Can You Have A Credit Score Of Zero

No you cannot have a zero credit score because the industry-standard range begins at 300 and reaches up to 850 for people who meet the minimum standard for a numerical rating.For example, suppose a lender looks at a persons consumer report with insufficient historical information. In that case, they might see a message stating No Record Found or Too New to Rate instead of zero.In another instance, a lender reviewing an applicant that recently filed bankruptcy might see a 300 result rather than zero.

Lower Your Utilization Ratio

Utilization ratio is a significant credit score factor to consider. It represents how much of your credit limit youre using. For example, if you have a $1,000 balance on a $2,000 credit limit, you have a 50% utilization ratio. Generally, the lower your ratio, the better. This is why you want to achieve if possible. However, you might want to keep a small balance on your credit card. Generally, you want to have no more than about 25% to 30% utilization.

Use Loans To Build Credit

If you have outstanding student loans, one of the easiest ways to build credit is simply to make all your loan payments on time. If you don’t have student loans, getting a car loan or a personal loan and repaying it on time is another way to demonstrate you can use credit responsibly. If you have trouble getting good loan terms on your own, asking someone to cosign on the loan with you can help.

Another option: Some smaller banks and credit unions offer designed to help you establish credit. As with a secured credit card, these loans require you to make a deposit, which you then pay off over six to 24 months. Those payments are reported to the credit bureaus, and you get your deposit back once the loan is paid.

