How To Improve Your Credit Scores

To improve your credit scores, focus on the underlying factors that affect your scores. At a high level, the basic steps you need to take are fairly straightforward:

- Make at least your minimum payment and make all debt payments on time. Even a single late payment can hurt your credit scores and it’ll stay on your credit report for up to seven years. If you think you may miss a payment, reach out to your creditors as quickly as possible to see if they can work with you or offer hardship options.

- Keep your credit card balances low. Your is an important scoring factor that compares the current balance and credit limit of revolving accounts such as credit cards. Having a low credit utilization rate can help your credit scores. Those with excellent credit scores tend to have an overall utilization rate in the single digits.

- Open accounts that will be reported to the credit bureaus. If you have few credit accounts, make sure those you do open will be added to your credit report. These could be installment accounts, such as student, auto, home or personal loans, or revolving accounts, such as credit cards and lines of credit.

- Only apply for credit when you need it. Applying for a new account can lead to a hard inquiry, which may hurt your credit scores a little. The impact is often minimal, but applying for many different types of loans or credit cards during a short period could lead to a larger score drop.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Can I Improve A Bad Credit Score To Fair

- Record collection accounts. If your bills are impounded and you can pay them, act now.

- Fraud and controversial errors. Eliminate all false and malicious information through the credit reporting agency’s dispute resolution process.

- Increase your credit card occupancy rate.

- Take advantage of a debt consolidation loan.

Also Check: When Do Late Payments Fall Off Credit Report

What Is A Credit Score

A credit score is a number between 300850 that depicts a consumer’s creditworthiness. The higher the score, the better a borrower looks to potential lenders. A credit score is based on : number of open accounts, total levels of debt, and repayment history, and other factors. Lenders use credit scores to evaluate the probability that an individual will repay loans in a timely manner.

What Is A Fair Credit Score Range

Fair credit score = 620- 679: Individuals with scores over 620 are considered less risky and are even more likely to be approved for credit.

In the mid-600s range, consumers become prime borrowers. This means they may qualify for higher loan amounts, higher credit limits, lower down payments and better negotiating power with loan and credit card terms. Only 15-30% of borrowers in this range become delinquent.

Recommended Reading: How Long Does A Voluntary Repossession Stay On Your Credit

What To Do If You Don’t Have A Credit Score

For FICO® Scores, you need:

- An account that’s at least six months old

- An account that has been active in the past six months

VantageScore can score your credit report if it has at least one active account, even if the account is only a month old.

If you aren’t scorable, you may need to open a new account or add new activity to your credit report to start building credit. Often this means starting with a or secured credit card, or becoming an .

Different Scores At Each Credit Bureau

Because each credit bureau could have different information on file about you, your credit scores will most likely differ for each of the three credit bureaus: Equifax, TransUnion and Experian.

Sometimes the difference is just a few points. Other times, the difference in your credit scores from each bureau can be vast due to an error or mistake in your credit report. These differences can cost you thousands over the life of a loan. Be sure to check your reports regularly or sign up for alerts to be notified when your score changes.

