What Is A Hard Pull

The reason that one credit bureau might have records of credit applications that others dont is that each time you apply for a loan or credit card, the lender will check your credit report.

It does this by contacting a credit bureau and making a hard pull on your report. The credit bureau that the lender works with will send a copy of your report to the lender.

The bureau will also make note of the hard pull on your credit file.

Each hard pull on your report will reduce your by a few points. Records of hard pulls are kept for two years.

If a lender makes a hard pull on your credit with one credit bureau, but not the others, its possible that your scores will differ based on which bureau you ask.

Thats because the bureaus dont inform each other of hard pulls.

It is also possible for a company to make a soft pull on your credit. This lets them check your credit report without impacting your score.

How Do I Find Out If Verizon Reported To Credit Bureaus

Verizon will not affect your credit report unless you have an account with Verizon. So, to check Verizon, you will have to get a copy of your credit report.In this article it says if you are on a contract with Verizon you will have a Verizon account, but if you are not then you dont have any Verizon accounts.

What About Late Payments

If you have one or two late payments owed to your mobile provider, this wont affect your credit. But, again, in order to report to the credit bureaus, the cell phone provider would need to meet fair credit reporting laws and pay a fee.

That is time and money they simply dont want to spend.

Instead, they may charge you a late fee or penalize you in other ways to ensure future on-time payments.

While the cell phone company wont report to the credit bureaus, late payments will get turned over to collections if your account becomes delinquent enough.

Many of the larger cell phone companies have their own collections department that will reach out first to attempt to collect payment. If their inquiries go unresolved, they can then opt to sell the debt to a collection agency.

It is this third-party collection agency that reports your delinquent account to the credit bureaus.

A collection account can have a significant impact on your credit score. And if it remains unpaid, it will continue to harm your credit score for up to seven years and could result in you being sued.

You May Like: How To Check Credit Score For Free

Can My Start Up Build Business Credit

By | In: Finance, Financing & Credit

In a previous post I mentioned how you can start building business credit right away by having your everyday expenses like web hosting, phone services, and printing reported on your profile. If the companies youre doing business with are not reporting your payment history you can use a business credit builder product at DNB that will get the job done.

You can also start corporate credit accounts with companies like Verizon, Quill, Accurate Office Supply, BestBuy, FedEx and many others. You will need to provide your EIN number when you open an account and some companies will request your Dun & Bradstreet number. Remember, not all companies that you start business credit with will report your payment history.

Also, each company has its own credit approval guidelines and minimum requirements for business startup credit. For example, Accurate Office Supply offers a net 30 account with no personal guarantee but requires your business to have a minimum of three trade references and one bank reference.

So if your goal is building a strong business credit file then you will either need to select companies that report to the business credit bureaus or use the Dun & Bradstreet CreditBuilder to add your trade references yourself.

How Do I Delete Verizon Collections On My Credit Report

If you have a debt reported to collections, you may request that it be removed from the report by contacting the consumer reporting agency.

You also have the right to file a lawsuit if the debt is valid and is owed, the company refuses to validate the debt and you wish to resolve the matter. This is called a lawsuit because the lawsuit is the legal process by which you force the collection agency or the debtor to prove they are correct about your debt.

However, you might be able to prove that you never got the letter or that the letter was returned to them, but you cant do that if they have the documents from the collection agency.

If you pay for something with a credit or debit card, you can still get your money back if the merchant doesnt send it, so you might as well keep a copy of the receipt.

If you want to delete a comment, you dont have the option to say, Hey, I want to delete this comment.Instead, you have to flag the comment, and someone from the community can decide whether or not it needs to be deleted.

