What Affects Your Credit Scores

Do you feel like you need an advanced degree to figure out what is affecting your credit score? Good news is you don’tit can actually be rather simple.

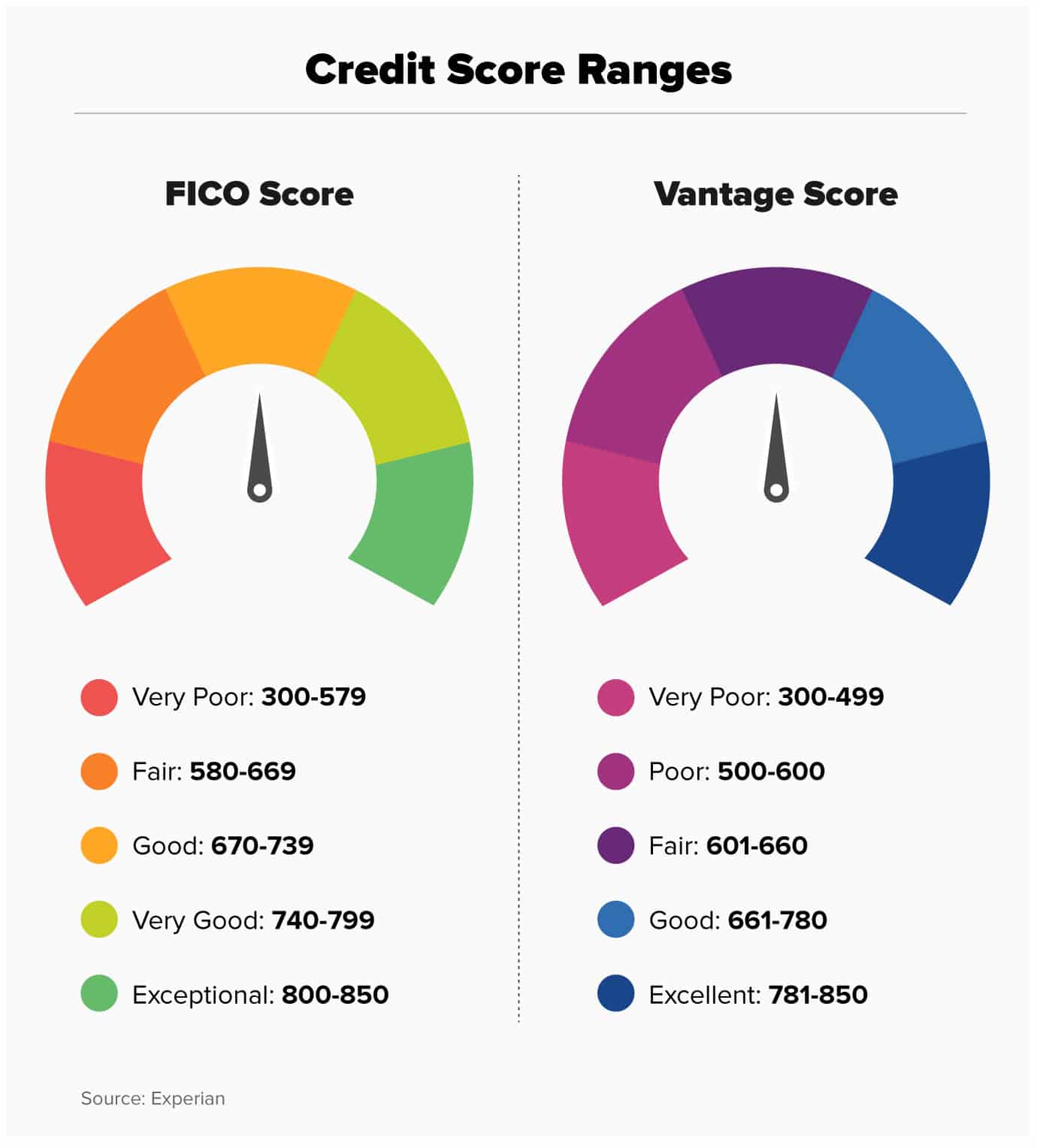

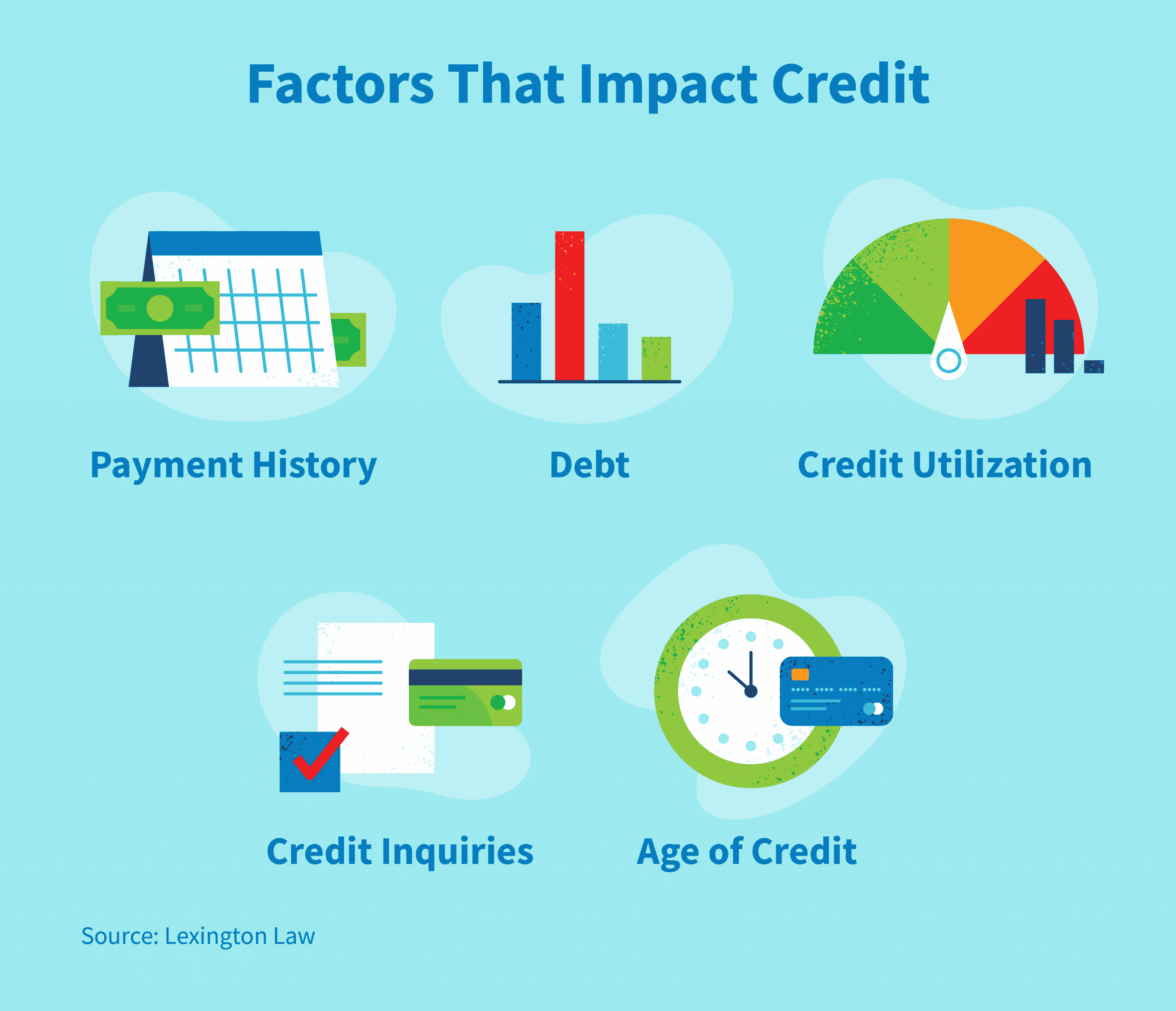

Behind the number itself , there are five main factors used to calculate credit scores. Lenders use those scores to figure out how likely you are to pay back your debtthus those scores are often the deciding factor in whether you will get a new loan.

