The Most Important Habit For Achieving A Good Credit Score

If you want to build credit and improve your score so you can experience the benefits of good credit for yourself, McClary says the most important habit is is simple pay your bills on time.

“A history of timely payments is the single biggest factor in determining your credit score according to FICO,” McClary advises. “Bringing past-due accounts up-to-date and keeping them there should be a priority for anyone who has been struggling because of delinquent accounts.”

Why There Are Different Credit Scores

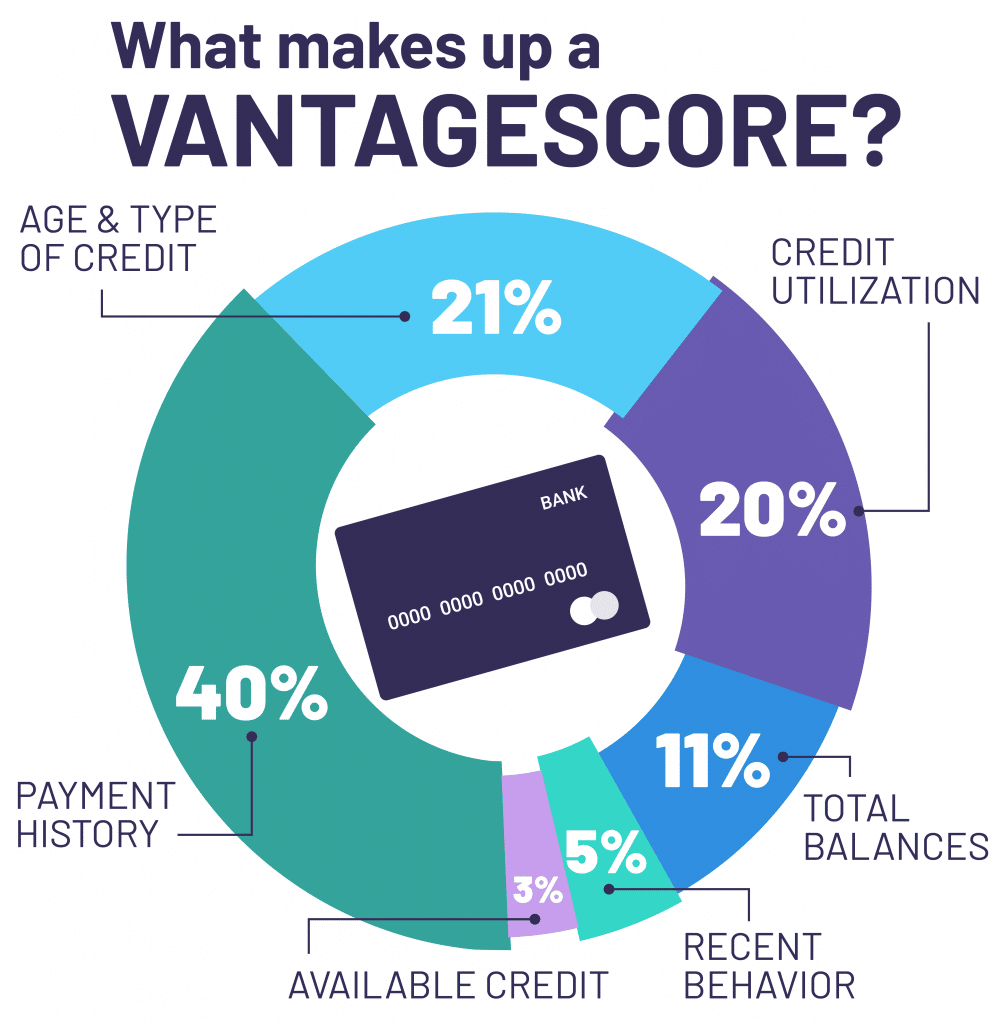

For example, VantageScore creates a tri-bureau scoring model, meaning the same model can evaluate your credit report from any of the three major consumer credit bureaus . The first version was built in 2006. The latest version, VantageScore 4.0, was released in 2017 and developed based on data from 2014 to 2016. It was the first generic credit score to incorporate trended datain other words, how consumers manage their accounts over time.

