Can You Rent With An Eviction On Your Record

Having an eviction on your rental history is never a good thing. An eviction makes you look like a risky tenant to any future landlords, and many may deny your rental applications. Most landlords and property managers require a good credit score to prove that you are a reliable tenant. Having an eviction on your record can be a major red flag and make it difficult to find a rental that meets your needs.

Evictions stay on your record for seven years, but many people are not the same person they were seven years ago. If you have an eviction on your record and are trying to rent a new place, follow the tips below to boost your chances.

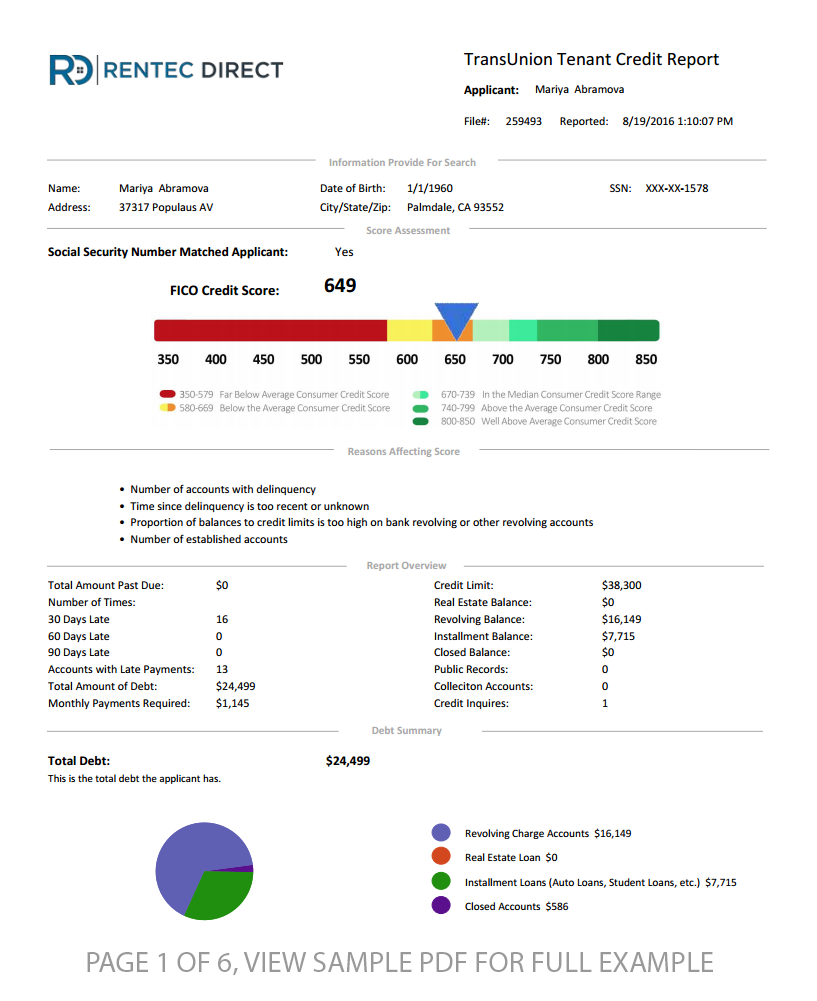

Where Would An Eviction Be On My Credit Report

Evictions aren’t included on your credit report, and neither are certain types of public records such as eviction judgments. … Second, judgments related to evictions are a matter of public record. Future landlords might not see them on your credit report, but they can easily find them by searching court records.

Access To Credit In The Future

It will most likely be difficult to find housing with an eviction on your rental history and credit history. You may also have limited access to credit in the future.

Even if the landlord doesnt check your credit report, they might look at your tenant screening report when considering rental applications.

