Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

How We Chose Our List Of Top Cards For Bad Credit

Bankrate uses a 5-star scoring system that evaluates credit cards based on annual fees, APR , sign-up bonuses, rewards programs and other features. For credit cards tailored to people with poor or bad credit, we focus on the attributes you might be most concerned about when selecting a new credit card.

What Information Credit Scores Do Not Consider

FICO® and VantageScore do not consider the following information when calculating credit scores:

- Your race, color, religion, national origin, sex or marital status.

- Your salary, occupation, title, employer, date employed or employment history.

- Where you live.

- Soft inquiries. Soft inquiries are usually initiated by others, like companies making promotional offers of credit or your lender conducting periodic reviews of your existing credit accounts. Soft inquiries also occur when you check your own credit report or when you use from companies like Experian. These inquiries do not impact your credit scores.

Don’t Miss: How High Of A Credit Score To Buy A House

What Is A Bad Credit Score Range

Bad credit score = 300 549: It is generally accepted that credit scores below 550 are going to result in a rejection of credit every time. If your score has fallen into this range, improving your score is going to take some work.

Filing for bankruptcy can bring a score down to this level. Statistically, borrowers with scores this low are delinquent approximately 75% of the time. But if you continue to make your payments on time, your score should improve. There are certain types of loans, like home loans, that are hard to get with a score in this range, but there are still options for getting a mortgage with bad credit.

Other Places To Check Your Credit Score

Although other scores arent used as often by lenders, they are still useful for tracking changes to your credit and are offered for free.

If you dont have a credit card or other product that provides free access to your score, it doesnt hurt to track one of the other scores, even though it isnt a FICO score.

You can also use these scores to check if you are making progress on your credit, and if there is a major decline or suspicious activity on your credit report, you can catch it right away. Then, you can at least investigate the activity and fix any issues.

Some of the other credit scores you might want to keep an eye on include the following:

You May Like: Can An Eviction Be Removed From Your Credit Report

What Are Credit Bureaus

Credit bureaus compile and about individual borrowers primarily for governments and lenders. They deal with consumer .

Credit bureaus are private companies that are highly regulated under the Fair Credit Reporting Act . They are limited in how they collect, disburse, and disclose consumer information and have come under increased scrutiny since the Great Recession of 2007-2009.

One interesting feature of the credit bureau business model is how information is exchanged. Banks, financing companies, retailers, and landlords send consumer credit information to the credit bureaus for free, and the credit bureaus turn around and sell consumer information right back to them.

Opensky Secured Visa Credit Card: Best For Low

- What we love about the OpenSky Secured Visa Credit Card: You can choose your own credit limit . And if you tend to carry a balance, its 18.14 percent variable APR can save you a lot of money compared to other credit cards for bad credit.

- Who this card is good for: Someone who wants more control over their credit. Choosing your own credit limit can help you manage your credit utilization ratio and credit score more effectively.

- Alternatives: If you can pay your balances in full each month and dont need a low-interest credit card, the BankAmericard® Secured Credit Card comes with a higher potential credit limit but also a higher APR.

Jump back to offer details.

All information about the BankAmericard® Secured Credit Card has been collected independently by Bankrate.com and has not been reviewed or approved by the issuer.

