Access To Credit Reports

- If you are over 18 and you have taken out credit or borrowed money before, . In a limited number of European countries e.g. Spain, lenders only provide local credit reference agencies with information pertaining to unfulfilled financial obligations, such as missed or late payments, judgment orders on debts, and other adverse or negative information. So, in those countries, credit reference agencies will not hold any information about you even if you have taken out credit and have repaid on-time.

- You can request your credit history via a basic statutory report for free. You should receive it within one month.

- It is a good idea to check your report every now and then but the main reasons for checking it include: if you are changing job or moving home if you are applying for credit if you are worried about ID fraud.

- Getting your credit report will not hurt your credit score. When you look at your own credit history, that search is not visible to companies on your credit report.

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

Why Are Credit Reports Pulled

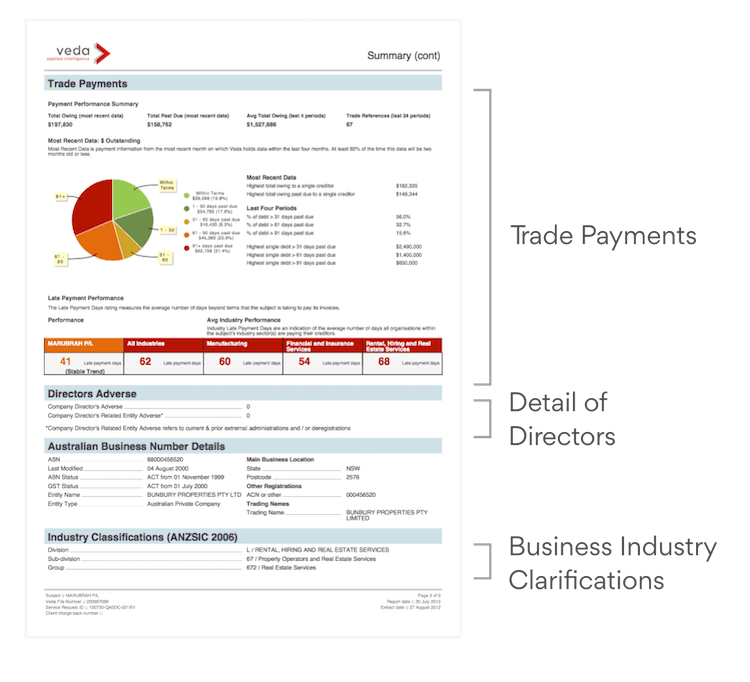

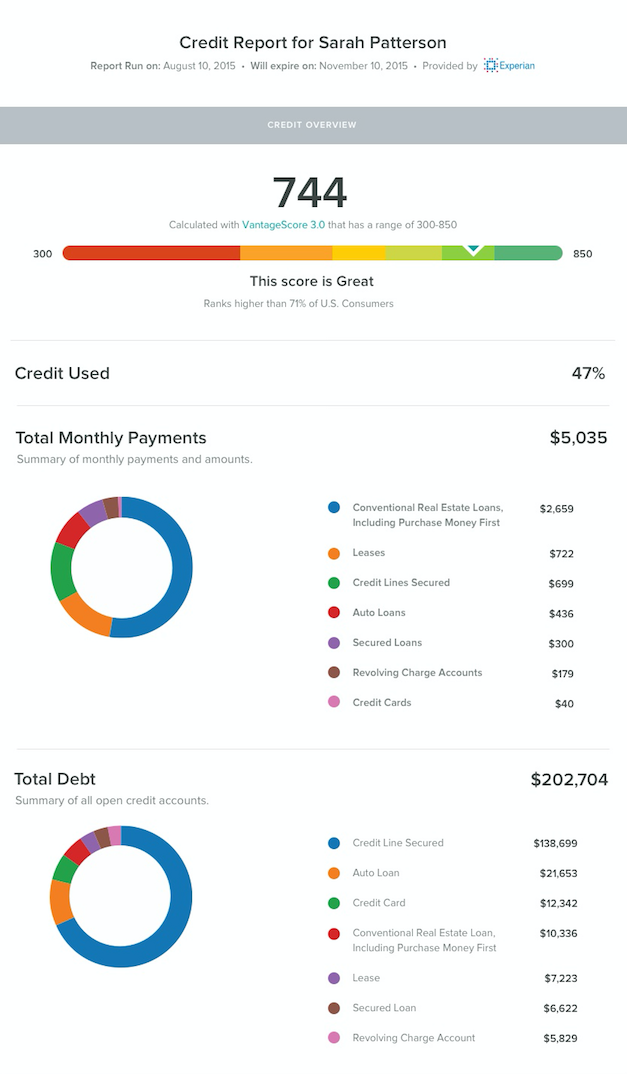

Your 3 credit reports will be pulled when a lender needs to determine if you are eligible to get a loan or get approved for a new credit card that you are applying for from an issuer. Your credit report which comes from one of the major bureau or all 3 major bureaus depending on the provider you choose to go with. For example, with the VantageScore 3.0 you will have the benefit of getting all 3 of your credit reports displayed.

Read Also: Will Paying Off My Student Loans Increase My Credit Score

Why Dont My Free Credit Reports Include Credit Scores

Your credit report and your credit score are not the same thing. Your credit report contains information that a credit reporting company has received about you. Your credit score is calculated by plugging the information in your credit report into a credit score formula. You may have multiple credit scores based upon who provided the score, and whether the company providing the score used their own scoring model or used a model available from a third party.

Federal law gives you the right to ask for a copy of your credit report from each nationwide credit reporting company every year for free. However, the law does not require the credit reporting companies to provide a free credit score.

Also Check: What Is My True Credit Score

Why Should I Check My Credit Report Regularly

Your because many companies use it to predict future financial behaviors. So the better your credit, the better your chances of qualifying for things like credit cards, loans, mortgages and other credit products. And the better your rates and terms might be.

