How Your Credit Card Balance Impacts Your Credit Score

Your is the second biggest factor that makes up your credit score. FICO and VantageScore, the two most common credit scoring models, look at the size of your credit card balances in comparison to how much available credit you have left.

Both major scoring models rank “amounts owed” and/or “percent of credit limit used” just below the number-one most important factor, on-time payment history.

Experts recommend keeping your total CUR well below 30% so if you have a $10,000 credit limit, you should aim not to spend more than $3,000 each billing cycle. Some experts even suggest staying below 10%, which might not always be realistic depending on your budget and how much credit you have available.

How Long Does A Settlement Stay On Your Record

As a general rule, a debt settlement will stay on your record for seven years. This goes for all settlements, including student loans.

Its also important to discuss delinquent payments. When settling debts, your settlement company may advise you to stop making payments and save money until a settlement is reached.

These payments may turn delinquent during this time, and if a settlement isnt reached, these will also end up on your credit report for seven years after the day they become delinquent.

How A Dmp Is Reported On Your Credit

First of all, a DMP is not listed as a separate account on your credit report. Your current creditors may flag your account to show that your payments are being made through a DMP. This will only happen if and when they accept the revised payment terms of the DMP. They may also add a status statement to your account showing the terms of your DMP. If a potential creditor views your full report, theyll see this statement and theyll know that you did not pay the account as originally agreed.Its important to note, however, that having your accounts noted as being paid through a debt management plan almost never has any impact on your actual score. Most major scoring agencies, such as FICO, dont factor this into their scoring models.

You May Like: How To Remove Prescribed Debt From Credit Report

Schedule Your Free Debt Analysis

Potential clients speak with a certified debt specialist regarding their financial situation.

The debt specialist evaluates the callers financial situation and suggests the optimal debt relief strategy.

Clients choosing to enroll in our debt relief program are then guided through the enrollment process.

Ways To Consolidate Your Debt

The basic idea of debt consolidation is to merge multiple credit or loan balances into one new loan. But not all debt consolidations make sense. Here are four ways you can consolidate debt depending on your credit and savings:

- Balance transfer credit cards Some credit cards, called balance transfer cards, offer introductory periods when they charge low or no interest on balances that you transfer to the card within a set period of time. This gives you an opening to save on interest and make more progress paying off your debt.

- Personal loans If you can get a personal loan with a lower interest rate, you can pay off your higher-interest credit card balances, which may allow you to pay off your debt faster.

- Retirement account loans You may be able to take a loan from your retirement account to consolidate and pay off debt. Just be careful to pay it back according to the retirement plans rules or you may face taxes and penalties.

- Home equity loan or line of credit With a home equity loan or home equity line of credit, homeowners whove built up an ownership stake in their home may be able to take out a loan using their home as collateral. These loans typically offer lower interest rates than credit cards or personal loans. But beware: If you dont pay it back, you could lose your home.

Read Also: How To Report Tradelines To Credit Bureau

How Long Will Debt Settlement Stay On Your Credit Report

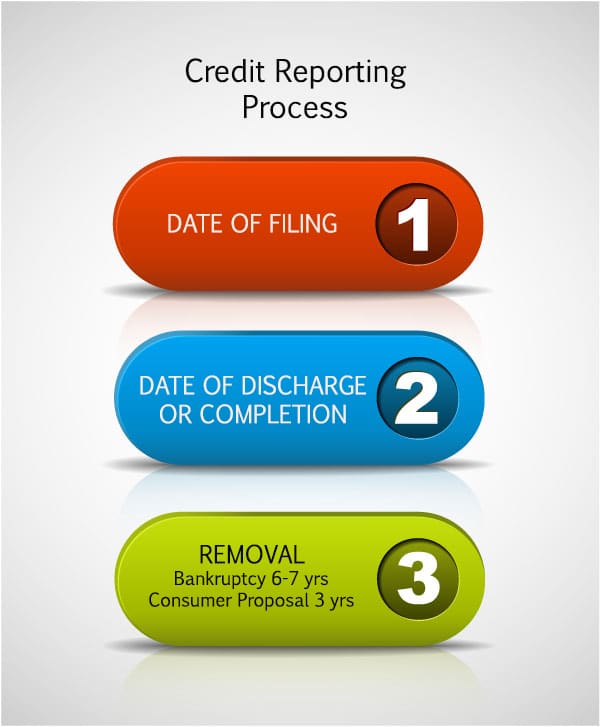

According to the Financial Consumer Agency of Canada, debt management plans will remain on your credit report for about two years once youâve paid off all your debts . A debt settlement professional will be able to give you a more accurate timeline.

One thing is clear: prioritize paying your debts off as soon as possible. The sooner you get them off your report, the sooner your score can bounce back. Remember, however, that credit reports are a compilation of many factors, and while the debt settlement may be removed from your credit file, the late payments from the account stay on your report for up to six years. The hard truth is that it can take many years for your credit report to recover from mismanaged credit, so it’s smart to start the credit rebuilding process without delay.

