What Does My Credit Score Need To Be For A Mortgage

The minimum credit score required to get a mortgage varies by loan type:

| Type of Loan | |

| 700-740 | 10-20% |

*With a credit score between 500-579 you may still qualify for an FHA loan if you can put at least 10% down.

If youre a firsttime home buyer, you may be surprised you could get approved for a mortgage loan with a credit score below 600.

But the score you see in a credit monitoring app, or in your credit card statement, wont be the score your lender sees when it pulls your credit.

The score your lender sees will likely be lower. So if your credit is borderline, youll want to understand how lenders evaluate your credit score and credit history before moving forward with a loan application.

A Mortgage Adds To Your Credit History

Nothing affects credit score more than your payment history.

Mortgages typically require 15 to 30 years of payments, which is plenty of time to polish your score by making on-time payments. It can also eventually contribute to the age of your credit, or how long youve had credit, which may help.

On the other hand, if you miss payments, expect a drop in your credit score.

What Is A Good Mortgage Rate

Mortgage rates change based on economic conditions, so a good mortgage rate now may not be the same as a good mortgage rate one year or five years from now. Published mortgage rates are typically based on an applicant with an excellent credit score, so they may not apply to you if your credit score isn’t high. To find a good mortgage rate for you, get quotes from at least a few lenders so you can compare them and get a sense of what’s available.

Read Also: Does Monroe And Main Report To Credit Bureaus

How Mortgage Rates Change By Credit Scores

Since lenders rely on the borrowers credit scores to determine how likely the borrower is to repay their loan, there is a relationship between credit scores and the mortgage rates that lenders assign to the loan.

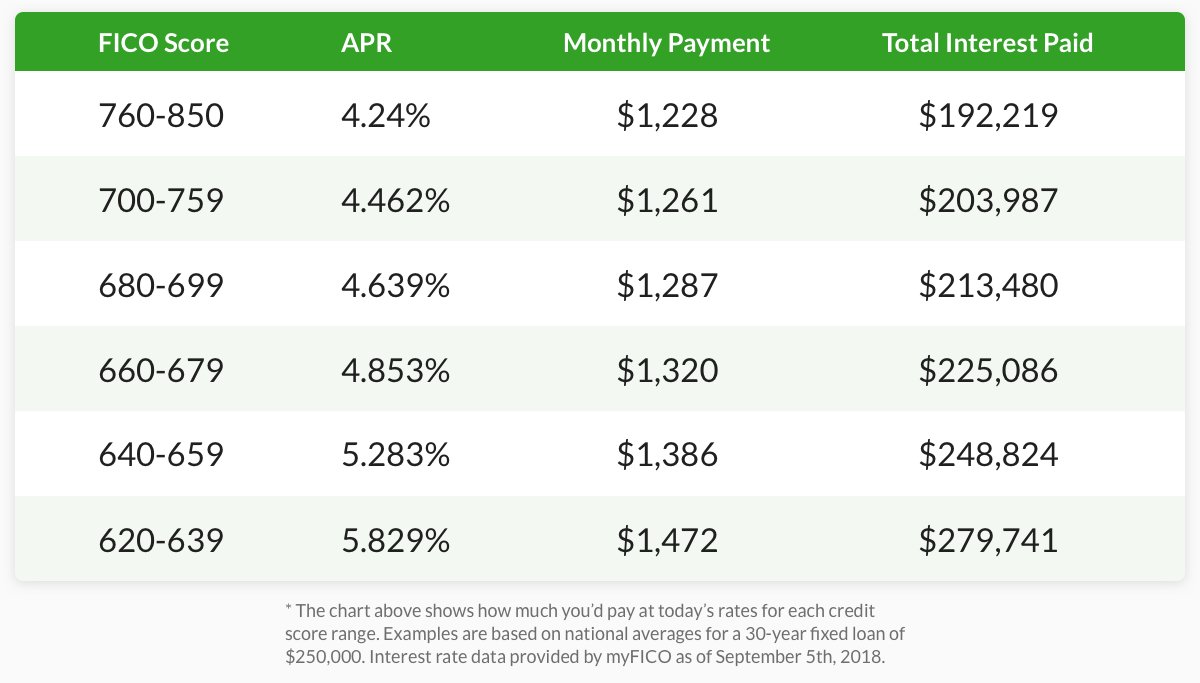

The table below illustrates the relationship between credit score, annual percentage rate , and ultimately your total monthly payment using a loan amount of $300,000. The better the credit score, the lower the APR and the lower the monthly payment:

Source: MyFico

You Applied For Credit

Youll see EMS LACS on your credit report if your prospective lender used one of the companys products to run a credit check on you to determine whether or not to extend you credit. There are two possible ways that an inquiry can appear on your credit report:

- Hard inquiry: Youll see a hard inquiry on your credit report if you actually applied for new credit, such as a car loan or mortgage.

