Cibil Score Range 600

You’re not in the top tier as well as you will get the loan at a higher rate of interest comparatively. Those with credit scores ranging from 600 to 700 are commonly seen as “subprime borrowers,” which means that qualifying for better loan terms could be more difficult to find. This range implies that payment has been delayed or defaulted a number of times in the past. Personal loans can be hard for a bank to approve and hefty interest can be charged by a private financier.

An Excellent Credit Score Is Good Enough

You don’t need a perfect credit score to get the best deals. A score of 720 or higher is generally considered excellent. And scoring 800 or above qualifies you for the best terms offered.

Thats pretty great news if you aspire to get into the group of people who have top-tier credit but you dont want to obsess over every single point in an effort to get the highest score possible.

Request A Credit Limit Increase

You can directly increase the denominator of your CUR, and thereby lower the ratios value, by increasing your available credit. You can do this without opening a new account if you already have one or more credit cards.

Most credit card companies will seriously evaluate a request for a higher credit limit, but you may have to provide extensive financial information to back your request.

The credit card company may ask for bank statements and tax returns before granting a higher limit. You should expect the creditor to do a hard pull of your credit, which reduces the positive impact of the higher limit, at least in the short run.

Naturally, youll get the biggest CUR improvement by not actually using your additional credit, as explained earlier. A credit card company expects you to use any card it issues to you otherwise, its not worth their effort.

Recommended Reading: Ccb/ppc Credit Inquiry

You May Like: Experian Commercial Relations

How To Get A Loan Despite A Poor Credit Score

- Borrow from non-banks:While non-banking financial companies, like Bajaj Finserv, still need you to have a decent credit score, they tend to have relatively simpler eligibility criteria, which may help you raise funds fast and without too much effort.

- Apply with a guarantor or co-signer to your loan account:Adding a co-borrower to your loan application helps distribute the responsibility of repayment between you and the co-borrower. When your co-borrower has a good score, you will be able to borrow a larger loan amount and boost your chances of approval too.

- Try to find a secured loan:When a loan is unsecured, the lender is more stringent with the eligibility criteria by carefully filtering and selecting the most dependable or reliable borrowers. However, if you have collateral to offer, the significance of having a good credit score diminishes.

Additional Read: Get personal loan on bad CIBIL score

Keep Your Credit Utilization Rate Low

The second most important credit score factor is your it accounts for 30% of your score. Your credit utilization ratio measures the amount of credit you use versus the amount you have available. While its usually recommended to keep your credit utilization ratio below 30%, a ratio closer to 0% will help boost your credit score even more.

Recommended Reading: Does Aarons Do A Credit Check

Cibil Score Range 700

This score range places you in the top creditworthiness bracket and, if you approach lenders, they will be generally very optimistic. The score indicates that you have wisely used your credit cards, paid your card fees, repaid loans on time, did not run up huge debt, and are typically a financially responsible person. You are a low default risk in trade parlance. The best rates will be offered to you as well, interest wise.

How Is A Canadian Credit Score Calculated

While we dont know the exact formula for how each of the two Canadian credit bureaus calculates your credit score, we do know the five most important factors that affect it.

- History of payments. Do you make all your credit and loan payments on time all the time?

- Debt level. How much debt do you carry month to month? Are you using up more than 30% of your total limit?

- How long have you been a credit user? The longer the better for the health of your credit.

- New inquiries. Every time a potential lender or your score drops a few points. Too many pulls within a short period of time is a bad sign.

- Diversity. Are you responsibly using more than one type of credit account?

Don’t Miss: Leasingdesk Screening Reviews

S To Improve Your Credit Score Right Now

Taking good care of your credit score is an important part of your financial life.

Interest rates on all kinds of products from personal and student loans to mortgages and have increased significantly since January, making it more costly for people to borrow money. When you apply for a new line of credit, a high credit score can help you qualify for a low interest rate. Good credit also makes it easier to refinance your debt, which can lower your monthly payments and free up money for other purposes.

Improving a credit score takes time, however. So if your score needs some work, the sooner you start working on it the better off youll be. Heres how to start.

How To Read Your Cibil Report Or Credit Report

The credit report is a detailed document that highlights your entire credit history and record. It includes your personal information, contact information, employment history, credit limit on various credit cards, credit balances, and dates on which you opened various accounts. This credit report is viewed by various parties or organisations.

Some common parties who may view your credit report are as follows:

- Lenders like banks and non-banking financial companies

- Landlords

Given that it is a comprehensive document with multiple sections, it is important for you to know how to read your credit report. This will help you understand your report better, and even check to see if it does justice to your credit history.