As your financial profile changes, so does your score, so knowing what factors and types of accounts affect your credit score gives you the opportunity to improve it over time.

You Can Still Get Credit If You Have A Low Credit Score

If you have a low credit score, a lender may ask for a guarantor. A guarantor is a second person who signs a credit agreement to say they will repay the money if you don’t. This can be a way you can borrow money or get credit when on your own you might not be able to.

If you are using a guarantor to borrow, they’ll also have to give information about their personal details so that the creditor can check they’re credit worthy. Try to pick a guarantor who is likely to have a good credit score.

The guarantor is responsible for paying the money back if you don’t and they have the same rights as you under the credit agreement. For example, the guarantor should get the same information before and after signing an agreement.

If you are thinking about agreeing to be a guarantor for someone else, make sure you understand what you are agreeing to. Read all the small print in the agreement before signing it.

Things You Didnt Know Could Hurt Your Credit

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Having good credit may give you more opportunities, but it doesnt make you invincible. There are all kinds of unexpected ways that your good credit score can go down in a heartbeat.

Here are 10 things you may not have known could hurt your credit score:

You May Like: Can You Check Your Credit Score Without Affecting It

Less Important: Recent Credit

Creditors may review your credit reports and scores when you apply to open a new line of credit. A record of this, known as a , can stay on your credit reports for up to two years.

Soft inquiries, like those that come from checking your own scores and some loan or credit card prequalifications, dont hurt your scores.

Hard inquiries, when a creditor checks your credit before making a lending decision, can hurt your scores even if you dont get approved for the credit card or loan. But often a single hard inquiry will have a minor effect. Unless there are other negative marks, your scores could recover, or even rise, within a few months.

The impact of a hard inquiry may be more significant if youre new to credit. It can also be greater if you have many hard inquiries during a short period.

Dont be afraid to shop for loans, though. Credit-scoring models recognize that consumers want to compare their options, so multiple inquiries for certain types of loans, like mortgage loans, auto loans and student loans, may only count as one inquiry. You typically have 14 days to shop for these kinds of loans. And though it could be longer depending on the scoring model, you may want to stick to getting rate quotes within those 14 days since you probably wont know which model is being used to generate your score.

Student Loans Don’t Affect My Credit Score

False. Your credit score isn’t just impacted by your credit card bills. You need to pay all your bills on time, which includes your utilities, student loans, mortgage and any medical bills you might have.

“Default on a few student loans, and you’ll see just how much student loans affect your scores,” Ulzheimer says.

If you struggle to remember to pay your bills each month, there’s an easy fix: autopay. In the case of student loan companies, some give you a discount on your interest rate if you set up autopay.

Read Also: How To Lock Your Credit Report

Is There One Best Way To Consolidate Debt

For some, the best way for debt elimination may be paying off smaller balances first. As the second step, you can add payments to those bigger burdens until they are fully paid off.

A second option is to consider transferring balances to one credit card or consider getting a consolidation loan. However, consolidating balances to one credit card or using a loan is a risky move. This is because, if you need to borrow additional money, it may be tempting to use one of the accounts with a zero balance. This opens a window for the debt to grow, even more, creating bigger credit problems.

Get A Credit Card If You Dont Have One

Irresponsible use of a credit card can be a negative for your credit score and your finances. But used wisely, a credit card can be one of the fastest ways to improve your credit, as it impacts the most important aspects of your score.

By signing up for a credit card and paying on time each month, you build a positive payment history. Then, by keeping spending on the card low, you create a low utilization ratio. Credit cards also positively impact your credit mix and new account aspects of your credit score.