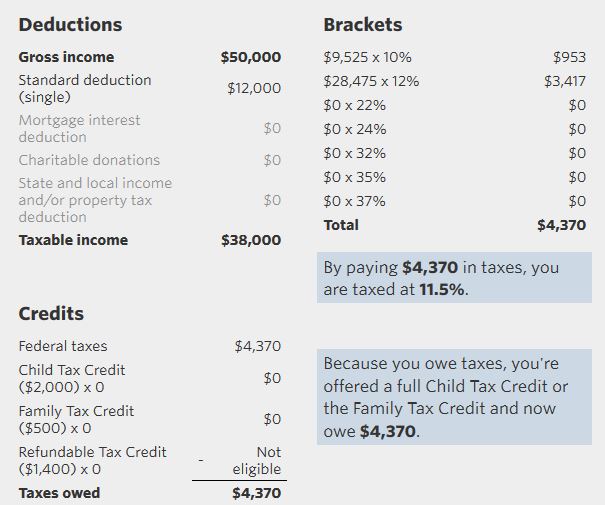

If you were to pay off $5,000 in arrears on a $25,000 CC, it would look like your credit utilization rate would be 25%, while in reality it would be 4.9%. This is because we can only see the portion of the outstanding balance on your statement that is in good standing, not the portion that youve paid.

In general, you should be aware of the credit utilization rate, because you want that percentage to be as low as possible.

Also Check: How To Add A Tradeline To Your Credit Report

Who Is Verizon Collections

Verizon Wireless is a telecommunications company that offers wireless products and services. They are headquartered in New York, New York.

You may see them listed on your credit report as a collections account. This can happen if you have a past-due balance on your Verizon account.

They may appear on your credit report as vzw collections or verizon credit inc.

Checking Credit On Verizon: A 4

Interested in Verizon as your wireless provider? Great. We would love to have you as one of our valued customers. Stay entertained and productive with the hottest smartphones and the latest in smart home, family tech and beyond. All with the benefits provided by the best network.

Running your credit is built right into your shopping experience. Heres a brief overview of the simple process for checking your credit requirements on Verizon so you know what to expect.

Read Also: How Many Points Does Your Credit Score Go Up

Agree Complete And Confirm

Once on the Phone and Agreement page you can confirm and complete process and soon have Verizon as your wireless provider of choice.

-

Confirm address and select phone number desired transfer existing or request new.

-

Accept Verizons terms and conditions and click Continue to the next step.

-

Complete the entire order by reviewing the summary for accuracy and clicking Complete your order.

Join Americas most awarded network.

So when youre looking for an impressive selection of devices from major brands like Apple, Samsung or LG, or the hottest smart tech from , Nest and more, Verizon is your go-to source to keep you in the know while on the go or at home doing the things you love to do. All on the nations most reliable 4G LTE network.

*Some buy-flow sequences shortened for the purposes of this content.

You might also be interested in:

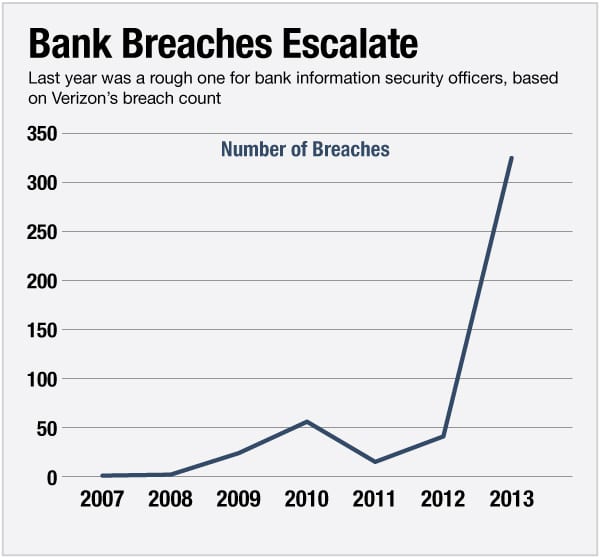

Where We Got The Data

In order to provide the most accurate information possible, we employed three methods of data gathering over six hours.

First, we scoured through credit and finance forums online to see what people were reporting when it came to which credit bureau was used by their provider when they signed up for mobile phone service.

We also called the customer service agents at each of the four major U.S. mobile carriers.