Don’t Miss: Is 614 A Good Credit Score

What Are Legitimate Reasons You Can Get Evicted

While rules on what actions qualify for an eviction vary by state, there are several common reasons for eviction:

- Failure to pay rent on time

- Substantial damage to the property

- Behavior that endangers health and safety

- Violation of lease terms

- Illegal behavior on the premises

- Holding over or remaining in the property after your lease has expired

It is important to note that eviction is a legal process. You typically have to be notified in writing, which many landlords do by posting a notice on a tenants front door. State attorneys say tenants should not ignore these notices, and they should appear at all court dates to argue their side.

How Can I See My Rental History

Contact your landlord or property manager. Ask if they would be willing to report your rental payment history to RentBureau. Your lease will appear in the “accounts” section of your Experian credit report, showing the date the lease started, your monthly payment amount and your payment history for the past 25 months.

You May Like: How To Fix My Credit Score In 6 Months

The Basics Of The Eviction Process

It may be helpful to know a little more about how the eviction process works before you learn more about how it can affect credit scores. Eviction will work differently depending on where you live each state has different laws. However, the general process is similar. Here are the steps of the legal process for an eviction:

Will A Notice Of Eviction Appear On My Credit Report

Evictions do not appear on your credit report. A notice of eviction is your landlords declaration that they intend to evict you unless you take corrective action.

The most common eviction notice is a notice to pay or quit, given when a tenant misses a rent payment. It tells the tenant to pay within a certain number of days or the landlord will seek a court order. If you either pay what you owe or move out voluntarily, the eviction process ends.

In some situations, the eviction notice will not give you an opportunity to fix the problem. For example, if you damaged the property, the landlord may want you out as soon as possible. This still may not appear on your credit report as it is only the start of the legal process.

Read Also: What’s The Average Credit Score In America

Property Damaging And Misconduct

In the cases of misbehavior, damage caused to the rental property, or complaints by other tenants and neighbors, the best way to resolve the issue is to apologize and rectify your mistakes.

This can be done by offering to pay for fixing the damage, keeping your behavior in check, and abiding by the rules.

How To Remove A Civil Judgment From Your Credit Report

Once youve had the eviction expunged from your rental history, you will have to dispute the civil judgment placed on your credit reports by the three major credit bureaus Equifax, Experian, and TransUnion. They will not remove it from your credit report automatically. Its also possible to have it removed from your credit report even if it hasnt been expunged from your record.

To do so, you will need to dispute the judgment with each credit bureau separately. You can do so by phone, online, or the best way is to send them a dispute letter.

Read Also: Is 725 A Good Credit Score

Does An Eviction Show On Your Credit Report

This question can be a tricky one. The eviction itself may not appear on credit reports, but any unpaid debt can appear on your credit report if your previous landlord sold the debt to a collection agency. Most collection agencies report to the three major credit bureaus .

These unpaid debts will show up as collections on your credit report. This can negatively impact your credit score. When your landlord sells your debts to a collection agency, they often call non-stop to get payments from you. You probably already know the extent of your financial troubles you dont need creditors constantly calling to remind you. At the OBryan Law Offices, we can help stop creditor harassment.

Can You Repair The Damage Or Remove The Information From Your Credit Report

If a landlord has turned over any unpaid money due to a collection agency, paying off what you owe can help. As stated above, once the balance is paid off, some of the newer credit-scoring models will remove it from your credit reports. Plus, it just looks better to future lenders to see that you have rectified the debt.

Going forward, the best way to repair any credit damage from an eviction is to tune up your financial health. By paying your bills on time and keeping your debt low, your scores will eventually start to improve.

While damaging information can stay on your credit report for seven years, debts carry less weight the older they get as more positive information is added to your credit reports. You may choose to seek help from a nonprofit , which can help you organize a budget to start repairing your credit health.

Recommended Reading: What Credit Score Is Required To Buy A House

How Can I Avoid An Eviction

If you are worried that you will be unable to pay your rent, talk to your landlord. Try to work out a deal to avoid eviction. Your landlord may be willing to create a payment plan, temporarily lower your rent, accept delayed payments, or otherwise come up with a plan that works for both of you. Attorneys from Legal Aid of Northwest give tips on how to negotiate with your landlord in this video.