FICO® is an older company, and it was one of the first to create credit scoring models based on consumer credit reports. It creates different versions of its scoring models to be used with each credit bureau’s data, although recent versions share a common name, such as FICO® Score 8. There are two commonly used types of consumer FICO® Scores:

- Base FICO® Scores: These scores are created for any type of lender to use, as they aim to predict the likelihood that a consumer will fall behind on any type of credit obligation. Base FICO® Scores range from 300 to 850.

- Industry-specific FICO® Scores: FICO® creates auto scores and bankcard scores specifically for auto lenders and card issuers. Industry scores aim to predict the likelihood that a consumer will fall behind on the specific type of account, and the scores range from 250 to 900.

You’ll Have An Easier Time Renting An Apartment

According to Experian, a credit score of 620 is often the minimum credit score you need to qualify for an apartment. This falls into the “fair credit” range for both FICO and VantageScore’s rating scales .

But some landlords and property management companies are stricter than others. If your credit score is 700 or above, it’s more likely that the rental application process will be easier since your good score can help you stand out to potential landlords.

Depending on the scoring model used, a good credit score falls between the following ranges:

- FICO: 670 to 739

- VantageScore: 661 to 780

Having a good credit score when you apply for an apartment can also protect you from needing to find a cosigner or paying a large security deposit, as some landlords require when a potential tenant has less-than-great credit.

Also Check: Do Medical Collections Affect Credit Score

Getting An Auto Loan And Insurance

More than 85% of college students commute to campus. If you arent going to walk to campus or take public transportation, you need a car.

Theres no minimum credit score requirement to get an auto loan, but it does determine what interest rate you may qualify for and what lenders may be willing to work with you. While you could get around this by purchasing a car with cash instead of taking out a loan, you still need car insurance.