Also Check: Does Affirm Affect Credit Score

What Your Credit Score Means

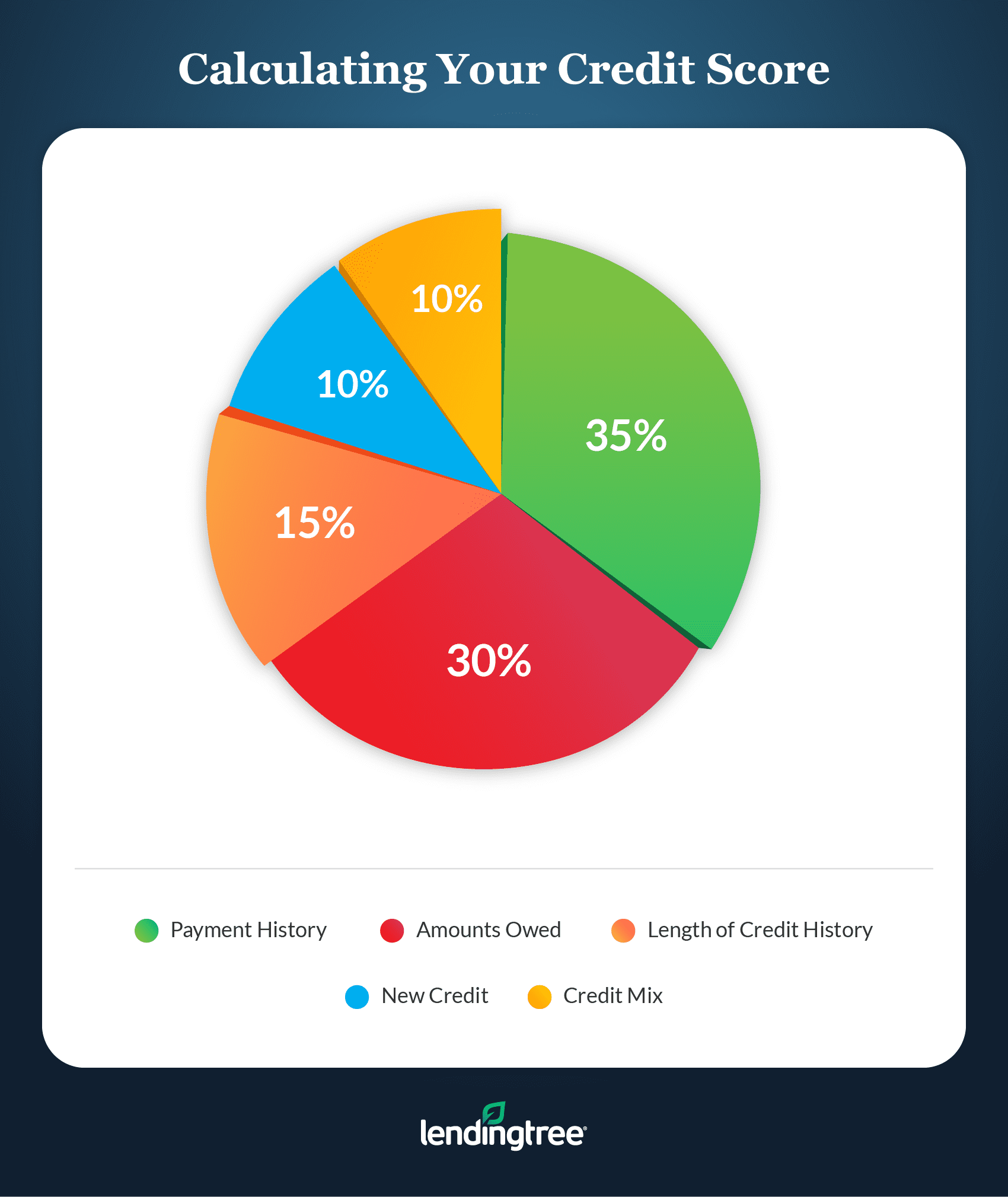

Your credit score represents the likelihood that you’ll repay a loan based on your history with credit accounts. Credit scoring calculations use your credit history to generate a three-digit score based on five key factors: your payment history, amount of debt, length of credit history, types of credit, and recent applications for credit.

High credit scores are better and represent a history of doing positive things, such as paying bills on time and using available credit responsibly, and avoiding the negatives, like late payments more than 30 days overdue, accounts going to collections, and bankruptcy. On the other hand, borrowers with lower scores typically have had trouble making payments in the past and carry more risk for lenders, resulting in higher interest rates, if they get approved.

Negative information generally affects your credit score less as it gets older and you add positive information to your credit history. After seven years, most negative information wont affect your credit score.

There are multiple credit scoring models available and each one has its own formula for calculating your score. VantageScore and FICO are two well-known brands of scoring models.

What Is The Average Credit Score In Canada And How Do You Compare

What is the average credit score in Canada, and how do you rank among average Canadian credit scores? More so, what is a good credit score in Canada?

Often, Canadians want to know how they measure up to other people when it comes to their credit score. Is your credit score better than the average credit score? Maybe its worse?

