Buying A House With Bad Credit

Having bad credit is different than having no credit.

If your low credit score comes from collections, write-offs, and late and missed payments, bad credit will get your loan denied.

If your credit score is low because youve failed to make loan payments on time, or you keep all your credit card balances maxed out, a lender isnt likely to overlook these issues.

Youll probably need to take a year or so and work on improving your credit score before you can get serious about buying a house.

Your Credit Score Can Fluctuate

You may see some short-term movement in your credit score. This happens as information is added or falls off your report, which can happen frequently. Our latestConsumer Pulse revealed one-third of consumers monitor their credit at least weekly. Its encouraging to see people take an active approach to managing their credit health. But when it comes to your credit score, theres no need to obsess over minor, day-to-day changes. Nor is it necessary to achieve a perfect score. Trying to stay within a certain credit range is a smart, less stressful way to monitor your score.

Also, your credit score may not be the only thing a lender looks at when making a lending decision. For example, if you apply for a mortgage, lenders may also verify your income, personal assets and employment history. Because lenders look at multiple factors, its important to strive for overall financial wellness in addition to any credit score goal you may have. Building an emergency savings account and creating a plan to pay down debt, if you have any, will help you be more financially secure and can reflect positively in your credit health.

Improving Your 767 Credit Score

A FICO® Score of 767 is well above the average credit score of 714, but there’s still some room for improvement.

Among consumers with FICO® credit scores of 767, the average utilization rate is 23.7%.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file. You’ll also find some good general score-improvement tips here.

Recommended Reading: How To Get Hard Copy Of Credit Report

What Is The Average Credit Score In America

The average credit score in the U.S. is at an all-time high of 711. This coincides with what the Consumer Financial Protection Bureau defines as “prime.”

About 1 in 5 American adults either have no credit history or are unscorable. As a result, these individuals will have difficulty obtaining new lines of credit.

In the eyes of lenders, credit scores fall into several buckets, which indicate how risky it may be to extend credit to an individual. Outside of playing a role in approvals for a loan or credit, these scores can also impact an individual’s lending terms. Perhaps the most important terms among those are interest rates.

The higher an individual’s credit score, the lower their quoted APR will typically be.

FICO credit scores break down in the following manner:

- 800 to 850: Exceptional

- 300 to 579: Very poor

This means the average credit score of 711 is in the good range.

Though the average credit score has generally improved since 2005, slight dips were seen around the Great Recession that ended in 2009. A large number of people declaring bankruptcy or defaulting on their loans would have caused their credit scores to plummet, which in turn would have affected the overall average.

What Does A 750 Credit Score Mean For Your Wallet

A 765 credit score is well above the national average of 679, according to the latest data from TransUnion. As a result, such a score generally gives you access to some of the best loans and lines of credit. The very best rates, rewards and fees may still be out of reach, though, as youll see in the table below.

Read Also: Does Credit Score Affect Car Insurance

Is 765 A Good Credit Score

Asked by: Kaylie Schuppe

Your score falls within the range of scores, from 740 to 799, that is considered Very Good. A 765 FICO® Score is above the average credit score. Consumers in this range may qualify for better interest rates from lenders. 25% of all consumers have FICO® Scores in the Very Good range.

Advantages Of Your Very Good Credit Score

A credit score in the Very Good range signifies a proven track record of timely bill payment and good credit management. Late payments and other negative entries on your credit file are rare or nonexistent, and if any appear, they are likely to be at least a few years in the past.

People with credit scores of 765 typically pay their bills on time in fact, late payments appear on just 22% of their credit reports.

People like you with Very Good credit scores are attractive customers to banks and credit card issuers, who typically offer borrowers like you better-than-average lending terms. These may include opportunities to refinance older loans at better rates than you were able to get in years past, and chances to sign up for credit cards with enticing rewards as well as relatively low interest rates.

Recommended Reading: What Makes You Have A Bad Credit Rating

What Credit Score Is Needed To Buy A House

You dont need perfect credit to buy a house. In fact, you might not even need good credit.

The minimum credit score to get a mortgage is 580, which is considered only fair. And with a score of 620 or above, you have access to most home loan programs.

But mortgage lenders will look beyond your credit score.

They also look at your credit report, debts, and down payment. The stronger you are in these areas, the more likely you are to qualify with a lower credit score.

In this article

What Can You Do With A 765 Credit Score

With a credit score of 765, you should be able to qualify for most loans however, you wont receive the absolute best terms.

This is because, even though 765 is a Very Good score, it is not technically an Exceptional score. That being said, here is what a credit score of 765 can get you:

- No-annual-fee credit card.

- Big initial credit card bonus.

- No-foreign-fee credit card.

- Airline/hotel credit card.

You may still not be qualified for every credit card or the best mortgage rate. While your credit score is considered Very Good, it is still not an Exceptional score that will allow you to get any card or mortgage rate.