If you are nervous about overspending with a credit card, consider getting a card with no annual fee and using it only for one or two recurring expenses. Get a credit card, place a small, recurring payment on it, then set the credit card to auto-pay and put it in the drawer. You wonât have to worry about missing a payment or racking up a big bill, but youâll be building your credit history fast.

Read Also: Does Lending Club Show On Credit Report

Limit Your Number Of Credit Applications Or Credit Checks

Its normal and expected that you’ll apply for credit from time to time. When lenders and others ask a credit bureau for your credit report, its recorded as an inquiry. Inquiries are also known as credit checks.

If there are too many credit checks in your credit report, lenders may think that youre:

- urgently seeking credit

- trying to live beyond your means

Read Your Credit Report

Its helpful to understand whats working in your favor and whats not while you learn how to improve your credit score. Your credit report will highlight potential issues that drag your score down, such as high credit card balances and late payments.

Action item: Get your free credit reports at AnnualCreditReport.com, a site thats jointly run by Experian, Equifax and TransUnion. Your credit score wont be on your credit report. A financial institution like your credit card company may tell you your score, but if not, you can get it from one of the credit bureaus for a fee.

You May Like: Is My Credit Score Good

Icipate In Rent Reporting

In 2019, a white paper from the Credit Builders Alliance showed the score-building power of a little-known tactic called rent reporting. Not all credit scoring models factor on-time rent payments into their calculations, but all three bureaus will include rental payments in their profiles and reports if they receive it but thats a big if.

The CBA paper showed that many people with low credit scores are renters who would stand to benefit the most from getting their history of on-time housing payments in front of lenders. About four out of five people saw their scores improve when landlords reported their rental payments, with the average score increasing by 23 points.

Some landlords and building managers report rental payments, but many do not. If you choose, you can pay for a service like RentReporters, which claims that their average user gets a 40-point boost in 10 days. Many services like RentReporters also get the bureaus to report your on-time utility payments, which can boost your score just like housing payments.

Take Advantage Of Score

The number of accounts and the average age of your accounts are both important factors in your credit score, which can leave those with limited credit history at a disadvantage.

Experian Boost and UltraFICO are programs that allow consumers to boost a thin credit profile with other financial information.

After opting into Experian Boost, you can connect your online banking data and allow the credit bureau to add telecommunications and utility payment histories to your report. UltraFICO allows you to give permission for your banking data, like checking and savings accounts, to be considered alongside your report when calculating your score.

Also Check: How To Check My Credit Report

Monitor Your Credit With Creditwise From Capital One

Keep an eye on your credit as often as you want with . This free tool gives you access to your TransUnion credit report and weekly VantageScore® 3.0 credit score from your desktop or your phone. It wonât hurt your score to use it and you donât even need to be a Capital One customer to enroll.

By creating some healthy financial habits, maintaining the good credit youâve built can benefit you in countless ways.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

We hope you found this helpful. Our content is not intended to provide legal, investment or financial advice or to indicate that a particular Capital One product or service is available or right for you. For specific advice about your unique circumstances, consider talking with a qualified professional.

How Paying Your Credit Card Debt Helps Your Credit Score

When consumers pay down their debt, their decreases. Your credit utilization rate, also referred to as your debt-to-credit ratio, is a measure of how much credit you are using compared to how much credit you have available.

The amount your utilization rate decreases depends on just how much of your credit card debt you pay off.

Let’s take a hypothetical example where two people with the same credit utilization use different amounts of the $1,200 stimulus check to pay off their credit card debt.

In our scenario, Julie and John both carry the same credit card balance of $2,000 and have the same credit limit of $5,000 thus, they share the same credit utilization rate of 40% .

| 24 percentage points | 12 percentage points |

The lower your utilization rate, the better your credit score. Your goal as a cardholder is to aim for a high credit limit and a low balance across all your credit cards. Experts recommend maintaining a utilization rate below 30%, with some even suggesting trying for a single-digit utilization rate to get the best credit score.