You can also look for local agencies and organizations that offer rent payment assistance. This aid is temporary, but it may be enough to help you avoid eviction while you get back on your feet. See the Texas Eviction Diversion Program article for a list of rent assistance programs near you. The Texas Eviction Diversion Program may also help you seal your eviction record so it does not count against you.

Hiring A Professional To Remove An Eviction From Your Credit Report

If youre feeling overwhelmed by the process of disputing an eviction on your credit report or the steps youve taken have hit a dead end, you may want to consider hiring a credit repair professional.

A credit repair professional can help take the stress out of the process and can help ensure that your eviction is removed from your credit report.

If youre considering hiring a credit repair professional, its important to do your research. Make sure that the company is reputable and has a good track record.

A few companies we recommend are and Sky Blue Credit Repair.

Don’t Miss: How Many Points Does Your Credit Score Go Up

Solve Your Problem With Evictions On Your Credit Report With The Help Of Donotpay

Removing evictions from a credit report can be daunting. The process is tedious, and it’s pretty easy to give up along the way. Sadly, an eviction in your credit report can get in the way when house hunting. This is the last experience you want to go through. The good news is DoNotPay has you covered.

How to clean up your credit report using DoNotPay:

If you want to clean up your credit report but don’t know where to start, DoNotPay has you covered in 3 easy steps:

You can also check out our other credit products, including Credit Limit Increase, Get My Credit Report, Keep Unused Cards Active, and more!

Is There A Deadline For Filing An Eviction Dispute Claim

There shouldnât be a deadline for filing an eviction dispute claim. However, the longer you wait to file dispute claims with the credit bureaus, the more difficult it could be to win your case. Thatâs because you may no longer be able to access the records necessary to win the case.

For example, if you need to show bank or credit card statements to prove that you paid your rent 24 months ago, but your bank or credit card statements online only go back 12 months, you might be out of luck.

Likewise, the credit bureaus may question why you waited so long to file a dispute. It might be because you didnât notice the incorrect or erroneous information until later on. That may be the truth, but waiting a long time to file a dispute sure doesnât help your case.

When filing a dispute, you should still check with Equifax and TransUnion to see if there are any important deadlines to be aware of. If the credit bureaus request supporting documentation and you donât provide it, your dispute could automatically be closed after 30 or 60 days for failing to respond.

You May Like: Does Having Multiple Credit Cards Affect Your Credit Rating

Also Check: How Do You Find Out Your Credit Score

How Long Before An Eviction Shows Up On Your Credit Report

The eviction itself wonât appear on your credit report, but an unpaid debt related to an eviction can. If you owe back rent and havenât been evicted for it, it may not show up on your credit report at all: Many property owners and management companies donât report rent payments to the credit bureaus.

If the debt is sold to collections, however, chances are the collections agency will report your debt to the credit bureaus, at which time it may appear on your credit reports.

Warn Potential Landlords To Avoid Risky Tenants

TransUnion reports that evicted tenants are three times more likely to have past eviction records or unpaid rental-related debts that have gone into collections. Property owners who rent their homes, apartments or commercial space can warn other property owners to be wary of risky tenants by reporting evictions to the credit bureaus. Potential landlords of your evicted tenants will appreciate the information, and you can improve the chances that other landlords will feel compelled to report similar information to credit bureaus to help protect you and other property owners in the future.

You May Like: How Do You Get A Perfect Credit Score

Recommended Reading: How To Get A Truly Free Credit Report

Where Can You Go For Help

Because eviction laws differ from state to state, its best to research the relevant laws where you live. If youre not sure where to start or think your landlord is mishandling the eviction process, look up your local Legal Aid chapter.

If you qualify under your chapters low-income guidelines, you can receive free legal assistance. Theyre likely to have specific expertise with eviction defense.

You can also try negotiating directly with your landlord. If you just need a bit more time to come up with your rent money, consider telling them about your financial situation.

Most landlords want to avoid lengthy and potentially expensive court proceedings. So if youve been a good tenant but are in a rough spot with your money, it cant hurt to try being open and working out an agreement.

