Mistakes On Your Report

Mistakes on credit reports can and do happen, and these can have a negative effect on your credit report.

Some of the most common errors include incorrect names and addresses, but other details such as whether youâre on the electoral roll, your debt levels and account status can have mistakes as well.

If your name or address have errors or if you have used different names/addresses for different accounts, some of your accounts may not appear on your credit report. This may mean you lose out on any positive effects that these accounts may have on your credit score. Make sure you look at the âaccountsâ section of your credit report to check all of your accounts are there and thereâs nothing you donât recognise. If you want to change something that’s not right on your ClearScore credit report , you can raise a dispute.

If you want a cheat sheet of things to check on your credit report, read our credit report checklist.

Instantly Boost Your Score

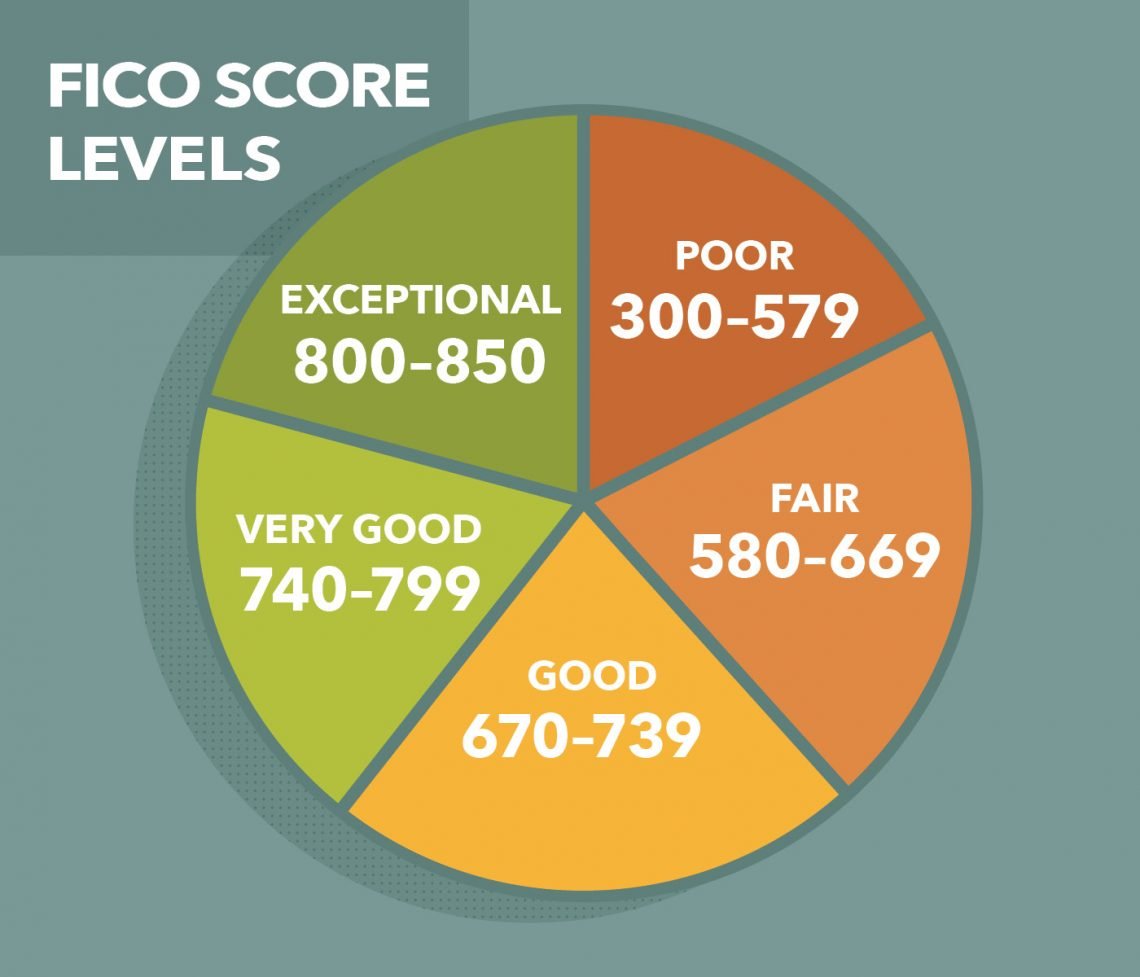

Each company may consider different information when working out your score and use a different formula. For example, your credit report held by each of the main credit reference agencies may contain different information. Firms also differ in how many points are awarded for each piece of relevant information, depending on the formula used and any lending policies. Scores are often expressed using different ranges, meaning they wonât usually be directly comparable.

