Do Rent Payments Help Build Credit

Rent payments do have the possibility to help you build credit, but thats only if you are actively making sure that your payments are being reported. If your payments are being reported, they can have a positive effect on your payment history and add another element to your credit profile, increasing your credit mix.

But remember, rent payments will only really have a positive effect if you are consistent with your payments. Falling behind on your rent payments can lead to negative reporting and a decrease in your credit score, especially if your debt is sent to a collections agency.

Sending Credit History Report To Potential Landlord

I have a credit report from TransUnion that contains:

A landlord in the United States wishes me to submit this report to him. All of my info above pertains to another country that I’m moving from.

What risks should I be concerned about with this submission?

It’s pretty common in the USA that landlords want to know your credit history before they let you sign a lease. They want to know how much you make as well as how much debt you have so they can verify your ability to pay rent. Tenants tend to have pretty strong protections in the USA , and the cost of having a bad tenant can easily run into the tens of thousands of dollars.

The landlord usually has fixed costs that continue regardless of whether or not they’re paid , so if a tenant refuses or is unable to pay their rent they’re not just out the cost of that rent, they also have to pay those substantial fixed costs out of pocket: essentially they lose two month’s rent for every month a tenant doesn’t pay. If the tenant refuses to move out then the landlord needs to go through the legal process of eviction, which can take months or up to a year, all the while the tenant isn’t paying.

How To Report Rent Payments To The Credit Bureau: Landlord Tips

- How To Report Rent Payments To The Credit Bureau: Landlord Tips

As a landlord, you will often rely on information gathered up and reported in a tenants credit history. Do they have a history of managing their financial system appropriately? Were they ever evicted from a property in the past?

This type of information becomes a part of the credit report that every potential tenant out there has. Did you know that your experiences with tenants who rent your property can and should help to create their credit as well?

When a tenant pays their rent on time every month, theyre showing financial responsibility that they should be praised for. Often, however, these payments never make any impact on their credit score because they arent reported to the credit bureau. Together, you and your tenant can change that.

On the flip side, some tenants consistently pay late rent, and this could be reported, too. When you report good and bad rental behavior, youre helping make a tenants credit more indicative of who they really are.

But do you know how to report rent payments to the credit bureau?

Many landlords do not have rental payment reporting set up, but it isnt hard to do and can make a big difference in the way you interact with tenants moving forward.

