Send A Request For Goodwill Deletion

Like pay-for-delete, writing a goodwill letter seems like a long shot, but its an option for borrowers who want to exhaust every possible alternative. Write to the creditor and ask for a Goodwill Deletion. If you have taken appropriate steps to pay down your debts and have become a more responsible borrower, you might be able to convince the creditor to remove your mistake.

There is no guarantee that your plea will get a response, but it does get results for some. This strategy is most successful for one-off problems, such as a single missing payment, but it may be futile for borrowers with a history of missed payments and credit mismanagement.

When writing the letter:

- Assume responsibility for the issue that caused the account to be reported to begin with

- Explain why the account was not paid

- If you can, point out good payment history before the incident

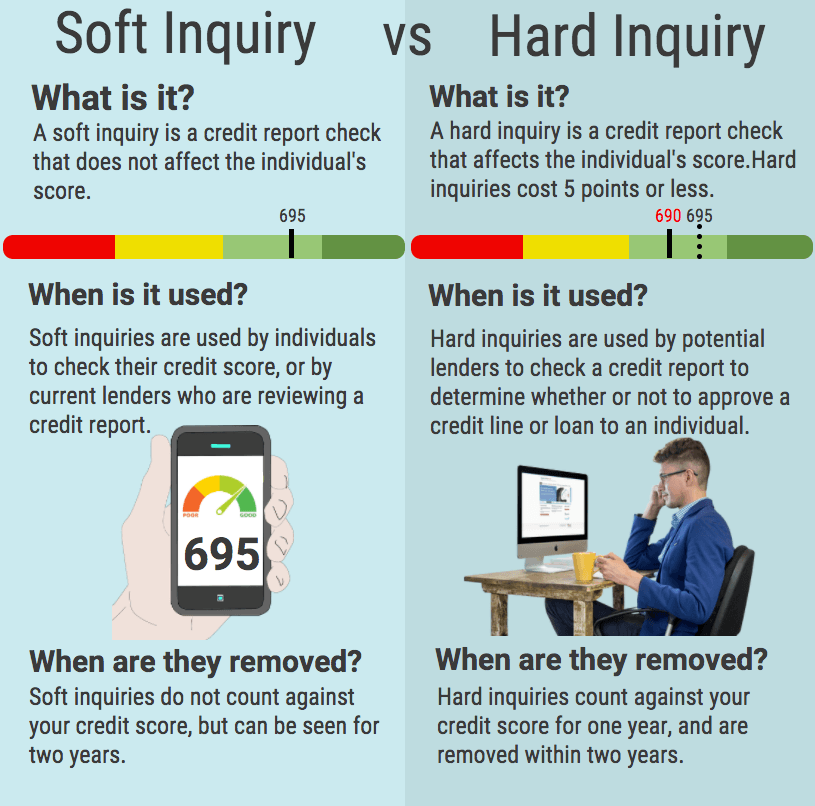

What Is A Soft Inquiry

Soft inquiries, on the other hand, occur when a creditor checks your credit without your permission. This could be a lender with whom youve talked to for a pre-approval quote but havent actually applied for a loan.

Sometimes a soft inquiry might even be pulled by an existing creditor just checking on your current credit situation. Another example of a soft inquiry is from a credit card issuer that would like to send you credit card offers.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: Does Opensky Report To Credit Bureaus

Exceptions To The Impact On Your Credit Scores

If you’re shopping for some types of loans, such as a mortgage loan, multiple inquires for the same purpose within a certain period of time are generally counted as one inquiry. The timeframes may vary, but range from 14 days to 45 days, depending on the credit scoring model being used. All inquiries will show on your credit reports, but generally only one within the specified period of time will impact your credit scores. This exception does not apply to credit cards.

Why Its Important To Remove Inaccurate Hard Inquiries

If you spot a hard credit inquiry on your credit report and its legitimate , theres nothing you can do to remove it besides wait. It wont impact your score after 12 months and will fall off your credit report after two years.

However, if you spot a hard credit inquiry you dont recognize, its vital to remove it. There are a few reasons for this. First, it means that youre being unfairly penalized for that error, even if it only has a small impact. Second, it could be a sign of fraud, so its important to investigate it further and to get it removed.

Read Also: Shopify Capital Eligibility Review

What About Inquiries From Fraud

If youve found an inquiry on your credit report that you believe to be fraudulent, submit your request to dispute the fraudulent inquiry with the correct credit bureau and then request for them to place a security freeze or a fraud alert on your account. A fraud alert typically stays on your credit report for six years, while a security freeze will put a stop on any new accounts from opening under your name and prevent inquiries without your permission.

How Long Do Inquiries Stay On Your Credit Report

As briefly mentioned above, you generally are stuck with your intentional checks for about 24 months. After these two trips around the sun, credit bureaus will remove them from your profile. However, just because they are on your report, it does not mean that your score will be decreased for that entire time. In fact, most hard pulls will only affect your score for half of that time 12 months.