The Experian Credit Score is completely free and gives you an indication of how companies may view your credit report. Itâs represented as a number from 0-999, where 999 is the best possible score, and is based on the information in your Experian Credit Report. You can check it without paying a penny, and itâll be updated every 30 days if you log in.

Monitor Your Credit Report

It’s a good idea to monitor your credit report and credit score frequently so you know exactly what you’re financially responsible for, according to lenders. Remember, the primary account holder named on the account is responsible for the bill regardless of who actually spent that money.

If you’d like help monitoring your credit, you can sign up for the Chase Credit Journey a free resource to help you through the process of managing your credit.

Read Also: What Credit Score Is Needed To Buy A Mahindra Tractor

How Influential Are Total Balances And Debt

This is a moderately influential categorynot weighed as heavily as Category #2 and Category #3, and definitely not as much as Category #1.

If you have a substantial amount of debt, theres a greater likelihood that youll be unable to take on new debt. Thats why higher debt negatively affects your credit score.

But large amounts of debt are not always an indicator that repayment is less likelyand thats why this category is not weighed as heavily as the prior categories.

Someone could have a substantial amount of debt to repay, but if that person consistently makes payments on timeand over a moderate span of timeit may suggest that person is quite capable of prompt repayment.

Credit reporting agencies do not take a persons income into account when determining that persons credit score. Someone with a substantial amount of debt might also have a high income, and thus be very capable of making prompt payments. For that reason, too, this category is not weighed as heavily as the prior ones.

Big Factors That Can Affect Your Credit Score

Get Personal Loan Upto INR 25 Lakhs* With Attractive Interest Rates

Get Personal Loan upto INR 25 Lakhs*

The Indian economy has undergone a significant transformation in the past couple of years which has driven customers to demand more credit instruments. Approximately 22 million Indians apply for credit instruments each month. While credit instruments have infused a wave of convenience in our daily lives, maintaining a good credit score is paramount to ensuring that you can avail the loan amount of your choice at better rates of interest. Credit scores are generated by organisations called . There are 6 major bureaus in India, of which Transunion CIBIL which provides the CIBIL score is the most famous.

Like credit scores provided by other organisations, CIBIL score is a number that ranges between 300 to 900 and is used by lenders to assess an applicants creditworthiness when they apply for a loan. A CIBIL score of minimum 750 is considered to be excellent and can help you in availing credit easily.

Also Check: What Credit Score Is Needed To Buy A House

How To Fix A Low Credit Score

Understand the fundamental components of credit score such as whether you pay your payments on time and whether you have credit card balances and pinpoint the issues that are having a negative effect. Another crucial step is to check your credit report for mistakes.

The following factors have the most effects on your credit score:

- Your payment history , including whether you always make on-time payments or have previously experienced missed or late payments.

- Your credit utilization rate indicates how much of your total credit line is currently being used

- How frequently you use credit

- The variety of credit products you presently have and have had

- The number of “hard inquiries,” or recent credit account openings and applications, that you’ve made

So, the most straightforward way to fix your credit score is to keep your payments on time. Here are some recommendations for the same:

- To ensure that payments are made on time and without error, you can choose automated bill payments

- You can set up either a paper filing system or a digital filing system to keep track of your monthly expenses

Apart from timely payments, you should follow the practices outlined below.

Browse through the best credit cards in the country and apply for the most convenient one through Policybazaar UAE. We also offer credit score services. Unlock these exciting features today and let us collaborate with you for a long and fruitful financial journey.

Does A Business Credit Card Affect Personal Credit Score

Lots of people use business and personal credit cards to keep their professional and personal finances separate. However, if you do so, its important to realise that your company credit card can affect your personal credit score.

For instance, if youre the main account holder for a small business credit card, the way you manage this credit card will have a direct influence on your credit score. You will need to make sure you stick to your credit limits, keep your balance low, and make your repayments on time, just as you do with your personal credit card.