You May Like: Navy Federal Credit Score For Auto Loan

Why Is It Important To Have A Good Credit Score

Banks and other lending institutions use your credit score to decide whether or not they will approve your requests for loans and other credit. Thus, if you have a higher credit score, it shows that you have demonstrated responsible credit behaviour in the past, and this may give potential lenders more confidence in approving credit requests.

You can also avail yourself of other benefits, such as lower interest rates, better terms of repayment, and a quicker loan approval process.

What Does Vantagescore Have To Say

Though there are no magic score numbers or strict cutoffs, VantageScore does provide some guidance on the quality of certain VantageScore 3.0 score ranges in this credit score chart:

The above grades/categories are meant to give a general idea of how a score stacks up, but again, it all depends on the lender, the loan and your entire application.

While you cant control how a lender might view your TransUnion credit score, you can control credit behaviors affecting your score. So make sure you use credit responsibly: pay your bills on time, dont borrow more than you can afford, and watch how frequently youre applying for credit.

See your credit trends, at a glance. Get smarter about your credit with our interactive score-trending graph.

You May Like: Does Qvc Easy Pay Report To Credit Bureaus

The Perfect Credit Score May Vary

Ask most people what constitutes a perfect credit score, and you’ll likely hear 850. That’s correct with respect to the generic FICO® Score used in most lending decisions, but it’s not always the right answer to the question.

The generic FICO® Score has a score range of 300 to 850, so a perfect score on that scale is, of course, 850. The same is true of the most recent scoring models from FICO competitor VantageScore®: Its VantageScore 3.0 and 4.0 models also use a 300 to 850 scale. So while FICO and VantageScore use different mathematical formulas to measure your creditworthiness , 850 is a perfect score on both companies’ generic scores.

But many, many scoring models exist, with different score ranges and measures of perfection that differ with their numerical scales. For instance, the first two versions of the VantageScore model, VantageScore 1.0 and 2.0, use a scale of 501 to 990, so 990 is their perfect ideal.

FICO also offers specialized industry scores, the FICO Auto Score and the FICO Bankcard Score . Each score is calculated differently, but both share a score range of 250 to 900, so perfection for each is a score of 900.

What Are The Factors That Affect Your Cibil Score

Given the significance of your CIBIL score, it is important to ensure that it’s always towards the higher side. To do this, it is vital to be aware of the factors that affect your credit score and control them accordingly. Here are the factors that affect your CIBIL score:

- Your income

- Any defaults, delays, or lapses in previous credit repayment

- Rejections for loans that you have applied for

Read Also: Check My Credit Score With Itin Number

How To Get An Excellent Credit Score

If your credit score falls within the good, fair or bad ranges and you want to get an excellent credit score, follow these tips to help raise your credit score.

- Make on-time payments. Payment history is the most important factor in your credit score, so it’s key to always pay on time. Autopay is a great way to ensure on-time payments, or you can set up reminders in your calendar.

- Pay in full. While you should always make at least your minimum payment, we recommend paying your bill in full every month to reduce your utilization rate. .

- Don’t open too many accounts at once. Each time you apply for credit, whether it’s a credit card or loan, and regardless if you’re denied or approved, an inquiry appears on your credit report. Inquiries temporarily reduce your credit score about five points, though they bounce back within a few months. Try to limit applications and shop around with prequalification tools that don’t hurt your credit score.

Why Is Your Credit Score Different At Different Credit Bureaus

The four RBI-licensed credit bureaus use slightly different scoring models while calculating credit scores. Thus, your scores may vary based on which credit bureau furnishes your credit report.

The four RBI-licensed credit bureaus use slightly different scoring models while calculating credit scores. Thus, your scores may vary based on which credit bureau furnishes your credit report.

Please try one more time!

Recommended Reading: Care Credit Minimum Score

What Is A Bad Credit Score Range

Bad credit score = 300 549: It is generally accepted that credit scores below 550 are going to result in a rejection of credit every time. If your score has fallen into this range, improving your score is going to take some work.

Filing for bankruptcy can bring a score down to this level. Statistically, borrowers with scores this low are delinquent approximately 75% of the time. But if you continue to make your payments on time, your score should improve. There are certain types of loans, like home loans, that are hard to get with a score in this range, but there are still options for getting a mortgage with bad credit.