Note that debt settlement plans should not be confused with a registered consumer proposal, which is a more formalized, legally binding form of debt settlement that must be arranged with a Licensed Insolvency Trustee and stay on your report for three to six years.

What You Can Do To Rebuild Your Credit After A Chapter 7

Rebuilding your credit after filing for Chapter 7 is hard work. Luckily there are ways to minimize the impact of bankruptcy and start repairing your credit.

- Monitor your credit â Keeping an eye on your credit is an essential step in rebuilding it. It helps you track any progress you make as well as helps you quickly identify any errors and inaccuracies.

- Verify information â According to the FTC, 20% of the population has at least one error on their credit report. Inaccurate negative marks hurt your score. Thatâs why itâs important to verify info on your report.

- Check your credit report for errors â Before you can dispute an error, you have to find it first. You can find common errors in personal info, account status, and balance & data mistakes.

- Dispute inaccuracies â Once you have found errors, you can dispute them. This means gathering evidence, writing a dispute letter to all 3 credit bureaus, & waiting.

Recommended Reading: How To Get Old Delinquencies Off Credit Report

Should You Consolidate Your Debt

Debt consolidation, if done correctly, can be a powerful tool in getting a consumer out from under a heavy debt burden. The most important thing for a consumer to remember is that taking on any new debt isnt ideal. If you take out a loan to pay off your debt and then run up your debt again, youre in far worse shape than you wouldve been had you done nothing.

If youre going to consolidate your debt into a debt consolidation loan, you should understand a few things first, including the advantages and disadvantages.

Other Factors That Affect Your Score

As you work to improve your financial standing via a debt consolidation program, keep in mind that there are myriad factors that affect your credit rating.

Beyond your actual credit score, other elements that factor into it include:

- Your job stability

- Your access to dormant credit lines

Understand that consolidating your debt will eliminate certain credit lines from your mix, which can lower your rating for a short while. However, as long as you have a stable job and consistent income, the overall impact will be small and short.

These two factors will also enable you to pay down your debts quicker, so securing steady employment should be a top goal if you arent already there.

Also Check: How To Read Experian Credit Report Codes

How Debt Consolidation Affects Credit Scores

When you consolidate debt, you pull several levers at once that help or harm your credit. Here are some short-term causes of a credit score drop when consolidating debt:

- New credit applications The first possible damage to your credit scores can happen before you even consolidate: When you apply for that personal loan or balance transfer credit card, the lender will perform a hard inquiry on your credit, which will lower your credit scores by a few points.

- New credit account Opening a new credit account, such as a credit card or personal loan, temporarily lowers your credit scores. Lenders look at new credit as a new risk, so your credit scores usually have an additional temporary dip when taking out a new loan.

- Lower average age of credit As your credit accounts get older and show a positive history of on-time payments, your credit scores rise. Opening a new account adds a new newest account and lowers your average account age and may lower your scores for a while.

But it isnt all bad. Here are some positives for your credit scores from a debt consolidation:

Rebuilding Your Credit Score After Debt Settlement

For seven years, your settled accounts are reflected on your credit report. This means that for those seven years, your settled accounts will affect your creditworthiness. Lenders usually look at your recent payment history. There is a high probability that you will be affected for a couple of months or even years after settling your debts. However, a debt settlement does not mean that your life needs to stop. You can begin rebuilding your credit score little by little.

Your credit score will usually take between 6 and 24 months to improve. It depends on how poor your credit score is after debt settlement. Some individuals have testified that their application for a mortgage was approved after three months of debt settlement. Some needed years before they could get a new or loan. It varies case by case and it is difficult to determine the exact timeframe required to improve your credit score. The time it takes to repair your credit score will depend primarily on your credit history.

You May Like: What Credit Score Do You Need For A Kohls Card

How Do You Find A Good Debt Settlement Company

If you are looking for a good debt settlement company, you could ask your friends and family if they have any recommendations, ask your financial advisor, or look for online reviews. For example, Consumer Affairs magazine publishes a reliable list, and the Federal Trade Commission offers information about both credit counseling and debt settlement companies.

How To Consolidate Debt

Two popular ways to consolidate debt are a balance transfer credit card and a debt consolidation loan:

- Balance transfer credit card: With a balance transfer credit card, you can streamline your loan payments by combining all of your debts onto this card with a single monthly payment. If you can, opt for a balance transfer credit card with an introductory 0% interest rate.You can save a lot on interest by paying off the balance in full before the promotional period ends. After the promotional period ends, your credit card will return to its set interest rate, which will increase your monthly payment amount. Its important to note that depending on the lender you choose, youll likely need a good credit score to qualify.