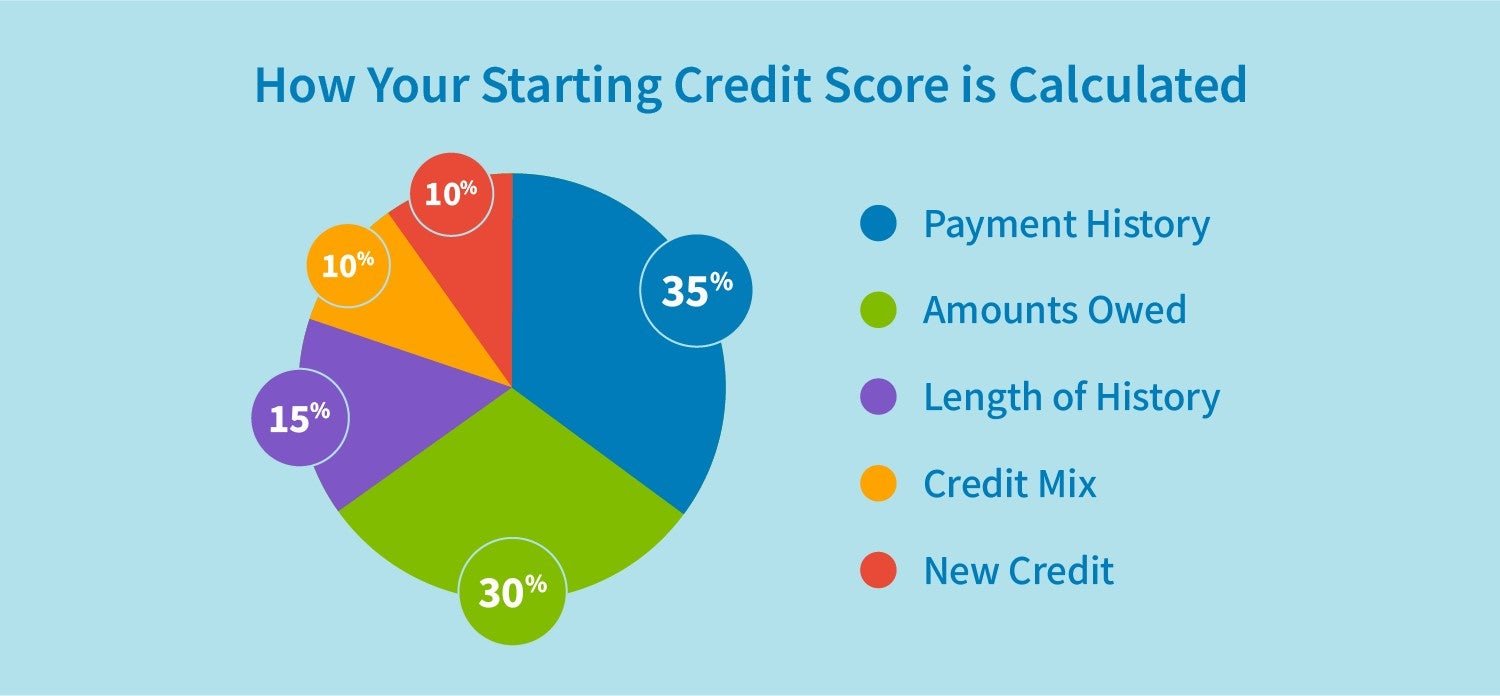

Whatever type of loan or credit you obtain, remember the factors used to calculate your credit score. Be sure to make your payments on time, keep your credit utilization ratio below 30%, and avoid generating too many hard inquiries on your credit report.

You may even be able to build credit and improve your credit score simply by paying bills related to daily living. For example, Experian Boost is a free service that adds your positive cellphone and utility bill payments to your credit file, often instantly improving your FICO® Score.

Recommended Reading: Remove Student Loans From Credit Report

Open A Secured Credit Card

A secured credit card is designed to help consumers build credit. Unlike a traditional card, this type of credit card is easier to qualify for because it requires a security deposit. The amount of money you put down acts as collateralsomething of value a provider can seize if you fail to meet repayment obligationsif youre unable to pay your balance and helps establish your credit limit.

When searching for a secured credit card, make sure the issuer reports to the three major credit bureaus: Experian, Equifax and TransUnion. To add positive payment history to your credit file and avoid late fees and interest, pay your credit card bill in full on or before the due date.

Related:Best Secured Credit Cards 2021

How To Check Your Credit Score For The First Time

If you already have a credit account, such as a loan or credit card, then its possible that your creditor will provide you with your credit scores for free.

If they dont, then you have a couple of other options:

- Purchase your FICO score: You can get your FICO credit score straight from FICOs website, although it wont be free. They offer different packages that you can choose from.

- Get your VantageScore for free: VantageScore offers free access to their credit scores, although youll have to get your score through one of VantageScores partners instead of from them directly.

- Sign up for credit monitoring: You can also sign up for a service, which will give you access to your credit scores and help you protect your credit by giving you updates about your credit activity so that you can spot fraud or identity theft early on.

Bear in mind that you likely have different credit scores with FICO and VantageScore, and simply looking at your VantageScore might not give you an accurate idea of your borrowing power. The vast majority of lenders will look at your FICO score when you apply for a new loan. 1

Whats considered a good credit score?

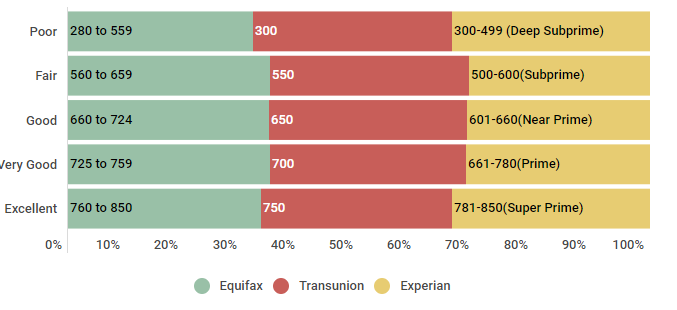

Theres no universal definition of a good credit score. FICO considers 670+ to be good, whereas VantageScore considers 661+ to be good. However, lenders also have their own score requirements, which vary depending on the type of credit account you apply for.