You May Like: Does Bankruptcy Stay On Your Credit Report

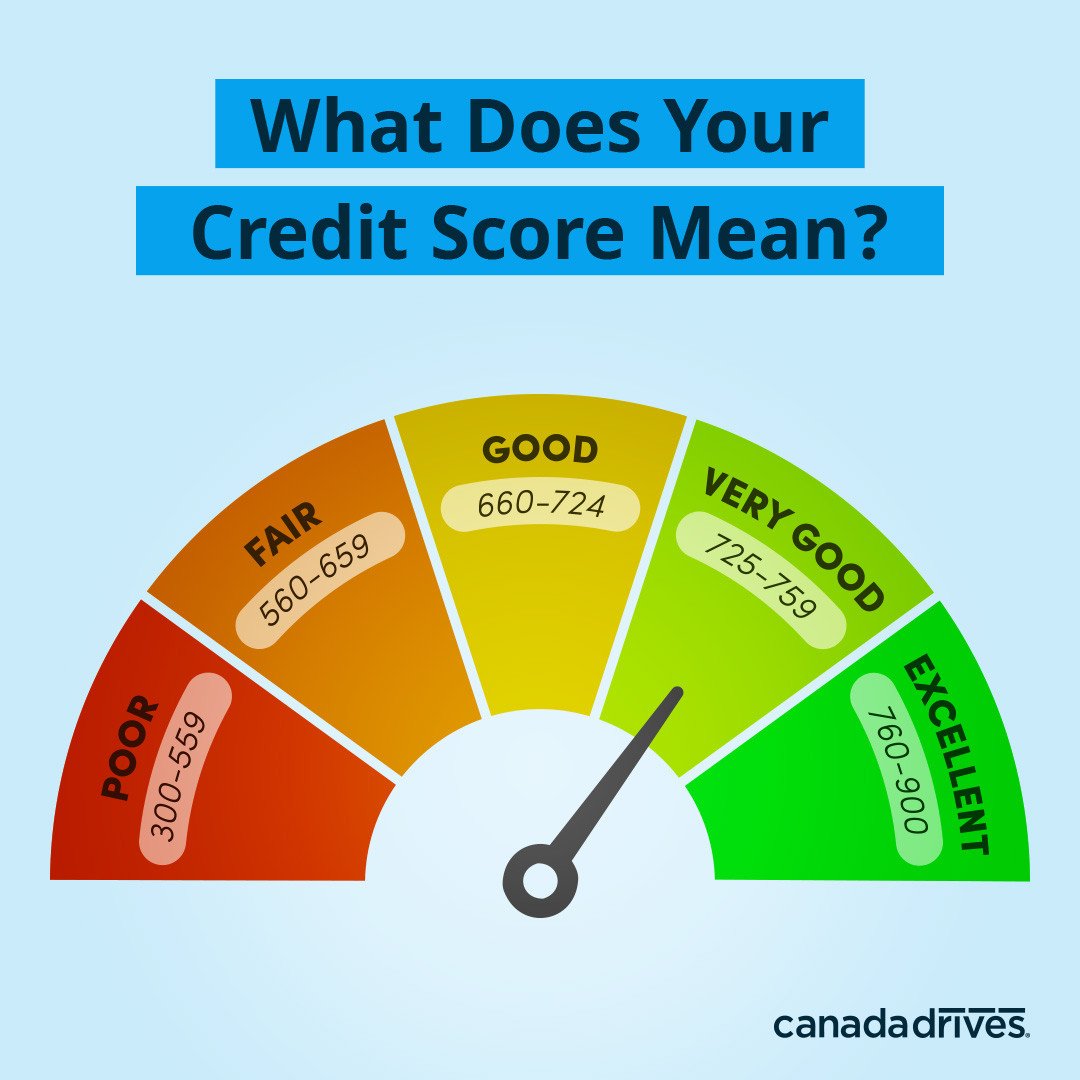

Vantagescore 30 Credit Score Ranges

vary by scoring model, and lenders can view ranges in different ways. VantageScore 3.0 credit scores range from 300 to 850. Think of them in terms of four basic categorizations: Excellent, Good, Fair and Poor. Heres how they break down.

Excellent :You may qualify for the best financial products available, and youll likely have several options when it comes to choosing repayment periods or other terms. But excellent credit scores arent the only factor in a lending decision a lender could still deny your application for another reason.

Good :Youre less likely to have an application denied based solely on your credit scores, compared to having scores in the fair or poor range, and youre more likely to be offered a low interest rate and favorable terms.

Fair :You may have several options when it comes to getting approved for a financial product, but you might not qualify for the best terms.

Poor :You may find it difficult to get approved for many loans or unsecured credit cards. And if youre approved, you might not qualify for the best terms or lowest interest rate.

Get Your Credit Score And Report For Free

If you’ve ever applied for credit or a loan, there will be a credit report about you.

You have a right to get a copy of your credit report for free every 3 months. It’s worth getting a copy at least once a year.

Your credit report also includes a credit rating. This is the ‘band’ your credit score sits in .