Tips For Achieving A Perfect Credit Score

No negatives. Just as the word perfect implies, there cannot be a single blemish on your credit report. This includes late or missed payments. If you have a dozen accounts between credit cards and loans, none can have a late payment ever. Payment history is the most important factor when calculating a FICO credit score with a weight of 35%, although its less important for a VantageScore.

No balances. There is a myth that people have to use their credit cards to earn a credit score but this isnt true. This is the most important factor for a VantageScore and the second most important factor for a FICO credit score.

To achieve a perfect credit score, balances need to remain at zero, if not close to it. Higher credit utilization means a lower credit score, and the number may continue a downward spiral over time if balances stay high.

The average length of credit history for an 850 credit score is 30 years. If a person begins establishing credit the day they turn 18, they may be 48 before achieving a perfect score.

And that only happens if the person is responsible with their finances early in life. Many consumers stumble through their twenties as they figure out the best ways to utilize credit and make payments responsibly. This can lead to lower credit scores later in life.

Recommended Reading: Ccb On Credit Report

Become An Authorized User

If you dont have a lengthy credit history, ask a family member who has excellent credit to add you as on their oldest credit cards. Your score can increase if the credit card issuer reports information to the credit bureaus for authorized users. However, the downside is that your score can decrease if the primary cardholder misses a payment and its reported on your credit report.

Are Credit Scores The Same Across The World

Many countries around the world may use similar credit scoring systems. However, while some credit bureaus operate in multiple countries, international laws prevent sharing credit histories with overseas lenders. This is done to prevent identity theft and fraud.But remember that if you plan to move abroad and open a credit card with a local bank or apply for a loan, the foreign banks and lending institutions may still inquire about your credit history and any outstanding debts in your home country.

Many countries around the world may use similar credit scoring systems. However, while some credit bureaus operate in multiple countries, international laws prevent sharing credit histories with overseas lenders. This is done to prevent identity theft and fraud.

But remember that if you plan to move abroad and open a credit card with a local bank or apply for a loan, the foreign banks and lending institutions may still inquire about your credit history and any outstanding debts in your home country.

Read Also: Remove Eviction From Credit

What About Transunions Credit Score

TransUnion uses the VantageScore® 3.0 model, but the above way of looking at it still applies: two different lenders may have completely different opinions on what a good-enough TransUnion score is. And since lenders may use several different sources of information to evaluate an applicants creditworthiness, one lender may view two separate applicants differently, even if those applicants have the exact same TransUnion score under consideration.

Fico Score Ranges Vary They Can Range From 300 To 850 Or 250 To 900 Depending On The Scoring Model But Higher Scores Can Indicate That You May Be Less Risky To Lenders

Lets take a deeper look at FICO® score ranges, whats considered to be a good FICO® score, and how to improve your credit if your scores fall on the lower end of the credit spectrum.

|

740 to 799 |

800 to 850 |

The latest FICO® base scoring model is FICO® Score 9. But some lenders still use FICO® Score 8 models. Bill Banfield, executive vice president of capital markets for Quicken Loans, says that many conventional mortgage lenders use even older FICO® scoring models.

The base scores are what you may see when you check your FICO® scores after logging into your credit card account or paying for FICO® scores online.

Read Also: Clark Howard Free Credit Scores

Making Payments On Time

Keeping up with repayment is essential to achieve the highest possible credit score. According to FICO, payment history accounts for 35% of the overall credit score, and never missing a payment means safely improving your score. If you are more than 30 days late with a payment, creditors will likely contact the credit bureaus, and your credit score will decrease. Late payments can stay on your record for up to seven years. During this time, you may find it challenging to borrow money.

How Do I Get The Highest Credit Score

While it is theoretically possible to achieve a perfect 850 score, statistically it probably wont happen. In fact, about 1% of all consumers will ever see an 850, and if they do, they probably wont see it for long, as FICO scores are constantly recalculated by the credit bureaus.

And its not like you can know with absolute certainty what is affecting your credit score. FICO says 35% of your score derives from your payment history and 30% from the amount you owe . Length of credit history counts for 15%, and a mix of accounts and new credit inquiries are factored in at 10% each. Of course, in actually calculating the score, each of these categories is broken down even further, and FICO doesnt disclose how that works.

The credit bureaus that create credit scores may also change how they make their calculationssometimes for your benefit. Changes were made in 2014 and 2017, for example, to reduce the weight of medical bills, tax liens, and civil judgments. However, changes made in January 2020 for FICO 10 involving trending data, credit card debt, personal loans, and delinquencies may make getting a higher score more difficult.