Thus, many people can go their entire lives without having to worry about disputing inquiries. If you would like to apply for additional credit but are in no rush to do so, it is in your best interest to wait a year after your last hard pull if your score is not otherwise high enough. If you are itching to remove your hard inquiries fast though, and feel you have the standing to do so, see the following section for steps on drafting a letter to remove inquiries from your credit report.

Also Check: Does Carvana Report To Credit Bureaus

The Purpose Of This Letter Is To Have Several Unauthorized Hard Credit Inquiries Removed From My Credit Report I Have Received A Copy Of My Credit Report From Your Bureau On 01/23/2020 And Noticed That There Are Three Unauthorized Inquiries Listed

The unauthorized inquiries are listed below, and I have also highlighted them on the enclosed copy of my credit report.

Item One Name of CompanyItem Two Name of Financial InstitutionItem Three Name of Credit Union

I have sent letters to these three companies and asked them to stop the unauthorized inquiries and have them removed from my credit report.

However, it has been 60 days and I have had no response from them. The letters were sent by certified mail, so I am sure when they were received.

Kindly investigate my claim in accordance with the Fair Credit Reporting Act. If you find any unauthorized inquiries, please remove them as quickly as possible and send me a copy of my new, accurate credit report.

Sincerely,

New York City, NY 20009

RE: Hard Credit Inquiry Removal Request

Dear :

I am writing to request several credit inquiries that were unauthorized be removed from my credit report. On April 18, 2020, I received a copy of my credit report and became aware of five inquiries that I did not authorize. They are as follows:

1. Name of the Inquiring Company2. Name of the Inquiring Company3. Name of the Inquiring Company4. Name of the Inquiring Company5. Name of the Inquiring Company

How To Remove Hard Inquiries From Credit Reports

The creditor you initiate an inquiry dispute with may do one of three things. They may simply remove the inquiries from your credit report or claim that the dispute is authorized or not respond at all. However, if they fail to respond or fail to furnish you with documented proof of an authorized inquiry within a reasonable amount of time , then they must delete the inquiry.

Additional steps you can take if a creditor fails to take action and address your inquiry dispute are as follows:

Did This Blog Help You? If so, I would greatly appreciate if you like and shared this on Facebook.

About the author

Image courtesy of FreeDigitalPhotos.net

You May Like: What Is Syncb Ntwk On Credit Report

Dont Worry About The Rest

Legitimate hard inquiries can ding your credit score, but not by much and not for long. Hard inquiries … represent potential new debt that doesnt yet appear in the credit report as an account, says Rod Griffin, Experians director of public education.

Typically, any impact drops off dramatically after a month or two, Griffin says, either because you did not add the debt, so theres no risk, or you did open an account and its now wrapped into other credit factors.

Some companies say they can remove even legitimate inquiries from your report for a fee but NerdWallet advises against using them. As long as youre not continuing to pile up applications, time will repair any damage to your credit.

Griffin advises keeping perspective because other things influence your credit score more .

Hard inquiries alone will never be the reason a person is declined for credit, he says. Inquiries may be the proverbial straw that broke the camels back, but they will not be the entire bale of hay.

About the author:Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Check Your Credit Report Carefully And Spot The Inaccuracy You Want To Dispute

The law requires credit reporting agencies to inform you when a company checks your credit. You can find these credit checks listed in your credit report under the Inquiries section.

When you look at the entries, you will see the name of the company that performed the hard pull and the date when your credit report was accessed. Review the entries carefully to see whether you recognize all of them and that they are accurate.

To get a free credit report, visit annualcreditreport.com or call 1-877-322-8228.

Recommended Reading: Syncb/ppc Account

Plan Before Shopping For A Loan

Before shopping for a loan, it’s always smart to proactively plan your finances.

First, learn whether the type of credit you’re applying for can have its hard inquiries treated as a single inquiry. If so, determine the applicable timeframe. Then you can plan your shopping period accordingly.

Second, you may also want to check your credit reports before getting quotes to understand what information is reported. Find out how to request a free credit report from Equifax.

If you’re worried about the effect that multiple hard inquiries may have on your credit reports, it may be tempting to accept an offer early rather than allow multiple hard inquiries on your credit. However, consider your individual situation carefully before cutting your shopping period short. In many cases, the impact hard inquiries have on your credit scores from shopping around will likely be minimal compared to the long-term benefits of finding a loan with a lower interest rate. The more informed you are about what happens when you apply for a loan, the better you can prepare for the process before you start shopping.

How To Remove Inquiries From Credit Report

Do you have excessive credit inquiries showing up on your credit reports?

Are these inquiries causing you to get declined for credit?

If you want to know how to remove inquiries from your credit report then youve come to the right place.