- Soft inquiry: Youll see a soft inquiry on your report if someone checked your credit for reasons unrelated to credit applications or to prequalify you for an installment loan or other type of credit.

The main difference between hard and soft inquiries is that hard inquiries will bring your credit score down by a few points, whereas soft inquiries dont affect your credit score.

Don’t Miss: Syncb Verizon

I Want To Receive Monthly Community News And Updates

Each of the homebuilders has one or more model homes ready to view. Talk to a builder and set up a visit.

Be your own tour guide and explore everything Reed’s Crossing has to offer at your own pace.

Pricing and amounts are provided for informational purposes only, are non-binding, and are subject to adjustments and change. Availability, prices, materials, and options may vary. Monthly pricing is approximate and is subject to change without notice or obligation. Square footage is approximate. All photographs, renderings and other depictions are for the sole purpose of illustration. Brookfield and its affiliates do not discriminate against any class of persons protected by federal, state or local law. Models do not reflect racial preference.

Not an offering to residents of jurisdictions where prior qualification of out-of-state real estate offerings is required unless we have been so qualified or exemptions are available.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: What Credit Score Does Navy Federal Use For Auto Loans

How A Mortgage Can Benefit Your Credit Score

These early dips in your credit score are minor compared with the potential upside a mortgage can have for your credit. To understand this more clearly, consider the factors that go into calculating your FICO® Score:

- Payment history: A typical mortgage provides the opportunity to make 30 years’ worth of on-time, credit-building payments.

- : By managing a mix of installment loans like mortgages and auto loans as well as revolving credit card accounts, you show your ability to handle different types of credit.

- Length of credit history: Although a new mortgage works against this metric, over the life of the loan, your mortgage becomes a long-term account that shows longevity.

The sheer size of a typical mortgage can also play in your favor. Make on-time payments over the life of the loan, and the positive influence your mortgage has on your credit will be long-lasting.

Mortgage Rate Factors You Can Control

Here are some factors you can control that can affect your mortgage rate:

- Down payment: A bigger upfront down payment generally equals lower interest rates.

- Loan term: Paying back your loan over a shorter period of time will typically earn you lower rates.

- Home location: Rates can fluctuate from state to state.

- Personal income: Are you employed? Is your income stable?

- The type of loan you choose: There are a wide variety to consider: fixed-rate mortgages, adjustable-rate mortgages, FHA loans and VA loans.

- Debt-to-income ratio: Do outstanding debts dwarf your yearly income? Lenders prefer a DTI of 36% or lower, though lenders may consider a DTI of up to 50% if your credit and credit history are good.

You May Like: Voluntary Repossession Drivetime

What Is A Credit Score And Why Does A Higher Score Mean More Favorable Rates

If you took your entire relationship with debt and boiled it down to a number between 300 and 850, youd have your credit score. Equifax, TransUnion, and Experian are the three major credit bureaus, but they all use similar criteria to create a credit score. Your FICO score, created by Equifax, is most lenders preferred credit score, but all of these scores may be considered when evaluating creditworthiness. When generating your score, credit bureaus weigh payment history, debt volume, the age of your credit, credit diversity , and credit inquiries. So if youre monitoring your credit, paying on time, and using less than 30% of your total credit, you should be well on your way to a high score.

Lenders then use that score as a guide to offer interest rates and terms for each borrower. If you think of a loan as a bet, the credit score is the odds of the lender being paid back in full. Rather than denying a mortgage application, lenders adjust the rates and terms to make sure their bet is safe. If a borrower has a high credit score, they can offer more favorable rates and terms because its a relatively safe investment. If a borrower has a fair to good credit score, lenders may raise the rates they offer by fractions of a percentage as a way to hedge against a possible default.

For example: Take a homebuyer with a 20% down payment applying for a 30-year-fixed loan to purchase a $200,000 home in New Jersey.

How A Mortgage Affects Your Credit

Know the fundamentals. Your measures your ability to pay back debts. You only earn so much money so keeping your amount of debt in good proportion to your income is essential. This is called your debt-to-income ratio.

Keeping it no higher than 36% is considered optimum with no more than 28% going to your mortgage. If you know you will purchase a home in the near future, dont take on other debt obligations. Keep your debt-to-income ratio low.