If youre a business card holder for a much larger company, your use of the credit card isnt likely to affect your credit score in the same way. Still, you should be mindful of how your company manages its credit card, as you dont want their irresponsibility to have a negative impact on your credit score.

You May Like: Is 565 A Good Credit Score

Mix Of Credit Accounts

Just as a long credit history shows you can handle credit well, a mix of different types of credit account types helps your credit score. That means you’re best off if you have credit cards and installment loans, like a mortgage or auto loan. More unique types of loans is best for your credit.

However, that doesn’t mean you should get a new loan just to help your credit in most cases. Instead, just apply for the credit you need and watch as your score slowly rises over time when you manage your loans well. Your credit mix makes up 10% of your credit score.

What Does Your Credit Score Affect

Having a good credit score is important because your credit can impact many areas of your life. Good credit can make it easier to qualify for loans and credit cards, allowing you to finance large purchases with low interest rates or get a premium rewards credit card with benefits.

The benefits of a good credit score go beyond debt. Bad credit can affect your housing applications, insurance premiums and security deposits, adding roadblocks to many of lifes everyday necessities.

Heres a closer look at when and how credit scores are used:

Don’t Miss: How To Get An Iphone With Bad Credit Rating

Does Spending More Increase Credit Score

Your credit score is not directly related to your spending. However, if you take out multiple forms of credit to increase your spending, your score is likely to be affected as a result. If youre spending cash that you have saved, your credit score wont be impacted.

Experts agree that you should aim to use no more than 30% of your credit limit on any of your cards. This is because your credit utilisation is one of the most significant factors in determining your credit score, and the more of the credit allowance you have used, the higher your credit score is likely to be.

Therefore, its vital that you only increase your spending if you can afford to do so. Its not good for your personal finances to drive up your spending on your credit score or to take out other forms of credit to increase your monthly expenditure. So, if youre spending more cash than normal, your credit score wont increase. But if you increase your expenditure on your credit cards, it will impact your credit score going forward.

Myth #: Checking Your Credit Score Hurts Your Credit

A hard inquiry may drop your credit score, but hard inquiries only occur when you submit applications for new credit accounts. A soft inquiry does not affect your credit score.

You can get your credit score from credit reporting agencies even if youre not applying for new credit, and this counts as a soft inquiry. Your credit score wont be penalized for a credit check. In fact, consumers are encouraged to regularly check their credit score or have it monitored.

Checking your credit score regularly is important so that you can have a better idea of your financial standing. Its also important so that you can catch potential fraudulent activity or incorrect information.

If you notice incorrect information on your credit report, be sure to follow the to get it removed before it can impact your credit score. You can stay on top of your credit history with a free credit score report, which you can get once a year.

Also Check: How To Unfreeze Your Credit Report

How To Check Your Credit Score

Knowing where your credit score stands before applying for a new credit card or loan can help give you insight into which products you may qualify for and what interest rates you can expect.

You can check your credit score in a variety of ways, knowing it wont hurt your credit by doing so. For example, you can request a free copy of your FICO Score every 30 days through Experian. You can also access your free credit score by signing up for LendingTree.

Your bank or credit card issuer may also offer the ability to check your credit score for free. If not, Discover, Capital One, Chase and American Express all offer a free credit score service.

Additionally, the Fair Credit Reporting Act requires each of the three major credit bureaus to provide individuals with free credit reports through AnnualCreditReport.com. Due to the COVID-19 pandemic, the credit bureaus are now allowing you to pull your credit reports weekly until April 2022. Checking your reports regularly can help identify potential fraud and identity theft, as well as legitimate errors that may be dragging your scores down.

Factors That Dont Affect Your Credit Scores

While many factors affect your credit scores, some things have no effect at all. These include things like:

- Your color, race, religion and sex.

- Your marital status.

- Where youâre from and where you live.

You might be wondering: Does paying bills affect your credit scores? The answer depends on the type of bill, whether your payments are reported to the credit bureaus, and how the scoring model considers that information.

Does Having a Credit Application Denied Hurt Your Credit Scores?

Getting denied for a credit card doesnât affect your credit scores directly. However, applying for credit may lower your credit scoresâusually by just a few points, according to FICOâbecause it triggers a hard inquiry. Thatâs why the CFPB recommends applying only for the credit you need.