- Debt consolidation loan: You can also take out a new debt consolidation loan from a bank, credit union, or lending platform to combine all of your debts into a single payment. Because most consolidation loans have fixed interest rates, the monthly payment remains the same throughout the repayment period.This will help simplify your debt payments. If you qualify for a lower interest rate, it could also help save you money over the life of the loan. Even if you have bad credit, you may still be able to qualify for a loan.However, borrowers with higher credit scores will likely qualify for the most favorable terms. If you have a low credit score, consider taking the time to improve your credit score before you apply for a new loan.

Recommended Reading: How Can You Increase Your Credit Score

Why Consolidate Your Debts

Consolidating your debt can save you money. If you have credit card debt that charges 20% or more in interest, consolidating into a new credit card or loan with a lower interest rate will save you money. Do the math for your specific debt to make sure youll save more than any fees youll pay for balance transfers.

It may also simplify your payments. When you have many accounts to manage, you are more likely to make a mistake and miss a payment. Missed and late payments can hurt your credit scores, so consolidating everything into one monthly payment might help protect your credit from a payment mishap.

Dont Apply For Big Loans

If you have a history of using large amounts of debt, this is not the time to use it. Wait until your debts are paid off and your credit score is better before applying for a car loan, mortgage, or other high-dollar amount loans.

If you cant wait and are impatient, then just wait six months until your debt consolidation plan has ended.

Also Check: How To Check Experian Credit Score

Get Your Credit Score And Report For Free

If you’ve ever applied for credit or a loan, there will be a credit report about you.

You have a right to get a copy of your credit report for free every 3 months. It’s worth getting a copy at least once a year.

Your credit report also includes a credit rating. This is the ‘band’ your credit score sits in .

No Change In Spending Habits

Many consumers find that after they consolidate their debts, their life changes very little. Any savings realized from their debt consolidation seems to disappear quickly in their everyday spending. If they havent changed their habits and dont budget their money going forward, they are likely to find themselves overwhelmed with debt once again.

Recommended Reading: Does Credit Karma Affect Credit Score

How Long Do Late Payments Stay On Your Credit Report

When you fail to pay a bill for 30 days or more past its due date, your lender may report it to the top three credit bureaus. A late payment of 30, 60, 90 days, or longer can appear on your credit report for up to seven years after it occurs. After seven years, it will fall off your report. At this time, the debt is still collectible, but it does not impact your credit report. Seven years is also the time limit for foreclosures, charge-offs, collections, settlements, and repossessions to appear on a credit report.

Fix Mistakes In Your Credit Report

When you get your credit report, check that:

- all the loans and debts listed are yours

- details such as your name and date of birth are correct

If something is wrong or out of date, contact the credit reporting agency and ask them to fix it. This is a free service.

Some companies may try to charge you to get all negative information removed from your credit report. The only thing they can ask the credit reporting agency to remove is wrong information. And you can do that yourself for free see .

If there are loans or debts in your report that you know nothing about, it could mean someone has stolen your identity. See identity theft for what to do.

Read Also: How Long Is Chapter 7 On Credit Report

Does Debt Consolidation Affect Your Credit Score

When you initially consolidate your debt, your credit score may drop a few points since youre opening a new account. As long as you make consistent on-time payments, your credit score will bounce back and may significantly improve. However, if you miss payments, or if you run up your credit card balances a lot, your credit score will drop.

Grace Enfield Content Writer

@grace_enfield09/01/22 This answer was first published on 09/01/22. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

Information related to debt consolidation will stay on your credit report for 7 – 10+ years depending on how you handle repaying the debt. Negative information, like from late payments, will stay on your report for 7 years, while accounts closed in good standing will stay for 10 years. Open accounts in good standing will remain on your report indefinitely.

That said, you will not find the words debt consolidation listed on your credit report anywhere. Only the effects of debt consolidation will show up.

Don’t Miss: How To Unfreeze Experian Credit Report

Debt Negotiation Companies A Debt Settlement Program And Your Credit Report

The credit reporting impacts from enrolling with a debt negotiation company to settle debts is more often than not going to stay on your credit report for 7.5 years. Debt settlement happens only after your accounts fall into advanced stages of delinquency. This means the credit card accounts will be showing late payments, charge offs, and possible debt collector entries later on. That kind of credit reporting lasts for seven and one half years from the date you last made a payment.

If you completed a debt settlement plan that you started in 2006, the credit reporting from that would start to fall off of your credit report sometime in 2013. That is, unless you were behind on credit card payments before you enrolled with the debt settlement company. In which case some of the negative credit card reporting may have already fallen off.

How To Remove A Charge

A charge-off stays on your credit report for seven years after the date the account in question first went delinquent. There is nothing you can do to get a legitimate charge-off entry removed from your credit report.

If a charge-off is reported inaccurately, or if it fails to fall off your credit report after seven years, you can file a dispute with Experian or one of the other national credit bureaus to have it removed from your credit reports.

Recommended Reading: How To Calculate Credit Score Points