Works To Solve Other Reporting Problems Across A Variety Of Groups Too

Imagine having a partner to help you do all sorts of things, just as frustrating as disputing your credit report. Lucky for you, you now know about the DoNotPay way of getting things done! Let us help you with :

And if you need more help with credit report-related issues, DoNotPay can help you with negotiating collections settlements, drafting debt validation letters, and lender notices of dispute.

If you’re not sure how to dispute your credit report mistakes and win, let DoNotPay take all the guesswork of getting started. We can help clean up your credit report on your behalf, allowing you to breathe a little easier knowing your credit scores are accurate.

Wait For The Credit Bureau Or Furnisher To Investigate

After you submit your dispute, you should be prepared to wait anywhere from 30 to 45 days.

If you submitted your dispute with the credit bureau, they will contact the furnisher and provide all relevant information and documents related to your dispute. The furnisher will be instructed to investigate, verify the accuracy of the information, provide a response and update their own records. You may receive a reference number so you can check on the status of your dispute.

Credit reporting companies have 30 days from the date your letter is received to investigate your claim, Smith says. They can add 15 more days to this if they need additional documentation or documents are received late.

If you submitted a dispute to the furnisher, they also typically have 30 to 45 days to investigate and report results. They will inform the credit bureau about the dispute, and the item will show up as disputed on your credit report.

Recommended Reading: Does Pre Qualify Affect Credit Score

File A Dispute With The Credit Reporting Agency

Once you have your report, look through each account and see if there are creditors or accounts you dont recognize. Its also important to check whether older derogatory items are still being reported.

If you do find errors in your reports, dispute them directly with the reporting bureau through its website or by mail. This will prompt an investigation on the bureau’s part.

Bear in mind that you have to dispute the entry with each agency to make sure the removal is complete across the board.

How to file a dispute online

Each bureau Equifax, Experian and TransUnion has a section dedicated to walking consumers through the online dispute process. Once you create an account, you can file as many disputes as you need and check their status for free.

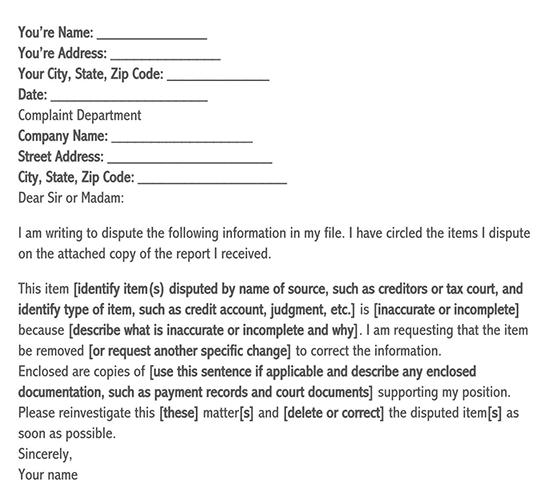

How to file a dispute letter

You can also send a dispute letter to the bureaus detailing any inaccuracies you’ve found in your credit file. When writing your letter, provide documentation that supports your claim and be precise about the information you are challenging. The Consumer Financial Protection Bureau recommends enclosing a copy of your report with the error circled or highlighted.

Depending on the information being disputed, these are some of the documents you can provide to help aid the investigation:

- Copies of checks

Include this dispute form with your letter.

Documentation To Provide For Your Dispute

In addition to the above, you’ll need to provide:

-

Proof of identity

-

Your Social Security number and date of birth

-

A copy of government-issued identification

-

Your current address and past addresses going back two years

-

A copy of a utility bill or bank or insurance statement that includes your name and address

Recommended Reading: What Does My Credit Score Mean

How To Dispute An Error On Your Credit Report

Errors on your credit report can be a serious problem. This document determines your credit score and overall credit health, so its vital for it to be accurate. Your credit report is considered when applying for a loan, buying a home, and sometimes even getting a job. Your credit score reflects a lenders likelihood of giving you money, so disputing any errors you may find is extremely important.

This article will discuss the ins and outs of your credit report, including how to view it and the appropriate steps to take when you find a mistake. By the end of this post, you will feel highly confident about disputing errors on your credit report and, more importantly, resolving them.

Dispute Credit Reports: How To Dispute Credit Reports

Disputing a credit report can be a confusing process. Consumer credit reports can vary in the way they look and the order information is listed depending on which of the three major national credit-reporting bureaus provided the report. Consumers can obtain their free credit reports once every 12 months at www.annualcreditreport.com. However, Equifax, Experian and Trans Union are currently offering free weekly online credit reports to help offset the recent economic challenges that have affected people around the world until the end 2022.

If you believe that there is inaccurate information on your credit report, its important to know what you can dispute and the steps to take.

Also Check: Does Car Insurance Go On Your Credit Report

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Dispute Inaccurate Items Yourself

You can embark on DIY credit repair by ordering your three credit reports from AnnualCreditReport.com, a source of free credit reports authorized by the federal government. You need all three reports because creditors may report transactions to only one or two credit bureaus.

