Why Does Your Credit Limit Matter

When lenders consider your creditworthiness, they look at one or more of your credit reports and scores from the three major credit bureaus: ExperianTM, Equifax® and TransUnion®.

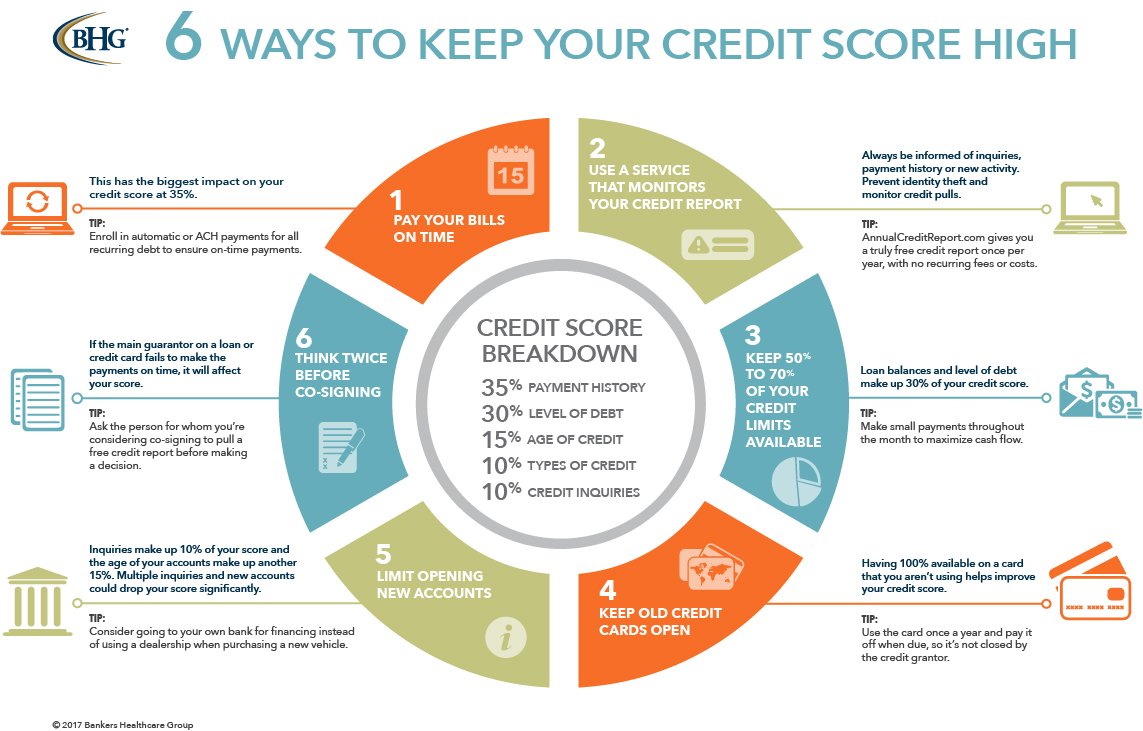

Your credit scores are calculated using different factors in your credit report. A large part of your score is made up of your payment history, so its critical to pay all your bills on time. But your credit utilization ratio, the percentage of your total credit card balances compared to your total credit limit, makes up another large part of your credit scores.

A lower credit utilization ratio has a more positive impact on your credit scores. To demonstrate how credit utilization works, lets look at a couple of scenarios.

- Charlie has one credit card with a $5,000 limit. Their balance is $2,500. Therefore, Charlies credit utilization ratio is 50%.

- Alex has two credit cards, each with a $5,000 limit. Their total credit card limit equals $10,000. Alexs total credit card balance equals $2,500, just like Charlies. But because Alex has a higher credit limit, their credit utilization ratio is only 25%, which could be better for their credit.

If Charlie wants to decrease their credit utilization ratio, they can pay down their credit card balance which could save money on interest, too. But if Charlie cant afford to pay off their credit card balance right now, they can either apply for another credit card or request a credit limit increase with their current credit card.