Don’t Miss: Does Snap Report To Credit Bureaus

Business & Consumer Credit Score

Image Credits: Unsplash

A good credit score can influence everything from getting a credit card to purchasing a home. However, it can also impact your companys credit lines. So whether you are asking for a new credit card or a small business financing, your credit history will be evaluated. Equifax Canada categorizes the scoring as:

- Poor: 560 or below

- Excellent: 760 to 900

- Overall credit range: 300 to 900

Whether youre looking for funding as a sole trader, a partnership, or a small company, the way your credit score is checked will change. For example, if youre a sole trader, your individual credit history will almost certainly be as important as your companys credit history.

The consumer and business credit will be treated on the same level. As a result, its critical to protect and increase your personal credit score whenever possible.

Bonus: Click to read a guide by Experian on steps you need to take to improve your personal credit score quickly to build a good credit history.

Does Your Credit Score Start At Zero

The answer is no. As briefly mentioned above, your credit score can never start at zero. This is the case because a lender calculates your credit score when you want to apply for a loan. Additionally, your credit card issuer often completes this process to check out your creditworthiness.

When this procedure starts, the card lander or other entity will look for a credit score that mirrors how you are dealing with your credit accounts.

Read Also: How Does Navy Federal Auto Loan Work

As You Begin Building Credit For The First Time It Can Help To Understand What Influences Your Starting Credit Score

When you check your credit score for the first time, you might be surprised to find a three-digit number, even if youâve never used credit before. Thatâs because your credit score doesnât start at zero. In fact, the lowest possible score from FICO® or VantageScore® is 300.

But unless youâve had some recent trouble with on-time payments or high spending, your score likely wonât be that low. Read on to learn more about where your score starts and why using credit responsibly is important from day one.

Only Charge What You Can Afford

Credit cards are a tool, not an excuse for a shopping spree. If you open a card to start building a credit score, use it for small purchases that fit your budget and pay the card off in full each month. Regular use and full payment are important, because your credit utilization ratiothe proportion of debt compared to available creditis the second biggest factor impacting your credit score.

Also Check: Report Death To Credit Bureau

How Are Business Credit Scores Used

Small business lenders rely on business credit scores from multiple credit rating agencies to decide whether or not to make loans to small businesses. The business credit score also helps lenders determine the size of a loan they are willing to make. Lenders look at factors like whether your business has been paying previous debts on time, how quickly you pay suppliers and how much revenue youve been bringing in over time.

Business credit scores provide them with recalculated ways of determining the creditworthiness of a business. High scores mean a business has been diligent in making payments to others while a low score sends up a red flag. Lenders need to know how likely it is that a business will repay the loan they are granting on a timely basis. The various rating agencies provide historical information that the lenders can access prior to making their lending decisions.

Like it or not, business credit scores are an important tool most small business lending companies use to decide whether or not you will get the loan you need. Most of the time, lenders consider both personal credit scores and business credit scores, paying attention to all the factors discussed above.

Your small business’ credit history also follows you from one business to another and records may become inaccurate over time so it is a good idea to maintain detailed records, even if one business closes and you open another one.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Also Check: Usaa Credit Score Free

What Is A Good Credit Score Range

Good credit score = 680 739: Credit scores around 700 are considered the threshold to good credit. Lenders are comfortable with this FICO score range, and the decision to extend credit is much easier. Borrowers in this range will almost always be approved for a loan and will be offered lower interest rates. If you have a 680 credit score and its moving up, youre definitely on the right track.

According to FICO, the median credit score in the U.S. is in this range, at 723. Borrowers with this good credit score are only delinquent 5% of the time.

Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

Recommended Reading: How Long Do Evictions Stay On Credit Report

Sign Up For Experian Boost

Offered through Experian, Experian Boost can help improve your credit score. Experian Boost lets you add accounts for things you pay through your bank account, like utilities or a monthly subscription to Netflix, to your Experian credit file. This can boost your score and credit history. The downside is that it only helps with your Experian credit score.

Apply For An Unsecured Credit Card

Unlike a secured card, an unsecured credit card has a starting credit limit based on factors like your credit score and income. Your interest rate and approval odds are also based on your score. Because of this, this option is best for those with some credit history and good credit.