How To Avoid Being Evicted And Save Your Credit Score At The Same Time

It should be clear by now that an eviction on your credit report can be a pain in the neck. So, why not avoid the inconvenience and save your credit score at the same time? Here is what you can do:

Keep Track of Your Credit Report

Learn how to read your credit report and keep an eye out for any alarming changes.

Pay Your Rent First

If you are late on paying rent, you are probably having trouble paying other bills as well. But you should always give precedence to keeping the roof over your head. Bear in mind that overdue medical bills and other unsecured debts take several months before they get to the collection phase. This will buy you some time to resolve these debts.

Talk to Your Landlord

Have an honest conversation with your landlord about the situation you are in. If you are lucky, he or she might agree to reduce your rent or accept belated payments until you overcome your financial troubles.

| Did you know that your doesnt include your income? You can have excellent credit scores even if you lose your job or if your income drops. |

Also Check: Is 808 A Good Credit Score

How Can I Rent If An Eviction Is Still On My Public Record

You can still rent if you have an eviction on your public record, but itll be more difficult. There are a few things that may improve your chances of getting a rental agreement.

- Explain the eviction: Be honest and upfront. If the landlord understands what happened, they might give you a better chance. If youve rectified the situation with your previous landlord, make sure the new landlord knows that.

- Provide references: To show youre a trustworthy renter, offer references in addition to the background check.

- Offer to pay more upfront: Consider paying the security deposit, first months rent and even second months rent at the time of signing a rental agreement.

- Get a co-signer: A co-signer reassures the landlord that you have someone legally and financially backing you.

- Improve your credit: A good credit score can be evidence of your ability to pay bills on time.

- Show youre financially viable to pay your rent: Provide proof of income and other successful payments, like payments on an auto loan.

Once youre accepted as a tenant, continue to prove yourself with timely payments and by properly caring for the property. You can rebuild your rental history and make it easier to rent in the future.

How Does Getting Evicted Affect Your Credit Score

If your landlord takes legal action against you, either by turning over any outstanding payments to a collection agency or filing a lawsuit, those actions can damage your credit score as the data in your credit reports is what generates your .

If the disputed amount goes to a third-party collection agency, that is one of the worst things that can show up on your credit report with negative consequences, said Bruce McClary, vice president of communications and marketing for the National Foundation for Credit Counseling ®. It can send your scores into the basement, said McClary.

Accounts that are in collection remain on your credit reports for seven years.

The biggest factor affecting your credit score is payment history, which accounts for 35% of your credit score. If you pay off what you owe, some of the newer credit-scoring models dont include paid collection accounts in their credit-scoring calculations, so you may want to settle up with your landlord to help improve your scores. However, any legal judgment will remain on your credit reports for that same seven-year period, which may be reviewed by future lenders and landlords.

Don’t Miss: How Do Student Loans Affect Credit Score

Will Credit Karma Show Evictions

If you’ve experienced an eviction, the removal process and judgement won’t appear on your credit reports. … These judgments won’t appear on consumer credit reports such as the VantageScore 3.0 you see on Credit Karma, as they were removed from consumer credit reports in 2017 and are no longer reported.

Are Rental Payments Included In My Credit Report

Esusu August 31, 2021

Pressed for time? Heres what you need to know.

Historically, credit reports dont include rent payments. Why? Because rent isnt considered debt. As we all know, landlords and property managers dont lend us rent money each month to be repaid later with interest.

Until 2010, the only time rent payments would show up on your credit report is if you have late or missing payments. If your landlord sells the rent you owe to a collections agency, then it becomes debt. This information will definitely appear on your credit report and can negatively affect your credit score. Since 2010, on-time payments can be included in your credit report.

If you have a stellar track record of on-time rent payments, that can be a great way to show lenders that youre a responsible consumer. A history of on-time rent payments can also help you build credit without taking on additional debt. It can even boost your credit score.

In this article:

You May Like: Do Student Loans Show On Your Credit Report