Lets first cover the two types of inquiries and which one actually impacts your FICO® Scores.Soft Inquiries

Soft inquiries also known as soft pulls do not have an impact on your scores. These are inquiries where your credit reports are not being checked by a lender or creditor. For example, ordering your own credit report, credit checks for promotional offers by a credit card company, credit reviews conducted by existing creditors you have an account with, or credit checks by an employer are all examples of a soft pull.

Hard Inquiries

Hard inquiries also known as hard pulls do have an impact on your scores but its minor unless its excessive. Hard inquiries occur when you apply for credit or a loan by filling out a credit application and give permission to a lender or creditor to review your credit reports and scores.

A hard inquiry may lower your score, generally less than 5 points, because the FICO® scoring system calculates credit inquiries for new credit as a potential risk factor.

However, where it becomes a concern is when its excessive and more importantly excessive in a short period of time. This can cause you to get declined for credit even if you have favorable scores.

Let me explain what I mean by excessive hard inquiries.

Recommended Reading: How To Get Car Repossession Off Credit Report

Some Words Of Caution Regarding Credit Repair Companies

Working with a credit repair company might save you time, but its also a lot of money to pay for something you can do yourself.

You should also be aware that there are fraudulent companies that claim they can remove any and all inquiries from your account. By law, a legitimate credit repair company isnt allowed to do this or even make these claims.

Consumer reporting agencies strive for maximum accuracy when it comes to your consumer report. The law requires that they do so, explains Föehl. They are unlikely to remove a legitimate hard inquiry because removing it would make your consumer report less accurate. As such, hiring a credit repair company to remove a legitimate hard inquiry from your consumer report is not a wise investment.

Ultimately, the decision to work with a credit repair agency is a trade-off between time and money. If you can afford the hundreds or even thousands of dollars it may cost to work with a credit repair agency and you feel confident the company can save you time by disputing inaccurate inquiries for you then doing so might be worth it. Otherwise, you should probably just consider doing this yourself.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Also Check: Does Apple Card Pull Credit Report

Look For Any Inaccurate Hard Inquiries

Once youve received your credit report, there will be a section for Hard Inquiries. Youll want to scan over the entire report to make sure its accurate, but pay close attention to the inquiry section. If there are any hard inquiries listed here, make sure that you recognize them.

Its important to note that sometimes the company listed that made the inquiry doesnt match exactly with who you did business with. This often happens if a retailer partners with a bank to manage its credit card program.

For example, while you may have thought you were applying for a card with Victorias Secret or Sportsmans Warehouse, you may have a credit inquiry from Comenity Bank, which manages the credit cards for these two retailers. Thus, you may have to do a bit of Google sleuthing to make sure an inquiry is legitimate.

Why You Should Avoid Too Many Inquiries

For those new to the credit world, it can be quite enticing to accept every offer and apply for every card imaginable. This is a bad idea for several reasons, not the least of which is the impact to ones credit score. Multiple inquiries send up red flags to creditors, in part because it can signal that someone is about to go on a spending spree that they may or may not be able to afford. Multiple inquiries can have a drastic negative impact on a score, especially for those with thin credit files.

There are exceptions when it comes to multiple inquiries. If you are in the market for a mortgage or a student or car loan, you will probably want to do some comparison shopping. The credit bureaus and scoring elves understand this and will count these multiple shopping inquiries as only a single one if they are done in a short period of time . After all, chances are you will only be getting one mortgage or car loan at a time.

I mentioned that landlords can use either a hard or soft inquiry. If the landlord doesnt use a service, the inquiry may be a hard one. If you have multiple landlord inquiries, be prepared to explain why in case they are interpreted as turn-downs from other property owners.

Recommended Reading: Is 672 A Good Credit Score

How Do Hard Inquiries Affect Your Credit Score

Often, questions about hard inquiries arise when someone checks their credit report after applying for an auto loan or credit card, and they notice that theres been an immediate drop in their credit score.

What many dont realize is that the drop in the credit score isnt necessarily from the hard inquiry but rather from a decrease in the average age of accounts.

Hard inquiries are just one aspect of your overall credit score. Its estimated that this category makes up about 10% of your credit file. The rest of the score comes from the following factors:

How much free credit you have available compared to how much you owe. The lower the number, the better.

Account age New credit accounts are seen as less favorable than aged accounts.

Length of credit history The longer youve been a reputable borrower, the higher the score you can achieve.

Payment history Making on-time payments can boost your score, while being late can cause a drop.

Not all credit is created equal. Credit bureaus are looking for a mix of accounts, including credit cards, mortgages, student loans, retail accounts, and car loans.

If, however, you notice that the inquiries show up as individual items on your credit report, you have grounds for a dispute.

To minimize the impact hard inquiries have on your credit score, follow these tips:

Now that you’re aware of the effect of these inquiries, you’ll be able to take steps to prevent unauthorized credit inquiries in the future.