First, let’s answer the question you are here to find out:

Don’t Miss: Aargon Agncy

How To Improve Your Credit Score:

Another common question when dealing with credit scores is What can I do to improve my score? There are many ways to improve your credit score to the higher end of the scale. Some of these methods include:

- Cleaning up your credit report

- Paying down your balance

- Negotiating outstanding balance

- Making payments on time

Credit.org offers consumers help in managing multiple payments. With a Debt Management Plan, you have the possibility of joining these payments into one lump sum with a lower interest rate. Learn more by reaching out to one of our today!

What Information Credit Scores Do Not Consider

FICO® and VantageScore do not consider the following information when calculating credit scores:

- Your race, color, religion, national origin, sex or marital status.

- Your age.

- Your salary, occupation, title, employer, date employed or employment history.

- Where you live.

- Soft inquiries. Soft inquiries are usually initiated by others, like companies making promotional offers of credit or your lender conducting periodic reviews of your existing credit accounts. Soft inquiries also occur when you check your own credit report or when you use from companies like Experian. These inquiries do not impact your credit scores.

Also Check: Does Balance Transfer Affect My Credit Score

How Do I Fix Mistakes In My Credit Report

- Write a letter. Tell the credit reporting company that you have questions about information in your report.

- Explain which information is wrong and why you think so.

- Say that you want the information corrected or removed from your report.

- Send a copy of your credit report with the wrong information circled.

- Send copies of other papers that help you explain your opinion.

- Send this information Certified Mail. Ask the post office for a return receipt. The receipt is proof that the credit reporting company got your letter.

The credit reporting company must look into your complaint and answer you in writing.

Your Score Range: 650

Your credit score sits in the range of between 650 and 799, along with those of 47 percent of Americans. While your score is not in a problem range, there is plenty of room for improvement.

Small mistakes may have prevented you from achieving a top credit score: You may have missed a few payments or accidentally overcharged your credit card, but youve probably avoided serious mishaps like bankruptcy in the recent past.

Recommended Reading: Credit Score For Amazon Prime Credit Card

Why Is My Check Posted But Not Available

Another reason that your check or cash deposit may not be showing up as planned is that the bank put an exception hold on the funds, which allows it to hold the deposit for a period is longer than the standard hold periods established under the law. Deposits that the bank suspects it cant collect on.

Very Good Credit Score: 740 To 799

A credit score between 740 and 799 indicates a consumer is generally financially responsible when it comes to money and credit management. Most of their payments, including loans, credit cards, utilities, and rental payments, are made on time. are relatively low compared with their credit account limits.

Read Also: Aargon Collection Agency Ripoff

Where Do I Get My Free Credit Report

You can get your free credit report from Annual Credit Report. That is the only free place to get your report. You can get it online: AnnualCreditReport.com, or by phone: 1-877-322-8228.

You get one free report from each credit reporting company every year. That means you get three reports each year.

Your Transunion Credit Score

TransUnion is the second largest credit reference agency in the UK. It used to be known as Callcredit. You can check your TransUnion credit score by going to Noddle. You can also access your TransUnion and Equifax credit reports at the same time by registering for a 30-day free trial of CheckMyFile. Just make sure you have a look at their terms and conditions before you register. And if you want to continue with their service beyond the 30 days, a monthly fee would apply.

Don’t Miss: Paypal Credit Fico Score

Why Do I Have A Credit Report

Businesses want to know about you before they lend you money. Would you want to lend money to someone who pays bills on time? Or to someone who always pays late?

Businesses look at your credit report to learn about you. They decide if they want to lend you money, or give you a credit card. Sometimes, employers look at your credit report when you apply for a job. Cell phone companies and insurance companies look at your credit report, too.

Can You Go To Jail For A Negative Bank Account

Overdrawing your bank account is rarely a criminal offense. It depends on your intentions and your states check fraud laws. According to the National Check Fraud Center, all states can impose jail time for overdrawing your account, but the reasons for overdrawing an account must support criminal prosecution.

Also Check: Does Ginny’s Report To Credit Bureaus

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

Monitor Your Credit Report And Score

Checking your credit score right before you apply for a new loan or credit card can help you understand your chances of qualifying for favorable termsbut checking it further ahead of time gives you the chance to improve your score, and possibly save hundreds or thousands of dollars in interest. Experian offers free credit monitoring for your Experian report, which in addition to a free score and report, includes alerts if there’s a suspicious change in your report.

