The Average Credit Score By Age State And Year

Insider’s experts choose the best products and services to help make smart decisions with your money . In some cases, we receive a commission from our our partners, however, our opinions are our own. Terms apply to offers listed on this page.

- The average American has a credit score of 714, according to data from Experian. That’s considered ‘good’ by FICO’s score ranges.

- People over 50 have average credit scores higher than the national average. Scores in some states, including Minnesota, Wisconsin, and Vermont, tend to exceed the US average, too.

The average credit score in the US is 714, according to credit reporting company Experian, calculated using the FICO scoring model.

Credit scores, which are like a grade for your borrowing history, fall in the range of 300 to 850. The higher your score, the better people with higher credit scores tend to get better interest rates on loans, have access to and lower interest rates, and could even pay less for insurance.

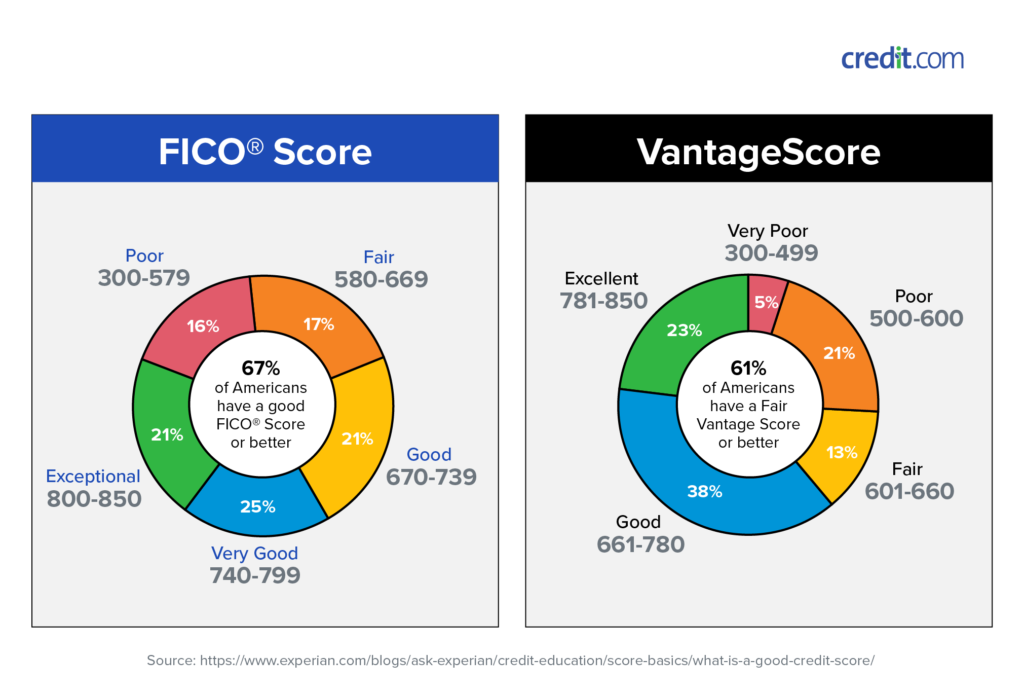

The FICO model of credit scoring puts credit scores into five categories:

- Very poor: 300-579

- Very good: 740-799

- Exceptional: 800-850

Based on this scoring system, the average American has a good credit score. But, the average credit score is different by demographic.

Benefits Of Having A Good Credit Score

Good credit is crucial when applying for loans, lines of credit and credit cards. Approval is much easier when you have good credit, and you’re more likely to qualify for a low-interest rate.

Here’s how much a good credit score can help you. Let’s say you want to take out a $200,000 mortgage, and you have a credit score between 620 and 639. You may qualify for a 6.788% interest rate on a 30-year mortgage. If you had a credit score between 680 and 699, however, you would qualify for a 5.598% interest rate and end up saving $55,565 in total interest.

Having good credit can also make it easier to set up utilities for a house or apartment. If you don’t have good credit, you may have to provide a refundable deposit. Car insurance companies will also run a credit check, and those with good credit may pay lower premiums than those with poor credit.

How To Find Your Credit Score

There is no one credit score for each consumer. Both FICO and VantageScore produce different credit scores for different types of loans. They also update the scoring algorithm every few years. That’s why every consumer may have multiple credit scores.

In general, you can use free services to look up your credit score. Many banks and credit card providers also provide a free credit score. Just be aware that you will likely not see the same score that a lender will see.

Checking your score regularly is a good way to monitor change and ensure that it’s trending upward. It’s good to view your score at least once a month to ensure that no mistakes have been reported to the credit bureaus and that you haven’t done anything to hurt your score.

It’s important to stay on top of your credit score and history and work to improve it.