Also Check: Does Capital One Report Authorized Users To Credit Bureaus

How Mortgage Lenders Pull Credit

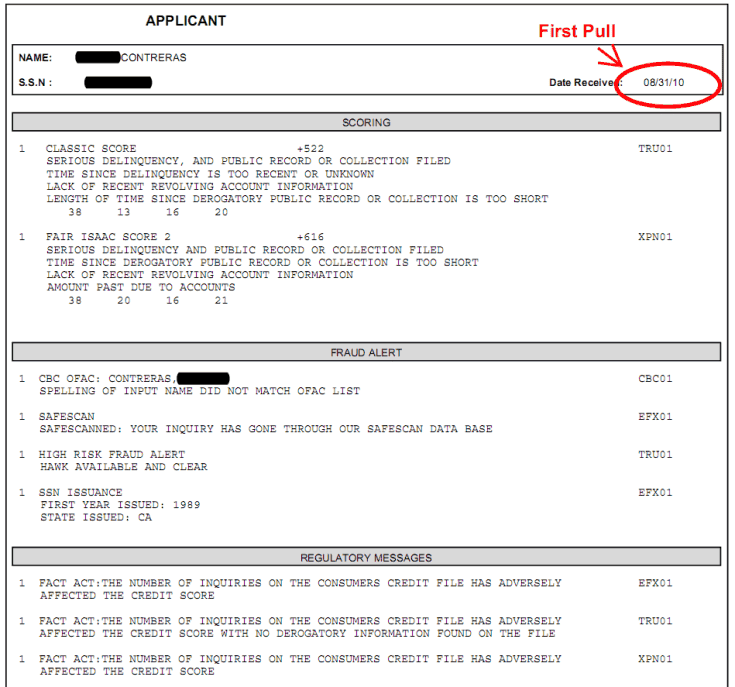

When you apply for a mortgage, lenders pull your credit report from all three major credit bureaus: Transunion, Equifax, and Experian.

Whether you get approved for the loan and the terms of your loan will depend on the result of those reports.

Lenders qualify you based on your middle credit score.

For example, if your scores are 720, 740, and 750, the lender will use 740 as your FICO. If your scores are 630, 690, and 690, the lender will use 690 as your FICO.

When you apply with a spouse or co-borrower, the lender will use the lower of the two applicants middle credit scores.

Expect each bureau to show a different FICO for you, since each will have slightly different information about you. And, expect your mortgage FICO score to be lower than the VantageScore youll see in most free credit reporting apps.

In all cases, you will need to show at least one account which has been reporting a payment history for at least six months in order for the bureaus to have enough data to calculate a score.

Paying Your Bills On Time

While paying each of your bills on time may seem like the most obvious way to improve your credit score, its also the most important one. There is nothing that will harm your credit score as much as having a series of late payments on anything from car loans to mortgage loans. This is why it is extremely critical that you always make the minimum monthly payments by the determined date each month WITHOUT ANY EXCEPTIONS.

Even skipping just one mortgage payment is going to have a detrimental effect on your credit score. Sorry if that sounds cruel, but its the truth, and it should serve as your primary source of motivation for making your payment on time.

Heres an important fact to keep in the back of your mind: every time that you fail to make a monthly payment when you are required to do so, whether it be on a car or your home or anything else, it will be on your credit history and thus impact your credit score for up to seven years. Seven years. Think about that.

Now, one primary benefit to using a credit card here is that you can choose how much money you spend while using them, and then also determine how much you pay back each month, so long as that amount is equal or greater than the minimum payment you owe.

The reason why this is a benefit to you is because it allows you to budget your money accordingly and make the smartest financial decisions you can. In other words, you can avoid going into serious debt.

You May Like: Does Pre Approval Hurt Credit Score

Average Credit Score By Income

The higher ones income level, the higher their average credit score tends to be.

While debt-to-income ratio doesnt play a direct role in determining one’s credit score, it does have an indirect one. One of the factors lenders consider when modeling an individual’s credit risk is their credit utilization the percentage of total available credit a consumer is using month to month.

To improve one’s credit score, credit utilization should generally be kept below 30%. The lower one’s income is, the more a consumer may rely on their credit for their expenditures.

Another way income may play into credit utilization, and ultimately one’s credit score, is by determining one’s . Credit issuers look at borrowers incomes when deciding on the amount of revolving credit that should be issued.

The lower one’s income, the lower their line of credit is likely to be.

In turn, by having significantly lower credit limits, it becomes easier for lower-income individuals to eat up a larger portion of what’s available, increasing their credit utilization.

The graphic belows shows that median credit scores are highly correlated to income.

For context:

- Low income: Up to 50% of the area median income

- Moderate income: Greater than 50% and up to 80% of the area median income

- Medium income: Greater than 80% and up to 120% of the area median income

- High income: More than 120% of the area median income

Can I Get A Personal Loan Or Credit Card W/ A 765 Credit Score

Like home and car loans, a personal loan and credit card is easy to get with a 765 credit score.

You donât need to apply for a secured card with Discover or Capital One, who may make you pay $500-$1000 just for a deposit.

You can get even better terms on your personal loan or credit card by repairing your credit and waiting a few short months until your score improves.

A 765 score means you likely have few-no negative items on your report. Removing any outstanding negative items is usually the quickest way to fixing your report.

