You Have A High Balance

Image source: imtmphoto/Shutterstock.com

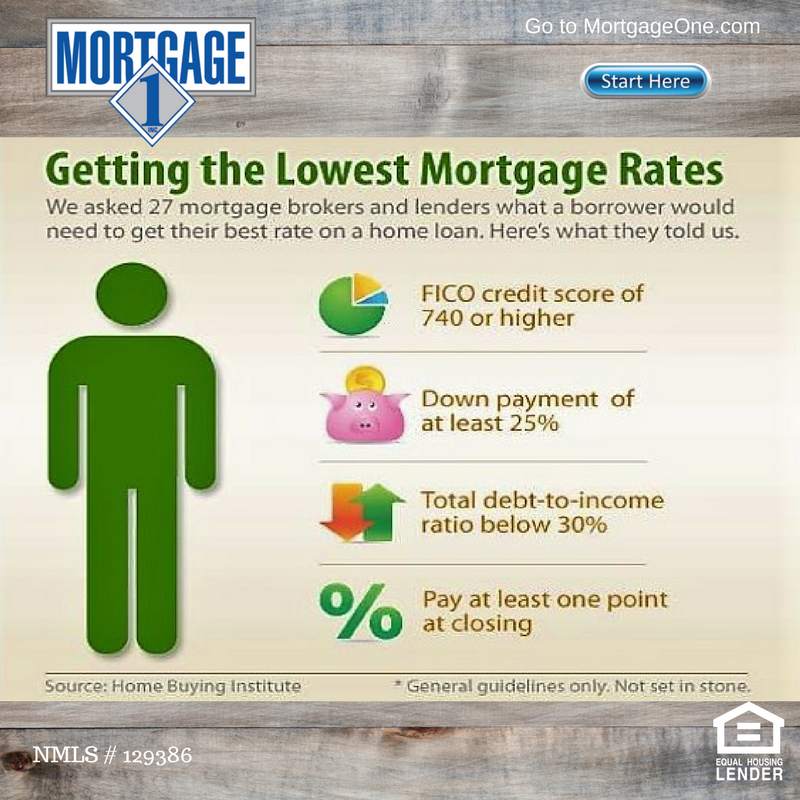

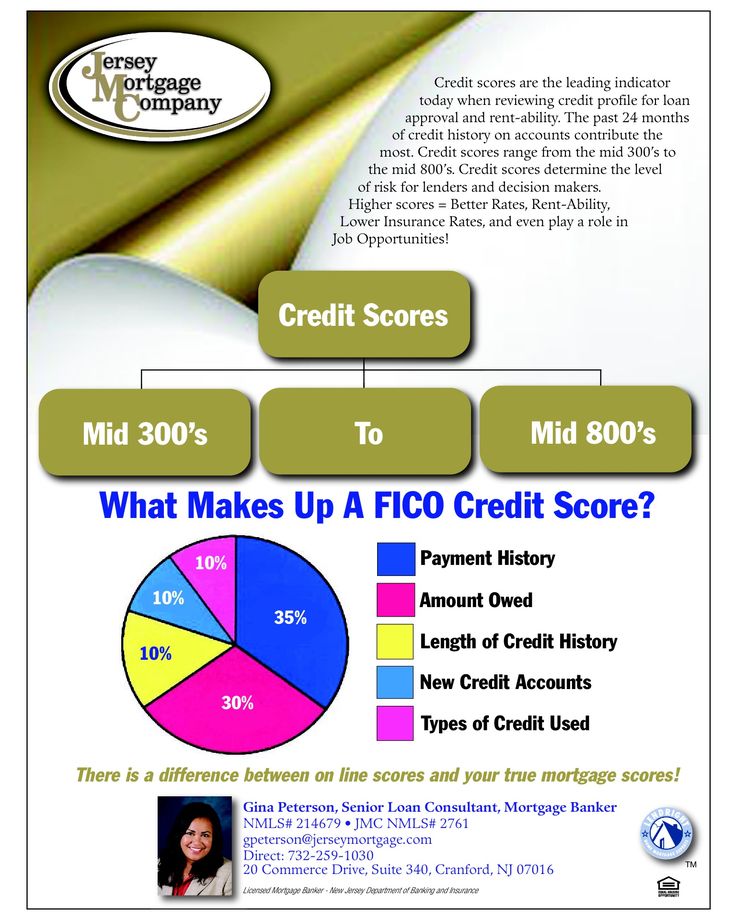

If you carry a high balance on your credit card, this could be hurting your credit score since credit utilization is 30% of your credit score.

