What To Do Instead: Dispute Inaccuracies And Wait It Out

Instead of disputing all of the negative items on your credit report, you should only dispute the inaccurate information. This gives your dispute legitimacy. When you send the dispute, you should include any relevant documentation that proves why youre disputing the record.

From there youll have to wait about 30 to 45 days for the credit bureaus to complete their investigation with the lender, debt collector, or creditor before sending you a response. They may ask for more information or decide that your dispute is valid and remove the error.

The credit reporting agency can also choose to decline the dispute altogether. If they do, you can choose to challenge the decision.

Most people think that you have to wait seven years before true bad information stops hurting your credit. Thats not true. After 2 years, late payments and other bad items on your credit report dont hurt you very much.

There are people who achieve a 700+ credit score just two years after obtaining a bankruptcy. You can completely turn around your credit profile within just two years!

How Does It Work

Although there are many different , your main FICO score is the gold standard that financial institutions use in deciding whether to lend money or issue a credit card to consumers. Your FICO score isnt actually a single score. You have one from each of the three credit reporting agenciesExperian, TransUnion, and Equifax. Each FICO score is based exclusively on the report from that credit bureau.

The score that FICO reports to lenders could be from any one of its 50 different scoring models, but your main score is the middle score from the three credit bureaus, which may have slightly different data. If you have scores of 720, 750, and 770, you have a FICO score of 750.

A perfect score of 850 will give you bragging rights, but any score of 800 or up is considered exceptional and will give you access to the best rates on credit cards, auto loans, and any other loans.

Limit Your Hard Credit Inquiries

When you apply for credit of any kind, it generates a hard credit inquiry. Since applying for new credit can be an early sign that someone is dealing with financial troubles, hard inquires will have a slight negative effect on your scores temporarily.

If you want to get a really high score, youll want to limit your hard inquiries meaning you should only apply for new credit when necessary.

Also Check: How Many People Have 850 Credit Score

How To Earn An Excellent/exceptional Credit Score:

Borrowers with credit scores in the excellent credit range likely haven’t missed a payment in the past seven years. Additionally, they will most likely have a credit utilization rate of less than 30%: meaning that their current ratio of credit balances to credit limits is roughly 1:3 or better. They also likely have a diverse mix of credit demonstrating that many different lenders are comfortable extending credit to them.

Percent Of Adults Who Check Their Score Monthly

Data regarding how many adults check or dont check their scores will vary from study to study due to the nature of the sample population. Research offered by CreditCardInsider.com found that only 21 percent of their respondents check their credit score on a monthly basis9.

This low number can be supported by data in other studies, such as a LendingTree survey that found only 33 percent of adults checked their score within the past year in 202010.

Recommended Reading: Do Cell Phone Companies Report To Credit Bureaus

Don’t Miss: Can A Charge Off Be Removed From Your Credit Report

What Is An Excellent Credit Score Range

Excellent credit score = 740 850: Anything in the mid 700s and higher is considered excellent credit and will be greeted by easy credit approvals and the very best interest rates.Consumers with excellent credit scores have a delinquency rate of approximately 2%.

In this high-end of credit scoring, extra points dont improve your loan terms much. Most lenders would consider a credit score of 760 the same as 800. However, having a higher score can serve as a buffer if negative occurrences in your report. For example, if you max out a credit card , the resulting damage wont push you down into a lower tier.

How Do Lenders Use New Fico Scores

When a new FICO® Score version like FICO Score 10 or FICO Score 10 T is developed, we release it to the market.

From there, each lender determines if and when it will upgrade to the latest version. Some lenders make the upgrade quickly, while others may take longer. This is why some lenders are currently using different versions of the FICO® Score. As an example, FICO Score 5 at Equifax is the FICO Score version previous to FICO Score 8 at Equifax.

Other FICO® Score versions, including industry-specific auto and bankcard versions, are also included in the FICO Score products on myFICO.com so you can see what most lenders see when looking at your scores.

You May Like: What Is Locking Your Credit Report

What To Do If You Don’t Have A Credit Score

For FICO® Scores, you need:

- An account that’s at least six months old

- An account that has been active in the past six months

VantageScore can score your credit report if it has at least one active account, even if the account is only a month old.

If you aren’t scorable, you may need to open a new account or add new activity to your credit report to start building credit. Often this means starting with a or secured credit card, or becoming an .