Recommended Reading: What Is A Very Good Credit Score

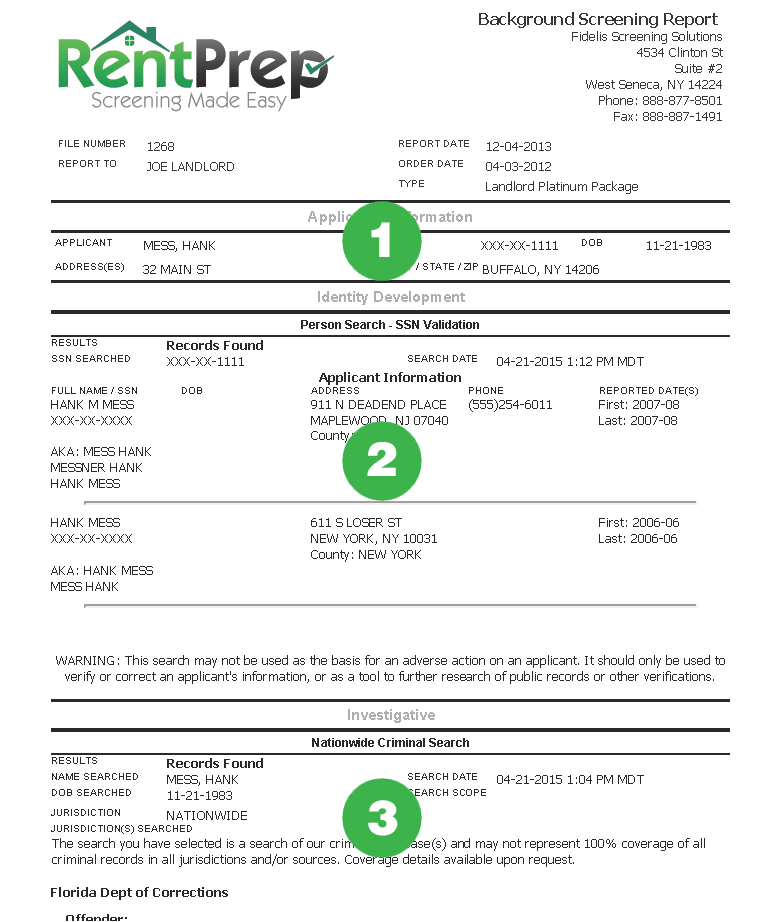

Information Landlords Need To Get A Tenant’s Credit Report

To run a credit check, you’ll need a prospective tenant’s name, address, and Social Security number or ITIN , which will typically be on the rental application or consent to background check forms you ask prospects to complete. The application is also the place for applicants to authorize you to run a credit report. Be sure to tell prospective tenants the amount of any credit fee you are charging .

What Is An Adverse Action

An adverse action is any action by a landlord that is unfavorable to the interests of a rental applicant or tenant. Examples of common adverse actions by landlords include:

- Denying the application

- Requiring a co-signer on the lease

- Requiring a deposit that would not be required for another applicant

- Requiring a larger deposit than might be required for another applicant and

- Raising the rent to a higher amount than for another applicant.

Also Check: Does Borrowing From 401k Affect Credit Score

Specialty Consumer Reporting Agencies

Specialty consumer reporting agencies prepare reports on consumers’ histories for specific purposes. The reports cover employment, insurance claims, residential rentals, check writing, and medical records. Think about ordering a specialty report if you are ready to buy homeowners or automobile insurance, open a checking account, apply for private health or life insurance, or rent a home or apartment.

Property Insurance Claim Reports: Insurance companies often check reports of this kind when you apply for homeowners or automobile insurance. One of these reports is the CLUE report .2 CLUE reports contain information on property loss claims against homeowner’s insurance and automobile insurance policies. A CLUE report contains personal information, such as your name, birth date, and Social Security number. It also contains a record of any auto or homeowner property loss claims you submitted to an insurance company. It includes the type of loss, date of the loss, and amount paid by the insurance company. It lists inquiries, or companies that have checked your claim history.

Another property loss report is called A-PLUS . The A-PLUS database is compiled by a smaller company and is less commonly used than the CLUE database. You may order a CLUE report and an A-PLUS for free once every 12 months.

Tenant History Reports: Landlords sometimes check your tenant history as well as your credit history. You may order a free copy of your tenant history report once every 12 months.