Want a better idea of whether you might be approved before you trigger a hard inquiry? Pre-approval or pre-qualification can help you find out whether you might be eligible for a credit card or loan before you even apply.

With Capital Oneâs pre-approval tool, for example, you can find out whether youâre pre-approved for some of Capital Oneâs credit cards before you submit an application. Itâs quick and only requires some basic information. And checking to see whether youâre pre-approved wonât impact your credit scores, since it only requires a soft inquiry.

Also Check: How To Unblock My Credit Report

Does Opening A Savings Account Affect Your Credit Score

Simply put, no, opening a savings account does not impact your credit score because youre not borrowing money. Financial institutions dont generally run any type of credit report nor do they report your history to a credit agency. If a bank account is doing a soft credit inquiry it is typically only to verify your identity and not to use the information to make a decision on your opening an account.

If you are concerned about a potential hit to your credit score, reach out to the bank or credit union before opening your new savings account. A representative should be able to tell you all about the application process and what, if any, you should be worried about.

How To Use Your Newfound Knowledge

Credit scoring companies review your credit reports to see how youre doing on all these factors. Then they build your scores from that data. You can see the same things they do by checking your credit reports.

Focus your credit-building efforts on on-time payments and keeping balances low relative to credit limits, because those factors have the biggest effect on your scores. You can track your score and get personalized tips with NerdWallets free credit score dashboard.

Recommended Reading: How To Build Your Credit Rating Uk

How Much You Use Credit

Anyone who has a limited credit history may find it hard to borrow money because the lender is not able to determine if the borrower is a good risk. In addition, those customers with frequent and multiple credit applications raise a red flag for lenders because they may be overburdened with too much debt and might struggle with any further credit. Handling credit responsibly will boost your score.

Keep Credit Utilization Ratio Low

While your finances are in flux, try to avoid maxing out your credit line. You’ll want to get your credit utilization ratio to under 30%. This means only spending 30% of your total credit. For example, if you have a credit card with a limit of $10,000, aim to spend no more than $3,000 on that card within any monthly billing cycle.

Recommended Reading: Is 660 A Good Credit Score

Most Important: Payment History

Your payment history is one of the most important credit scoring factors and can have the biggest impact on your scores.

Having a long history of on-time payments is best for your credit scores, while missing a payment could hurt them. The effects of missing payments can also increase the longer a bill goes unpaid. So a 30-day late payment might have a lesser effect than a 60- or 90-day late payment.

How much a late payment affects your credit can also vary depending on how much you owe. Dont worry, though: If you start making on-time payments and actively reduce the amount owed, then the impact on your scores can diminish over time.

If youre having trouble making payments at all, you could also wind up with a public record, such as a foreclosure or tax lien, that ends up on your credit reports and can hurt your scores. Sometimes a single derogatory mark on your credit, such as a bankruptcy, could have a major impact.

Why Does My Credit Type Matter

You might receive a higher credit score if you successfully maintain a mix of credit accounts: installment loans and revolving credit accounts.

Maintaining a mix of installment and revolving credit may demonstrate that youre able to manage different types of loans.

Revolving credit demands a high amount of responsibility due to the varied amount of debt you may accumulate in a given month. A history of successfully managing revolving credit may result in a higher credit score.

Don’t Miss: What Credit Score Do You Start At

Factors That Don’t Affect Your Credit Score

Checking your own score: If you get your own score through your bank or a free credit score service, it does not affect your score. That’s because checking your own score is considered a soft pull on your credit. You can check it as many times as you want with no impact to your score.

Rent and utility payments: In most cases, your rent payments and your utility payments are not reported to the credit bureaus, so they do not count toward your score. The exception is if you use a rent-reporting service or if you are late on utility payments. The utility company may charge it off or sell it to a collector, who can report it to the credit bureaus and hurt your score. Some new products, such as Experian Boost, allow you to add utility payment information to your Experian credit report, which can influence your credit.

Income and bank balances: Credit reports do include some employer information, but it’s used only to match account data to the right person. Getting a raise won’t bump up your score, and it is possible to build credit on a small income. And since reports list only credit accounts not savings, checking or investment accounts your balances in those also won’t help your score.