Check Your Credit And Monitor Your Progress

While you’re working your way toward the credit score needed to buy a house, check your progress with a free score some credit cards and many personal finance websites offer them.

Free credit scores often are VantageScores, a competitor to FICO. Either type of score can be used to track your progress they both emphasize the same factors, with slight differences in weighting, so they tend to move in tandem.

Mortgage lenders check older versions of the FICO score . If you want to see where you stand on those so you know exactly what mortgage lenders will see, youll have to purchase a comprehensive FICO report. You can do that at myFICO.com, then cancel the monthly service rather than pay an ongoing fee. Be sure to cancel before the next billing cycle starts the monthly subscription fee will not be prorated.

However, if youre near or in the excellent credit score range on a free score source, you dont need to pay to check your FICO scores. You almost certainly have good enough credit to qualify for the best rates.

What Mortgage Lenders Look For When Approving A Home Loan

When you apply to get pre-approved, your lenders will review your credit history and consider your current credit outlook. This includes looking at:

- How on-time have you been with your payments and obligations?

- What does your current debt load look like, and how is it spread out?

- How much experience do you have managing credit?

- Have you been recently trying to acquire access to new sources of credit?

- Do you let items go into collections?

- Have you previously filed for bankruptcy?

Lenders ask these questions to get comfortable with you. Your financial health isnt the only consideration lenders make, but how you manage your bills tells a large part of your story.

Lenders also look for specific credit events known as derogatory items, like bankruptcy or delinquent accounts.

Derogatory items dont disqualify a mortgage approval. Generally, its only required that theyre historical events and not current ones. For example, you can get approved for a mortgage if youve declared bankruptcy in the past, or if youve lost a home due to foreclosure.

Lenders know that life is unexpected and bad things happen. Whats important is whats happened in the time since the derogatory event occurred.

Can I Get A Usda Loan With A 500 Credit Score

USDA Rural Housing Loans does not publish a minimum credit score requirement. Nonetheless, you may be able to get a USDA loan with a score as low as 580.

If you want to be eligible for automatic loan approval through the USDAs automated underwriting system, youll need a credit score of at least 640.

USDA loans are an attractive alternative for low-to-moderate-income consumers who want to live in a rural or suburban area. About 97% of the geographical United States is eligible for USDA home loans.

You can get either a direct or guaranteed loan from the USDA. Direct loans are available if your income is low or very low, and eligible homes must meet the agencys requirements for cost, size, and other criteria.

USDA guaranteed loans insure 90% of the loan amounts from USDA-approved lenders, which may allow you to avoid a down payment, even with a bad credit score. USDA charges only 1% for private mortgage insurance, whereas FHA loans charge 1.75%. Moreover, USDA loans charge less interest than loans guaranteed by the FHA.

Recommended Reading: Is 661 A Good Credit Score

How Much Do Rv Loan Interest Rates Vary By Credit Score

Heres a look at how your credit score may affect your RV loan interest rate, according to Good Sam, a major company offering RV financing:

How RV Loan Interest Rates Vary by Credit Score

| Loan Amount | |

|---|---|

| 5.24% | 5.24% |

As you can see, your credit score has a major impact on your interest rate. Again, this means that if you can wait to get an RV until your credit score improves, the purchase will be much less of a financial burden.

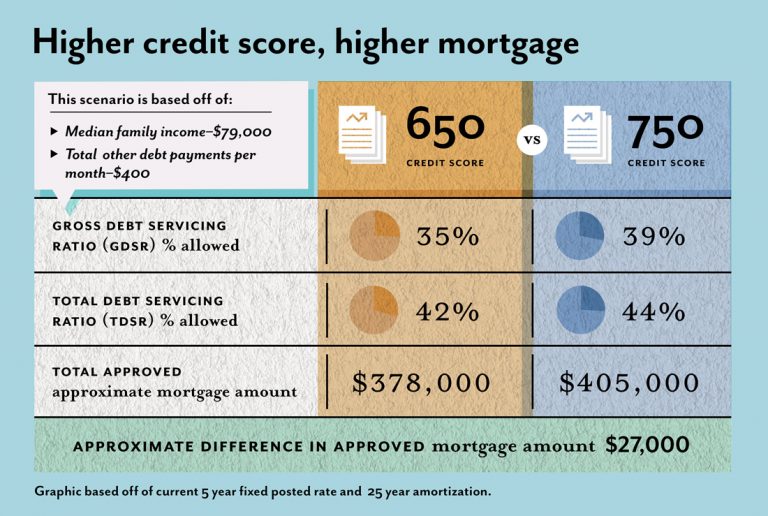

How Your Credit Score Affects Your Mortgage Eligibility

When it comes to getting a mortgage, your credit score is incredibly important. It determines:

- What loan options you qualify for

- Your interest rate

- Your loan amount and home price range

- Your monthly payment throughout the life of the loan

For example, having a credit score of excellent versus poor could fetch lower interest rates, which can save you over $200 per month on a $200,000 mortgage.