Keeping track of your score can help you take measures to improve it so you’ll increase your odds of qualifying for a loan, credit card, apartment or insurance policyall while improving your financial health.

You May Like: Opensky Credit Card Delivery

Accept The Risk Factors You Cannot Change

Certain risk factors, such as “short account history” and “length of time accounts have been established” reflect the fact that longer positive credit histories represent less risk. The longer your positive payment history, the better your scores will become.

Similarly, a factor such as “amount owed on mortgage loans is too high” simply means you’ve got to keep making mortgage payments on time . If you persevere and avoid missed payments and other missteps, your score will tend to improve over time.

What Happens If Your Credit Score Gets Lower Than 750

If the score is less than 750, the person has to consider many factors that can negatively affect the score, for example: You have a loan.

What’s the highest credit scoreWhat is the best credit score you can get?A score above 600 gives you a good chance of being approved for a home loan. However, this may vary depending on the sofa used.A score of 670+ is considered excellent credit, greatly increasing your chances of obtaining a home loan.Values below 600 are considered high to very high risk.What is the h

Also Check: What Credit Score Do You Need For Comenity Bank

How To Earn A Good Credit Score:

If you currently have a credit score below the “good”rating, you may be labeled as a subprime borrower, which can significantly limit your ability to find attractive loans or lines of credit. If you want to get into the “good” range, start by requesting your credit report to see if there are any errors. Going over your report will reveal what’s hurting your score, and guide you on what you need to do to build it.

Do I Need To Get My Credit Score

It is very important to know what is in your credit report. But a credit score is a number that matches your credit history. If you know your history is good, your score will be good. You can get your credit report for free.

It costs money to find out your credit score. Sometimes a company might say the score is free. But if you look closely, you might find that you signed up for a service that checks your credit for you. Those services charge you every month.

Before you pay any money, ask yourself if you need to see your credit score. It might be interesting. But is it worth paying money for?

Don’t Miss: Qvc Synchrony Card Pay

What Factors Contribute To The Fico Credit Score

Most credit rating companies use five main factors to build their credit score, each having a different level of impact. Here are the factors and their weights for the FICO Classic Credit Score®:

-

Payment history .

What it looks at: Especially within the past two years, but up to the past seven years, how often do you meet your credit payments on time and in full?

What it means: If lenders see a strong history of positive payments, they are more likely to see you as a trustworthy borrower.

-

Amounts owed .

What it looks at: What is your credit utilization rate? Divide the total amount of credit you have been given by the total amount you currently owe.

What it means: When your credit utilization rate is less than 30%, you are seen as a responsible manager of credit.

-

Length of credit history .

What it looks at: What’s the average age of your credit lines?

What it means: When lenders see a long average age, they can be confident that you have strong relationships with your creditors.

-

What it looks at: How many different lines of credit are currently open in your name?

What it means: When lenders see a diverse mix of credit, they can feel confident that you are good at managing your credit lines.

-

New credit .

What it looks at: How often are credit checks made for your credit score to open new lines of credit?

What it means: When lenders see many new credit inquiries, they assign a higher level of risk to the borrower.

Understanding Your Credit Scores

First off, you have more than one credit score, and there are a few reasons for that.

There are different scores for specific products. For example, there are special auto and home insurance credit scores. There are also different credit-scoring models, like FICO and VantageScore, which means you could have scores according to each model. Even the same model could give a different score depending on whether it uses data from your Equifax, Experian or TransUnion credit report.

Lastly, there are multiple consumer credit bureaus that provide on which scores are based. So depending on what information each bureau gets from individual lenders and that can differ the data used to compile your reports and build your scores could vary from bureau to bureau.

When you put it all together, that means that each individual could have multiple scores, and sometimes they dont match. Its difficult to pinpoint exactly how many scores you may have, but it could be hundreds.

Even though there are many different credit scores out there, its worth knowing the general range that your scores fall into especially since they can determine your access to certain financial products and the terms youll get.

FICO and VantageScore Solutions create the most widely used consumer credit scores, and these companies update their scoring models from time to time.

You May Like: Victoria Secret Credit Card Lost Or Stolen