We also called physical stores in New York City to see if different agents provided different answers .

Finally, we spoke to relatives and family members to gather more anecdotal evidence.

Once we put all of our data together, we were able to come to reasonable solid conclusions about which credit bureau each provider favors.

Read Also: How To Get A Timeshare Off Your Credit Report

Why Should You Use Donotpay To File Verizon Disputes

DoNotPay is fast, easy, and successful. We save you the time of filling out multiple forms. We save you the worry of figuring out how to fine-tune your writing skills to request debt removal. We take away the stress. You only have to give us the important information, and we will make the best case for you.

Validate The Debt If You Dont Think Its Accurate

Sometimes other companies contract with Verizon Collections to collect on their past due accounts. If you dont have a Verizon account or dont think the collection belongs to you, consider asking for validation.

You have only 30 days from the first date of contact to do this, though, so act fast. Request validation in writing, asking Verizon Collections to validate:

- Name on the account

You May Like: Does Taking A Loan Payment Holiday Affect Your Credit Rating

Remove Verizon Collections From Your Credit Report Today

Lexington Law specializes in disputing Verizon collections accounts. They have over 18 years of experience and have removed over 7 million negative items for their clients in 2020 alone.

If youre looking for a reputable credit repair company to help you with Verizon collection accounts and repair your credit, we highly recommend Lexington Law.

Call them at for a free credit consultation. They have helped many people in your situation and have paralegals standing by waiting to take your call.

Verizon Reports To Credit Bureaus

02-02-201608:19 PM

Hello Verizon,

I was a loyal customer of Verizon since November 2011. I closed my account in July 2015. Later, a collection agency contacted e via mail to pay remaining $66. They offered me an option of paying the amount in 2 installments. I paid my remaining balance in 2 months .

Recently, when I checked my credit score and report, I saw Verizon reported it as “unpaid/delinquent” to all 3 credit bureaus. That caused my credit score to go down from “Excellent” to “Poor”. The negative remarks by Verizon on the credit reports will last for 7 years just because I paid $ 66 in 2 installments?

I really think this is not fair. I was a customer for almost 4 years and had been paying more than $90 per month. I was never late in those 4 years. I have paid the last amount as soon as the collection agency contacted me.

I kindly request Verizon to retract this negative reporting from all three credit beueaus. If you have any questions or want discuss this futher, please contact me via phone or email.

Read Also: Is 766 A Good Credit Score

Settle The Debt For Less Than The Full Amount Owed

This may be the best strategy if your primary goal is to settle the account, make the collection agency go away, and somewhat improve your credit score by reporting the collection account as settled.

Dont be afraid to try this strategy either. To avoid the account never getting paid, many collection agencies will settle for less than the full amount.

Send the collection agency a letter proposing to settle the debt for some amount well below the full amount.

We recommend making your first offer something less than 50% of the full amount.

If the collection agency is willing to settle, theyll counter with a higher dollar amount.

Its likely youll continue to go back and forth several times until you arrive at a satisfactory number.

If they dont counter on your first offer, its likely that theyre not open to a settlement.

But, even if they agree to settle, send no money until they confirm all the details of your agreement in writing.

That will include agreeing to:

- accept the reduced payment in full satisfaction of the debt

- ending further attempts to collect on the debt

- reporting the account as paid with all three major credit bureaus

Once you receive the letter, then send your payment.

About Prevent Loan Scams

Prevent Loan Scams provides guides, reviews & information to help consumers through every restorative step of their financial journey.

Use A Proxy To Remove Credit Bureau Reports

Another effective way to remove credit bureau reports from websites is through a proxy server. A proxy server helps you disguise your IP address so that site visitors cannot see your true identity . This approach is less likely to be detected by internet security services and can help you keep track of how many people are visiting your site during specific periods of time.

Read Also: Is American Express Good For Your Credit Score

Request A Goodwill Deletion

A goodwill deletion is when you request a collection agency remove a collection account from your credit reports on a paid debt.