We recommend speaking with a friendly credit repair expert online to help guide you through this process. Your consultation is completely free, no-pressure, and will set you on the right path toward boosting your score.

Also Check: What Is A Social Credit Score

Keeping Your Credit Card Balance Low

The very act of having credit cards will impact your credit rating. Regardless of whether its positive or negative, it has an impact.

But something else that you want to ensure you do is keep the balance on your credit card low. The balance on your credit cards can influence over one third of your total credit score. The higher your balance is, the lower your score will be.

What you want your credit card history to show is that you have been reducing your balance on an active basis by making your minimum monthly payments on time and using your credit cards responsibly.

A good rule to follow is for your balance on your credit card to be 35% of the total limit on that card. So if you have a limit of $1,000 on your card, you want your balance to be $350 at the very highest. This holds true regardless of whether you have one credit card or multiple cards. In the long run, this will not only prevent your overall credit score from dropping, but it could also cause it to increase.

The reason why this is so important is because most lenders these days want you to stay as far away from the limit as possible in order to have the best credit scores. In fact, most experts would recommend that you never use more than fifty percent of your total available credit. If you use any more than that, or if you max out your limit, your overall credit score will drop.

What Does Not Count Towards Your 765 Credit Score

There are many things that people assume go into their 765 credit scores but that actually dont. Examples include how much money you earn, your age, your marital status, your child support payments , how much money you have donated to charity, where you work or live, or your employment history.

None of these things or anything like them do anything at all to your credit score, so instead, focus on the five primary factors that we outlined and discussed above.

Now that you know what counts towards your overall credit score and what does not, you should know exactly what you need to pinpoint in order to enhance your score. For example, maybe one reason your credit score is low is because youve opened several new accounts of credit.

Regardless, its important at this stage for you to positively identify what it exactly is that is lowering your credit rating. Once you have identified what that is, you can start to formulate a plan.

Don’t Miss: What Is The Best Way To Hurt Your Credit Rating

What Is The Minimum Credit Score To Qualify For A Mortgage

There is no official minimum credit score since lenders can take other factors into consideration when determining if you qualify for a mortgage. You can be approved for a mortgage with a lower credit score if, for example, you have a solid down payment or your debt load is otherwise low. Since many lenders view your credit score as just one piece of the puzzle, a low score wont necessarily prevent you from getting a mortgage.

You Apply For New Credit Only When Needed

It is possible to lose a few points on your credit score every time you apply for a new credit card or loan. The reason for this is that many credit applications are associated with a high risk that you will not pay them on time, resulting in a negative effect on your credit score.

The solution is to stop applying for new credit or apply less frequently. If you find yourself applying less frequently for new credit, it is a sign that your credit score will not be affected very much.

To make sure that it does not affect your score, you need to apply for new credit only in rare cases. This will secure your credit score and prevent any potential decline.

Read Also: How To Dispute Collections On My Credit Report

Recognize That Your Rates Can Increase

Currently, credit card companies cannot raise your credit rate for at least one year after you have opened your account, unless any of the following circumstances apply:

- A six month introductory rate exists

- You are late paying your bill by sixty days

- You have a card with a variable rate that is tied to an index and that index increases

You need to recognize that your credit rates will increase in the future, at least after the initial twelve months, and you need to establish with your potential creditor exactly when your rates will increase, by how much, and if there is anything you can do to lower your rates.

Dont Hit Your Credit Limit

If you want to get into the 800+ credit score club, be sure that you dont use your credit card up to its full limit. Use no more than one-third of your credit limit if you dont want to hurt your credit score, Nitzsche says.

For example, if your credit card has a limit of $9,000, dont have a balance of more than $3,000.

Ideally, credit card utilization should be 10% or less. Jennifer Martin, a business coach, says she has a credit score of around 825, and that she tries to keep her spending to no more than 10% of a credit cards available credit.

Outstanding debt accounts for 30% of a credit score, Ross says.

If you are overextended and close to your credit limit this indicates overextension and you need to work at getting your credit card balances well below the limits, she says.

Recommended Reading: How To Report Credit Card Fraud To Amazon

Shopping For The Best Rates On Loans And Credit Cards For A Credit Score Under 765

If you are ever on the market for high-priced items, such as home appliances, it is very common for people to walk into the store and get offered a discount or an otherwise excellent financing deal.. .but only if they open up a credit card account with that store.

Why do stores offer these credit cards? The reason why is because theres usually a high interest rate or multiple fees that go along with them. Those rates and fees can be found on the small fine print of the credit card deal, but of course, the store doesnt tell you.

A golden rule of credit cards is that you should only apply for credit that is a necessity for your financial life. When applying for a credit card from a retail store, youre probably only going to use it once, twice, or three times maximum. You could just as easily be using an existing credit card that you already have.

Heres why this is so critical: applying for multiple credit cards within a few months of each other will be very harmful to your overall credit score. Never apply for a credit card that you dont need.

Now, when you do decide to apply for credit cards and loans in general, there are a few factors that you will want to remember, including: