What A Good Credit Score Can Get You

Having good credit matters because it determines whether you can borrow money and how much you’ll pay in interest to do so.

Among the things a good credit score can help you get:

-

An unsecured credit card with a decent interest rate, or even a balance-transfer card.

-

A desirable car loan or lease.

-

A mortgage with a favorable interest rate.

-

The ability to open new credit to cover expenses in a crisis if you don’t have an emergency fund or it runs out.

A good credit score helps in other ways: In many states, people with higher credit scores pay less for car insurance. In addition, some landlords use credit scores to screen tenants.

So having a good credit score is helpful whether you plan to apply for credit or not.

If your credit score is below about 700, prepare for questions about negative items on your credit record when shopping for a car. People with major blemishes on their credit are routinely approved for car loans, but you may not qualify for a low rate. Read about what rates to expect with your score.

You dont need flawless credit to get a mortgage. In some cases, credit scores can be in the 500s. But credit scores estimate the risk that you wont repay as agreed, so lenders do reward higher scores with lower interest rates. Read about your mortgage options by credit score tier.

Landlords or property managers generally aren’t looking for immaculate scores, they are interested in your credit record. Learn more about what landlords really look for in a credit check.

Whats A Utilization Ratio Or Debt

According to Equifax, your debt-to-credit ratio, also known as your utilization ratio, is the amount of your debt compared to your credit limit.5 Your debt-to-credit ratio is important because if your ratio is high, it can indicate that youre a higher-risk borrower.5 Thats because lenders see borrowers who use a lot of their available credit as a greater risk.5

For example, imagine you have a couple of credit cards and a line of credit with a total debt of $14,000 and a combined limit of $20,000. Your debt-to-credit ratio would be 70%.

According to the Government of Canada, a ratio of 35% or below on credit cards, loans and lines of credit is recommended.3

How A Good Credit Score Can Help You

A credit score is a numeric representation, based on the information in your , of how risky you are as a borrower. In other words, it tells lenders how likely you are to pay back the amount you take on as debt.

In general, the higher your scores, the better your chances of getting approved for loans with more-favorable terms, including lower interest rates and fees. And this can mean significant savings over the life of the loan.

Having a good score doesnt necessarily mean youll be approved for credit or get the lowest interest rates though, as lenders consider other factors, too. But understanding your credit scores could help you decide which offers to apply for or how to work on your credit before applying.

Read Also: What Credit Score Is Needed For Affirm

What Information Credit Scores Do Not Consider

FICO® and VantageScore do not consider the following information when calculating credit scores:

- Your race, color, religion, national origin, sex or marital status.

- Your age.

- Your salary, occupation, title, employer, date employed or employment history.

- Where you live.

- Soft inquiries. Soft inquiries are usually initiated by others, like companies making promotional offers of credit or your lender conducting periodic reviews of your existing credit accounts. Soft inquiries also occur when you check your own credit report or when you use from companies like Experian. These inquiries do not impact your credit scores.

Your Score Range: 300

Your score falls between 300 and 549, which is the lowest credit score range. About 16 percent of Americans are in this category.

It will take time to counteract your financial problems and win back the trust of creditors. However, with patience and dedication, you can improve your credit score. A higher score can grant you access to loans when you need them and help you live better.

You May Like: How To Get A Car Repossession Off Your Credit

Measuring Your Credit Score

Measuring your credit score is something that has to be done. Every specific credit bureau has a different way of measuring the score. Some measure to 850 while others will measure to 830 and so on. Each one is different and while one might record one default on their records, another might not and so on.

With the three major credit reporting agencies: TransUnion FICO, Equifax and Experian, you can be sure that you have all of the information you need. Youre allowed to have a free print out of your credit score every year from each of these three bureaus. If youre ever curious about what is on your report or ways that you can find out what you can do to fix your report, printing a copy and reading it is the best way to find out more about it, as well as report anything that shouldnt be on the report.

Average Age By Credit Score Tier

| West | 687 |

The South has the worst credit, on average , whereas the Midwest has the best . In fact, three of the five states with the highest average credit scores are in the Midwest. With that being said, every region has at least one state whose residents boast good credit, on average.

So, while job opportunities, living costs and other local factors definitely affect credit-score averages, its also true that credit scores can flourish anywhere.

Recommended Reading: What Credit Score Does Care Credit Use

Consumer Credit Card Debt Showed Biggest Decrease

- 75% of U.S. adults have a credit card balance greater than $0.

- The average FICO® Score for someone with a credit card balance in 2020 was 735.

- The percentage of consumers’ credit card accounts 30 or more DPD decreased by 29% in 2020.

In 2020, credit card balances saw the most drastic change of any debt type, reversing a nearly and decreasing by 14%. Credit cards are the most popular form of debt: More than 90% of U.S. adults have a credit card account listed in their credit report.

Generally speaking, revolving debt carries more weight than installment debt in FICO® Scores. The trend of lower credit card balances is also driving lower revolving utilization ratios, which is having a positive effect on average FICO® Score results.

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

Read Also: Can A Closed Account Be Reopened On My Credit Report

Tips And Tricks To Improve Credit Score :

Effects Of Good Credit

A good credit score tells lenders you are a good investment. It tells them you are relatively good at heeding your financial obligations. Most people in this category repay their loans and are therefore considered to be relatively low-risk investments.

Having good credit typically means having little trouble finding a loan when you need one. Most likely, you havent been turned down for a credit card, car loan or mortgage. However, when you do receive loans or open new lines of credit, your credit score makes you ineligible for lenders lowest interest rates.

A good credit score is not the same as an excellent score. Even a small hike in interest rates can make a big difference.

Assume you have a mortgage of $250,000, and you plan to own your house after 30 years. Your good credit score earns you an interest rate of 4 percent, whereas someone with excellent credit may receive a rate of 3 percent. During the 30-year repayment period, youll spend $179,674 in interest, while the person with the lower interest rate spends only $129,444. The small rate difference cost you more than $50,000.

On the other hand, youll pay substantially less than someone with a lower credit score requesting a comparable mortgage. In other words, your situation could be worse, but having some credit blemishes will still cost you.

Don’t Miss: Tri Merge Credit

Other Credit Scores Or Fico Scores

While FICO Scores are used by 90% of top lenders, there are other credit scores made available to consumers. Other credit scores may evaluate your credit report differently than FICO Scores. When purchasing a credit score for yourself, most experts recommend getting a FICO Score, as FICO Scores are used in 90% of lending decisions.

How Good Is A 750 Credit Score

A 750 credit score is better than the U.S. average, which was 711 in 2020, according to credit bureau Experian. Lenders tend to evaluate and offer the same rates to people within the same range.

A 750 credit score generally falls into the excellent range, which shows lenders that youre a very dependable borrower. People with credit scores within this range tend to qualify for loans and secure the best mortgage rates.

A 750 credit score could help you:

- Qualify for a mortgage

- Negotiate the loan terms, since the lender might be willing to compete for your business

- Get low mortgage rates, which makes borrowing cheaper

Some lenders might consider a 750 credit score on the cusp between good and excellent, which could influence the rate you receive. Be sure to monitor your credit score in the months leading up to your mortgage application.

Tip:

Theres no official cutoff that all lenders use, but a higher credit score can generally help when you apply for a mortgage.

Keep Reading: How Your Credit Score Impacts Mortgage Rates

Recommended Reading: Voluntary Repossession Drivetime

Strategies To Keep Building Your 720 Credit Score

If your score moved up to 720, youll probably see continued improvement from the momentum youve established by paying on time and keeping balances low. But if your score seems stuck at 720, or if its general direction is down, there are ways to address this.

Understanding what information in your credit reports has the biggest impact on your credit is a good place to start.

The tried-and-true ways actually do work. Heres how to build your score.

Does Paying Off Collections Improve My Credit Score

Historically, paying off your collections does not improve your credit score because a collection stays on your report for seven years. Newer ways of calculating credit scores no longer count collections against you once they have a zero balance, but it is not possible for you to predict which method your lender will use to calculate your score.

Recommended Reading: What Credit Bureau Does Uplift Use

What Is A Fair Credit Score Range

Fair credit score = 620- 679: Individuals with scores over 620 are considered less risky and are even more likely to be approved for credit.

In the mid-600s range, consumers become prime borrowers. This means they may qualify for higher loan amounts, higher credit limits, lower down payments and better negotiating power with loan and credit card terms. Only 15-30% of borrowers in this range become delinquent.

Qualify For Higher Credit Limits And Loan Amounts

The amount of credit a credit card issuer is willing to extend to you is based partly on your credit score. With an excellent credit score, youve likely demonstrated that you can handle credit responsibly. When you apply for most major credit cards, youre more likely to get a higher credit limitprovided your income is enough to handle that credit limit.

