Re: Capital One Report Day

Any credit score monitoring site will show you each card’s report date.

E.G. I log into Credit Karma, go to Credit Card Utilization and scroll down to view my credit cards. Under each card shows the Balance, Utilization and Reported On – Date.

Dates are usually the same each month. Some cards report automatically when you paid a balance to zero, however, From personal experience Cap1 doesn’t.

Final Thoughts: When Does Capital One Report To Credit Bureaus

So, to recap: when does Capital One report to credit bureaus? Typically every 30-45 days. This is the common practice among many credit issuers.

Keep your payments on time and always consistent, and focus on lowering your credit utilization before your credit card company reports to the three bureaus. This will keep your credit score strong and maintain your financial possibilities.

Need help building up your credit score after having some trouble, or looking for advice on how to make the most of your score? Cred Increase is the leading credit repair company to turn things around and maximize your credit report.

Check them out today and get a free consultation and credit analysis!

Capital One Reports Business Credit Activity

Because they can, Capital One reports your business credit activity to your personal credit report. Discover is the only other national bank to have a similar reporting policy. Banks including Chase, American Express, Citi, and Bank of America dont report your business activity to the personal bureaus.

These Capital One business credit cards report to your personal credit reports:

- Capital One Spark Miles for Business

- The Capital One Spark Miles Select for Business

- Capital One Spark Cash for Business

- The Capital One Spark Cash Select for Business

- Capital One Spark Classic for Business

If youre thinking about applying for a Capital One Spark business credit card, its worth weighing the pros and cons to avoid a potential credit surprise. Also, knowing the Spark business card approval odds can help you determine if the time is right or if you want to work on your credit score or look at another option.

At first glance, this extra reporting may not seem like a problem if you pay your monthly statement in full. However, you might experience these unintended consequences.

Learn more: Business Credit Cards

The information for the Capital One Spark Cash for Business, Capital One Spark Miles Select for Business, and Capital One Spark Classic for Business has been collected independently by Johnny Jet. The card details on this page have not been reviewed or provided by the card issuer.

Also Check: Credit Score Serious Delinquency

Impact Of A Capital One Credit Limit Increase On Your Credit Score

When you request a Capital One credit limit increase, Capital One will conduct a hard pull of your credit report, which will cause a short-term dip in your credit score. Capital One cannot do a hard pull without your permission, though.

On the other hand, there are times when you could be eligible for a Capital One credit limit increase without even requesting one. Capital One may offer an automatic credit limit increase if its regular reviews of your account show a history of on-time payments and low debt.

Summary Of Capital One Reports Business Credit Activity

Capital One reporting your business credit activity to your personal credit reports can temporarily penalize your credit situation. You will need to be smart with how you use your Capital One business credit card and time your future credit card applications. Having another best small business credit card can give you more flexibility in building business credit with minimum effect on your personal credit.

Recommended Reading: Ashley Furniture Credit Card Score

Does My Business Credit Card Show Up On My Personal Credit Report

Most business credit card activity wont appear on your personal credit report. Two exceptions are Capital One and Discover small business credit cards. These two banks report your monthly activity including your payment activity and monthly balance. A high credit limit usage on your business credit card can penalize your personal credit score with Capital One or Discover.

Other banks may only report delinquencies to your personal credit report. This is when the bank must use the personal guarantee and use non-business assets to cover a business credit card balance thats in bad standing.

The hard inquiry for a new credit card may appear on your personal credit report. This can temporarily influence your approval odds for new personal credit card cards. However, it shouldnt have an ongoing impact.

Cons Of Higher Credit Limits

Having a higher credit limit can be risky if cardholders are not responsible with spending.

- More available credit can lead to more spending. It can be easy to fall into a spending trap when more credit becomes available. Dont spend more than can be paid off by the end of every billing cycle if you can avoid it.

- Greater risk of debt. As a result of spending more, cardholders become more likely to fall into debt with a cycle of unpaid balances and rapidly accruing interest.

- Hard credit inquiries. Card issuers may perform a hard credit inquiry to process a credit limit request . Too many hard inquiries in a short period can negatively affect credit scores .

Also Check: What Is Syncb Ppc On My Credit Report

Remove Inaccurate Late Payments W/help From Credit Glory

Disputing negative items on your credit report is hard work! It takes a lot of time, effort, organization, and follow up. The good news? Our team of credit repair professionals is here to simplify everything! Let your dedicated credit repair expert relieve you of the stress, hassle, and time needed to fight your inaccuracies and boost your credit score

Call us at or set up a consultation to get started, today

Capital One Report Date

Does anyone know when cap 1 reports monthly balance to credit bureaus? My statement close was today. I usually dont get an alert from myfico until the 30th of the month. I might have a hard pull before that but am hoping to show my balance pif. Does Myfico send alert as soon as balance is reported to the credit bureaus?

Thanks!