However, do continue to build your . A little credit is better than no credit as far as your credit score is concerned. And of course, paying your mortgage on time is good for your credit history.

Read Also: Factual Data Inquiry

How Does Credit Score Affect Mortgage

Last Updated on September 17, 2020 by Andrew Lee

Borrowers who have a high qualifies for much better mortgage interest rates than their peers who have a less-than-stellar credit score. People who fall in the latter category spend more over the life of their home loan. Even if the rates are at their historic lows at the moment, interest payments can quickly add up, especially for those who plan to apply for a 30-year fixed-rate mortgage.

How Much Does Your Credit Score Affect Your Mortgage Rate

The simple answer: a lot.

Thats why youll want to know your credit rating well before applying for a mortgage something only 67% of Canadians aged 18 to 24 do, according to a RATESDOTCA survey.

If your score is below average, planning ahead can at least give you a chance to try and fix it. That could potentially give you access to better interest rates.

Also Check: How Often Does Capital One Report To The Bureaus

How Does A New Mortgage Affect Your Credit Score

A mortgage is the largest debt many people will take on in their lifetime. If youâre planning to buy a home, having a high means youâre more likely to be approved for the best mortgage rates. But once you become a homeowner, how does your new mortgage affect your credit score?

Canadian homeowners carry an average of $174,000 in mortgage debt, according to a 2016 survey by Manulife Bank of Canada. The amount of debt you owe accounts for about 30% of how your credit score is calculated. Because youâve just assumed a loan totalling hundreds of thousands of dollars, expect your credit score to take a hit.

The good news: once you prove youâre responsible by making your mortgage payments on time, every time, your credit score will begin to heal itself. Your score is a numerical reflection of your ability to repay debt, and payment history makes up the largest portion of it . So as long as you pay all of your bills on time, youâll see your score begin to rise. In general, making consistent on-time payments is the easiest way to improve a credit score.

Missing mortgage payments, however, will set you back. Mortgage delinquencies are treated much harsher than a missed credit card payment â even a single payment 30 days late can knock up to 110 points off your score, according to a 2011 study by FICO.

The bottom line

Also read:

How To Improve Your Credit Score

If you have a bruised credit score, or youâve recently moved to Canada and would like to establish credit, here is a list of things you can do to improve your credit score:

- Make sure to have a least two credit facilities in use at all times. Use each credit facility every month, and pay off the balance.

- Always make your payments on time, and always pay at least the minimum payment. If you canât make the minimum payment, let your lender know right away, as they may be able to accommodate you by extending your payment due date.

- Do not to use more than 35% of your available credit. For example, if you have a credit card with an available limit of $5,000 and a line of credit with an available limit of $9,200, try not to borrow more than $4,970 at any given time.

- Establish a long credit history. Try not to cancel your oldest credit card, even if you rarely use it. The longer your credit history is, the better your credit rating will be.

- Limit how frequently you apply for credit. The more times you apply for new credit, the worse it looks to lenders. Note that checking your own credit will not affect your credit score.

Recommended Reading: Equifax Address To Report Death

Will Shopping For Mortgage Rates Hurt Our Credit Score

By on April 29, 2016

Money Fit bloggers Sammu and Mandy Dhaliwall are on the hunt for a better rate but worry it may come at a cost

In our April 2016 issue of MoneySense, we introduced you to Sammu and Mandy Dhaliwall, a young married couple with three kids from Brampton, Ont. They are trying to juggle RRSPs, TFSAs, paying down their $350,000 mortgage as well as their $90,000 home equity line of credit. Throughout the year well be giving them a financial challenge every four weeks to help them get their finances in tip top shape. Make sure to follow along! Lets start.