By monitoring your credit, you may be better prepared as you apply for loans. And it can give you an idea of areas where you can work to improve your credit.

We hope you found this helpful. Our content is not intended to provide legal, investment or financial advice or to indicate that a particular Capital One product or service is available or right for you. For specific advice about your unique circumstances, consider talking with a qualified professional.

Capital One does not provide, endorse or guarantee any third-party product, service, information, or recommendation listed above. The third parties listed are solely responsible for their products and services, and all trademarks listed are the property of their respective owners.

The CreditWise Simulator provides an estimate of your score change and does not guarantee how your score may change.

Related Content

Read Also: Do Checking Accounts Affect Credit Score

Full Credit Report Services

Remember

You can apply for your credit record as often as you like without harming your chances of getting credit.

You can get free 30-day trials of more comprehensive credit checking services from Experian and Equifax. These include your full credit report.

However, you normally have to give your credit or debit card details when you sign up to the free trial. Money will be taken from your account unless you cancel in time.

How To Check Your Credit Score

There are several convenient ways to check your credit score and keep tabs on your creditworthiness:

- Visiting a free credit scoring website is one of the easiest and most convenient ways to check your credit score. These services, which update weekly to monthly, sometimes offer credit monitoring in addition to scores and limited reports. Checking your credit through these websites is typically free, but some platforms offer additional tools for a monthly fee.

- Many credit card issuers also offer cardholders free credit scores and score forecasting tools. Just check with your card provider to see if the service is offered, and then opt in to access available resources.

- Nonprofit credit counselors. Beyond just checking your score, working with a nonprofit credit counselor can help you better understand your credit profile and help you build more responsible financial habits.

Don’t Miss: Will Increasing My Credit Limit Help My Score

How To Get Free Copies Of My Credit Reports

You can get a free copy of your credit report from each of the three major credit bureausâEquifax, Experian and TransUnionâby visiting AnnualCreditReport.com. It may help to collect personal information ahead of timeâthings like your Social Security number and previous addressesâso you can verify your identity. But the process is relatively simple.