Recommended Reading: Centurylink Collections Agency

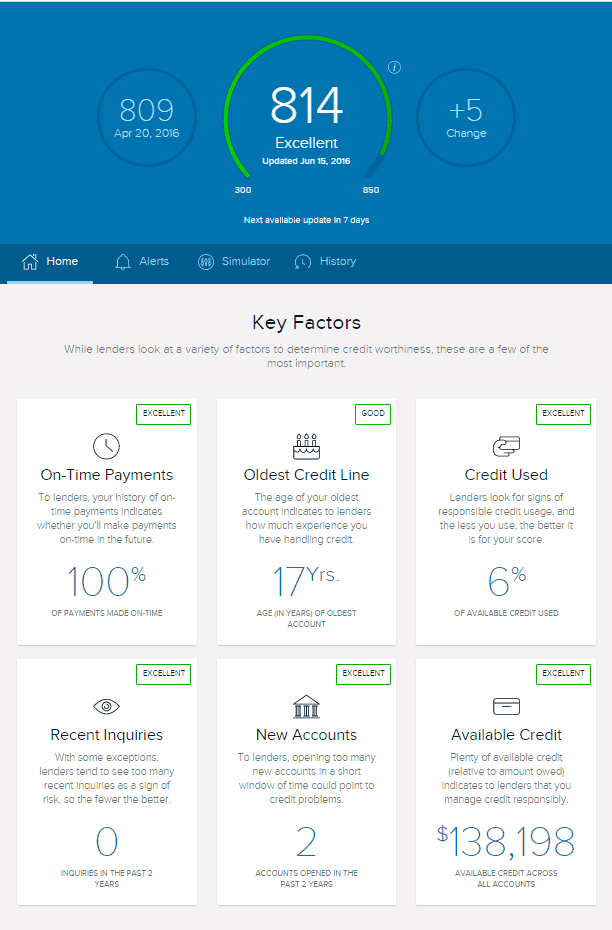

What Is A Credit Rating

You may hear the words credit rating and credit score used to describe the same thing. Your CreditWise credit score is TransUnions numerical interpretation of your creditworthiness and is calculated based on a complex combination of all the information TransUnion holds on your credit report over a 6-year period. Your CreditWise credit rating is TransUnions interpretation of how well youre doing. For example, good or excellent. Generally speaking, the higher your credit score, and the better your credit rating, the more likely you are to be accepted for the best credit deals and interest rates.

Capital One offers a myriad of business cards for all kinds of credit levels and business-related spending. They all feature unlimited free employee cards, unlimited rewards, and no foreign transaction fees.

Credit Card Insider receives compensation from advertisers whose products may be mentioned on this page. Advertiser relationships do not affect card evaluations. Advertising partners do not edit or endorse our editorial content. Content is accurate to the best of our knowledge when its published. Learn more in our Editorial Guidelines.

Capital One Spark is Capital Ones line of small business credit cards. For Capital Ones personal cards go to this page.

| Card |

|---|

Insider tip

Pros And Cons Of Business Credit Cards That Do Report Activity

Which way is better? It depends on your situation. As long as you pay your business card on time and avoid high balances, having a business card that appears on your personal credit reports with Equifax, Experian and TransUnion should not be a problem, and may even help your credit scores.

But if you charge everything you can on your card to rack up rewards, for example, then your personal credit could suffer. Why? Credit scoring models take into account your debt usage or utilization ratio, which compares the balances reported against available credit limits, often for each card as well as all credit cards totalled together. A high balance on a business card that appears on an individuals personal credit can mean a high debt usage ratio which can lower credit scores.

On the other hand, if your personal credit history is a bit thin, a business card that reports your full account activity may help. For example, if you avoid credit cards and use a debit card, then you may have a thin credit profile that could benefit from the boost another card can help provide.

Choosing a business credit card that does not report to personal credit may be helpful if you know there will be times you need to run up charges that put you close to the limit or carry a balance think holiday inventory, or that big tradeshow, for example and you dont want that activity to bring down your scores.

Following are the policies of the major business credit card issuers at a glance:

Read Also: Factual Data Hard Inquiry

How Your Credit Report Is Affect Each Billing Cycle

A credit report is affected by a monthly billing cycle in a few ways. First, the information reported to the credit bureaus changes each month slightly.

Its important to understand how your account information is reported to the credit bureaus and how it can impact your credit score. By understanding Capital Ones credit reporting policies, you can better manage your finances and make informed decisions about borrowing money.

Strategies On Successfully Disputing Your Credit Report

It’s important to remember that disputing your credit report with Capital One means more than just filling out a simple form. Here are some ways to help ensure that your dispute will be successful:

- Get all of the documentation you can. Be sure to include invoices, debit cards, receipts, and any other documentation that can prove that you have done what you agree to in your dispute request.

- Make sure your dispute is clear, concise, and focused on the errors in your credit report.

- Avoid submitting a dispute that has already been investigated. If you have already taken the creditor’s previous step of investigating your dispute, it might make more sense for you to write a new dispute letter and file an entirely new dispute instead of adding another layer of paperwork to the process.

- Speak with a knowledgeable attorney if you can’t decide which dispute form is best for you.

- Be sure to look over your credit report and make sure that you don’t have duplicate disputes being submitted. It’s not a good idea to submit the same disputed information more than once because you will end up sending multiple dispute letters without any results at all.