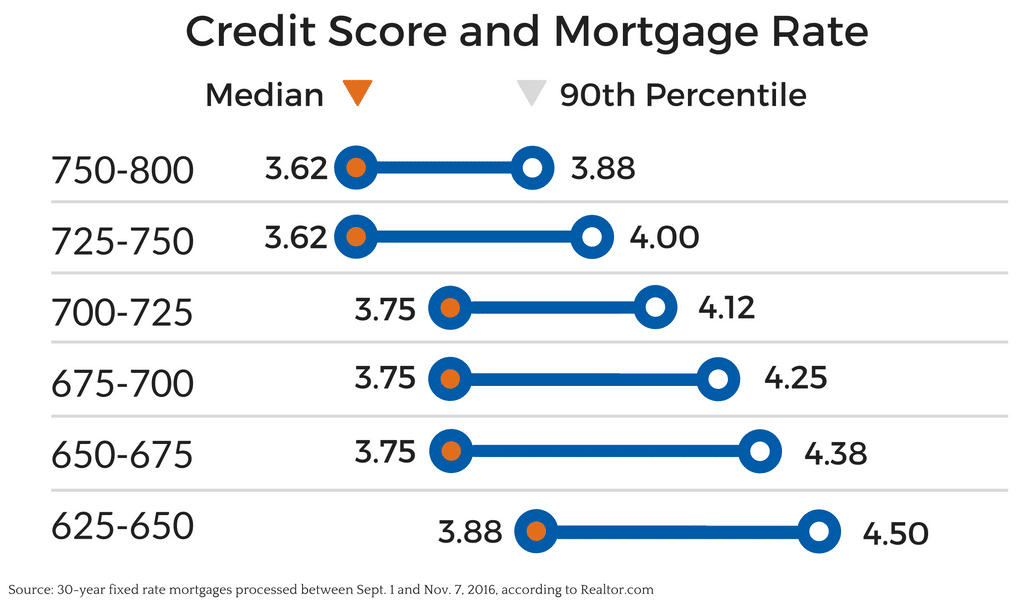

Sliding Scale For Credit Scores Rates

According to the Fair Isaac Co., which developed the FICO credit scoring system, the best interest rates are currently available to borrowers with scores of 760 and above, to a “perfect” score of 850 on the FICO system. Just below that, borrowers in the 700-759 range can expect to pay about 0.2 percentage points more on a 30-year fixed-rate loan, all other things being equal.

From there on down, interest rates jump for every 20-point decrease in credit score. The interest rate goes up by roughly another 0.2 percent for each additional drop to the 680-699 range and 660-679. Drop below 660 and the increase is more than twice as big, a 0.43 percentage point increase for borrowers in the 640-659 range. Below that, you can tack on roughly another half percent for borrowers with scores from 620-639, although many lenders will decline clients with scores this low.

There are some lenders who will still make loans for borrowers with credit scores below 620 but they’re relatively few and you’re going to need a sizeable down payment or equity in your home .

Read Also: Navy Federal Auto Loan Rates By Credit Score

Compare 680 Credit Score Mortgage Rates Today

As any mortgage professional will tell you, the only way to find the lowest mortgage rate is by shopping around.

Get estimates from at least three lenders and remember to look at more than just the interest rate. Also compare:

- Your effective rate when fees and loan costs are added in

- Points Is the lender charging extra via discount points to reach the offered rate?

- Closing costs How much does the lender charge upfront to set up your loan?

These figures will show you which lender is offering the best deal overall, not just a low rate with hidden fees that jack up the cost.

Remember, a 680 credit score is right on the borderline of good.

So its even more important to find a lender that will look at your credit profile favorably and offer you a great deal on your mortgage.

What Is A Credit Score

The term “credit score” usually refers to a FICO score. FICO stands for the Fair Isaac Corporation, the company that developed the most commonly used credit scoring system. With FICO, everyone is assigned a score ranging from 300 to 850. The higher the number, the better the credit.

Your credit score takes several things into account including current debt, payment history, new credit and types of credit.

Your credit score is important because it’s one of the key factors lenders look at when deciding whether to offer you a loan.

Also Check: Syncppc

Hard Credit Inquiries Will Impact Your Credit Score

While a single hard inquiry should not affect your credit score, if you have too many hard inquiries, that can lower your credit score. You can mitigate this issue by applying for mortgages from multiple lenders at the same time.

Also, be sure to avoid applying for too many new credit cards, auto loans, or other loans if they result in a hard inquiry and youre planning to apply for a mortgage the following year. If you dont, the hard inquiry will still appear on your credit report when you go to apply for the mortgage.

Qualifying For A Lower Mortgage Rate

It may be helpful to improve your credit score before applying for a mortgage so you can qualify for a lower mortgage rate and save tens of thousands of dollars over the life of the mortgage. The money you save on your mortgage is well worth the time and effort to improve your credit score.

If you have a low credit score, review your credit reports to see the items that are affecting your credit score. You can raise your credit score by making timely payments on all your bills, paying down your credit card debt, removing errors from your credit report, and paying off outstanding delinquent balances. In some cases, just a few points can make a big difference in your mortgage rate.

Continue to monitor your credit score in the weeks leading up to your mortgage application to see how your credit score improves.

Don’t Miss: Paypal Credit Score Check