Read Also: Usaa Credit Monitoring Experian

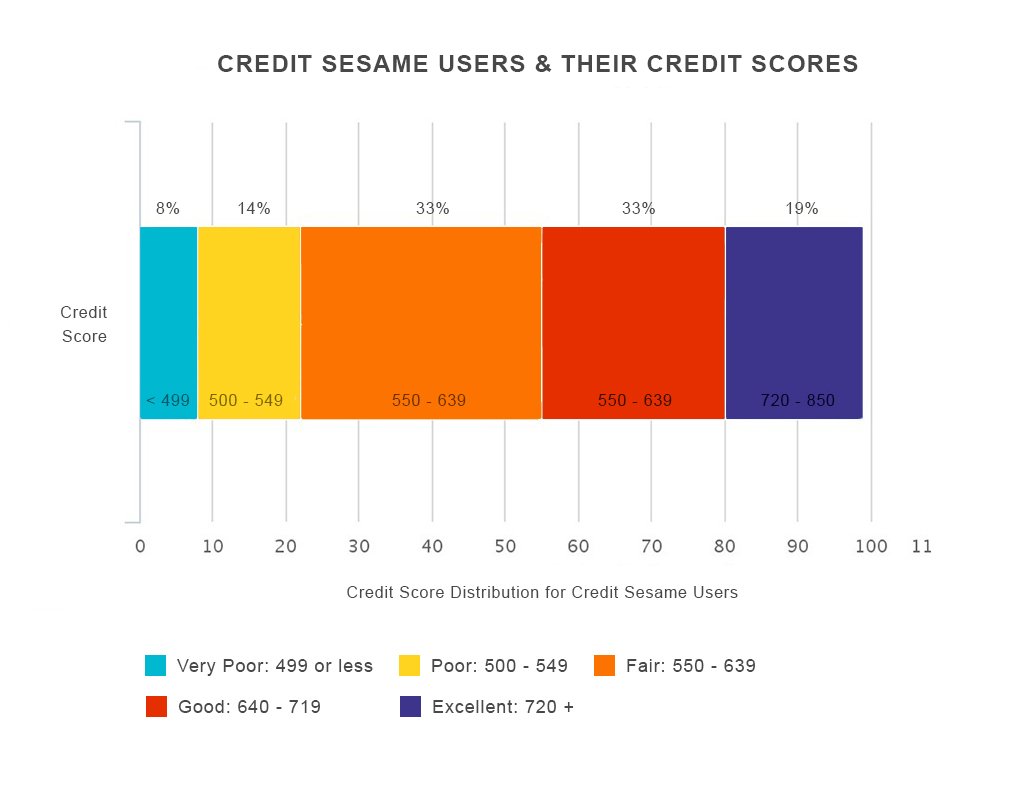

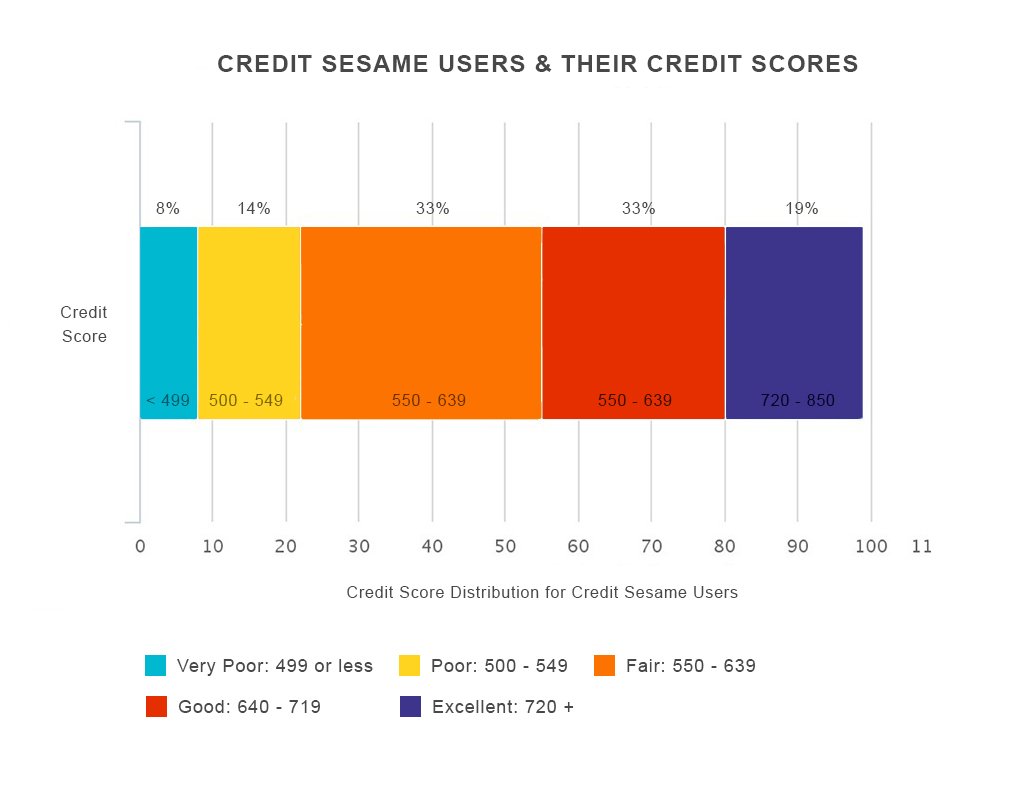

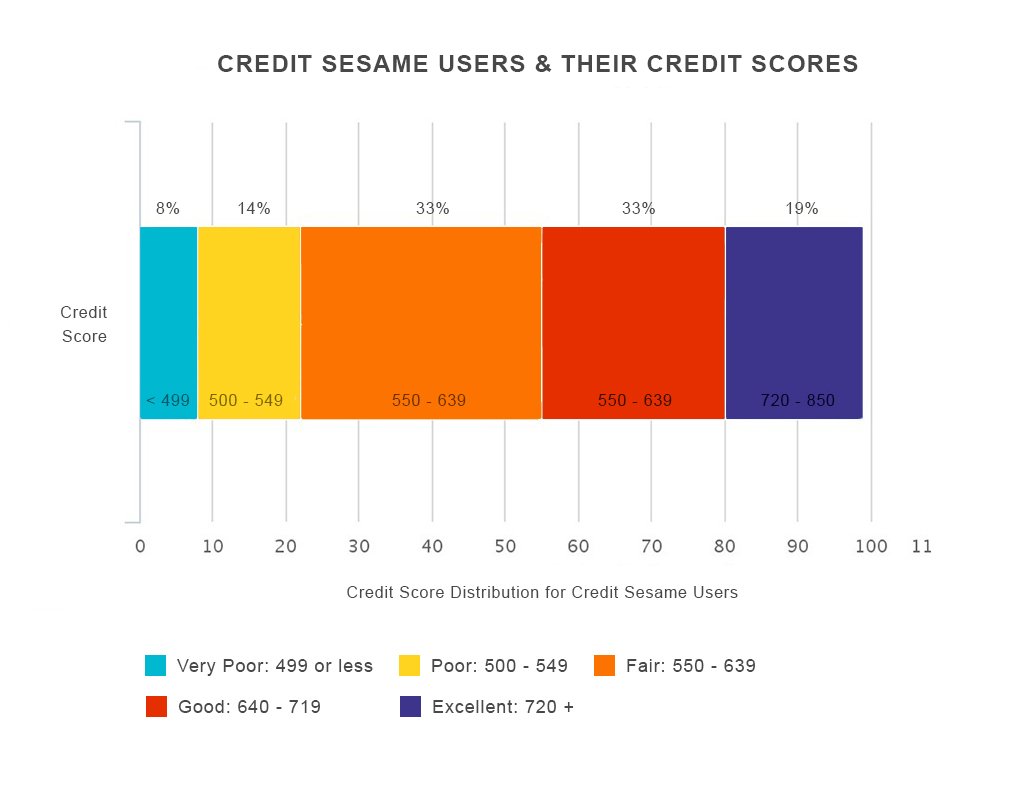

Understanding Credit Score Ranges

The credit score you see if youre signed up for TransUnion Credit Monitoring or if you purchased a credit score with your credit report is based on the VantageScore® 3.0 model. Scores in this model range from 300 to 850. A good score with TransUnion and VantageScore® 3.0 is between 720 and 780. As your score climbs through and above this range, you can benefit from the increased freedom and flexibility healthy credit brings. Some people want to achieve a score of 850, the highest credit score possible. Having this perfect score may feel like a win, but it isnt necessary to enjoy the benefits of strong credit.

In TransUnion Credit Monitoring, you may also see a letter grade with your credit score. For VantageScore® 3.0, an A score is in the range of 781850, while a B score is 720780. A score of 658719 is labeled a C. Think of these rankings and ranges as guides, not hard-and-fast rules for what good credit is. You can use them to help stay on the right track, but they dont necessarily indicate if you will or wont be approved for credit.

Think of these rankings and ranges as guides, not hard and fast rules for what good credit is.