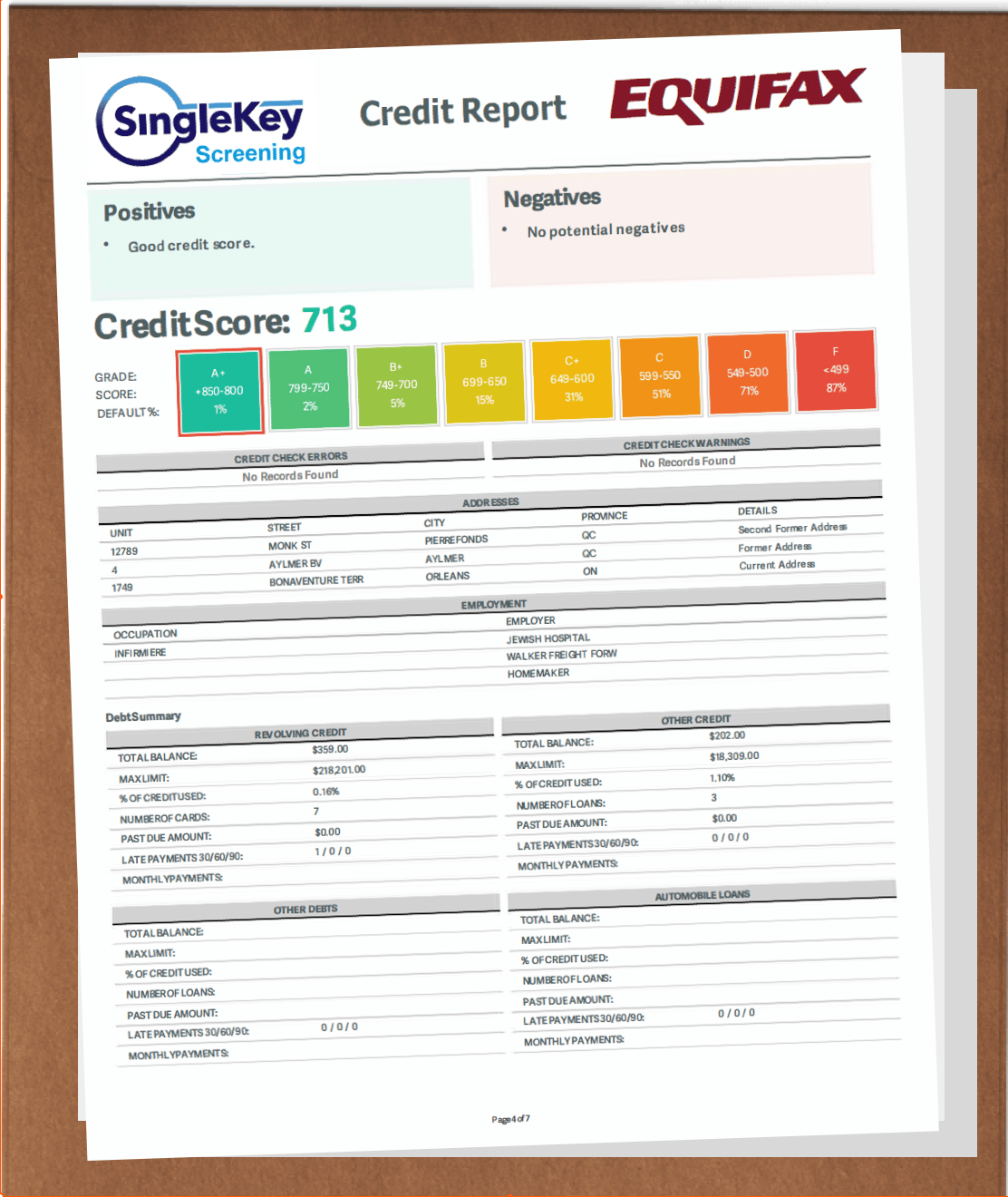

How Do I Get A Credit Check On A Tenant In Canada

To run a credit check in Canada, you will need to use either a qualified consumer reporting agency or a tenant screening service that can gather the necessary information.

In Canada, both Equifax Canada and TransUnion Canada can be used to run consumer reports with tenant involvement, and tenant screening services can be used to run other types of reports with the proper disclosures.

Read Also: What Do Employers Look For In A Credit Report

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

Recommended Reading: When Will Chapter 7 Bankruptcy Be Removed From Credit Report

Other Ways To Build Credit

Reporting your rent payments can help you to build credit, but if improving your credit score is your priority, there are better methods you can use.

If your landlord offers the option, consider paying your rent with a credit card. Just watch out for costly fees and make sure you can pay off the balance each month so you dont take on interest on your rent payments.

Develop good, long-lasting credit habits using your credit cards that can boost your score, such as consistent, timely payment history and low credit utilization.

If you are unable to get a credit card at this time, look into being added as an authorized user on someone elses credit card. You can also consider applying for a secured credit card. These cards are generally easier to be approved for since youll put down a deposit on your credit card that serves as your credit limit. You can use the card to make small purchases that you can easily pay off, in order to build up your score credit history over time.

Recommended Reading: Is 627 A Good Credit Score

How To Report Rental Payments To Credit Bureaus For Free

Building a good credit history can be difficult for young tenants just starting out. As a landlord, you can help first-time renters build a positive credit history by reporting their on-time payments. More seasoned tenants may just need an extra boost to help them rebuild their good credit after hitting a rough patch in their lives.

Unless youre managing a huge number of rental properties, the only way you can provide rental history free to credit bureaus is by signing up with a reputable rent collection service, like PayRent.

Do Rent Payments Affect Credit

All three major credit bureaus Equifax, Experian and TransUnion will include rent payment information in credit reports if they receive it.