Lowering Your Credit Utilization

is the percentage of your available credit youre using, and its an important factor, making up 30% of your FICO credit score.

A common rule of thumb is to keep your credit utilization ratio below 30%. Ultimately, the lower the better. According to Experian, consumers with exceptional FICO credit scores have an average credit utilization ratio of 5.7%.

Keep in mind, credit utilization considers each card individually and collectively . Check out our to understand your current ratio.

A high-limit credit card can have a positive impact on your credit score by lowering your credit utilization ratio, assuming you dont accumulate more debt. For example, if your credit card balance is $1,000, a limit of $2,000 will give you a high utilization ratio of 50%. But a limit of $5,000 would make your credit utilization just 20% and a $10,000 limit would drop it even further to 10%.

FICO has not revealed exactly how many points you can gain or lose based on credit utilization alone, and the overall impact varies based on your overall credit profile. But high-limit cards can help in the right circumstances.

For instance, AJ Saleem, who owns a private tutoring company in Houston, Texas, has seen credit score increases of up to 40 points after adding high-limit cards to his collection of business credit cards. He said he has no negative items in his credit history.

I have seen a high credit score boost, especially when it puts my credit utilization below the 30% mark, Saleem said.

How To Increase Your Credit Limit Without Hurting Your Score

As noted earlier, most lenders have a mechanism for asking for an increase. This can usually be done either by phone or via the internet. Your lender will want some information from you to consider your request, whether a hard pull is done or not. This will include your current income and employment information. You can ask if a hard pull will be done and, as noted earlier, if one can be avoided at a lower increase threshold. I would suggest that you always ask for your own information.

Before you make any decisions like this, I would also suggest that you check your credit reports for yourself. You can do this for free at AnnualCreditReport.com.

Just like taking on any new credit, this is a step I always recommend be done so that you know what is in your reports. It will benefit you by allowing you the time to correct any errors you find and be sure that your credit is in tip-top shape.

Good luck!

Have a credit score question for Steve? Drop him a line at the Ask Bankrate Experts page.

Read Also: How Is Your Credit Score Calculated

Am I A Good Candidate For A Credit Increase

Yes, provided youve used and regularly paid your credit card bills on time over the last 6 to 12 months or youve recently received a pay increase. If youre responsible with credit cards, youre probably a good candidate.

If youre bad with credit cards, youll likely be denied upon requesting a credit increase while potentially dinging your score further. On top of that, youd just be digging yourself a bigger hole in the off chance an issuer grants you more credit.

To get an idea of your current credit score without negatively affecting it, you can check your credit score with all three major reporting agencies once per year with Annual Credit Report or once per month with TransUnion® via Rocket HomesSM.

The Worst They Can Say Is No Shouldnt I Try

Oftentimes, a limit increase request will trigger a hard pull on your credit report. This can hurt your credit, especially if you have a short credit history. If you call your credit card issuer, you can ask whether a hard inquiry will be initiated. Sometimes you can take a smaller increase and forgo the pull.

Asking for an increase could affect your credit score.

If you decide its the right time to up your limit, either call customer service or request a credit limit increase online. Its a very simple procedure. Dont be discouraged if your request is denied. Your in the future when the timing is right.

Bottom line: Try to time your credit limit increase request so its more likely to get approved. And, of course, try to keep your spending low enough that you can pay your credit card in full each month.

Don’t Miss: Can Medical Bills Affect Your Credit Rating

How Does Applying For A Credit Limit Increase Affect Your Score

Much depends on how the request is initiated. Most lenders have a mechanism for requesting credit line increases some will even automatically kick in if you meet certain guidelines laid out by the lender. In these instances, a limited or soft inquiry is usually made by your lender, which, as we have discussed previously in this space, will have no effect on your credit score.

However, if the increase is not automatic and you request it, some lenders may make a hard inquiry. This could pull your score down by a few points and the effect will likely be short-lived. But the request will stay on your credit reports for two years. If you are concerned about the impact of a hard pull on your score, consider asking the credit issuer if a smaller increase request can be reviewed under a soft pull.