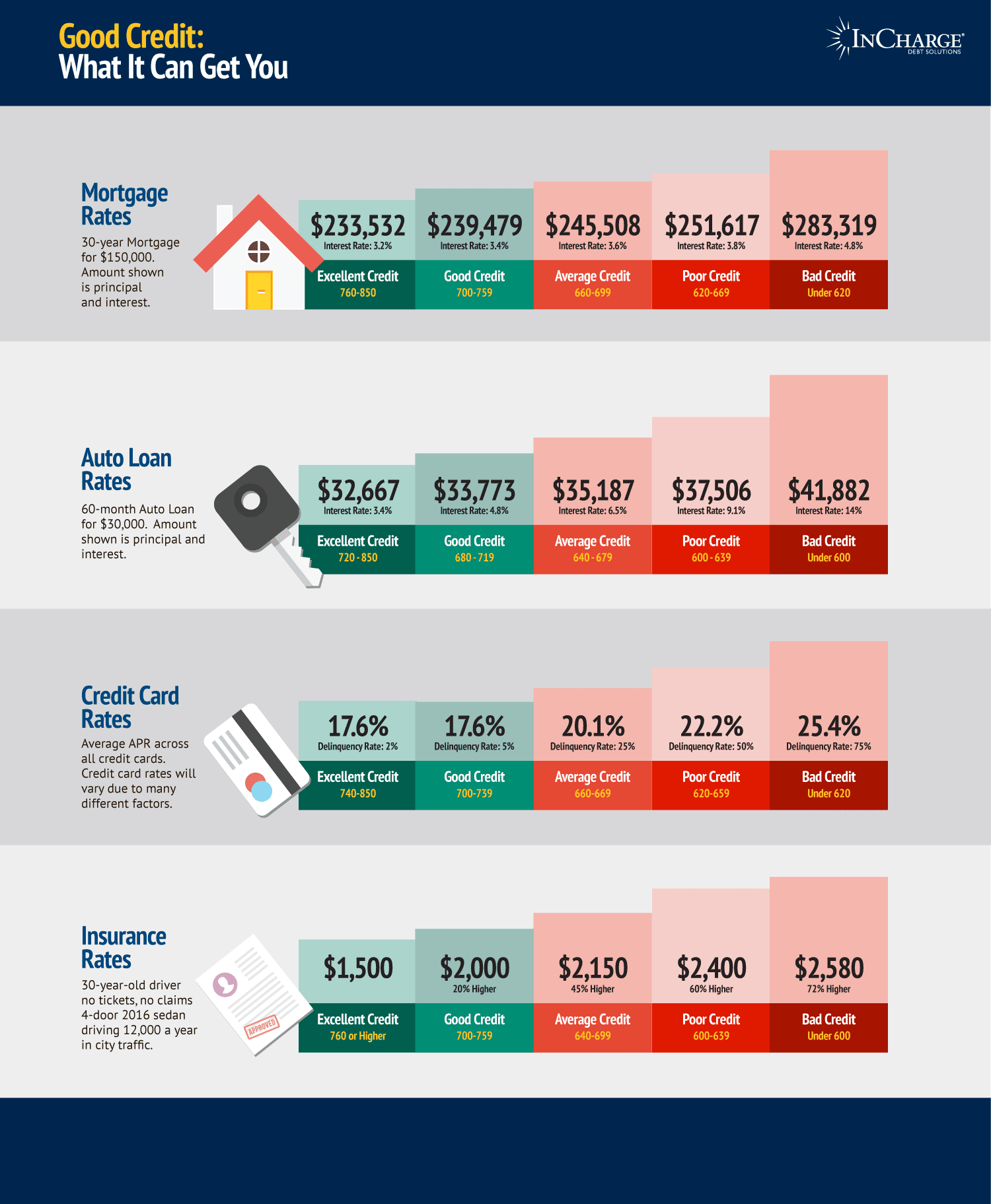

Your credit score may influence the rate you pay for car insurance. According to a nationwide analysis of top insurers, poor credit could more than double your insurance premium. The higher your credit score, the better the rate.

Benefits Of Good Credit: Renting Apartments And Buying Homes

Another area where having good credit is beneficial is if you are searching for an apartment to rent or a home to own. Renters and future homeowners with good credit see higher rates of approval for rental and mortgage applications. Moreover, those with good credit who are looking to buy a house receive better interest rates on their mortgages.

Also Check: How Can You Get A Credit Report

Consider Consolidating Your Debts

If you have a number of outstanding debts, it could be to your advantage to take out a debt consolidation loan from a bank or credit union and pay off all of them. Then youll just have one payment to deal with, and if youre able to get a lower interest rate on the loan, youll be in a position to pay down your debt faster. That can improve your credit utilization ratio and, in turn, your credit score.

A similar tactic is to consolidate multiple credit card balances by paying them off with a balance transfer credit card. Such cards often have a promotional period when they charge 0% interest on your balance. But beware of balance transfer fees, which can cost you 3%5% of the amount of your transfer.

Bad Scores Can Be Fixed

A bad credit score wont haunt you for life. A FICO insurance score is a snapshot of insurance risk at a particular point in time, the credit-scoring firm points out. The score changes as new information is added to your credit bureau files.

Scores also change gradually as you change the way you handle your credit obligation. Insurers, credit card companies and other lenders request the most current score when a new application is submitted, and by taking time to improve your credit score, you can qualify for better rates.

Read Also: How To Find Out Your Credit Score For Free

Make Sure Your Credit Accounts Are Accurate

Checking your credit report and keeping track of where you stand is another really good way to improve your score. Not only will it show you which areas in your credit needs the most work, but youll also be able to see if any errors have occurred, which is more common than you may think.

To make sure your report is accurate, youll have to be on the look out for potential errors, so if something is wrong, you can get that fixed by filing a dispute. Dont wait until after youve been denied a credit application to check for errors if you want your score to be the best it can be.

It might also be useful to get your credit report, which gives you a complete rundown of your credit history.