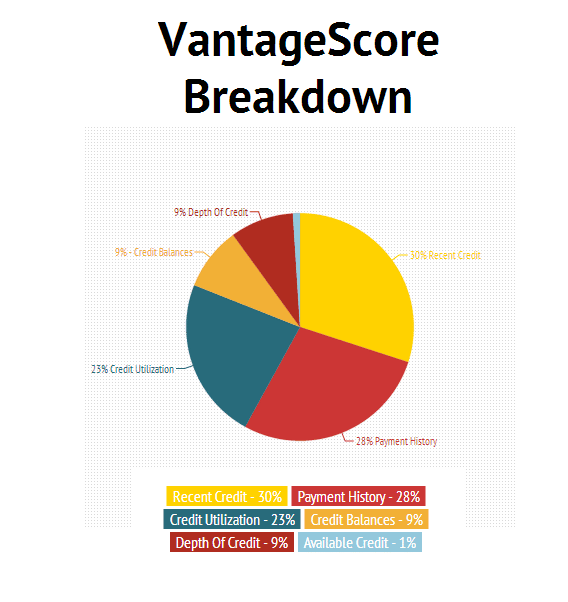

The Vantagescore Credit Score Model

While FICO may be the mortgage-industry standard, the VantageScore credit score model is actually used fairly widely. In fact, according to VantageScores website, approximately 12.3 billion VantageScore credit scores were used by more than 2,500 users between July 1, 2018 and June 30, 2019. Additionally, many free credit score sources use the VantageScore credit score.

Watch on

As with the FICO credit score model, the VantageScore model has had several variations over its lifetime. The current model, VantageScore 4.0, was released in 2017 and changed the scoring structure to include trended data, which reflects patterns in borrower behavior, among other things.

Unlike FICO, the VantageScore models ignore paid collection accounts. It also puts less emphasis on unpaid medical debt compared with other types of collection accounts.

For the older VantageScore 1.0 and 2.0 models, the credit score scale ran from 501 to 990. The VantageScore 4.0 scale is the same as the FICO Score 8 scale, going from 300 to 850. As with the FICO scales, a higher number indicates lower credit risk.

Don’t Miss: What Should Your Credit Score Be

How The Vantagescore Works

Since its debut in 2006, there have been four models of the VantageScore, but VantageScore 3.0âreleased in 2013âis the most common. This is because the data prioritized by the VantageScore 3.0 algorithm makes it easier for people with limited credit history to get a score. So, even though VantageScore 4.0 was subsequently released in 2017, VantageScore 3.0 is still the most popular option among lenders.

Buy Authorized User Tradelines

Building credit isnt easy. If youve been at it for a while, you may have even encountered a in your credit file. Instances like this drive many people to find fast and easy solutions like buying tradelines.

Buying authorized user tradelines straddles the line of legality. Technically, buying authorized user tradelines isnt illegalyet. There are currently no federal regulations against buying authorized user tradelines. However, there is legislation being introduced to ban the practice.

The lack of solid legislation hasnt stopped credit card issuers from prohibiting this within their terms and conditions. Credit card companies are very good at recognizing what tradeline selling and buying looks like and theyre known to shut down accounts that participate in it.

The penalties arent just for the seller.

If its discovered that you purchased a tradeline to improve your credit scores before a credit application, youll have your application denied or have any approvals revoked. Its viewed as a deceptive practice that aims to defraud creditors and lenders.

When you really want that new car, home purchase, or credit card, its a tempting solution that seems to get you what you want. In reality, its dishonest and circumvents the protective aspects of the credit system. That could lead you to qualify for more debt than you can afford.

Don’t Miss: How Does A Mortgage Affect Your Credit Score

What Is The Highest Credit Score

Its the Bigfoot of the financial world a perfect. AKA, the highest score a person can get. This mythical and elusive number for the FICO Score is 850. And, for those unaware, FICO Scores range from 300 to 850.

In reality, there are Americans with 850 FICO Scores. As a matter of fact, 1.6% of all FICO Scores currently stand at 850. Which, may sound dire considering that 11% of people believe that Bigfoot is real.

At the same time, obtaining credit with the best terms and lowest interest rates doesnt require a perfect score. A score above 700 is considered good in most cases. Whatâs more, the exceptional range of 800 to 850 doesnt usually make a difference to lenders. In fact, a score over 760 usually qualifies you for the best rate.

In other words, while achieving a good credit score is a great goal, getting to the top of the scale isnt necessary. Remember that credit scores keep changing, so even ones that reach 850 dont always stay there.

In light of the fact that the elusive 850 is only achieved by a small fraction of Americans, it can be valuable to examine the features of top scorers if you want to build your credit score.