- Keep copies of all of the paperwork you send in as well as any confirmation receipts from the credit bureaus and your bank or banking institution.

To avoid this hectic encounter, let DoNotPay help you know when Capital One has reported to the credit bureaus, as well as help you with the dispute process more efficiently.

Don’t Miss: How Do I Unlock My Experian Credit Report

How To Maximize Your Rewards

Because the card offers a flat 1% back on everything, there’s no trick to maximizing the value of the rewards program. You simply use the card whenever possible to ensure you’re getting rewards on every purchase you make. There isn’t a bonus, so you needn’t pay attention to reaching a certain level of spending within the first few months in order to receive a cash incentive.

Since the Capital One Spark Classic is so heavily aimed at helping to build credit, its worth noting how best to reach that goal as you use it. The first tip is to avoid using the cards credit for longer than the month in which you make a charge. Pay off your bill on time and in full every month. By doing so, youll not only avoid interest charges, but add to your credit history in a way thats likely to increase your credit score, and so give you access to further credit and credit options that have more favorable terms and benefits.

How Many Capital One Business Credit Cards Can You Have

We contacted Capital One support directly to discuss per-person card limits, and heres what we got: You may not be approved for additional accounts if you have 5 or more open credit card accounts with Capital One. This is consistent with what appears in these cards terms.

So you can have up to five Capital One business credit cards open at the same time, as long as you dont have any other open credit card accounts with Capital One.

Recommended Reading: Tri-merge

How Many Times A Month Does Capital One Report To Credit Bureaus

As per the Capital One website, they typically share credit card account information with credit bureaus once a month.

Although when they report to the credit bureaus tends to differ among Reddit forum users.

One Reddit user indicates Capital One is reporting their account information almost a week before their due date. In contrast, another user mentions the reporting happening a few days after the last day of their billing cycle.

The last Reddit user on the tread contacted Capital One directly and was advised that credit card accounts are reported five days after the statement date.

For example, if your statement date is May 15th each month, Capital One reports five days later, according to the above information, which would fall on May 20th.

Which Credit Cards Help Authorized Users Build Credit

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Adding someone to your credit card as an is a simple way to potentially buoy their credit scores, assuming youve paid the account on time and havent used too much of your available credit. But to make this strategy actually work, youll want to be sure that information about that account is included on their credit reports. Otherwise, adding someone to your card whether its a child, partner or parent wont do a thing for their scores.

Getting that same account to appear as a “tradeline” on your authorized users credit reports will depend on two major factors:

Ultimately, if you want to help someone establish a credit history by adding them to your account, you can save time and energy by knowing beforehand about how issuers and bureaus handle this information. After all, you dont want to add someone to an account in an effort to help their scores, only to find out months later that it had no effect.

» MORE: View authorized user purchases with these credit cards

Recommended Reading: Care Credit Minimum Score

Capital One Spark Classic For Business

| $0 | |

| Rewards Earning Rate | Earn unlimited 1% cash back for your business on every purchase, everywhere, no limits or category restrictions. |

| Balance Transfer Fee | There is no standard balance transfer fee for this card. |

| Cash Advance APR | |

| Either $10 or 3% of the amount of each cash advance, whichever is greater. |

The Capital One Spark Classic for Business Card is not one of our top-rated business credit cards. You can review our list of the best best credit cards for what we think are better options.

How Often Capital One Reports To Credit Bureaus

According to Capital One, it typically provides your credit information to all three bureaus every 30 to 45 days.

The company doesn’t specify exactly when it does this, but it’s normal for creditors to report your data at the end of every billing cycle.

Capital One also doesn’t specify what exactly it reports, but based on a review of the information that shows up on a credit report, you can reasonably guess that Capital One reports:

- Your payment history for two years

- Your balance

- The amount of your last payment

- The past amount due

- The account status

- The date the account was open

- Who is responsible for the account

Other information may be reported, depending on your individual circumstances. Also, Capital One says that your credit report will show when the issuer provided your data to each bureau.

One key piece of data is your balance. With this information, plus your credit limit, a credit bureau can determine your utilization ratio. More on this all-important ratio in a moment.

Don’t Miss: What Is Aoc Credit Score

No Foreign Transaction Fee

All of the Capital One business credit cards have no foreign transaction fees. This is unique as most business credit cards without an annual fee still charge a foreign transaction fee. Thats not the case with the Capital One Spark Miles Select, Spark Cash Select, or Spark Classic.

Related article: Best Business Credit Cards With No Annual Fee

How To Check Your Credit Score For Free

There are dozens of resources available for you to check your credit score for free, but the type of score you receive varies between a FICO Score and VantageScore. While both are helpful for understanding the key factors that influence your credit history, FICO Scores are used in the majority of lending decisions.

The simplest way to access your free credit score is through your credit card issuer. Many card issuers provide their cardholders with free access to their FICO Score or VantageScore. Beyond your bank, consider free resources from Experian, Discover and Capital One.

You May Like: Does Speedy Cash Report To Credit Bureaus