You’ll Get The Best Rates On Car And Homeowners Insurance

According to McClary, having a good credit score can help you save money on your car and/or homeowners insurance.

Most U.S. states allow , where insurance companies assess your risk based on how well you handle your money.

A variety of other factors go into evaluating your rates, and insurance companies don’t rely solely on your credit score in the underwriting process. They cannot penalize you for a bad score by raising premiums, denying coverage or canceling your policy.

But according to the insurance company Nationwide, credit-based scoring results in the most fair assessment of a driver’s risk and the company reports that it actually lowers premiums for about half of its customers.

Getting a free quote from an insurance carrier is the most accurate way to see whether your credit score might bring you savings. You can also view your credit-based insurance score through LexisNexis.

Read Also: How Long Does A Judgment Stay On My Credit Report

Pay Your Credit Card Balance In Full

If you’re only charging what you can afford to pay, paying off your full balance each month won’t be a problem. Paying off your balance each month shows that you’re capable of paying bills, something creditors and lenders want to see. Since a large part of your is based on the timeliness of your payments, paying your balances on time improves your credit.

Qualify For The Best Credit Card Deals

A strong credit history will help you qualify for the best credit cards, which include low interest rates, rewards and cash back. As well as helping you save money, these perks will encourage you to keep using your credit card which can help your credit if you continue to pay on time and keep balances low compared to your credit limits.

A low- or no-interest credit card can also serve as a temporary emergency fund if the need arises, or it can allow you to take advantage of a business opportunity.

Don’t Miss: How Do You Get Your Credit Score

Better Car Loan Rates

The COVID-19 pandemic hit the auto industry in 2020, but not as badly as initially feared. Total car and light trucks sales were about 14.6 million in the United States in 2020, down 14.6% from the previous year. Thats not ideal, but with plant shutdowns hitting the industry, the decrease from 17.1 million in 2019 could have been worse.

The challenge continues in 2021, as companies are having a hard time obtaining the chips needed to run circuits in cars and trucks. General Motors idled four North America plants for four months this year and has decreased its expected pretax 2021 by between $1.5 and $2 billion. Ford said it could reduce second quarter production by one-half.

That does not mean the price of cars is coming down. Analysts at Kelley Blue Book reported that the estimated price for a light vehicle in the United States was $38,723 in 2020. New vehicle prices jumped $940 year-over-year. Car loan debt totaled $1.37 trillion. That is 9.5% of all consumer debt the average monthly cost is $550.

A strong credit score can help. According to U.S. News and World Report, the interest rate on an auto loan can range from 2.5% for a borrower with a credit score of 700 or more to 6.76% for those between 450 and 599. Thats a difference of thousands of dollars based on the credit score.

Rates are somewhat higher if youre buying a used car, ranging from 2.74% for the best credit scores, to 7.01% for the not-so-good scores.

You Can Access Perks And Enjoy The Best Rewards

It’s no secret that the best rewards credit cards require at least good credit. And McClary says there are other perks, as well.

With a good credit score, “you can also take full advantage of the best introductory offers and reward incentives on new credit cards,” says McClary. “Some higher tier credit cardholders are able to receive special invitations to exclusive events, free access to online streaming services and even free swag.”

One of Select’s best credit cards for sports fans, restaurant lovers, movie buffs and adventure seekers is the American Express® Gold Card. Cardholders can earn 4X Membership Rewards® points on restaurants and at U.S. supermarkets , 3X points on flights booked directly with airlines or on amextravel.com, 1X points on all other purchases .

Also Check: When Does Capital One Report To Credit Bureaus

What Is A Credit Score

Your credit score is three-digit number, ranging from 300 to 850, that is the result of an analysis of your credit file. Lenders use your credit score to judge your potential credit risk and ability to repay loans. Credit score ranges vary based on the model used and the that pulls the score. FICO scores are used in 90% of lending decisions, so those ranges are listed below, using estimates from Experian.