In our Ultimate Guide to Credit Scores, we explain it like this: Credit utilization refers to the amount of credit that you are using relative to the amount that is allotted to you. For instance, if you have a credit card with a $1,000 credit limit, and you have a balance of $200 on that card, its a 20% credit utilization.

It has been speculated that maxing out your credit cards can drop your credit score by up to 50 points.

Is It Common For Your Credit Score To Fluctuate

Absolutely. Small mistakes like missing a bill payment could cause short-term drops in your score. But also, as your life changes, its common to have your credit score change with it. You go from a struggling college student to an adult with a higher income and additional responsibilities. You start signing up for more credit cards, you have easier access to credit, and you build a credit history.

Related: Whats the Best Age to Get a Credit Card?

Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at

Also Check: Is 741 A Good Credit Score

Pay Down Outstanding Balances

If you see outstanding balances, pay them! This can be overwhelming, but there are a few tried-and-true methods you can use. The snowball method involves paying off your lowest balance first, while the avalanche method has you pay off the balances with the highest interest rate first. You could also roll your credit card debt into one balance transfer card. Either way, choose the plan thats going to consistently work best for you.

Common Questions About Credit Scores Dropping

If youve recently opened several credit cards that required a credit check and added multiple hard inquires to your credit profile, it could be easy to identify why your credit score dropped. But its not always so cut and dry. Here are some of the most common questions that people ask about a credit score drop.

Read Also: Can You Have A Credit Score Of 0

Why Did My Credit Score Drop

When information is updated in your credit report, your score may change as well. By how much depends on the nature of the updated information. Because information in your credit reports may be updated frequently, changes that cause your score to fluctuate may not be obvious.

There are also different scoring models and many companies that provide credit scores. Scoring models may change over time as they update how information is processed and a score is calculated. Its common to see differences in scores from one model to the next. That said, if you see a big drop in your score, its usually triggered by something specific.

Below are some common reasons why you might see a drop in your credit score, along with what to look for on your report.

You Made A Late Payment

When reviewing the factors that affect your credit score, the one that has the most impact is your payment history . Lenders like consistency and reliability. So if you miss a payment, it can lead to a drop in score.

But it depends whether its a one-time mishap or a frequent occurrence, as well as how much time has passed since you missed your payment.

You get a yo-yo effect with a single missed payment, says Tuyo. Your score goes down and it pops right back up again after 30 days. But as you get into that 60 days and 90 days, now you get into what is considered serious delinquency. And that is going to cause the score to go down and trend downward as well. And so if you have multiple missed payments, again, now thats going to qualify as serious delinquency.

If you make a late payment, you may face late fees and interest as well as a drop in your credit score. But timing also matters. If you can remedy the issue before the activity gets reported to the credit bureaus, you may get ahead of the issue. According to credit bureau Equifax, late payments may not be reported until 60 days after the due date.

Once a late payment is reported, though, it can stick around for a much longer time on your credit report. That one missed paymenta blip in timecan be on your credit report for seven years.

Also Check: Is 648 A Good Credit Score

How Can I Raise My Credit Score 100 Points Overnight

How To Raise Your Credit Score by 100 Points Overnight

Someone Racked Up A Big Balance With Your Credit Card

Sometimes you overspent without even realizing it! The Journal of Consumer Research reports that the use of a credit card as a payment mechanism increases the prosperity to spend as compared to cash in otherwise identical purchase situations.

This is to say, people with credit cards may be tempted to spend more than if they just had cash. Try to pay down this high balance as quickly as you can and then go back to using only a small portion of your available credit. Or if need be, you could ask for a higher credit limit.