-

The most commonly used versions of the FICO score dont use rental payment information in calculating scores.

-

Newer versions of FICO, such as the FICO 9 and FICO 10, do consider rental information if it is in your credit report.

-

VantageScore, FICOs competitor, also considers rent payment information.

Also Check: How To Fight Collections On Credit Report

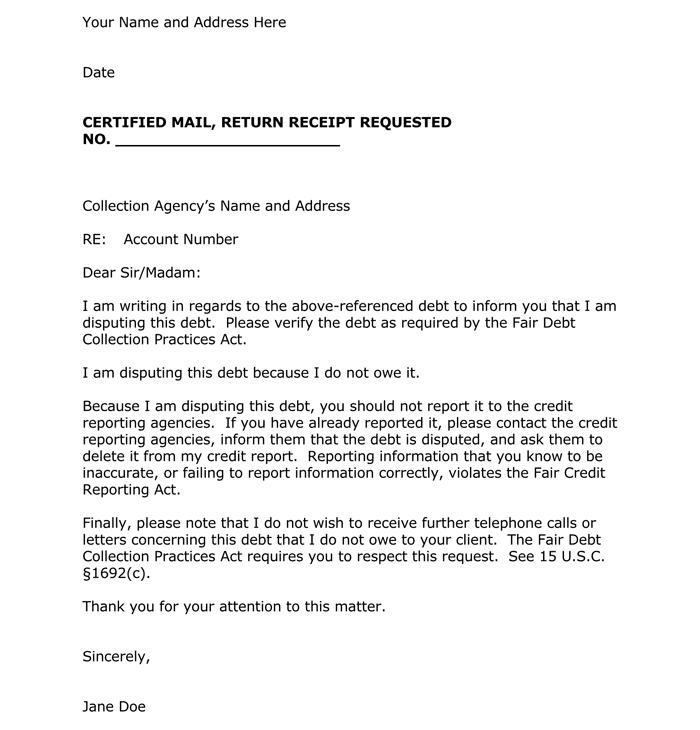

What Can I Do If I Believe The Information In My Credit Report Is Inaccurate

Write to the credit bureau immediately and describe the error in as much detail as possible. The agency must investigate your request and correct the error if one is found. If a correction is necessary, the agency must inform every business that has recently received your report that a correction has been made. If the dispute is not resolved, you have the right to file a brief statement describing the nature of the dispute with the credit reporting agency. This statement, or an accurate summary of the statement, must be included in any future credit report concerning you. Since the reports from the three major credit bureaus may contain different information about you, it is a good idea to obtain a report from each of them. Additionally, you should contact the company that provided the incorrect information. It may verify the mistake and write a letter on your behalf requesting that the credit reporting agency fix the error.

Dont Miss: How To Check Credit Score For Free

What Landlord Credit Check Services Are Available

There are several providers that offer self-serve credit report services to landlords, but the most common way is to go through one of the three major credit report bureaus:

Zillows application and screening tool includes a tenants rental application, a credit report from Experian and a background check from Checkr. You just need to input the tenants email address and the service does the rest. Once the tenant has completed their part and the credit check is complete, youll receive a notification to view their tenant credit report online.

Read Also: How Long Do Credit Inquiries Stay On Your Credit Report

Who Should Pay Opt

Depending on which service that you decide to use as a landlord, there will likely be some sort of fees involved. Some services have an annual fee that landlords must pay to be registered on the service. Others also have a monthly fee for the actual reporting every month.

The fee structure varies a lot from service to service, so it can benefit you to look around before you lock into one reporting service. Depending on what your goals are when it comes to reporting rent payments, one might stand out more than others.

You can pay that cost to do the reporting or the tenant can pay for it. Landlords usually decide who should pay for it depending on who wants the reporting to be done.

One way to decide who should pay is to introduce the possibility of credit reporting to your tenants. If they want to opt-in, they can pay or split the cost with you. If they opt-out and you still want to report payments, any associated fees will be yours to cover.

How Do I Get A Credit Report For A Prospective Tenant

The easiest way to get a credit report for a prospective tenant is to start by having them completely fill out a rental application, including their SSN and full legal name.