After receiving the reports, review the four sections for errors:

- Identification: Information identifying yourself, including your address, date of birth, and Social Security number. Incorrect information may be a tip-off that the report covers accounts that dont belong to you.

- Tradelines: This contains your account data, which includes your use of credit and your borrowing activity. The data includes loan and credit account balances, payment history, and a collection account or charge-off.

- Public records: Court information regarding adverse legal judgments, bankruptcies, liens, foreclosures, vehicle repos, and money owed for child support.

- Inquiries: Hard inquiries are those you authorize a credit provider to make when you apply for a credit card or loan. These can lower your credit score. Unauthorized soft inquiries have no impact on your score.

The hardest part of DIY credit repair is combing through your report data for accounts or account activity you dont recognize, incorrectly reported negative credit file items , and liens and judgments you have already paid. You also should check for hard inquiries you didnt authorize.

Don’t Miss: Do Remarks Affect Credit Score

What Happens When An Item Is Deleted From Your Credit Report

Whenever your credit report is altered because of a dispute lodged by you or a credit repair service, the credit bureau must inform you in writing. You are then entitled to a fresh copy of your credit report from the bureau.

Many credit cards offer free alerts that inform you whenever your credit score changes. Thus, if an item deletion results in a change to your score, your credit card company may be the first to inform you of the good news. You also may get a free fraud alert service.

You should see your credit score improve when negative items are removed from your reports. How much it improves, however, depends on the type of item that is removed and its age.

The credit bureau must send you written results about your dispute, which usually arrive within the initial 30-day window. If the results are favorable, you can instruct the bureau to notify anyone who received your report in the past six months.

Do Disputed Errors Always Go Away

If your disputed error is legitimate and gets corrected, your report will be updated with the correct information, and your credit score will likely go up. Once your report is entirely corrected, the information will be removed, and it will be as though it was never there! However, this is only if the disputed error is investigated and found to be legitimate.

You May Like: What Credit Score Do You Need To Rent An Apartment

A Guide To Credit Report Disputes

Reading time: 4 minutes

- Regularly checking your credit reports can help ensure information is accurate and complete

- If you believe information on your credit reports is inaccurate or incomplete, contact the lender

- You can also file a free dispute with the three nationwide credit bureaus

When reviewing your credit reports, its important to make sure all of the information is complete and accurate. This includes everything from the account information to the other personal information thats on your credit report such as your home address, name, and Social Security number.

Here are some steps you can take to address information you believe is inaccurate or incomplete:

What information can I dispute on my credit reports?

What should I expect after filing a dispute?

Why Is There An Error On My Credit Report

Checking your credit reports and finding an error can be a frightening experience, though it isnt an uncommon one. The most recent study by the Federal Trade Commission found some 26 percent of participants spotted errors on at least one of their credit reports. You may be wondering how or why an error found its way onto your credit report. There are several reasons why an error may end up on your credit profile, varying from the more benigna creditor that didnt send updated info to the three credit bureaus, for exampleto the severe, like fraudulent activity captured on your credit reports.

Some errors that could have a significant impact on your credit score include:

- Incorrect balances on accounts

- Derogatory marks that are older than seven years

- Incorrect credit limits

- Bills reported as late or delinquent when your account should be in good standing.

Errors on your credit reports that lead to lower credit scores can impact your approval odds for home loans, auto loans and credit cards. Even if you are approved, youll be burdened with higher interest rates. To be sure your credit reports are accurate, check them consistently and quickly dispute any errors.

You May Like: Who To Call To Dispute Credit Report

Wait Up To 45 Days For The Results

After you dispute credit reporting errors with a credit bureau, it typically has 30 days to investigate your claim. It must notify you of the results five days after completing the investigation. However, it can take up to 45 days under the following circumstances:

- Youve submitted a dispute after receiving a free credit report from AnnualCreditReport.com

- During the 30-day investigation window, you submit new materials and documents

How To Track Your Dispute Status

Once you’ve submitted your dispute, Experian will send you alerts via email whenever there is a status update. If you already have an account with Experian, you can also view your dispute alerts in the main Alerts section of your Experian account. Alerts you’ll receive while Experian processes your dispute include:

- Open: This indicates the dispute process has been initiated.

- Update: Your dispute investigation has been completed and your credit report is being updated with the results.

- Dispute results ready: Your credit report has been updated with the results of the dispute investigation.

Read Also: Do Balance Transfers Hurt Credit Score

How An Error On Your Credit Report Can Affect You

Is it really necessary to keep close tabs on your credit report? Can one error really have an impact on you? Yes. Your credit report contains all kinds of information about you, such as how you pay your bills, and if youve ever filed for bankruptcy. You could be impacted negatively by an error on your credit report in many ways.

To start, its important to understand that credit reporting companies sell the information in your credit reports to groups that include employers, insurers, utility companies, and many other groups that want to use that information to verify your identity and evaluate your creditworthiness.

For instance, if a utility company reviews your credit history and finds a less-than-favorable credit report, they may offer less favorable terms to you as a customer. While this is called risk-based pricing and companies must notify you if theyre doing this, it can still have an impact on you. Your credit report also may affect whether you can get a loan and the terms of that loan, including your interest rate.