If youre facing building credit card debt, our financial coaches are trained to help. They can help you create a payoff plan and explain your options for a debt relief program, if thats something youre interested in.

Don’t Miss: When Does Discover Report To Credit Bureaus

My Credit Score Dropped But There Were No Changes On My Report

Your credit score is calculated based off the information in your credit report. To create your score, the information is broken down into different categories or factors. These factors may be weighed differently based on their importance. For instance, your payment history and utilization tend to carry the most weight in calculating your score.

The Passage Of Time Affects Your Credit Scores

Even if there are no changes to your credit reports, the passage of time could cause fluctuations in your credit scores. If you have a late credit card payment, for example, its effect on your credit scores may diminish over time. That doesn’t mean that it’s okay to make a late payment. One of the best habits you can get into is paying your bills on time every time.

Read Also: Does Missing A Credit Card Payment Affect Your Credit Rating

Your Credit Utilization Rate Is Too High

Your credit utilization rate measures your outstanding balance against your total credit limit. The general rule is the lower your credit utilization, the better. The standard advice is to keep your credit utilization below 30% of your available credit so that your utilization rate doesnât hurt your credit score.

For example, suppose you have a total credit limit of $2,000, and you owe a balance of $1,900. In that case, you are utilizing 95% of your available credit. This suggests to lenders you arenât managing your credit accounts responsibly. You may be at risk of missing a payment, which is why they penalize your credit score.

With a $2,000 limit, try to keep it around $600, or about 30% of available credit. Try to keep your credit utilization rate as low as possible to avoid a credit score drop.

Tips For Improving Credit Score After Paying Off Debt

While paying off your credit card debt is important, what matters more is on-time payments and your utilization rate. Many times, borrowers will ignore these factors, thinking that clearing up their debt as quickly as possible is the key to a stellar score. But there are a few other methods to consider:

- Be strategic with the order in which you pay off your debts. Personal loans and credit cards often have higher interest rates than mortgages, car loans and student loans. Paying off those first not only helps keep your credit utilization in check, but will also save you money in interest. You can also use a debt paydown calculator to help .

- Check your credit utilization. If youve paid off your debt and your credit score went down, look at just how much of your credit you are using. If its above 30 percent, you might consider charging less each month. If that isnt an option, you could speak with your issuer about increasing your credit limit. Both of those should help increase your credit score.

- Open another credit card. While opening accounts could temporarily lower your score due to hard credit checks, opening a new card could increase your total available credit and spread your charging among several cards.

Don’t Miss: How To Report Tradelines To Credit Bureau

Youve Checked Your Credit Score Too Many Times

Image source: garagestock/Shutterstock.com

While Equifax and TransUnion are the two credit bureaus for Canadian consumers, the score that lenders typically check isnt from either of those, but rather from FICO, a US-based data provider.

When you apply for any kind of loan, the lender will pull your credit score with a hard check to find your FICO score . This could actually drop your credit score by up to 5 points according to FICO. So if youve been shopping for a mortgage or a car loan recently, this couldve caused a drop in your credit score.

Related: Does Checking Your Credit Score Hurt Your Credit?

You Were The Victim Of Identity Theft

Finally, lets address what might be the most frightening reason for a drop in credit scores: Someone could have stolen your identity and applied for credit accounts in your name.

If you discover that an impostor is using your identity, dont panic. There are actions you can take to help reverse the damage it may have caused to your credit scores.

But how do you spot identity theft in the first place? One step to consider is . Keeping a close eye on your credit scores and credit reports may help you catch suspicious activity faster than if youre not regularly monitoring your accounts. Youre entitled to one free credit report periodically from each of the three major consumer credit bureaus at annualcreditreport.com.

If youve been a victim of identity theft, youll likely want to make a recovery plan. Placing a fraud alert on your credit file could be a good place to begin. You only need to place the alert with one of the national credit bureaus. The other two bureaus will be automatically notified.

After youve added your fraud alert to your credit profile, you may want to fill out an identity theft report with the FTC. Then you can begin the process of disputing inquiries on your report if necessary.

