Keep Old Accounts Open And Deal With Delinquencies

The age of credit portion of your credit score looks at how long you’ve had your credit accounts. The older your average credit age, the more favorably you appear to lenders.

If you have old credit accounts youre not using, dont close them down. Though the credit history for those accounts would remain on your credit report, closing credit cards while you have a balance on other cards would lower your available credit and increase your credit utilization ratio. That could knock a few points off your score.

And if you have delinquent accounts, charge-offs, or collection accounts, take action to resolve them. If you have an account with multiple late or missed payments, for instance, get caught up on the past due amount, then work out a plan for making future payments on time. That wont erase the late payments, but it can improve your payment history going forward.

If you have charge-offs or collection accounts, decide whether it makes sense to pay off those accounts in full or to offer the creditor a settlement. Newer FICO and VantageScore credit-scoring models assign less negative impact to paid collection accounts. Paying off collections or charge-offs might offer a modest score boost. Remember, negative account information can remain on your credit history for up to seven yearsbankruptcies for 10.

Make Note Of Inaccurate Details

If you see a credit account being reported that youre unfamiliar with, inaccuracies in accounts that you have already paid in full, or closed accounts that should no longer be on your credit report, you can challenge these inaccuracies. Some discrepancies may be honest mistakes; e.g., the report lists a relatives account as if it were yours because you have a similar name. Other discrepancies may be the result of dishonesty, e.g., identity theft. However minor or serious an inaccuracy may be, its important that your credit report reflect your true credit usage.

Also update your personal information so that lenders have the most current information about you. Deleting an old address or updating your phone number can be done online. You may need to provide supporting documents if you wish to update your name, Social Insurance Number, or date of birth.

You cant dispute everything related to your credit report. For example, you cannot directly dispute your credit score, which is calculated using details of your credit report. If your score has changed and you are unsure why, review the report carefully to find the reasons.

Hard Hits Versus Soft Hits

Hard hits are credit checks that appear in your credit report and count toward your credit score. Anyone who views your credit report will see these inquiries.

Examples of hard hits include:

- an application for a credit card

- some rental applications

- some employment applications

Soft hits are credit checks that appear in your credit report but only you can see them. These credit checks don’t affect your credit score in any way.

Examples of soft hits include:

- requesting your own credit report

- businesses asking for your credit report to update their records about an existing account you have with them

You May Like: Why Is There Aargon Agency On My Credit Report

Problem: Lack Of Credit History = Low Score

Its a credit Catch-22: You need credit to build credit, says Bill Hardekopf, a senior industry analyst at CardRates.com, a company that evaluates credit card offers. This can be a challenge in communities of color in particular, he says. The Urban Institute found that 32 percent of Black people vs. 18 percent of white people didnt have enough information in their credit reports to generate a score.

One way to build history is to open a checking or savings account. But that can be easier said than done: A 2020 Morgan Stanley report on inequality in homeownership found that there is greater commercial branch scarcity in communities with diverse populations. Minimum deposit rules and high checking fees can be other deterrents.

Be aware that even if you have a credit history, it can become stale if you dont continue to use credit regularly. Thats because some of the scoring algorithms treat recent use of credit as a positive factor in calculating your score, Hardekopf says. In some instances, credit card issuers can close inactive accounts, and your credit score can take a hit.