With this information, you can use a service such as the TransUnion Full Credit Report, formerly known as SmartMove, is a full credit report to unlock their credit history, address history, and more. The tenant will need to sign in to complete this process, but you will get a comprehensive report.

Read Also: How To Fix Mistakes On My Credit Report

Get Your Credit Score

A lender will use your credit score to determine if they will lend you money and how much interest they will charge you to borrow it. Your credit score is a number calculated from the information in your credit report. It shows the risk you represent to a lender compared to other consumers.

Knowing your credit score before a major purchase, such as a car or a home, may help you to negotiate lower interest rates.

You usually need to pay a fee when you order your credit score online from the two credit bureaus.

Some companies offer to provide your credit score for free. Others may ask you to sign up for a paid service to see your score.

Make sure you do your research before providing a company with your information. Carefully read the terms of use and privacy policy to know how your personal information will be used and stored. For example, find out if your information will be sold to a third party. This could result in you receiving unexpected offers for products and services. Fraudsters may also offer free credit scores in an attempt to get you to share your personal and financial information.

Always check to see if a website is secured before providing any of your personal information. A secured website will start with https instead of http.

Learn Why Landlords And Property Managers Often Run Credit Checks On Potential Tenantsand Ways To Help Improve Your Score

Your credit scores can be important when youâre looking to rent an apartment. Thatâs because the landlord or property manager may pull your credit as part of the screening process. Your credit history can show them how youâve managed money in the past and help them determine whether you might be a responsible tenant.

A credit score in the 600s typically places you in either the âfairâ or âgoodâ credit score range and could be a starting point for some landlords and property managers. Meeting their minimum requirements doesnât necessarily guarantee approval. But knowing what they look for could help you position yourself as a great rental candidate.

Recommended Reading: How To Dispute Collections On My Credit Report

Before You Get A Consumer Report

You can only obtain a consumer report if you have a permissible purpose. Landlords may obtain consumer reports on applicants and tenants who apply to rent housing or renew a lease. You may obtain written permission from applicants or tenants to show that you have a permissible purpose.

You must certify to the company from which you are getting the consumer report that you will only use the report for housing purposes. You may not use the consumer report for another purpose.

Its also a good idea to review other applicable federal and state laws related to consumer reports. For example, a blanket policy of refusing to rent to anyone with a criminal record may violate the Fair Housing Act.

How To Order Your Free Annual Reports From Specialty Consumer Reporting Agencies

All of these reports are ordered through automated telephone systems. The system will ask you for personal information, including your Social Security number, to identify your file. In some cases, you will be sent an order form to fill out and mail in.

- CLUE Personal Property and/or Auto Report

- WorkPlace Solutions Inc. Employment History Report

Read Also: How To Access Credit Report

Services You Can Use To Report Rent Payments

Theres not a direct way for you to report rent payments to credit bureaus yourself. Instead, you can use one of the many reporting services which send information about your monthly payments to credit bureaus. Before signing up for a reporting service, make sure you know how much youll pay and which credit bureaus the service reports to.

How To Stay Compliant With The Fcra

Staying compliant with the FCRA is critical for property managers and landlords. Keep these rules in mind as you process applications and perform tenant background checks:

Only Request Credit Reports From Current Applicants

You can only request a credit report for someone applying to live in one of your properties or trying to renew their lease. You cannot request one for an existing tenant because youre worried about their financial situation and want more details.

Obtain Written Permission

You should obtain written permission before accessing applicants credit reports. Keep a copy of their consent to a credit check in your records in case you face any issues down the road.

Tell the Credit Bureau That You Plan to Use the Report for Housing Purposes

You are only allowed to use applicants credit reports to determine whether you want to offer them housing. You cannot pull one for any other reason. Its not acceptable to request one, for instance, if youre trying to decide whether or not to give someone a personal loan or to help you decide whether or not to raise the rent on an existing tenant.

Notify Applicants of Adverse Actions

Write the Adverse Action Notification Correctly

Consider Making Reports to the Credit Bureaus

Read Also: Does Pay For Delete Increase Credit Score