Don’t Miss: What Credit Score Do You Need For Affirm

What Are The Factors That Affect Your Cibil Score

Given the significance of your CIBIL score, it is important to ensure that it’s always towards the higher side. To do this, it is vital to be aware of the factors that affect your credit score and control them accordingly. Here are the factors that affect your CIBIL score:

- Your income

- Any defaults, delays, or lapses in previous credit repayment

- Rejections for loans that you have applied for

Tips For Getting A Good Credit Score

The fundamentals of credit building are the same no matter your starting point. But if youre beginning with bad credit, your first order of business should be to stop the bleeding. If youre delinquent on an account, for example, making the payments necessary to become current will prevent further credit score damage.

Finally, there are more tips and tricks of the trade to discover once youve nailed down the basics. You can learn more about those strategies in our .

Read Also: How Does Credit Score Affect Mortgage

Why Your Credit Score Matters

There are real benefits to staying on top of your credit score.

Thats because a strong credit score can translate into real perks, like access to a wider range of products and services including loans, credit cards and mortgages. You could also enjoy better interest rates and more generous credit limits. Meanwhile, if your credit score isnt quite where you want it to be, knowing the score is the first step to improving it.

Either way, it pays to know your credit score. Its your financial footprint the way companies decide how financially reliable you are. A higher credit score means lenders see you as lower risk.

Exceptional Credit Score: 800 To 850

Consumers with a credit score in the range of 740 to 850 are considered consistently responsible when it comes to managing their borrowing and are prime candidates to qualify for the lowest interest rates. However, the best scores are in the range of 800 to 850.

People with this score have a long history of no late payments, as well as low balances on credit cards. Consumers with excellent credit scores may receive lower interest rates on mortgages, credit cards, loans, and lines of credit, because they are deemed to be at low risk for defaulting on their agreements. Having an excellent credit score is particularly useful for qualifying for a personal loan, as it typically more than makes up for a lack of collateral.

Read Also: How To Get Free Credit Score

What Is The Average Credit Score In Canada By Age

Join millions of Canadians who have already trusted Loans Canada

Good credit is a valuable tool for anyone trying to get approved for credit. While income and low debt are also important factors, good credit allows you to qualify for credit products more easily and access lower interest rates. Having access to low-cost credit can help you save on different financial goals such as paying for higher education, buying a car or a house. Given the importance of your credit, its best to keep tabs on it and ensure its health.

It can be tough to predict what your own credit scores will look like in the years to come. You could experience debt issues, job loss, or bankruptcy, no one can predict the future. While its never a good idea to compare your finances to someone elses, it can be beneficial to understand the average credit score Canadians have at your age range.

A Quick Guide Explaining Credit Scores Including How They Work What Range Is Considered Good And Why Theyre Valuable

- FICO says good credit scores fall between 670 and 739. Thatâs on a scoring range from 300 to 850.

- VantageScoreâs good scores are reported to fall between 661 and 780. And like FICO, VantageScore also uses a scoring range of 300 to 850.

But thereâs a lot more to it than that. So keep reading to take a closer look at credit scores, including how theyâre determined, whoâs looking at them and what you can do to monitor and improve yours.

Don’t Miss: How Do You Get A Free Credit Report

Tips For Improving Your Credit Score

You can work toward improving your credit score no matter where you live. Since payment history is the biggest factor influencing your credit score, paying your bills on time is the best thing you can do to improve your credit score. Catch up on past due accounts and take care of debt collections.

Minimize the amount of credit you’re using. Having high credit card balances also will bring down your credit score. While it’s easier on the budget to pay just the minimum on your credit cards each month, that’s not the best thing for your credit. Work on paying down your credit card balances to below 30% of the . The lower the better. Maintaining extremely low credit card balances will help boost your credit score. This shows lenders that you can handle credit responsibly and not allow it to get out of control.

Apply for new credit only as needed. While each new credit card will ding your credit a little, the real harm in opening several credit cards is the risk of running up large balances and missing payments. Minimize the number of credit cards you apply for.

How To Maintain Your Credit Score

One way to maintain your credit score is to try to stay within the 35% ratio mentioned above.3 Add up all your credit limits and multiply the total by 35%. Thats the amount you should ideally try to avoid exceeding when borrowing money or using credit.3

Avoid applying for too much credit

There are some downsides to having too many credits cards. You may be tempted to use them and spend more.

According to the federal government, you should also avoid applying for too many loans, having too many credit cards and requesting too many credit checks in a short timeframe.3 Thats because it could negatively impact your credit score too.3

Stay within your credit limit

Avoid going over your credit limit. If you go over your limit, it could lower your credit score.3

Overall, having a good credit score can help boost your financial confidence and security. So, congrats on taking the first step by learning how credit scores work and how you can improve yours!

Legal

Recommended Reading: Who Looks At Your Credit Report

The Average Canadian Credit Scores

According to TransUnion , the average Canadian credit score is around 650. Based on the credit score ranges we discussed above, most Canadians have fair credit, though some lenders may consider 650 as good.

Does Age Matter?

According to Equifax, Canadas second credit reporting bureau, the highest percentage of Canadian citizens with a credit score of 750 and higher are in the 65 and older age group. On the other hand, the highest percentage of Canadians with a score of 520 and under are in the 25 and younger age group.