You May Like: How Long Are Foreclosures On Your Credit Report

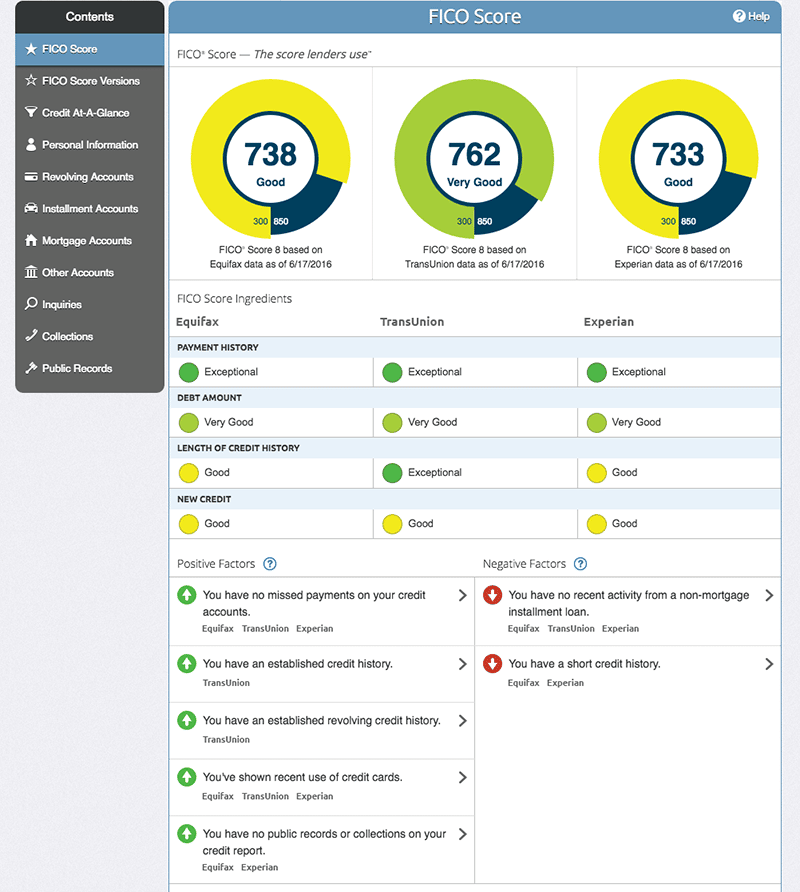

What Is The Most Accurate Credit Score

Although there are many different scores and scoring models, there is a light at the end of this confusing tunnel.

Among all the credit score models, the FICO credit score is used by more than 90% of major U.S. lenders.

You might have a different score calculated by a different scoring model with a different provider.

However, it’s very likely that the lender or creditor will use the FICO score to determine if they’ll approve your application for a new line of credit.

Because of this, you might want to keep your eye on your FICO score, rather than many of the others that are available, simply because this is the number the lenders care about most. A FICO score ranges from 300 to 850 .

Why Experts Say 760 Is The Best Credit Score To Aim For

It might be exciting for some to aim to achieve the highest credit score of 850. However, it comes with no additional benefits that you likely won’t already get with a 760 score.

“The best published interest rates for auto loans are 720+ and for mortgages 760+,” financial expert John Ulzheimer, formerly of FICO and Equifax, tells Select. “As such, I always tell people, shoot for 760 or better. That way, they’re safe for all loan types and cards.”

For Jim Droske, president of the credit counseling company Illinois Credit Services , the threshold is 760 as well. But he says aiming for 780 is even better to be “the safest” in any type of lending situation. Anything higher, though, won’t be more beneficial, nor would it get you a better offer with more favorable terms.

“If you’re above 760, or 780, certainly you’re already getting the best you can get,” Droske tells Select. “You’re already hitting that pinnacle of what care about.” A high enough credit score shows lenders and credit card issuers that you are less of a risk and more likely to pay back the loan, versus if you had a lower credit score.

“Anything above that is really just maybe a little pride,” says Droske. “When you have already reached the summit, no need to look for a ladder.”