If youve already paid a collection account to Verizon or their assigned collection agency, you may be able to send a goodwill letter to the collection agency and request deletion.

The letter should remind the agency that:

- the debt is paid in full

- describe the circumstances that were beyond your control that led to the debt going into collection.

If you can prove those circumstances,such as divorce, death of a loved one, disability, or other causethe company may delete the collection account as a goodwill gesture.

Your case will be stronger if you can support your explanation with documentation that proves the circumstances that led to the collection.

Get Verizon Wireless To Fix Your Credit Report

Before you take on Verizon Wireless alone, let our expert team help you submit an official claim.

Federal law protects you from a collections department reporting inaccurate or unsupported items on your credit report.

If a company like Verizon Wireless becomes aware that they reported incorrect information to a credit bureau they must inform the credit bureau.

If you think that the Verizon Wireless Collections Department should remove a negative item from your credit report, read on to learn how to request it.

Recommended Reading: How To Change Credit Score Illegally

Startup Business Credit Cards

While trade credit with companies like Quill and FedEx can help your business fund its short-term needs, cash credit is much more preferable. The mistake that most business owners make is applying for a business credit card that requires a personal credit check as well as a personal guarantee.

These types of cards are a glorified version of a personal credit card because the charges and debt your business incurs all report on your personal credit reports. Furthermore if you default on any outstanding debt incurred on the card then you are personally liable for that debt.

So youre probably wondering how a start up company like yours can obtain business credit cards with no personal credit check or personal guarantee. For starters I suggest a secured business credit card for establishing business credit. After several months of solid payment history you can request an unsecured credit line increase.

In addition you may want to consider a business debit card from the bank that services your business checking account. Even though this doesnt start corporate credit for your company it does help establish bank credit.

If youre a startup company, I encourage you to start building business credit by taking advantage of everyday expenses, corporate credit accounts, a secured business credit card, a business debit card and business credit cards.

To your business credit success!

How Do I Remove Verizon Collections From My Credit Report

Removing Verizon Collections from your credit report may be possible if any information on the account is incorrect, error’d, or fraudulent, and is not fixed in an appropriate amount of time. According to a study by the U.S. PIRGs, 79% of credit reports contain mistakes or serious errors. We specialize in going after these types of accounts for our clients.

Read Also: Does Apple Card Show Up On Credit Report

The Reason To Care About The Credit Report

Many readers and customers might question, why do we even need to care about the Credit Report? You should be caring about the Credit Report because it plays the main role in whether you are eligible to be a customer of Verizon or not. To be precise, it can affect whether you qualify for a phone plan at Verizon or not.

There is no doubt that every bureau uses the same source data for generating your credit report, yet there might be some minor differences among them. Let us take an example one bureau may have records of an application, whereas others dont. This can impact your score, and if you know what credit bureau will be used when you are trying to sign up at Verizon, you will be able to make sure that the report is perfect, and you can increase the chances of being eligible to be a customer of Verizon.

Which Credit Bureaus Does Verizon Report To

Verizons Customer Service representatives have also been reported to have been known to report delinquent accounts to all three credit bureaus, which is a practice that most other companies do not do.

So if your balance goes into the negative and Verizon contacts the credit bureaus, you could find yourself having to make arrangements to clear this off your account.

Read Also: Is 769 A Good Credit Score

Get Professional Help In Dealing With Verizon Collections

If youre not making any progress with Verizon Collections, or if the process is just wearing you out, its time to get professional help.

If your account has gone into collection, your credit has already been impaired.

In that case, working with a good credit repair company will be your best option.

They cannot only help to settle your account, but also to minimize or even eliminate the damage to your credit report.

But, if Verizon Collections threatens you with legal action, youll need to get legal representation.

We recommend you do this through a law firm that specializes in credit, like Lexington Law.

Sometimes just having legal representation makes collection agencies more cooperative, and avoids having the case go to court.

Use these steps below to help you remove a collection from your credit report: