What Is A Credit Dispute Letter

A credit dispute letter is a written document that a borrower sends to their lender or to a credit bureau/agency. Typically, the term “credit dispute letter” refers to letters sent to correct errors in a credit report.

Best penny cryptocurrency to invest in 2020What is the best cryptocurrency for beginners?Bitcoin. Bitcoin is the most widely used cryptocurrency to date.and one of the hottest cryptocurrencies of the decade.Ethereum.Binance Coin A unit of currency consumed in the process does.Basic Attention Token A unit of currency consumed in the process does.Which cryptocurrency do you buy?Coinbase site seâ¦

How Disputing Impacts Credit

Filing a dispute with one or all of the credit bureaus has no direct impact on your credit scores. But once the dispute process is completed, any changes to your credit reports could lead to changes in your credit scores.

Whether your score goes up, down or remains the same depends on what you’re disputing and the outcome of the dispute. Removal of mistakenly reported negative information, such as late payments or unpaid collections accounts, could lead to credit score improvements. On the other hand, corrections to your personal information, while important to maintaining accurate credit tracking, have no impact on credit scores.

How To Remove Credit Inquiries

You applied for a loan and found out that it was not approved. You are informed that your does not meet the underwriting guidelines but you can get a copy of your credit report if you want to dispute the inquiries you have with the business credit bureaus. When this happens, you will want to do whatever possible to remove the authorized inquires from credit reports to increase your credit score. Today we will discuss how to remove from your credit report.

Recommended Reading: How To Remove Yourself As An Authorized User

How Does The Dispute Process Work

File a dispute for free

If you see information on your Equifax credit report that you believe is inaccurate or incomplete, you have two options to submit a dispute form and required documents: electronically or by postal mail.

Results

After your dispute is processed, we will notify you with the results and outcome of the investigation. If you submitted your documents electronically, you will receive the results by email. If you printed and mailed in your dispute information, your results will be mailed to you.

Please note that you will need to contact Trans Union of Canada, Inc. directly to correct inaccuracies found on your TransUnion Canada credit file.

What Happens After You Submit Your Dispute

After you’ve submitted a dispute, Experian goes to work to resolve the issue. The data furnisher will be asked to check their records. Then one of three things will happen:

- Incorrect information will be corrected.

- Information that cannot be verified will be updated or deleted.

- Information verified as accurate will remain intact on your credit report.

Don’t Miss: Carmax Bad Credit Loans

How To Handle An Unauthorized Credit Inquiry

There are many reasons why you might not recognize an inquiry on your credit report. This doesnt necessarily mean that your identity has been compromised, but its nevertheless important to make sure. An unauthorized inquiry could be the first sign of a fraudster seeking to take out credit in your name, and getting to the bottom of things as quickly as possible will save you a lot of time, hassle and potential credit score damage in the future.

Hard Inquiries Sometimes Appear In Error

There are several reasons that inaccurate hard inquiries might appear. All of them impact whether you receive credit and loans, and the interest rates that you receive for these loans. One cause of error is identity theft. When you receive a fraud alert, itâs sometimes because someone is using your personal information that they gained through identity theft to apply for credit or a loan in your name.

A hard credit inquiry carried out through identity theft will hurt your credit score, so the inquiry itself is worth disputing. If the fraud threatens immediate harm, you can put a on your record, to prevent anyone from accessing it until the issue is resolved.

Hard inquiries are supposed to last for only two years on a credit report. If one is older than two years, itâs in error. The mistake still hurts your credit score, so you should contest it. Additionally, a hard inquiry from a single application could mistakenly appear on your credit report multiple times. This is an innocent slip up, but you should still dispute it.

Sometimes retailers or lenders run unauthorized hard inquiries, where they look up a credit report by mistake and/or without permission. This can also happen if a merchant sends out multiple inquiries to try to get you the best financing for a loan. In situations like this, as long as the inquiries are all within 14 days of each other, they will only count as one inquiry against your credit score.

Don’t Miss: What Credit Score Is Needed For Paypal Bill Me Later

Focus Your Credit Repair Efforts On More Serious Items

While having too many credit inquiries can hurt your credit score, they are the smallest scoring factor. In fact, each hard inquiry typically deducts about five points from your credit score.

We find that most people spend too much time worrying about credit inquiries. They usually have worse negative items on their credit report that have a much bigger impact on their credit score.

But if you apply for credit cards every month, either out of necessity or as a rewards bonus hack, you can really start to cause some damage.

Check Your Credit Reports For Free

The first step is to get your credit reports from each of the three credit bureausEquifax, Experian and TransUnion. Often, the same information is recorded on all three, but not always, and thats why its important to check all three.

You can typically pull your credit reports for free once per year on AnnualCreditReport.com. However, due to Covid-19, you can order free weekly credit reports until April 20, 2022.

Recommended Reading: Comenity Capital Bank Credit Score

What Is A Hard Inquiry

A hard inquiry occurs when you apply for a new loan or credit card. It involves the lender checking one or more credit reports to determine whether you meet its creditworthiness criteria. This is also sometimes called a hard credit check or hard pull.

Hard inquiries differ from soft inquiries in two major ways. First, hard inquiries occur when you apply for a loan, credit card or other financing.

Soft inquiries, on the other hand, can happen upon your requestsuch as when you want to check your credit reportor even without your knowledge, which happens when lenders check your credit before sending you a preapproval offer.

Second, soft inquiries don’t affect your credit score at all, while each hard inquiry typically knocks a few points off your credit score. The more hard inquiries you have on your reports, the riskier you’ll be viewed by prospective lenders. Why? Because applying for different types of credit relatively often could indicate financial instability, and that translates to risk in a lender’s eyes.

Hard inquiries stay on your credit reports for two years before they fall off naturally. If you have legitimate hard inquiries, you’ll likely need to wait until the 24-month period is over to see them disappear.

Should I Dispute The Inquiry

Returning to the example of our commenter, we should verify that she is seeing a hard inquiry affect her score and not just the report of a soft inquiry. When checking your credit reports, you will see them in different columns. Someone pulling a credit report without authorization happens more often that you may think. If it is a confirmed hard inquiry, and if our commenter does decide to dispute the inquiry, she has a few options. Disputing errors on your credit report is something you can do on your own, or you can turn to a professional credit repair agency for help. Either way, these are the four steps a dispute requires:

Recommended Reading: When Do Companies Report To Credit Bureau

Review Your Reports For Mistakes Inaccuracies Items That Shouldn’t Appear

After you get your credit reports, be sure to review them and dispute any inaccurate information you find. If you’re planning to make a big purchase, like a house or a car, or a significant financial commitment, such as refinancing your mortgage, you might want to review information from all three agencies well in advance.

How To File A Dispute

- If the information on your credit report is inaccurate you can simply contact the credit bureaus on your own to dispute the inaccurate item.

- Dispute missing Information on your credit report. You cannot remove legally accurate and timely information from your credit report for better or for worse. But the law allows you to request an inquiry into any information in your file. That you believe is outdated, inaccurate, or incomplete. You can get your free dispute letters here.

- Send a dispute letter to any of three credit bureaus that have inaccurate information. Make sure you provide proof of this error with your letter and keep a copy for your records.

- After the bureau receives the dispute, it contacts the source who provided the data. This source has 30 days to respond. If the source cannot verify the data within the permitted period, the information must be deleted from your report. If the information has been verified and they find the information to be correct the item will remain on your credit report. In either case, you be sent a letter of any action that may result from your dispute.

- If you are unhappy with the outcome of your dispute. And feel that you have been treated unfairly or not taken seriously, contact the Federal Trade Commission .

Don’t Miss: What Credit Bureau Does Affirm Use

Preventing Unauthorized Hard Inquiries

To prevent future unauthorized hard inquiries, consider placing a freeze on your credit report. This option prevents any lenders or creditors from accessing your credit information.

Its great for preventing identity theft because no one can open a new credit account using your financial information since they wont get approved without a credit check. However, it also helps prevent unwanted inquiries if you find this to be an ongoing headache.

Placing a freeze on your credit report and having it removed both incur separate fees in most states, so dont do this if youre planning on applying for a new credit card or loan in the near future. But if you anticipate your financials to remain the same for the time being, this can be a convenient option to keep your credit nice and clean.

How Can I Have Hard Inquiries Removed

- 3 major credit bureaus. The first thing to do is contact the three major credit reporting agencies Experian, TransUnion and Equifax.

- Time to explore. It can take Schufa 30-45 days to investigate a dispute.

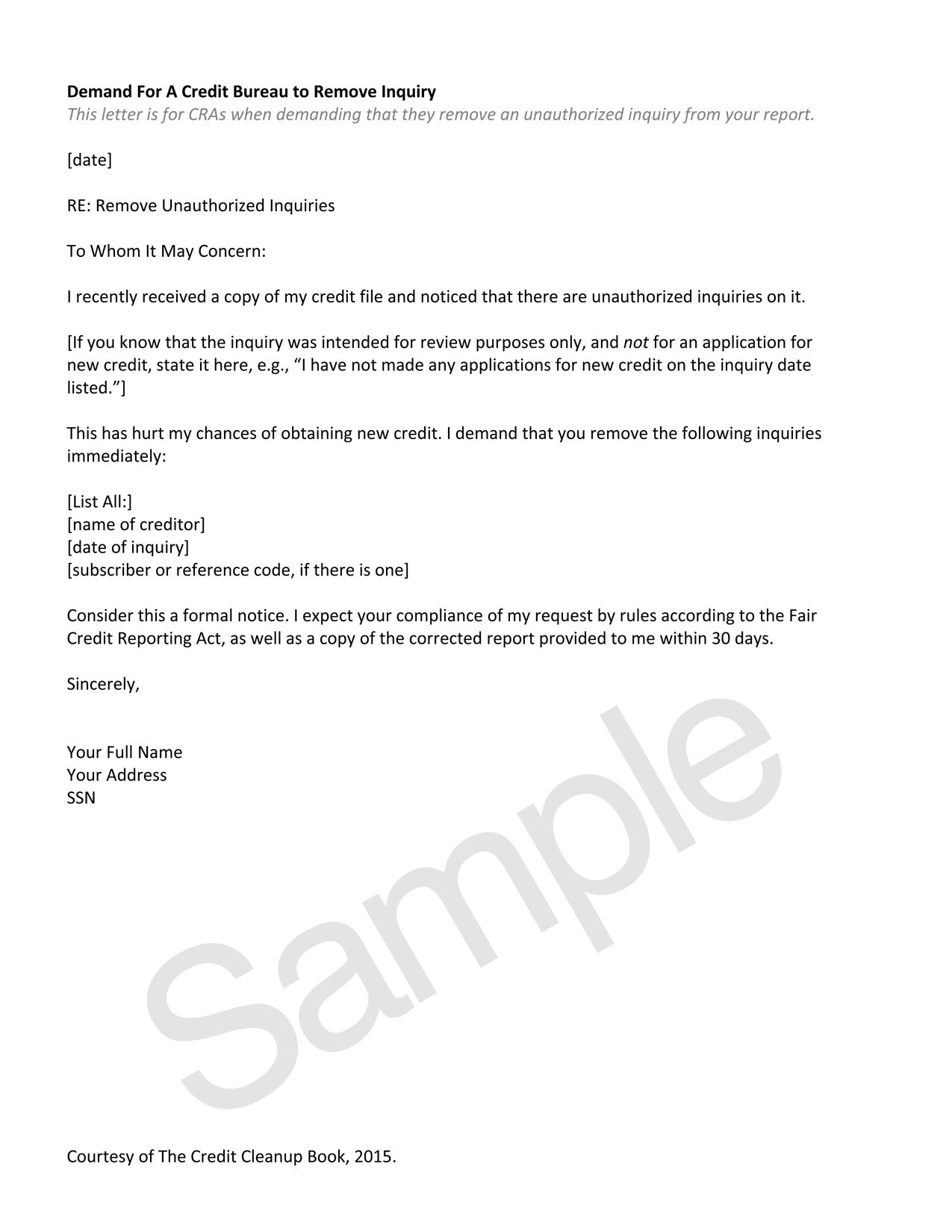

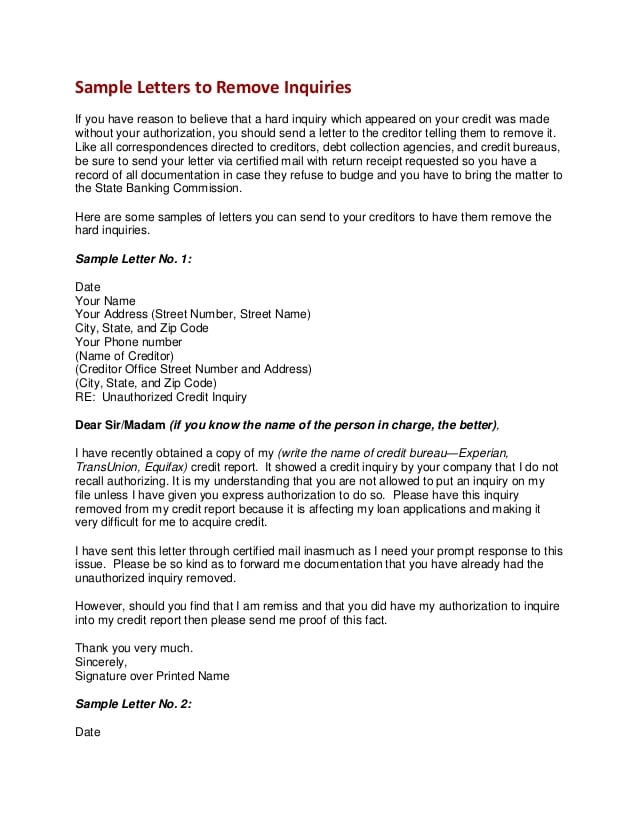

- Example 1 letter of revocation of a loan application.

- Example 2 of a letter requesting the removal of a permanent credit application.

Don’t Miss: How To Report A Tenant To The Credit Bureau

How To Dispute Collections From Your Credit Report

- If the negative item is nearing the time it will be removed you may choose to let the item drop of naturally. most negative information wont last longer than seven years from the date of the last activity. Chapter 7 Bankruptcy will show up for ten years.

- If you have accounts in collections, you can either pay them in full or offer a settlement. If you pay it off make sure you get it writing that the creditor will remove the item from your credit report. Settled accounts dont look as good on a report as those that are fully satisfied.

Next Stepscheck Your Credit Score & Report Regularly

Its a good idea to check your credit score at least once per quarter and your credit report once per year to check for errors. Free credit report websites can be a handy source to notify you about any new inquiries on your report. Signing up with one of these sites can help you receive any new updates about your credit reports in real-time.

Don’t Miss: Zebit Report To Credit Bureau

Immediate Steps To Take

Contact The Creditor In Question: The first step in investigating an unrecognized credit inquiry should always be to call the creditor that has been poking around your reports. Speaking with them may help you realize that you actually did authorize the inquiry or get clues about how this fraud is being perpetrated. Make sure to take detailed notes during this call, including the name, ID number and direct phone number of the customer service representative or fraud specialist that you talk to.

Review Your Three Major Credit Reports: You already have your TransUnion credit report from WalletHub, and while Experian and Equifax credit reports contain largely the same information, there are some differences in terms of their data sources and the financial institutions that use them. Seeing how, and if, this unauthorized inquiry is listed on your other reports may provide additional context about whether its fraudulent. This will also give you the opportunity to thoroughly review each of your files for other suspicious listings. You can order your Experian and Equifax credit reports for free through the government-sponsored website AnnualCreditReport.com.

| Start Here |

“It is the best, cheapest, and most effective thing that someone can do,” said Steven J. Weisman, a senior lecturer of law, taxation and financial planning at Bentley University and author of numerous books about identity theft.

Why Remove Inquiries

Some people might feel that an inquiry is a difference between loan approval and denial. In some cases, inquiries might not affect the credit score at all. Then why remove them? Thus, before moving to steps for removing inquiries, let us first understand when individuals can benefit from removing inquiries.

So, before we move into how to remove inquiries, lets explore if deleting inquiries will make any useful impact on your particular credit report.

Don’t Miss: Klarna Approval Odds

What Is An Inquiry

An inquiry is a document record that has the details of who has reviewed your credit report. Whenever anyone reviews your credit report, it is shows up on your inquiry and is on your credit report for two years, unless the inquire is disputed and removed.

A has two different types of inquires hard inquires and soft inquires. You can learn how to remove authorized inquiries from credit report for either.

Can You Remove Derogatory Accounts From Credit Report

![50 Best Credit Dispute Letters Templates [Free] ? TemplateLab](https://www.knowyourcreditscore.net/wp-content/uploads/50-best-credit-dispute-letters-templates-free-templatelab.jpeg)

Once you have the information, review the credit report information for the checking account. If this is not correct, you can and should file a complaint with Schufa to have it removed from your report immediately. You can submit your dispute online or by mail.

Linkedin data breachWhen did the Linkedin data breach take place? On July 1, 2021, LinkedIn was exposed to a data breach that exposed more than 700 million of the personal information of its 756 million users. The data was offered for sale on a well-known hacker forum. The user who posted the message provided a data sample of one million users to prove the legality of the leak.How are hackers using the leaked Linkedin data?Câ¦

Read Also: Open Sky Credit Card Review

Remove Old And Outdated Addresses

When you remove your old addresses the credit bureaus electronic verification system will sometimes automate deletions when the address on your credit report cannot match up with the account information stored at the creditor.

Sometimes old charge-offs or collection accounts can be tied directly to the old addresses so removing them can help your credit report if they are removed.

How Long Do Inquiries Stay On My Credit Report

All credit inquiries are listed on your credit report for two years. After that, they should fall off naturally. On the plus side, an inquiry only affects your credit score for one year. Once that period is up, your score should rebound a few points.

Again, its no big deal if you just have a few hard inquiries listed on your credit report. But if you have a long list of them, you might want to try getting one or more of the inquiries removed.

This is especially true if you dont remember authorizing the inquiry. To dispute a hard credit inquiry, you must contact each credit bureau that lists it.

Recommended Reading: How Can You Get A Repo Off Your Credit

What Should I Do If I Find Information That Is Inaccurate On My Credit Report

Federal law allows you to dispute inaccurate information on your credit report. There is no fee for filing a dispute. You may submit your dispute to the business who provided the information to the credit reporting company and/or to the credit reporting company who included the information on your credit report.

The Federal Trade Commission’s website has information about how to dispute errors on credit reports, and the Consumer Financial Protection Bureau’s website provides additional guidance about disputing information on credit reports.