Don’t Miss: How To Get Free Credit Report In Georgia

You Have A Derogatory Mark On Your Credit Report

A derogatory mark on your credit report shows lenders that you didnt pay back a loan in the agreed-upon way. A bank or credit issuer could have placed a derogatory mark for many reasons including a late payment, bankruptcy, an account collection, lawsuit, foreclosure, or tax lien.

They can remain on your report for up to 10 years. Derogatory marks do go down over time, and you may be able to get them removed if you dispute it with the credit bureaus. If you see one, be sure to verify immediately whether its legitimate or not.

Something Was Recorded On Your Credit Report

Think back on your payment history have you missed a credit card payment in the last few months? Were there any bills that you may have missed in previous months?

Missed payments are typically not reported to the credit bureaus until theyre at least 30 days late, so your score wont be impacted until after that time. Your score will be hurt by a payment thats more than 30 days late, but a delinquency, referring to a payment that is over 30 days late, can devastate your score.

Derogatory marks such as tax liens, charge-offs, collections, foreclosures or bankruptcies have drastic impacts on your credit too, and it may take weeks or months for them to show up on your report. If youve experienced any of these, it may take time for your score to change.

Read Also: How To Add Things To Your Credit Report

Increase In Credit Utilization Ratio

The next factor that affects your credit score is the credit utilization ratio, which depends on your revolving credit. Your credit utilization ratio should always be less than 30%.

When you close your account by clearing your debt, theutilization ratio rises and leads to a drop in your credit score.

Its best to not close your unused older accounts unless you find a good reason to do so.

How Long Do Derogatory Marks Stay On Credit Score

It depends on the type of derogatory mark, but typically 7-10 years for most issues. Bankruptcy, collections, repossession, foreclosure, or missing payments will stay on your credit file for 7 years. Most credit cards charge a late fee when missing a payment, but legally need to give you 30 days to make a late payment before reporting it, which would then hurt your score and stay on record for 7 years.

Recommended Reading: Does Credit Karma Hurt Your Score

How Are Credit Scores Calculated 5 Factors Credit Bureaus Look At

Its also really important to understand how your credit score is calculated. That way, should you want to address any drops in your credit score, you can identify the key issues impacting your credit score the most and work to resolve them.

There are five main factors credit bureaus consider when determining your credit score. They are :

Your Credit Report Has A Mistake

Did you know that 79% of credit reports contain mistakes? Yikes!

Lenders make mistakes, so its important to check your credit report for any errors. If you do find a mistake, you have the right to report it to your lender and dispute it with the credit bureaus. Credit companies are required to investigate any confirmed disputes promptly and free of charge.

To prevent any mistakes from sitting on your credit report for too long, to get access to credit monitoring with IdentityIQ for free!

Read Also: How To Send Credit Report From Experian

Length Of Credit History

The average age of your credit accounts is another important factor in determining your credit score. Having many older accounts has a positive impact on your credit score, and having several new accounts is a negative contributing factor. If you pay off debt on an older account and subsequently close it, your credit score may drop.

Why Is My Credit Score Going Down Even When I Pay On Time

your is affected by more than one reason, so you might have made your bills payment and loan due payments on time, but your credit score is going down. many people assume that if they have paid their dues on time, their credit score should be high, and when it’s not the case, they wonder why. if you also want to know why your credit score is going down, even though you have paid all your bills on time, then we are here to help. read below to find out the five most common reasons why you may have a lower credit score range than you expected:

1. you have a high credit utilization ratio

you might have paid your bills on time, but you also need to check the balance you carry on each credit card. if you have a high credit utilization ratio, it can cause a drop in your credit score. you should check your credit limit usage on both an overall and per-card basis. it’s ideal that you should not consume more than 30% of your credit limit on any card. if you want to have a good credit score, scale down your credit utilization ratio. for example, you have a relatively low limit on a credit card and you use it to buy a new air conditioner. if you dont pay off enough before the next billing cycle, your credit score can drop. however, credit card providers typically report to the credit bureaus every month, so as soon as your card payment, your credit score will improve.

2. you missed payment and the same is showing on your credit report

4. you applied for new credit in a short gap

Read Also: Will Paying Off My Student Loans Increase My Credit Score