And if your credit score is on the lower end, a few points could make the difference in your ability to buy a house at all. So, it makes sense to check and monitor your credit scores regularly, especially before getting a mortgage or other big loan.

The challenge, however, is that theres conflicting information when it comes to credit scores.

There are three different credit agencies and two credit scoring models. As a result, your credit score can vary a lot depending on whos looking and where they find it.

Recommended Reading: What Is Cbna On My Credit Report

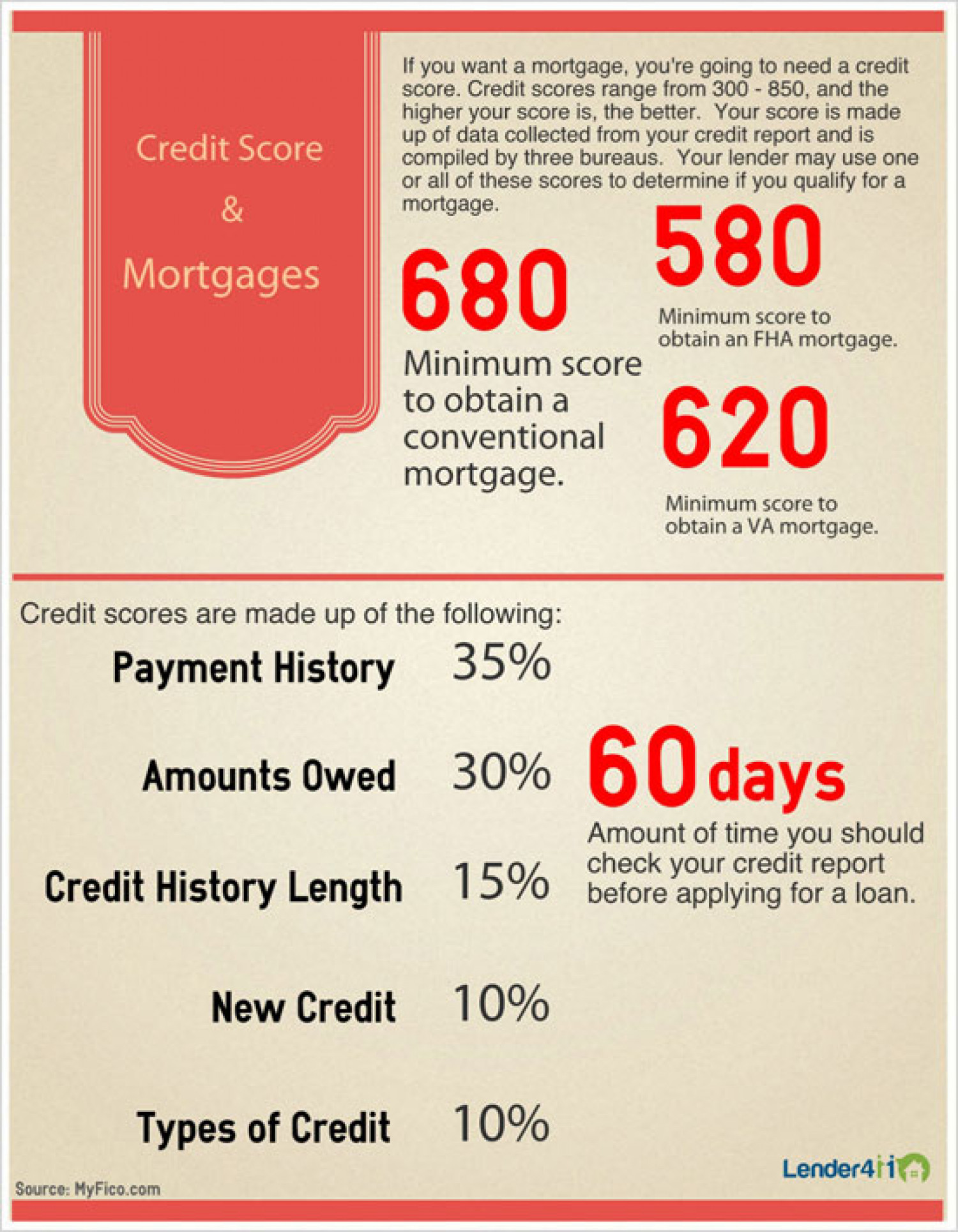

What Makes Up Your Credit Score

The FICO credit scoring model interprets the information found in your credit report. Some parts of your credit history are more important than others and will carry more weight on your overall score.

Your FICO score is made up of the following:

- Payment history: 35% of your total score

- Total amounts owed: 30% of your total score

- Length of credit history: 15% of your total score

- New credit: 10% of your total score

- Type of credit in use: 10% of your total score

Based on this formula, the largest part of your credit score is derived from your payment history and the amount of debt you carry versus the amount of credit available to you. These two elements account for 65% of your FICO score.

To put yourself in the best position to qualify for a mortgage, focus on these areas first. Pay your bills on time whenever possible, and try to reduce your credit utilization ratio.

Your credit utilization ratio compares the total amount of credit available to you against your current balances try to keep it under 30%.

This will improve your FICO scores and mortgage loan terms measurably.

Read Also: How Does A Home Equity Conversion Mortgage Work

Which Home Loan Company Is Best For Bad Credit

We give our top rating to eMortgage. It excels in connecting you to multiple home loan offers from competing bad credit mortgage lenders or mortgage broker companies.

You need only fill out one short loan request form to get up to five quotes within two minutes.

| 4 minutes | 8.5/10 |

Wells Fargo Home Mortgage receives a slightly higher score among the direct-lending banks, thanks mostly to its Easy to OwnSM programs that are optimized for applicants with limited credit history, low income, and low down payments. The bank offers some home loans that do not require monthly mortgage insurance, an unusual feature.

Any bad credit mortgage lender allowed to participate in a government-guaranteed home loan program must meet certain standards that help ensure honest dealings.

Perhaps your biggest concern when applying for a guaranteed loan is bait-and-switch tactics, where a bank offers, say, FHA mortgage loan deals but then tries to get you to choose its own conventional home loan products instead. Thats fine as long as its a truthful, above-board effort.

You May Like: What Does Collection Account Mean In Credit Report

How Your Credit Score Impacts Your Apr

Your credit score has a major effect on the APR of your loan. The APR of any installment loan, such as a mortgage, reflects the cost of interest expense and fees over the life of the loan. The higher the APR, the more the borrower will have to pay.

If you apply for a $250,000, 30-year mortgage, you can wind up paying wildly different amounts depending on your credit score, as shown below.

Prep Your Credit As Far In Advance As Possible

Youd be amazed at the difference that a few months of credit prep can make to your loan applications. If possible, take steps to rebuild your credit in the months leading up to your RV loan applications.

Here are simple tips that will go a long way to improving your credit score:

- Pay all your bills on time: Your payment history is the most important factor influencing your credit score. Late payments can do a lot of damage to your score, whereas on-time payments can improve it.

- Keep your credit utilization low: Reduce your by lowering your spending on your credit cards or increasing your credit card limits.

- Use credit-building tools: Build up credit by taking out a , getting a secured credit card, or signing up for Experian Boost.

Keep new credit applications to a minimum: Make sure you dont have too many hard inquiries in the months leading up to when you plan to apply for RV financing.

Takeaway: You can get an RV loan with a credit score as low as 550, but the best loans require higher credit scores.

Article Sources

Recommended Reading: When Does Chase Sapphire Report To Credit Bureaus

How To Improve Your Credit Scores

Its clear that good credit scores are one of the more important factors when trying to gain mortgage approval. Its also a factor in calculating the interest rate youll be given, so having a high credit score can also save you thousands of dollars over the course of your amortization. Therefore, its best to get your credit scores in the best shape you can manage before you apply with any lender. Here are a few simple things you can try that may help improve your credit scores.

- Paying bills on time and in full

- Do not carry a large amount of unpaid debt

Also Check: How To Apply For Mortgage Assistance

Does A Bad Credit Score Automatically Disqualify You For A Home Equity Loan

Not necessarily. While a score in the poor range probably does disqualify you, some lenders will look at other factors in addition to your credit score if it falls in the lower portion of the good scale or high fair. However, if you are approved, you will likely not have as attractive an interest rate as you would with a better score.

Recommended Reading: What Is The Best Credit Score

How Credit Scoring Models Affect Your Score

In the old days, banks and other lenders developed their own scorecards to assess the risk of lending to a particular person. But these scores could vary drastically from one lender to the next, based on an individual loan officers ability to judge risk.

To solve this issue, the Fair Isaac Corporation introduced the first general-purpose credit score in 1989. Known as the FICO Score, it filters through information in your credit reports to calculate your score.

Since then, the company has expanded to offer 28 unique scores that are optimized for various types of credit card, mortgage, and auto lending decisions.

But FICO is no longer the only player in the game. The other main credit scoring model youre likely to run into is the VantageScore.

Jeff Richardson, vice president for VantageScore Solutions, says the VantageScore system aimed to expand the number of people who receive credit scores, including college students and recent immigrants, and others who might not have used credit or use it sparingly.

Introducing The Fico Score 10 Suite The Most Recent Updated Fico Score Version

FICO Score 10 relies on the same design and key ingredients of prior models as well as captures the subtle shifts in consumer credit data that have occurred over the 5+ years since FICO Score 9 launched, such as the increasing use of personal loans, especially for purposes of debt consolidation.

As long as consumers practice good habits like consistently paying bills on time, lowering their debt as much as possible, and applying for credit only when needed, they can achieve and maintain a good FICO Score 10.

FICO Score 10 T builds on FICO Score 10 by also assessing “trended credit bureau data” when determining your score. Scores that don’t use trended data typically use the most recently reported month of data to drive certain components of the score such as the most recently reported balance and/or credit limit on an account.

The trended data allows the credit scoring model to determine what your “trend” is: are your balances trending up, down, or staying the same? Someone whose balances are trending up may be higher risk than someone whose balances are trending down or staying the same.

FICO Score 10 and FICO Score 10 T are currently available to lenders.

Recommended Reading: What Score Does Credit Karma Use

Make As Large A Down Payment As You Can Afford

The reason its harder to qualify for RV financing when you have poor credit is that from your lenders perspective, theres a higher risk that you wont repay the loan. Making a larger down payment when buying an RV will offset some of this risk by reducing the amount you need to borrow and showing your lender that you take your financial commitments seriously.

Paying more upfront could also get you a lower APR . Between the lower interest rate and the lower loan amount, you could end up saving a lot of money over the life of your RV loan.

Mortgage Lenders Use A Tri

- Unlike most other creditors such as credit card issuers and auto loan lenders

- Mortgage lenders pull all 3 of your credit scores

- Then use the middle score for qualification purposes

- So all 3 need to be in good shape in order to receive the best pricing

If you want to know where you stand beforehand, be sure to go with a service that allows you to see all 3 credit scores from Equifax, Experian, and TransUnion.

As mentioned, mortgage lenders typically pull a tri-merge credit report, which includes credit scores from all three of those bureaus.

The bureaus each report information a little differently, so knowing just one score wont do you much good.

Aside from the scores, payment history and amounts may differ, so its important to see them all.

As far as lenders are concerned, it basically allows them to triple-check your credit before making the decision to hand over a large sum of money.

They use the mid-score for pricing/qualification, so its imperative that all 3 credit scores are in tip-top shape.

You May Like: How To Fight Late Payments From Credit Report

Talk To The Mortgage Pros For Guidance During The Loan Process

If you are trying to secure a favorable home loan for your real estate purchase and are concerned about your credit or would like to learn more about your options given your current creditworthiness, be sure to talk with a real estate and mortgage financing expert.

The professionals at Fairfax Mortgage Investments would be happy to help you achieve advantageous terms on your mortgage and prepare you for the process of closing on a home. Reach out to schedule an appointment to discuss your situation and develop a strategy to put you in the best position possible for this important financial decision.

Which Credit Bureau Is Most Important When Buying A House

The most important credit bureau or score when buying a house is the one your lender will utilize to change an underwriting decision for a loan application.

Because of the large loan amounts, mortgage companies typically use all three bureau reports. The outlier, if any, could be the one to change approval to a denial.

Therefore, you should focus on identifying the agency that reports an adverse trade line that does not appear on the files of the other two bureaus.

As you will shortly learn, this one anomaly could impact your Tri-Bureau merged report and make the middle credit score lower than it might otherwise be.

You May Like: How To Repair Your Credit Score

Preparing Your Credit For A Mortgage

If youre planning to purchase a home or refinance your mortgage, its smart to keep a close eye on your credit reports and credit scores. You can purchase the same FICO scores used by mortgage lenders at FICOs website, myFICO.com.

You can also monitor the health of your credit reports, which are the sole basis of all of your credit scores, at no cost. Federal law gives you the right to claim a free copy of your three credit reports once every 12 months at AnnualCreditReport.com.

However, through April 2021, you can access a free copy of your three reports once a week on the same website. This move was announced by the three credit bureaus in in response to the COVID-19 pandemic.

These free weekly credit reports dont include your credit scores, but they will show you the information upon which your credit scores are based.

Check Your Credit First

Regardless of the type of loan youre applying for, its always a good idea to first review your credit reports and check your credit score so youre not going in blind. You can access your credit reports from all three credit bureaus for free at AnnualCreditReport.com.

Lenders are going to check your credit history and your credit score when you apply for an RV loan. Knowing what theyll see will give you the opportunity to fix any problems with your credit.

In particular, you could have worse credit than you thought if your credit report contains errors, such as an overdue debt that belongs to someone else or a bill payment that was mistakenly reported as late. For optimal credit health, dispute the errors on your credit report with the credit bureaus if you notice any inaccuracies in your credit file.

Don’t Miss: How To Fix Credit Report