The good news is that whether you get an automatic increase or if your request is accepted, your will go down. This will serve to bump your score up, since utilization accounts for 30 percent of your overall FICO score. This is assuming, however, that you dont go right out and charge up a storm with your newfound increase.

But there is no free lunch, as they say. Requesting new credit can trigger a drop from the new credit portion of your FICO score, which is worth 10 percent of your score. However, given the disparate weighting of the two factors, you should come out ahead in the end.

Should I Increase My Credit Limit

Theres no precise measurement for how much credit you should have, but generally speaking, a higher credit limit is a good thing .

A credit increase is often the fastest, easiest way to increase your spending power. Having more available credit at your disposal means you will be better positioned to charge a large purchase or numerous smaller ones. Increasing your credit limit is also simpler than getting a new card since youll only have one account and bill to keep track of.

Also Check: How To Get 800 Credit Score In 45 Days

When Should You Increase Your Credit Limit

Timing is important when you request a credit limit increase. Knowing when to ask for a credit card limit increase may give you better odds of approval.

Your card issuer might be more likely to approve your request for a higher credit limit under some of the following conditions:

- You opened your credit card account at least 6-12 months ago.

- You have made consistent on-time payments for a year or more.

- Your income or your credit score has increased.

- You make a habit of paying more than the minimum payment on your accounts.

- The credit utilization rate on your account is low .

Itâs also important to understand that there are times when you probably shouldnât ask for a credit limit increase. You may want to avoid requesting a higher credit limit if:

- Youâve had new, negative changes in your credit report or credit score.

- You recently lost your job or experienced an income reduction.

- Your current credit limit is maxed out, or your balance is over the limit on your account.

- Your card issuer recently lowered your credit limit.

Of course, each credit card issuer has its own criteria when it comes to approving a credit limit increase request. Some card issuers will want to check your credit history and score while others may skip this step .

The Last Time You Increased Your Credit:

As mentioned, every time you try to increase your credit, you can negatively affect your credit score. And, if you ask too many times, some lenders may see this as a red flag and that youâre about to go on a spending spree. With credit limit increases being given based on a hard inquiry of a credit report, itâs important to space out your requests to keep your credit score in good standing.

While credit limit increase requests made by you can sometimes involve hard inquiry by your lender, if your lender offers you an increase instead, chances are your credit wasnât accessed in a way that will hurt your credit score.

However, if youâre known to overspend with more access to funds, you might want to think twice about giving yourself access to more.

Also Check: Does Credit Limit Increase Hurt Score

A Higher Credit Limit May Help Improve Your Credit Score

In the long term, a higher credit limit may actually help to improve your credit score. However, there is one important caveat: your debt-to-credit ratio.

If you get a higher credit limit and your balance stays the same, then your debt-to-credit ratio will be lower, which is likely to improve your credit score over time. Paying down your debt will reduce the debt to credit ratio further and your credit score should improve thereafter.

However, if you cannot control your spending, your debt-to-credit ratio will be higher and your credit score may drop as a result.

Are You Ready For A Card Upgrade

An automatic credit limit increase is a sign of a consistent payment history. If youve also kept your debt balances low in addition to making on-time payments, then you may have seen your credit score improve over time. That means you could be ready for a better credit card if you started off with a student card or one designed for bad credit applicants. Weaver recommends a credit score of 700 as a good benchmark to aim for before applying for a rewards card.

If your current credit card doesnt match up with your lifestyle, thats another sign its time to apply for a new one. If youre starting to use your credit card more and more, you want to look at what the rewards are on the credit card, says Weaver. Aim to choose a rewards credit card that offers rewards for the categories in which you spend the most. Also pay attention to other bonuses and perks, and choose the card youll get the most use out of. For example, if youre planning a trip abroad, you may want a travel rewards card with no foreign transaction fees.

