How Can I Wipe My Credit Clean

The main ways to erase items in your credit history are filing a credit dispute, requesting a goodwill adjustment, negotiating pay for delete, or hiring a credit repair company. You can also stop using credit and wait for your credit history to be wiped clean automatically, which will usually happen after 710 years.

When You Pay Taxes With A Personal Loan

Paying your taxes with a personal loan can be a more affordable option than using a credit card, since interest rates on personal loans are sometimes more affordable than credit card rates. With a set number of fixed payments, over a repayment period of two to five years, personal loans are predictable and can be easier to budget for than credit card bills, with their indefinite payment amounts.

Using a personal loan to pay taxes requires some advance planning. You’ll need to calculate your tax obligation early enough to give yourself time to apply for and receive the loan amount before your tax payment deadline. You may be able to qualify for a personal loan within a few days, but it’s wise to apply to multiple lenders to shop around for the best interest rate deal.

A personal loan and your record of making payments on it will appear as activity on your credit reports, and will therefore have an impact on your credit score. The credit checks associated with applying for a personal loan, known as hard inquiries, will cause a slight reduction in your credit score, but your score should rebound within a few months as long as you keep up with all your debt payments.

Closing A Card Hurts The Length Of Your Credit

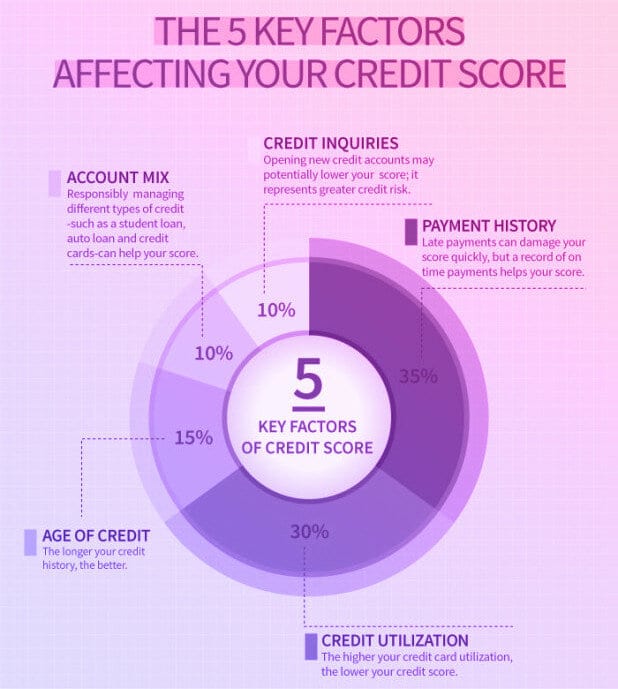

Having an inactive account shut down can hurt your length of credit history which impacts 15% of your score. If the card closed is one of your older credit cards, this can reduce the average age of your accounts which will lower your score.

Additionally, if it is your oldest credit account, it could impact your score even more since the scoring formula typically looks at your oldest credit line, too.