What Do Lenders See on Your Credit Report?

What you see on your credit reports may be slightly different from the things lenders who are reviewing your credit might see. But generally, if a lender is reviewing your credit, they might see your:

- Personal information, such as your name, current address and previous addresses.

- Credit and loan accounts, including information about your payment history.

- Employment history.

- Public records, such as bankruptcies.

- Recent inquiries where you applied for other loans or credit cards.

What Does A Cifas Marker On My Credit Report Mean

Cifas is a national fraud prevention service. It can place Protective Registration and Victim of impersonation warnings on your credit file.

Protective Registration

This is a paid service for people who have recently been victims of financial fraud. It indicates to any lender that youre potentially vulnerable to fraud so that theyll make extra checks every time you apply for a financial product. While this can protect you, it can increase how long credit application approvals can take. It will stay on your credit report for two years.

Find out more, and apply, on the Cifas website

Victim of impersonation

This is filed by your lender for your own protection if youve been the victim of identity fraud. It will stay on your report for 13 months.

If one of these is on your credit report, it gives potential lenders a fraud warning. It tells them youve been a victim of fraud in the past, or could be particularly vulnerable to fraud in the future.

You May Like: Does Having Multiple Credit Cards Affect Your Credit Rating

Which Credit Report Is Most Accurate

No one credit report is innately more accurate than the others. Your TransUnion credit report might contain information that your Equifax credit report doesnt, or vice versa.

This is partly because lenders are not required to report your information to all three credit bureaus. In some cases, they may only report to one bureau and not the others, or they may report information at different times.

In any case, its a good idea to review your credit reports on a regular basis so that you can be sure any discrepancies are minor.

Ready to help your credit go the distance? Log in or create an account to get started.

Difference Between Credit Reports And Credit Scores

While your credit score and credit report are related, they’re not the same thing. Your credit score is a single three-digit number that signals your credit health to lenders and creditors. Your credit report doesn’t include your credit score. The report, which includes credit activity, is used to calculate your credit score.

Recommended Reading: Does A Late Payment Affect My Credit Rating

How To Check My Credit Without Hurting It

Some places may charge you to check or monitor your credit. But you donât have to pay to use . You can use it to access your TransUnion credit report and weekly VantageScore 3.0 credit score for free anytimeâwithout negatively impacting your score.

You can even see the potential impacts of financial decisions on your credit score before you make them, with the CreditWise Simulator.

What Does This Mean When I Apply For Credit

Any application for credit might be subject to further checks to prove your identity. As this is often a manual check, if youre applying for credit your application could be delayed.

Having a marker under this section wont automatically mean your application will be rejected. Its there to protect you from being a victim of fraud.

You May Like: How To Get Your Credit Score Up Quickly

Why Don’t My Free Credit Reports Include Credit Scores

Your credit report and your credit score are not the same thing. Your credit report contains information that a credit reporting company has received about you. Your credit score is calculated by plugging the information in your credit report into a credit score formula. You may have multiple credit scores based upon who provided the score, and whether the company providing the score used their own scoring model or used a model available from a third party.

Federal law gives you the right to ask for a copy of your credit report from each nationwide credit reporting company every year for free. However, the law does not require the credit reporting companies to provide a free credit score.

Get Your Credit Report

You can ask each credit reference agency to give you a free copy of the credit report they hold about you. This is called your statutory credit report. Hover over the country where you have taken out credit and click on the logo of the ACCIS member that provides credit reports in that country. You will be taken to the dedicated area of their website.

Note: ACCIS cannot accept any responsibility or liability for the information provided on the website of its members, or for the use to which it is put to or for any resulting loss.

Also Check: How Do You Unlock Experian Credit Report

Access To Credit Reports Across Borders

One of the challenges facing anyone moving to another country is financial. You could have a great credit history but no way to leverage that credit to get housing or consumer goods in your new destination. To solve that problem, the ACCIS has actively encouraged the reciprocal exchange of credit information among its members. Since the 1990s, ACCIS members can sign bilateral Credit Bureau Data Exchange agreements on the exchange of information, in order to improve the cross-border accessibility and transferability of your credit data and to support their clients .