How To Improve Your Credit Score

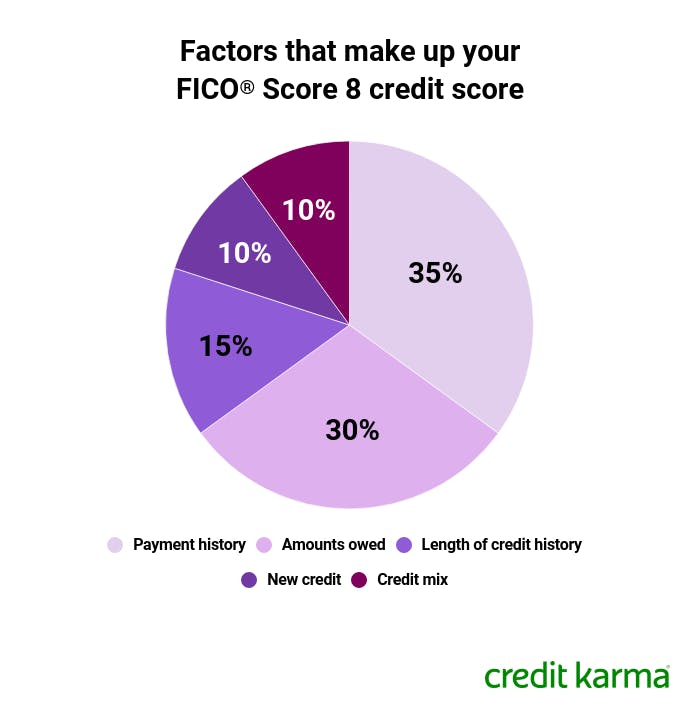

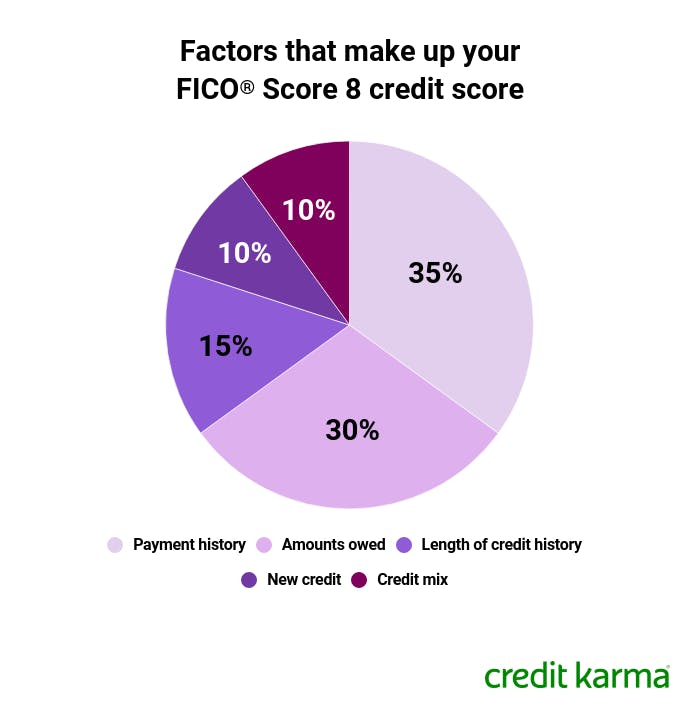

Whether you have a poor credit score or none at all, you can take action today towards building the score that you want. In both the FICO and VantageScore models, payment history is the most important factor. So if you’re looking to improve your score, making on-time payments each month is a critical first step.

Next, you’ll want to consider your credit utilization ratio the percentage of your available credit that you use each month. Aiming to keep your credit utilization ratio below 30% is a great start.

Other factors that affect your credit score include your length of credit history, your credit mix, and new credit accounts that you recently opened. These factors aren’t as influential, but paying attention to them could help you lift your score to the next level.

Want to check your credit score? You can do so for free once every 12 months at AnnualCreditReport.com. Your bank or credit card issuer may provide your credit score for free as well. You can also use credit score sites like or .

You May Like: How To Freeze Your Credit Report

Tips For Achieving A Perfect Credit Score

No negatives. Just as the word perfect implies, there cannot be a single blemish on your credit report. This includes late or missed payments. If you have a dozen accounts between credit cards and loans, none can have a late payment ever. Payment history is the most important factor when calculating a FICO credit score with a weight of 35%, although its less important for a VantageScore.

No balances. There is a myth that people have to use their credit cards to earn a credit score but this isnt true. This is the most important factor for a VantageScore and the second most important factor for a FICO credit score.

To achieve a perfect credit score, balances need to remain at zero, if not close to it. Higher credit utilization means a lower credit score, and the number may continue a downward spiral over time if balances stay high.