Age does play a factor in the credit health of most Canadians. Technically, younger Canadians are more likely to have lower credit scores while older consumers are more likely to have higher scores. But, its important to keep in mind that this is not always the case, just because youre under 25 doesnt mean youll automatically have bad credit.

There are a couple of reasons why this is often the case:

- As mentioned your credit age generally accounts for 15% of your credit scores. As such, a 65-year-old will have decades over a 25-year-old to build that category.

- Good financial habits take time to develop. Generally speaking, young adults are more likely to make irresponsible financial decisions that will negatively affect their credit scores.

As you can see, good credit is all about time. So, dont beat yourself up if youre currently struggling to improve or build your credit scores, give it time and it will happen.

How To Get A Loan Despite A Poor Credit Score

- Borrow from non-banks:While non-banking financial companies, like Bajaj Finserv, still need you to have a decent credit score, they tend to have relatively simpler eligibility criteria, which may help you raise funds fast and without too much effort.

- Apply with a guarantor or co-signer to your loan account:Adding a co-borrower to your loan application helps distribute the responsibility of repayment between you and the co-borrower. When your co-borrower has a good score, you will be able to borrow a larger loan amount and boost your chances of approval too.

- Try to find a secured loan:When a loan is unsecured, the lender is more stringent with the eligibility criteria by carefully filtering and selecting the most reliable borrowers. However, if you have collateral to offer, the significance of having a good credit score diminishes.

Additional Read: Get a personal loan on a bad CIBIL score

Read Also: Is 818 A Good Credit Score

Start With A Credit Checkup

Youll want to start any credit improvement plan with a checkup of your three credit reports from Equifax, TransUnion and Experian. Credit scoring models rely on the details on your credit reports to calculate your credit scores. If any incorrect information is present, it could have a negative credit score impact.

Currently, you can visit AnnualCreditReport.com to download free credit reports every week. This benefit is available through April 2022 in response to the Covid-19 pandemic. During normal times, the Fair Credit Reporting Act gives you free access to your credit reports once every 12 months through the same website.

Why Your Credit Score Changed

Your credit score can change for many reasons, and it’s not uncommon for scores to move up or down throughout the month as new information gets added to your credit reports.

You may be able to point to a specific event that leads to a score change. For example, a late payment or new collection account will likely lower your credit score. Conversely, paying down a high credit card balance and lowering your utilization rate may increase your score.

But some actions might have an impact on your credit scores that you didn’t expect. Paying off a loan, for example, might lead to a drop in your scores, even though it’s a positive action in terms of responsible money management. This could be because it was the only open installment account you had on your credit report or the only loan with a low balance. After paying off the loan, you may be left without a mix of open installment and revolving accounts, or with only high-balance loans.

Perhaps you decide to stop using your credit cards after paying off the balances. Avoiding debt is a good idea, but lack of activity in your accounts could lead to a lower score. You may want to use a card for a small monthly subscription and then pay off the balance in full each month to maintain your account’s activity and build its on-time payment history.

You May Like: Will Paying Off Collections Help My Credit Score

What A Fair Good Or Excellent Credit Score Means For You

The better your credit score, the more choices youll have when it comes to applying for a loan or credit card. Thats the bottom line.

If you have a fair credit score and are approved for a credit card, you may be offered a slightly higher interest rate. Your initial credit limit may also be on the lower side. But if you make your payments on time and demonstrate financial stability, you might be able to have your limit increased after 6-12 months.

If you have a good credit score, your chances of being approved for loans and credit cards increases. Youre also more likely to be offered a more competitive interest rate, as well as a more generous credit limit.

Finally, an excellent credit score makes borrowing money and getting credit cards much easier. Its also more likely to get you the best available interest rates and generous credit limits.

What Is The Average Credit Score By Age In The Us

The average credit score in the U.S. stands at 703 as of the second quarter of 2019, but this is not the same for everyone. For instance, Louisiana has the lowest average credit score of 685 in the U.S., while Minnesota has the highest average at 739.

Your age can also indirectly play a role in your score. While age itself is not a factor used in credit scoring reports, the age of your accounts is. The older you are, the older your accounts are and the higher your credit score is, mostly due to your extensive payment history. As people reach retirement age, they generally have less debt, which can improve credit scores.

Different age groups have varying averages, with consumers in their 20s having the lowest average score at 660. Those in their 60s have a significantly higher score as theyve built it over many years, with their average credit score standing at 733. Scores increase the most between 40 to 69, jumping an average of 20 points in each decade.

The some of the links above will take you to one of our partner’s sites, where you can compare and apply for a selected credit card.

Scroll for more

Also Check: How To Get Medical Collections Off Credit Report

What Is A Good Credit Score Range

Good credit score = 680 739: Credit scores around 700 are considered the threshold to good credit. Lenders are comfortable with this FICO score range, and the decision to extend credit is much easier. Borrowers in this range will almost always be approved for a loan and will be offered lower interest rates. If you have a 680 credit score and its moving up, youre definitely on the right track.

According to FICO, the median credit score in the U.S. is in this range, at 723. Borrowers with this good credit score are only delinquent 5% of the time.