In the scenario above, John’s new utilization rate would be just below 30% while Julie’s would be closer to 10%. How exactly this transfers to their individual credit scores depends on their overall credit profiles. Credit utilization makes up 30%, or one-third, of a credit score on the FICO model. However, both John and Julie would both see a noticeable increase in their scores.

Also Check: Does American Express Report To The Credit Bureaus

How Fraud Can Affect Your Credit Rating

When lenders search your credit reference file, they may find a warning against your name if someone has used your financial or personal details in a fraudulent way. For example, there may be a warning if someone has used your name to apply for credit or forged your signature.

There might also be a warning against your name if you have done something fraudulent.

To be able to see this warning, the lender must be a member of CIFAS. This is a fraud prevention service used by financial companies and public authorities to share information about fraudulent activity. CIFAS is not a credit reference agency. The information it provides is only used to prevent fraud and not to make lending decisions.

If there is a warning against your name, it means that the lender needs to carry out further checks before agreeing your application. This may include asking you to provide extra evidence of your identity to confirm who you are. Although this may delay your application and cause you inconvenience, it is done to ensure that you don’t end up being chased for money you don’t owe.

Explore Ways To Keep Your Credit Score In Good Standing

Your credit history reflects how youâve managed debt in the past. And that history shows up in your credit scoreâa three-digit number that summarizes the information in your credit report.

Creditors can use that score to determine creditworthiness and when setting the terms of loans, including mortgages. And landlords may use it when you apply for an apartment. So maintaining a good credit score can have a big impact on your financial future.

You May Like: What Credit Score Do You Need For Amazon Prime Visa

Why Experts Say 760 Is The Best Credit Score To Aim For

It might be exciting for some to aim to achieve the highest credit score of 850. However, it comes with no additional benefits that you likely won’t already get with a 760 score.

“The best published interest rates for auto loans are 720+ and for mortgages 760+,” financial expert John Ulzheimer, formerly of FICO and Equifax, tells Select. “As such, I always tell people, shoot for 760 or better. That way, they’re safe for all loan types and cards.”

For Jim Droske, president of the credit counseling company Illinois Credit Services , the threshold is 760 as well. But he says aiming for 780 is even better to be “the safest” in any type of lending situation. Anything higher, though, won’t be more beneficial, nor would it get you a better offer with more favorable terms.

“If you’re above 760, or 780, certainly you’re already getting the best you can get,” Droske tells Select. “You’re already hitting that pinnacle of what care about.” A high enough credit score shows lenders and credit card issuers that you are less of a risk and more likely to pay back the loan, versus if you had a lower credit score.

“Anything above that is really just maybe a little pride,” says Droske. “When you have already reached the summit, no need to look for a ladder.”

Tips To Improve Your Credit Score

Also Check: When Does Debt Fall Off Credit Report

Use Different Types Of Credit

Having multiple types of credit such as a secured credit card, a refinanced auto loan and a mortgage payment is good for your credit score. Just make sure to pay your bills on time, or the downsides of holding multiple types of credit could outweigh the potential benefits.

Action item: Diversify the types of accounts on your credit report, but dont apply for many credit types within a short time frame. Doing so could lead to multiple hard inquiries that make your credit score drop.

What Information Is Kept By Credit Reference Agencies

Credit reference agencies are companies which are allowed to collect and keep information about consumers’ borrowing and financial behaviour. When you apply for credit or a loan, you sign an application form which gives the lender permission to check the information on your . Lenders use this information to make decisions about whether or not to lend to you. If a lender refuses you credit after checking your credit reference file they must tell you why credit has been refused and give you the details of the credit reference agency they used.

There are three credit reference agencies – Experian, Equifax and TransUnion. All the credit reference agencies keep information about you and a lender can consult one or more of them when making a decision.

The credit reference agencies keep the following information:

If there has been any fraud against you, for example if someone has used your identity, there may be a marker against your name to protect you. You will be able to see this on your credit file.

Read Also: How To Remove Closed Student Loans From Credit Report