Similarly, when youre applying for a loan, having excellent credit will allow you to qualify for higher loan amounts. This makes a major difference in the price of the home or car you can afford to buy.

Read Also: Does Paypal Report To Credit Agencies

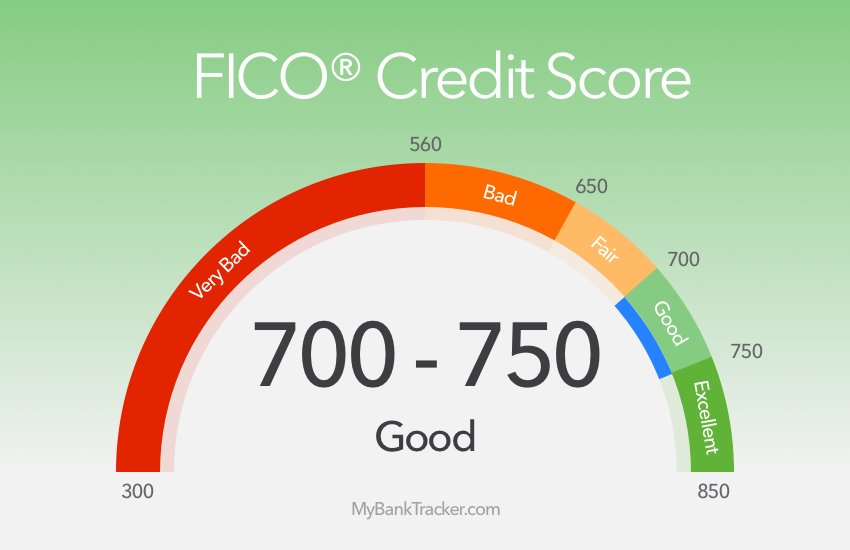

What Does A Good Fico Score Mean

FICO Scores fall into five different ranges poor, fair, good, very good and excellent. Just as beauty is in the eye of the beholder, the interpretation of your FICO Score depends on who you ask. In general, a FICO Score of 670 or above typically qualifies as good. If your FICO Score climbs to 740 or higher, its very good. And FICO Scores between 800-850 range are exceptional.

With good FICO Scores, you have a better chance of qualifying for loans, credit cards, new apartment leases and more. Plus, higher FICO Scores can often save you money in the form of lower interest rates and lower fees. Any time your FICO Score crosses over into a better range , theres a chance you may unlock better financing offers.

The base FICO scoring model periodically gets updated. The most recent version is the FICO Score 10, although FICO Score 8 is still the most commonly used. The following guideline applies to both FICO Score 8, FICO Score 9 and FICO Score 10 models.

| Good Base FICO Scores |

|---|

| Exceptional |

Avoid Canceling Credit Cards

You may find it hard to use your credit cards responsibly and find that youre building up debt. The last thing you want to do is cancel the credit card because its connected to your credit history. Also, if you cancel a credit card, you increase your Credit Utilization Ratio, which can negatively impact your credit.

A better alternative is to keep it out of your wallet in a safe place. You only use it if absolutely necessary. Also, make sure to disconnect it from any automatic online payments you have.

If you have a credit score of more than 660, its considered to be good credit. Do keep in mind that good credit differs with the creditor. If you have a credit score of 700 or more, its most likely that any creditor will view this as good. This means you have access to pretty much any kind of credit product you need to improve your life in the ways you want. You can own a home or start a business through a low interest loan.

If your credit isnt up to this level quite yet, its in your power to change this. You can use a guaranteed credit card to learn how to properly manage your credit. Pay bills on time and pay your credit cards down to at least 30%. Even if your credit is bad at the moment, theres an opportunity to improve it by spending modestly and paying for things on time. The low interest rates you can get by having good credit is worth any effort you put into it.

What would you say to easily boosting your credit score ?

Read Also: Realpage Consumer Report

Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

Better Car Insurance Rates

Add auto insurers to the list of companies that will use a bad credit score against you. Insurance companies use information from your credit report and insurance history to develop your insurance risk score, so they often penalize people who have low credit scores with higher insurance premiums. With a good credit score, youll typically pay less for insurance than similar applicants with lower credit scores.

Don’t Miss: What Credit Bureau Does Comenity Bank Use