- Very poor: 300 to 579

- Fair: 580 to 669

- Very good: 740 to 799

- Excellent: 800 to 850

Having A High Credit Score Could Give You Access To More Favorable Loans Credit Cards And More

Good credit. You mayâve heard the term more times than you can count. Thereâs a reason for that.

Itâs because credit can touch many parts of your life. For example, it may impact where you live, how much money you can borrow and how certain employers may view your job application. Read on to take a closer look at the benefits of good credit and how you could work on improving your own.

Read Also: Will Increasing Credit Limit Hurt Score

What Can Cause A Bad Credit Score

From late payments and numerous credit card applications to defaults and bankruptcy, here are some of the factors that can lead to a low credit score:

- Numerous credit accounts and applications. Having too many loans to your name isn’t a good look because it puts in question your ability to manage and repay all of them at once. All loan applications stay on record for 5 years.

- Every time you apply for credit, the lender makes an enquiry on your credit history. This enquiry itself is then recorded on the report going forward, leaving a trail of credit enquiries that other future lenders will not look favourably upon. These stay on record for 5 years.

- Late or skipped payments. Poor payment habits can be a warning sign to potential lenders, so it is always better to make a repayment on time, even if it’s a small or partial amount. It’s also important to remember that loan repayment history stays on your record for 2 years.

- This happens when a lender takes action to retrieve an outstanding payment and stays on your record for 5 years.

- Court writs and summons. These legal blemishes stay on your record for 4 years.

- Serious credit infringement or clearouts. If you fail to make payment and the creditor is unable to contact you for more than 6 months, a serious credit infringement will be marked on your record for 7 years.

- Bankruptcy and insolvency. These will stay on your report for 5 years after the start of insolvency, or 2 years after the insolvency ends, whichever is longer.

Limits Your Requests For New Creditand The Hard Inquiries With Them

There are two types of inquiries into your credit history, often referred to as hard and soft inquiries. A typical soft inquiry might include you checking your own credit, giving a potential employer permission to check your credit, checks performed by financial institutions with which you already do business, and credit card companies that check your file to determine if they want to send you pre-approved credit offers. Soft inquiries will not affect your credit score.

Hard inquiries, however, can affect your credit scoreadverselyfor anywhere from a few months to two years. Hard inquiries can include applications for a new credit card, a mortgage, an auto loan, or some other form of new credit. The occasional hard inquiry is unlikely to have much of an effect. But many of them in a short period of time can damage your credit score. Banks could take it to mean that you need money because youre facing financial difficulties and are therefore a bigger risk. If you are trying to raise your credit score, avoid applying for new credit for a while.

You May Like: Does Rent Show Up On Credit Report

Strategies That Will Quickly Get You A Better Credit Score

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Your is one of the most important measures of your financial health. It tells lenders at a glance how responsibly you use credit. The better your score, the easier you will find it to be approved for new loans or new lines of credit. A higher credit score can also open the door to the lowest available interest rates when you borrow.

If you would like to boost your credit score, there are a number of quick, simple things that you can do. While it might take a few months to see an improvement in your credit score, you can start working toward a better score in just a few hours.

How Is Your Credit Score Generated

As we mentioned, your credit score is generated based on your credit report. Credit reporting bureaus draw up your credit report and subsequent credit score based on the information reported to them this is why you may have a slightly different score with each agency. Lets illustrate this with a quick hypothetical example.

Lets say you have a personal loan. Youve been a diligent borrower in the past, but come into some money troubles and end up defaulting on your loan. Your lender only reports this default to Equifax, which then goes onto your Equifax credit report. So, your credit score with Equifax is worse than your credit scores with Experian and illion.

This is the short answer to how your credit score is generated the long answer is a little more complicated.

To understand this, we must discuss the two types of credit reporting used in Australia: comprehensive credit reporting and negative credit reporting. All credit reports and scores used to be generated using negative credit reporting, but CCR was introduced to provide a more comprehensive understanding of a persons borrowing and repayment history, hence the name.

Recommended Reading: How To Remove Inquiries From Credit Report Fast

Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at te