Don’t Miss: Is 664 A Good Credit Score

Does Increasing The Credit Limit Affect Your Credit Score

the decision to increase the credit limit can be confusing and may happen in various ways. it might be possible that you have outgrown your available credit limit and want to request more. sometimes, credit care companies themselves offer extra credit limits on your existing if you have used your credit card responsibly. but what is the impact of a credit limit increase on your ? does it increase or decrease your credit limit? let’s discuss all these points:

Can You Transfer Your Credit Limit

If you get denied a credit limit increase, dont give up. Another strategy you can try is to apply for a new credit card from the same issuer and, if approved, transfer a portion of your new credit line to your original credit card.

Imagine you have one card with a $10,000 limit and another with a $20,000 limit. You could ask to transfer $5,000 of your credit line from the second card to the first card, giving both cards a credit limit of $15,000. Since youre not applying for more credit, and instead are just asking to move your current credit around, you may have better luck.

To transfer your new credit line to the original card, youll need to contact customer service. Depending on the issuer, your credit limit transfer may be approved immediately or you may need to wait days or weeks.

Or if you already have two credit cards from the same issuer, you can ask to move a portion of your credit line from one card to another.

Keep in mind that moving a portion of your credit line from one card to another wont lower your overall credit utilization ratio. However, it could potentially lower your utilization ratio on one account.

Don’t Miss: How To Check Your Credit Score Without Hurting It

Reasons Why Your Credit Limit Increase May Have Been Denied

When you request a credit limit increase, the card issuer may review your credit reports, credit scores, how you use credit cards, your history with the company, and the income information it has on file.

- The credit card account is only a few months old

- You requested and received a credit line increase in the past few months

- You have a low credit score

- Your income isn’t high enough

- You don’t use the card often

- You rarely pay more than your minimum monthly payment

- You’ve missed a payment or are currently past due on this or another credit account

When you’re denied a credit limit increase due, at least in part, to your credit information, you might be sent an adverse action letter. If the lender used your Experian credit report in their decision-making, receipt of an adverse action letter means you have the right to request a free copy of your report, which you can do on the Experian’s Report Access page. If a report from one of the other major consumer credit bureaus was used, you can request a copy of your report from those companies as well.

The letter will also explain why the card issuer denied your request. Addressing any issues included in that explanation may increase your chances of getting approved later, although it’s no guarantee.

How To Increase Your Credit Limit

Ready for a credit limit increase? If youre a responsible borrowermeaning you dont spend beyond your means and you pay your bills on time, every timeits very likely that your lender will give you a boost periodically, with no need to ask. Typically, if you have six months to a year of on-time payments under your belt, you work with a healthy utilization ratio and youve never maxed out your card, your lender may be inclined to automatically raise your limit.

Plus, if your account information is up to date, including your income level, your lender can see any increases in income and bump up your limit accordingly.

If you feel like youve been waiting forever for a credit limit increase, theres no harm in asking. Here are the basic steps to keep in mind when it comes to requesting a credit limit increase:

Recommended Reading: Does Ginny’s Report To Credit

Does Requesting A Credit Limit Increase For Your Credit Card Hurt Your Credit Score

Quick answer: it depends. If your credit card company does a soft inquiry, it wont hurt your credit score at all. Soft inquiries are a limited type of credit report that gives just enough information to help lenders make decisions. Credit card issuers dont need your permission to do soft inquiries to decide, for example, whether they should prequalify you for a new account.

But if the credit card company does a hard inquiry, your FICO® score could drop 5 to 10 points. Hard inquiries seek a full credit history, which lenders use as a factor in deciding whether to lend you money. They can affect credit reports for two years or so. However, lenders need your permission to do a hard credit inquiry, so youll know when it happens.

If your FICO® score is near 850, the maximum, a few points wont make much difference. But if your score is lower, a 10-point reduction might hurt your chances for a credit line increase. Before asking for a higher credit limit, consider calling your credit card issuer to find out what kind of inquiry theyll do if you request a credit increase.

On the bright side, if your credit limit increase request is approved, your credit score could increase, negating any small dings from hard inquiries.