Don’t Miss: Does Your Credit Score Drop When You Buy A House

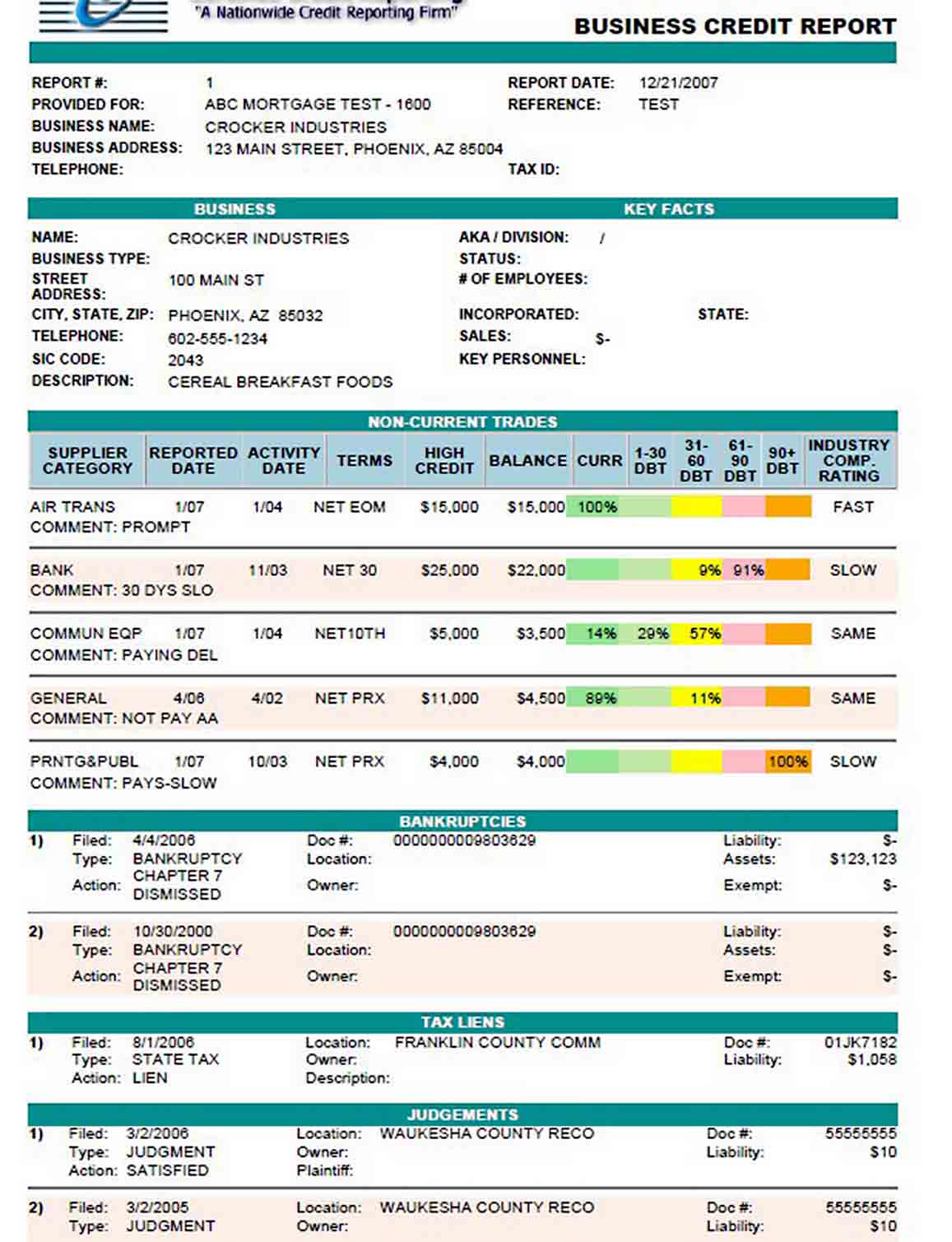

Report Details & Frequency

Free credit services are never as detailed as the report you get directly from the credit bureaus. Since we favored free memberships, we compared the reports they offered and selected the ones that provided the most comprehensive information.

We preferred free memberships that included personal information, open and closed accounts, account numbers, balances and status of accounts, payments, credit age and usage, derogatory items , public records, and inquiries.

Your credit report is constantly changing as creditors send new information about your credit accounts and payments to the major credit bureaus. However, not all creditors send information to the bureaus with the same frequency and credit bureaus dont update your credit report with the same frequency either.

We preferred credit reporting services that updated your information weekly over those that did so on a monthly basis. This should show you a more accurate view of your credit data, and how it can fluctuate over time.

What Is The Best Credit Card Company

When it comes to personal finance, youll find the best solution for you is exactly that, personal. However, several card issuers consistently rank on the list of best credit cards. Favorites like American Express, Capital One, Chase and Citi offer a wide range of rewards cards and also bundle consumer protections and cardholder benefits.

Read Also: Will Being In My Overdraft Affect My Credit Rating

Why Should You Check Your Credit Report

Mistakes happen. In fact, a study finds that 34% of consumers have at least one error on their credit report. These errors can affect your ability to get approved or cause you to pay higher rates when you are approved. The only way to verify that your credit report contains the right information is to review the information on an ongoing basis.

Limit Your Hard Credit Inquiries

When you apply for credit of any kind, it generates a hard credit inquiry. Since applying for new credit can be an early sign that someone is dealing with financial troubles, hard inquires will have a slight negative effect on your scores temporarily.

If you want to get a really high score, youll want to limit your hard inquiries meaning you should only apply for new credit when necessary.

Recommended Reading: How To Report Credit Card Fraud Chase

Monitoring & Extra Features

Some services also include credit monitoring alerts, security scans, and identity theft insurance. Alerts are a great way of getting a heads up on any changes in your credit report and may even offer some identity theft protection. Each time theres a change in your credit report, the service sends out an email or push notification alerting you of the change. If these dont relate to your usual credit activity or are otherwise unfamiliar, it could mean someone else is using your personal information.