In the CBDE model, in order for a lender to get access to your credit data from another country, the lender accesses CRAs located in that country through the CRA with whom it usually works in its own country. As a borrower, you may want to inform your lender that such service may be available with the CRA it uses for creditworthiness assessments.

% Collections Foreclosure & Bankruptcy

An account thats in collections can severely damage a credit score, since its reached the point that a borrower has given up paying their bills and now, their lender has asked a collection agency to intervene and get the debt paid. A bankruptcy never has a positive impact on your credit score, but the severity which it affects your numbers depends on your own individual credit profile and situation.

Read Also: What Is A Good Business Credit Score

You May Like: What Is The Most Important Credit Score

Financial Information On Your Credit Report

Your credit report may contain the following financial information:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a lien on a car that allows the lender to seize it if you dont make payments

- remarks, including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if you made your payments on time

- if you missed payments

- if your debt has been transferred to a collection agency

- if you went over your credit limit

- personal information thats available in public records, such as a bankruptcy

How Can You Monitor Your Report And Score For Free

Consumers have not always had access to their scores. Now, however, scores are widely available to consumers for free from a variety of sources. When picking a source of a free score so you can monitor your credit, look for one that includes free credit report information as well, such as NerdWallet, which has scores and reports that update weekly. That gives you a convenient way to check your credit health any time and monitor your progress. It’s smart to choose a particular score and monitor that one, using the same credit bureau and scoring model.

Also Check: What Does Your Credit Score Tell Lenders About You

What Is My Real Credit Score

When evaluating loan applications, lenders choose the scoring system that best suit their needs. They may use one or more commercial scoring systems or even employ their own custom scoring tools. Lenders may choose to base scores from those systems on data from one, two or all three national credit bureaus.

Since different lenders use different scoring methods, you do not have a single definitive credit score. As a result, the credit score that matters most for you is whichever one a lender is considering in connection with your loan application.

If your based on a credit score, or if a score leads a lender to offer you credit with interest charges higher than its best available rate, the lender must inform you which scoring system was used and what score you received.

Because all credit scoring systems respond similarly to good credit habits, however, steps that bring an increase any one credit score will typically lead to improvement across all credit scoring systems.

Does Your Credit Score Show Up On A Background Check

Its the question everyone is asking: does your credit score show up on a background check?

Or maybe theyre asking why would I have to have a background check?

Well, those questions and more will soon be answered for you! Buckle in, because youre about to go on a roller coaster. A roller coaster of knowledge!

Also Check: How To Get Negative Stuff Off Credit Report

How To Check Your Credit Report For Free

Use the above steps to check your credit report for free on AnnualCreditReport.com. Remember, you can access your reports from all three bureaus weekly through April 2022, so take advantage while you can.

Experts recommend checking each bureaus report about once a year and the FTC reports one out of five people finds an error when they do. Thats why its important you check your report regularly and dispute and fix any errors, which can help boost your score.

How Your Credit Score Is Calculated

Your credit score is calculated based on what’s in your credit report. For example:

- the amount of money youve borrowed

- the number of credit applications youve made

- whether you pay on time

Depending on the credit reporting agency, your score will be between zero and either 1,000 or 1,200.

A higher score means the lender will consider you less risky. This could mean getting a better deal and saving money.

A lower score will affect your ability to get a loan or credit. See how to improve your credit score.

Read Also: What Credit Score Do You Need To Refinance Your House

Expired And Extraneous Information

At some point, even relevant financial information becomes old news. Following are a few examples of when items expire and should automatically drop off your credit report:

- Chapter 7 bankruptcy: 10 years

- Chapter 13 bankruptcy: 7 years

- Collection accounts: 7 years

- Late or missed payments: 7 years

- Closed credit accounts in good standing: 10 years

Your credit report also excludes personal information that is irrelevant to your credit. Examples include:

- Political affiliations