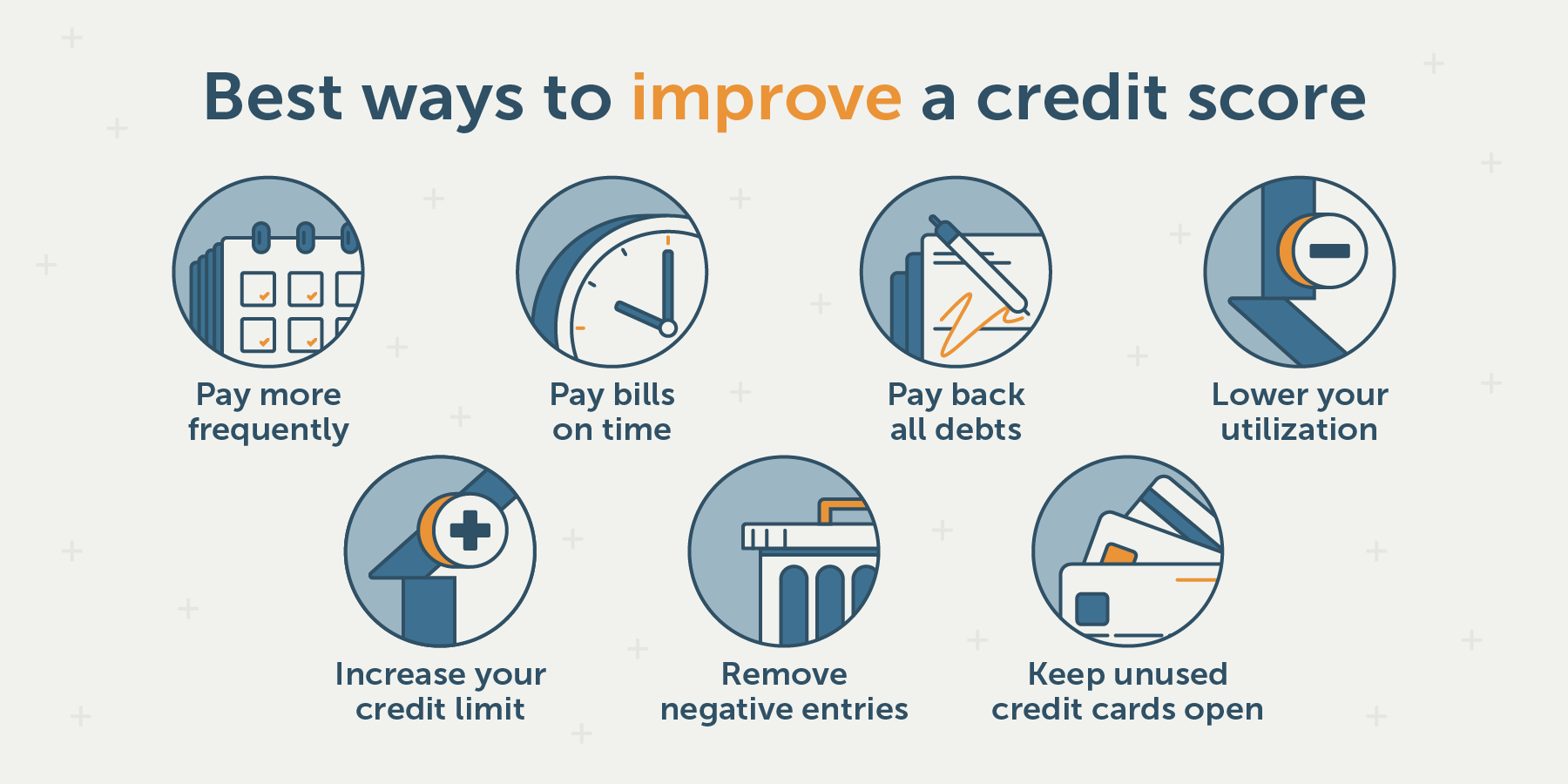

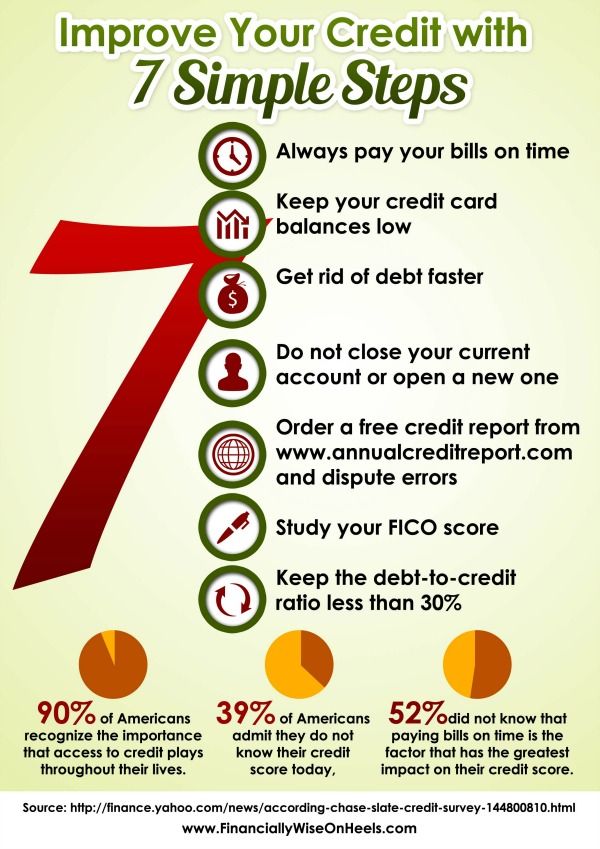

Ways To Boost Your Credit Score Fast

Your financial security might soon depend upon the strength of your credit score.

Like it or not, your credit score dictates everything from whether youre approved for a credit card to what interest rate youre offered on a mortgage or other loan.

So, you would be wise to get your credit score in tip-top shape ASAP. Your financial security might soon depend upon the strength of your score.

Here are some of the fastest ways to increase your credit score.

Recommended Reading: How To Get Credit Report Without Social Security Number

Pay Your Bills On Time

The first step to improving your credit score is to pay your credit card balances on time all of the time. Payment history is the most important factor for ranking your score. Late payments register on your credit as negative information. The later the payment is, the more damage you can expect to your credit score.