The average length of credit history for an 850 credit score is 30 years. If a person begins establishing credit the day they turn 18, they may be 48 before achieving a perfect score.

And that only happens if the person is responsible with their finances early in life. Many consumers stumble through their twenties as they figure out the best ways to utilize credit and make payments responsibly. This can lead to lower credit scores later in life.

The Average Fico Score Increase In The Last Decade

Between 2010 and 2020, the average FICO score has increased by approximately 24 points. The average FICO score in 2010 was 687, while todays average FICO score in the United States is 711.

This trend increase in credit score statistics also seems to appear in different age brackets, as illustrated in the data above in Experians and The Ascents reports.

Don’t Miss: What Date Does Capital One Report To The Credit Bureaus

Why Does My Score Vary Between Bureaus

There are differences in the models, but you may be wondering why your score can be different between the credit bureaus even when the same FICO® or VantageScore® is looked at.

One key thing to be aware of is that not every lender or creditor reports to every bureau, so you may have some loans or accounts that show up on one report and not others. The score for each bureau is only based on the information its able to collect.

Put Your Credit Card Debt In The Past.

Is 893 A Good Credit Score

An 893 credit score is excellent. Before you can do anything to increase your 893 credit score, you need to identify what part of it needs to be improved, plain and simple. And in order to identify what needs to be improved, you should probably be aware of all the things that count and don’t count towards your score.

Also Check: What Credit Score Is Needed For Chase Sapphire

Fico Score Scale: 300

The bottom range for the FICO Score model runs from 300 to 579, and, happily, has the fewest number of people at just 17%. Realistically, its highly unlikely for someone to have such horrible credit as to have a 300 score, those who have been through a messy bankruptcy could easily wind up at 400 or below.

What Does This Change Mean For Homebuyers

Your plays a huge role in your ability to secure a mortgage and favorable terms like a low interest rate. Ideally, these new credit scoring models will help even the playing field for borrowers with thinner credit profiles. The hope is that potential homebuyers, across income levels and races, should have better access to mortgage products.

A 2021 report by the Urban Institute found that Black and Hispanic Americans are more likely to have no or low credit and are more likely to be renters. This more robust credit-scoring model could help create an easier path to homeownership.

Todays decision will benefit borrowers and the Enterprises, along with maintaining safety and soundness, said FHFA director Sandra L. Thompson. While implementing the newer credit score models is a significant change that will take time and require close coordination across the industry, the models bring improved accuracy and a more inclusive approach to evaluating borrowers.

Read Also: How To Get My Credit Report

Is It True That After Seven Years Your Credit Is Clear

This is true in some cases but not all. For situations involving a collection account, the account will be removed from your credit report after seven years.

This isnt always true for bankruptcies. Depending on the type of bankruptcy you filed for, it may take up to 10 years to remove the record from your credit report.

This article originally appeared on DigitalHoney.com and was syndicated by MediaFeed.org.

What Percent Of The Population Has Over An 800 Credit Score

About 20% of Americans have a credit score over 800 points. If you have a credit score of 800 or higher, you will be able to manage your debt and never miss a loan payment. You will be an ideal borrower because of this and you will be able to get more offers and lower interest rates.

Dont Miss: What Is Aocs Credit Score

Read Also: How Long Does Bad Credit Stay On Your Credit Report

What Is A Good Fico Score

FICO® creates different types of consumer credit scores. There are “base” FICO® Scores that the company makes for lenders in multiple industries to use, as well as industry-specific credit scores for credit card issuers and auto lenders.

The base FICO® Scores range from 300 to 850, and FICO defines the “good” range as 670 to 739. FICO®’s industry-specific credit scores have a different range250 to 900. However, the middle categories have the same groupings and a “good” industry-specific FICO® Score is still 670 to 739.

How To Check Your Credit Score

Checking your credit score was once a difficult task. But today, there are many ways to check your credit scores, including a variety of free options.

Your bank, credit union, lender or credit card issuer may give you free access to one of your credit scores. Experian also lets you check your FICO® Score 8 based on your Experian credit report for free.

The type of credit score you get can depend on the source. Some services may offer you a version of your FICO® Score, while others offer VantageScore credit scores. In either case, the calculated score will also depend on which credit report the scoring model analyzes.

Some services even let you check multiple credit scores at once. For example, with an Experian CreditWorks Premium membership, you can get your FICO® Score 8 scores based on your Experian, Equifax and TransUnion credit reportsplus multiple other FICO® Scores based on your Experian credit report.

You May Like: How To Remove Disputed Accounts From Credit Report