We also took a look into services that included identity theft insurance or security scans. These features are usually available only for premium members but they could interest people who fear their personal information might have been exposed to hackers.

Which Credit Report Should I Get What Scores Do Lenders Use

When it comes time to see whats on your credit report or find out your credit score, its important to know which bureau you need to pull from.

Even if you are not close to buying a home or new car, its still important to watch over our credit file from time-to-time.

Picking up on any errors along the way will guarantee you the best credit rating, which in return gives you optimal borrowing rates. Plus, doing a tri-annual credit report review is possible at no cost and can dramatically reduce the amount of time it takes to catch identity theft.

That said, theres a lot you should know about the specific credit bureaus, their reports and their scores, and how it impacts you as a consumer.

Also Check: How To Remove A Repossession From My Credit Report

What Affects A Credit Score

While every credit scoring model is different, there are a number of common factors that affect your score. These factors include:

- Payment history

- Balances on your active credit

- Available credit

- Number of accounts

Each factor has its own value in a credit score. If you want to keep your number at the higher end of the credit score scale, its important to stay on top of paying your bills, using your approved credit, and limiting inquiries.

However, if you are in the market to purchase a house or loan, there is an annual 45-day grace period in which all credit inquiries are considered one cumulative inquiry. In other words, if you go to two or three lenders within a 45-day period to get find the best rate and terms available for a loan, this only counts as one inquiry. This means that they are not all counted against you and will not affect your credit score.

How Can You Get A Free Annual Credit Report

You have three options for requesting your free annual credit report:

- Online: You can request a copy directly from AnnualCreditReport.com

- Phone: Call 322-8228

- Mail: Download and mail the complete the Annual Credit Report Request form to: Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281

Also Check: When Disputing Credit Report What Reason

+ Easy Ways Does Morbius Have Post Credit Scenes

23 October 2022

4+ Tips How To Self Report To Credit Bureaus. We’ve got some good news and bad news. Self reporting refers to giving the credit bureaus permission to view your accounts and payment history for . Here is an overview that looks at what exactly a credit report is, Learn the best ways to contact each of the three credit bureaus with questions and concerns by phone, email or website. In the united states, a credit report plays a large role in the financial decisions an individual will be able to make in the future.

What Is The Easiest Credit Card To Get

Secured credit cards are typically the easiest to be approved for and are designed for people who have no or bad credit. For anyone with average or better credit, you may be approved for traditional, unsecured credit cards as well. Typically cards with no or low rewards have less stringent application requirements. You may want to check for pre-approved offers personalized for you to improve your odds.

Also Check: When You Dispute Credit Report What Happens

How Do Credit Card Rewards Work

When you make a purchase on a rewards credit card, youll earn a percentage back on your spending as either cash back, points or miles depending on the type of card and what type of rewards its offering. Airline credit cards, for example, will typically earn miles, cash-back cards will earn you cash back and general purpose rewards cards may earn points that can be used for things like a statement credit or to redeem for travel, merchandise or other options.

Some rewards credit cards will earn the same flat rate back on all spending, like a card that earns 2% back on every purchase. Others will have tiered rewards where a certain type of purchase, like gas or groceries, may earn at a higher reward rate then other types of purchases. Before choosing a rewards card its important to consider your spending habits and the type of rewards you think youll get the most benefit from and then compare that to the various options available to you.

So What Are Credit Scores Then

As weve mentioned previously, a credit score is a three-digit grade credit bureaus give you based on your credit history. Since this grade can determine so many of your lifes big financial decisions – from buying a home to getting the job you want – its important to check your credit history regularly and be aware of whats being taken into account when calculating your score.

Many people arent aware that they dont have just one credit score, just as they dont have one single credit report. FICO, for instance, has over 50 distinct credit score types corresponding to different industries–and there are other, lesser-known and lesser-used scoring models as well .

at least in the two most popular scoring models, FICO and VantageScore usually range from 300 to 850, with 300 considered extremely poor and 850 excellent. The higher the number the more creditworthy youre thought to be. People in the higher end of the scale will not only qualify for most loans and credit cards, but will also be offered the lowest interest rates.

FICO Score

The FICO Score was created by the Fair Isaac Corporation and is considered the most widely used credit score model. In fact, FICO states they are used in more than 90% of lending decisions.

FICO has developed different versions of their score throughout the years. As a result, you have more FICO scores than you probably imagine.

Theres also the FICO Score 3 which is used primarily for credit card lending.

VantageScore

Don’t Miss: How To Get Inquiries Deleted From Credit Report