Even if you have missed paying your bills on time in the past, the only way to revive your score is to start making payments before they are due. Automate your bill payments so you do not forget!

Related: How To Dispute Errors on Your Credit Report;

Maintain Good Credit Habits

Once youve put in the hard work to build or improve your credit, the best way to maintain your success is by doing more of the same.;

Avoiding negative information, maintaining low credit card debt, and applying for credit sparingly are the best ways to maintain solid credit scores, says credit expert John Ulzheimer, formerly of FICO and Equifax. If you do these three things, you cant help but have great scores.

Don’t Miss: Syncb/ppc Closed

Periodically Use Dormant Credit Cards

As your credit history grows, you likely qualify for credit cards with better rewards and interest rates. Instead of closing your first credit card, make occasional purchases to keep it active.

When you keep the card active, banks are less likely to reduce your credit limit or close the card. The credit bureaus look at each revolving credit account’s credit utilization ratio as well as your overall credit utilization ratio.

A credit line decrease impacts your total credit utilization ratio.

Closing an old credit card account can also hurt your score. If your old card charges an annual fee, see if you can downgrade it to one without an annual fee. You maintain your account history and that continues to strengthen your credit.

Try A Secured Credit Card

Secured credit cards are a stepping stone to building credit for those with a bad or missing history. With this type of account, a lender will ask you to deposit money into a savings account in exchange for a line of credit. Youll still have to make payments out of pocket for any balance you accrue on the card, but if you miss a payment, the creditor will take the outstanding balance out of your savings account. Remember late payments on secured credit cards will show up as derogatory marks on your credit report, just like any other delinquency.

Read Also: Aargon Agency Settlement

Pitfalls To Avoid When Working On Your Credit Scores

When it comes to building credit, its easy to get overly focused on ways to raise your credit scores fast. The truth is that building credit takes time. So take a step back and make sure your strategy doesnt do more harm than good.

Here are a few donts to keep in mind.

- Dont apply for a bunch of new credit cards just because you want to increase your credit utilization. Even though this might help lower your credit utilization ratio, it could also make you look like a risky borrower thanks to the new hard inquiries on your reports.

- For the same reason, dont take out a loan just to improve your credit mix. Only apply for a new loan if you actually need it.

- Dont carry a balance on your credit card just so you can build credit. Carrying a balance can lead to unnecessary interest charges, and it might actually hold your scores down by increasing your credit utilization ratio.

- Dont cancel your credit card after you pay it off unless you have a good reason to do so. Closing your credit card will hurt your length of credit history, so its better to leave it open, even if youre not using it anymore. Of course, if having a card tempts you to spend more, or it comes with an expensive annual fee, you might want to rethink this conventional wisdom.

Get A Secured Credit Card

If your credit score is poor or you do not have a credit history at all , it may be difficult to qualify for a regular credit card.

A secured credit card requires you to put down a deposit with the bank that secures the amount of credit they are extending to you. For example, if your credit card has a limit of $2,000, you will be required to deposit $2,000 in a designated account.

A secured credit card helps you to build your credit score when there are limited options. You will still need to pay your balance on time and this is a good way to learn about how to use credit responsibly.

You can compare the other secured credit cards in Canada.

You can also raise your score by becoming an authorized user on someone elses credit account. For example, if you know someone with an excellent credit history, they could add you to their own credit card as an authorized user. They do not have to give you a credit card to use, however, their high credit score will impact your positively.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Check The Results Of Your Dispute

Once the investigation into your dispute is complete, you should receive an email to notify you. Log into your account to review the results and to review the updated credit report. Most dispute investigations are resolved within two weeks, but some may take up to 30 days. Contact your lender if you disagree with the results of the investigation.

Pay Balances On Time Going Forward

Timely payments are one of the most surefire ways to boost credit. If youre unable to make this happen, youll want to call the companies responsible for the particular payment lines youre struggling to pay. That way, they can advise you on the best scenario to avoid disrupting your credit even further.

This could include a new repayment plan, for example.

Read Also: Does Paypal Working Capital Report To Credit Bureaus

Factors Affecting Credit Score Rebuilding

Several factors will determine how long it will take to rebuild your credit score. Out of these, it is essential to note that different credit bureaus have different approaches to the credit rating and credit report generating.

Besides, no credit repository would publicly disclose its formula and approach towards credit scoring. This reason brings us to the general factors determining how long it will take before you regain your credit scores.

Get A Loan With The Help Of A Cosigner

Making on-time payments toward an installment loan, similar to making timely payments on a credit card, helps build credit history. Besides using a credit-builder loan, getting a traditional one such as a car loan can add positive information to your credit report and improve your credit mix.

If you can’t qualify for a loan on your own, a cosigner can helpbut make sure the cosigner knows what they are getting into. If you can’t afford to repay the loan, it becomes their responsibility. Also, as always, only seek out a loan if you really need it, not simply to improve credit. Potentially boosting your score should be an added bonus or motivation, not the central reason.

Also Check: How To Remove Inquiries Off Credit

Continue To Use Your Credit Accounts Responsibly

Once you build your credit score and qualify for higher credit limits and better interest rates, it could be tempting to take advantage of these improved terms by making big purchases. But this mindset should be avoided at all costs. Just because you have credit available doesnt mean you have to use it.

Sign Up For Experian Boost

If your low score is primarily the result of being new to the credit-seeking game and you are timely with your payments for utilities and your cell phone, ask the lender to pull a report from Experian, using its Experian Boost plan. This hybrid model draws on what the industry calls alternative credit data ; non-traditional payments that provide lenders useful insight into an applicants creditworthiness.

The way forward gets a little steeper from here, so its a good idea to know what youre up against.

Don’t Miss: What Credit Report Does Comenity Bank Pull

How Does A Poor Credit Score Affect You

Is your credit score above 670 or so? This is optimal. Anything below that number is a moderate result . If you fall into the latter category, that means you have poor credit.;

- High-risk label: You could be labeled high risk by lenders, which means your chance to qualify for loans will be quite slim.

- Insurance premiums: Poor credit may mean your insurance premiums are higher than they need to be.

- Employment: Some employers might deny you a job based on this, as it could indicate a lack of responsibility in their eyes.

- Interest rates: You may face higher interest rates because of it.

How To Improve Your Credit Score Quickly

The major contributing factor to improving my credit score in just 30 days was decreasing my ratio. I lowered my credit utilization ratio by 19%!

This took two different steps.

First, I paid more than the minimum amount due on my credit cards. I do that anyway, but I bumped up the amount by about $25.

Second, I increased my available credit on one of my credit cards by accepting a credit line increase offer on my account. I would definitely suggest that you accept any credit line increase offer. Just be smart enough not to use it!

Its suggested that you request a credit line increase once every 6-12 months. Why? It helps with your credit utilization ratio, and that helps your credit score.

Your credit utilization ratio is the amount of debt you have divided by the total amount of credit youve been extended. Sign in to your credit card account online to see if a credit limit request is waiting for you, or call the number on the back of your card to find out about your options. The suggested utilization ratio is 30% or less on each individual account and all accounts combined.

Another major contributing factor is my perfect track record of on-time payments. According to Credit Karma, I have a 100% record of consistent, on-time payments. I manage to never miss a payment by maintaining my own personal bills calendar, which tells me when all of my bills are due. I even set reminders one week early to allow room for any mistakes.

You May Like: Paypal Credit Hard Pull

Check Your Credit Reportson A Regular Basis To Track Your Progress

No matter where you turn for your credit check-in your bank, or one of the major consumer credit bureaus its important to keep an eye on your credit. And if you find any mistakes or inaccuracies, we can help you file a dispute. If your dispute is approved by the credit bureaus, you may see the error corrected as soon as within 30 days, which can help raise your credit scores.

Aim For 30% Credit Utilization Or Less

refers to the portion of your credit limit that youre using at any given time. After payment history, its the second most important factor in FICO credit score calculations.

The simplest way to keep your credit utilization in check is to pay your credit card balances in full each month. If you cant always do that, a good rule of thumb is to keep your total outstanding balance at 30% or less of your total credit limit. From there you can work on whittling that down to 10% or less, which is considered ideal for improving your credit score.

Use your credit cards high balance alert feature so you can stop adding new charges if your credit utilization ratio is getting too high.

Another way to improve your credit utilization ratio: Ask for a credit limit increase. Raising your credit limit can help your credit utilization, as long as your balance doesnt increase in tandem.

Most credit card companies allow you to request a credit limit increase online; you’ll just need to update your annual household income. Its possible to be approved for a higher limit in under a minute. You can also request a credit limit increase over the phone.

Read Also: How To Get Bankruptcy Off Credit Report Early

Protect Your Personal Information To Avoid Fraud

Your credit can be affected by identity theft, which is when fraudsters access your personal information and open accounts in your name. To help keep your data safe, use a password manager to create and store unique passwords and avoid making financial transactions on public Wi-Fi networks, which could leave you vulnerable.

Keep Old Accounts Open

Even if you no longer use an old credit card, it’s typically best to keep the account open. That’s because your credit scores benefit from a long credit history and a high total credit limit. Closing established accounts will shorten the average age of your accounts and lower your total credit limit. It will take years before an account closed in good standing drops off your credit report, but the effects on your credit utilization rate are immediate. If a credit card comes with a high annual fee you can’t afford, closing the account could be a good optionor ask your issuer to downgrade the card to a no-fee version if possible.

You May Like: Does Opensky Report To Credit Bureaus