Best Unsecured Card for No Credit

The best credit card for students or borrowers with no credit is the Discover It Student Cash Back card. It offers up to 5% cashback and doesnt have an annual fee.

Also Check: Affirm Credit Score Needed

Where Can You Check Your Small Business Credit Scores For Free

Both personal and business credit scores are available from a number of online sources. However, you may have to pay for them. With personal credit scores, its a legal requirement for the credit bureaus to provide you with a copy of your credit report for free. However, there is no such requirement for business credit scores.

You can do an online search for free business credit report, but you may encounter some scams. There are some websites out there that will promise you a free report in order to get your personal information. Make sure that you only share your information with a reputable website or company. We recommend that you contact each of the rating agencies and Dun & Bradstreet directly. You can obtain a copy of your D& B report for free.

Get A Starter Credit Card

Credit cards are a great tool to start building credit. If you don’t have a credit history, you may have trouble qualifying for certain cards. If you’re a student, consider a student credit card.

You can also establish a credit history with a secured credit card . A secured credit card requires a security deposit or collateral. The cash deposit typically $200-$500 becomes your credit line. Secured credit cards aren’t offered by Chase, but it’s similar to a traditional credit card. They charge late fees in cases of missed payments and may have high interest rates as well as annual fees.

Also Check: Does Paypal Credit Help Your Credit

Myth : You Should Never Close Your Oldest Credit Card

Experts often warn against closing a credit card, especially your oldest one, since it can have a negative impact on your . Closing your oldest card is bad for two reasons: It can lower your overall credit utilization ratio and shorten the length of your credit history, two major factors in determining your score. But if you have a strong mix of credit products, a big enough credit limit that you won’t go over a 30% CUR and only a few recent inquiries, the dip will likely be only a blip on the radar.

Dealing With Credit Scores Can Be Challenging Because:

-

It often takes at least a year or two to establish or improve your business credit history or personal credit history

-

You can influence and improve your credit scores with effort, but you cannot directly change them since they are given to you by external rating agencies

-

Internal record keeping and monitoring small business credit scores can be time consuming

Recommended Reading: How Long Can A Eviction Stay On Your Credit

What Is Your Starting Credit Score

We all start out with no credit score which makes sense, given that our credit scores are based on the information contained in our credit reports, and these reports arent even generated until we have had credit in our names for 6 months or longer. Without an established history, your credit report and credit score dont magically appear when you turn 18, despite many common misconceptions.

Once you have established credit, your first credit score could range anywhere from lower than 500 to well in the 700s, depending on your initial financial performance. The only connection between your first credit score and the scoring metrics would be the age of your credit profile. And given that this factor is only worth about 15% of the points in your total credit score, even by essentially failing this category and doing well in the others, you would still have a credit score well above 640.

Wondering what the credit scores of US consumers look like? Lets take a closer look.

U.S. Population Categorized by the Five FICO Ranges for Credit Scores

| Age | |

|---|---|

| 17% | 32% |

It comes as no surprise that older consumers with a more established credit history, have better credit scores with approximately one-third of Baby Boomers having excellent credit. Younger generations that are just starting out in building their credit are still working on improving their scores, with the bulk of Gen Zers and Millennials having poor or fair credit.

Dont Close Any Card Accounts

When you are new to credit and building a score from nothing, time is your friend. Even if a year from now, you have a card you no longer want or use, keep the account open unless it charges an annual fee. The length of your credit history directly affects your FICO score, so the longer your accounts are open, the better your credit score.

Don’t Miss: What Credit Bureau Does Usaa Use

How To Start A Credit Score

Building a credit history will start you on your way to having a credit score. If youre ready for your first credit card, it may help you get started. If it makes sense for you, you might want to consider applying for a card with no annual fee.

Once youve kicked things off, there are many ways to keep track of your credit score. First, start by checking your score regularly. If you have a credit card, you might check with your issuer. With Discover, for example, cardmembers get a free Credit Scorecard with your FICO® Credit Score and important information behind it.* You can also ask for a full credit report annually from the three major credit bureaus via AnnualCreditReport.com.