You May Like: Does Overdraft Affect Credit Rating

Read Also: Do You Want A High Or Low Credit Score

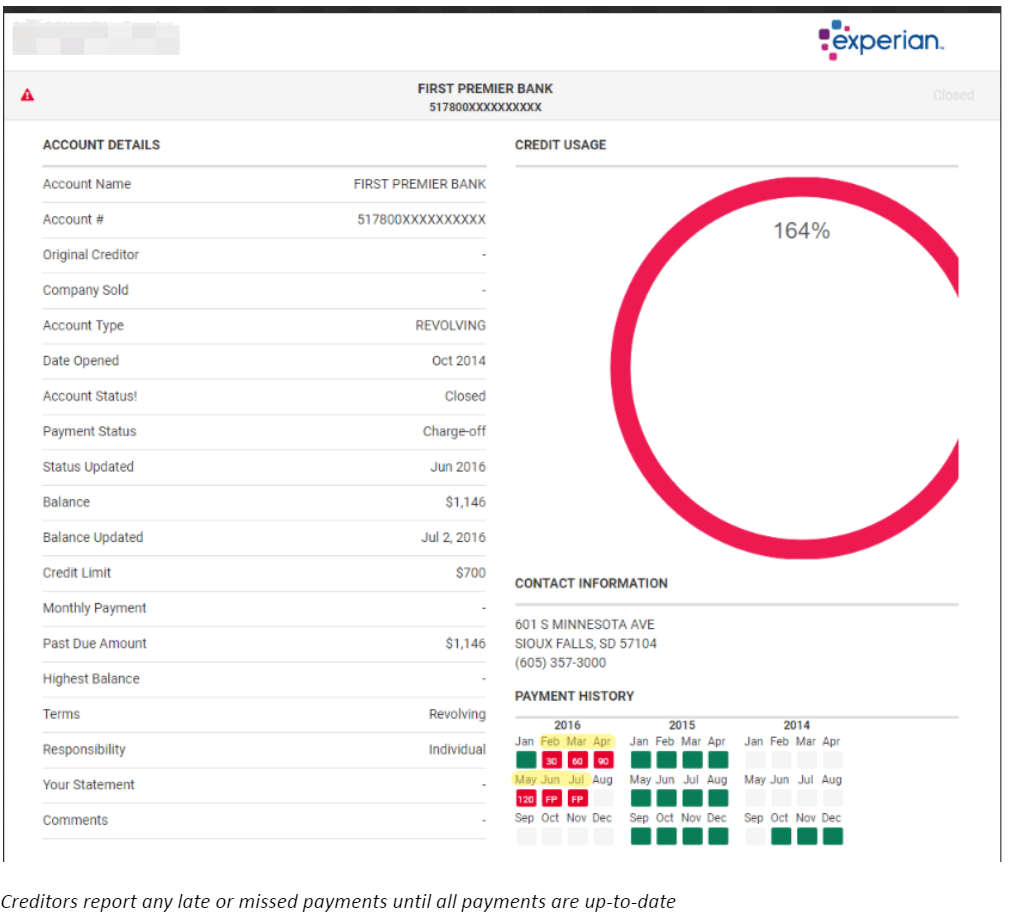

How Long Does A Late Payment Affect Your Credit

The bad news is a late payment can stay on your credit report for up toseven years. The good news is you can work to build up your credit during that time, correct your past mistakes and learn from them.

Late payments can significantly impact your credit score, which is based on your credit report. The amount of credit cards is not the focus, as long as youre paying them all on time. The more you have that are unpaid, the worse impact it will have on your credit score and opportunities available to you based on that credit score.

Ignoring your credit card due date doesnt just result in a bad credit score. There are late fees and increased interest rates that accrue every month that you fail to pay. If you have multiple accounts, this can really add up.

When Are Late Payments Reported

Now imagine you pay a bill after an entire billing cycle has lapsed, waiting until April 6 to make a payment that was due March 5. That means you’re behind enough for the issuer to furnish that information to the credit reporting agencies. It’s considered a 30-day late payment, and it will be noted on your credit report for up to seven years. Anyone who checks your report will see it and is free to form an opinion about it.

More important, a 30-day late payment will affect your credit scores. The two largest credit scoring companiesFICO® and VantageScorerank payment history as the most important score factor, and thus a late payment will shave points from your score. The extent of the damage depends on the state of your entire credit history. If you have a long and strong pattern of using credit products responsiblypaying on time and keeping revolving debts lowa single late payment isn’t likely to drop your scores drastically. On the other hand, if you have very little on your credit report, your scores will likely decline markedly.

If you continue to let billing cycles elapse, your credit scores will be harmed more severely. The later a payment is, the more alarming it is to creditors and the more dramatically your credit scores will sink. Severely late payments could be an indication that you’re in financial trouble, and a signal to lenders that you pose a credit risk.

Read Also: Does Chexsystems Report Credit Bureau

Can You Remove Late Payments From Your Credit Report

A late payment stays on your credit reports for seven years. Unless the entry was a mistake, you cant remove it and it remains there until it drops off after seven years. In some cases, a late payment entry is incorrect. Two of the most common mistakes you could run across are:

If either of these two instances apply, you can dispute the error to the credit bureau that reported it. The credit bureau must investigate your dispute within 30 days. Once 30 days have passed, you receive a letter explaining whether or not your dispute was resolved. If the credit bureau doesnt respond within the 30 days, the negative mark is automatically removed.

Late Payments And Your Credit Score

When you set up an account with a company, youâll usually agree to make monthly payments. Itâs important to meet these payments on time and in full. Otherwise, you may negatively affect your relationship with the company, and reduce your chances of getting credit with other companies in the future.

However, things donât always go according to plan. Perhaps youâve had a hectic month and the bills slipped your mind. Or maybe the car needed repairs and you donât have enough money left over. Whatever the reason, if youâve missed a payment or think youâre going to, there may be steps you can take to reduce the damage.

You May Like: What Is A Fico Credit Score

Whats A Payment Worth

Payment history is the single most important factor in your credit score. A basic FICO score, for example, is made up of:

- Payment history

- Inquiries/new accounts

- Amount of available credit

VantageScore is opaque when it comes to the exact weight it assigns to each category. But it leaves no doubt about the importance of paying bills on time. A consumers payment history is the only factor the VantageScore ranks as extremely influential.

The Number Of Late Payments Myth

The fifth and final myth is that the number of late payments is not a significant factor. Late is late, some believe, and whether one is late on one payment or five is not a meaningful factor. The FICO scoring models look at the number of late payments on a credit file. One late payment may reflect a simple oversight, but five late payments potentially reflect a more serious financial problem.

The key is to appreciate just how significant late payments are to the FICO score. Payment history is the single most important factor, making up 35% of the FICO formula.

Have a question about a late payment and how it will affect your credit scores? Tell us in the comments!

More on Credit Reports and Credit Scores:

You May Like: How To Boost Your Credit Score Fast

Why Can Late Rent Payments Affect Your Credit In The First Place

Rent payment history, in general, affects around 35% of your overall credit score. So, even a single late rent payment or missed rent payment can significantly impact your credit score especially if its already on the higher side.

According to the data analytics company Fair, Isaac and Company and the popular consumer credit-scoring model VantageScore a score in the range of 670-700 is considered good.

It is recommend to keep your score above that. This ensures you have a bit of a buffer in case you hit some bumps in the road financially. And this means that even if you do lose some points, you’ll still fall within the good category.

If you have a credit score of 780 or higher and default on payment just once, your credit score can dip by 90-110 points.

However, this hit to your credit score isn’t permanent. You can rectify the situation by ensuring all subsequent payments are made on time. But unfortunately, it takes seven and a half years for a late rent payment to disappear from your credit score report.

Utility And Cellphone Payments

Gone Wild / Creative RM / Getty

Like insurance companies, many utility and cellphone providers check your credit score before extending service. But these businesses don’t routinely provide your payment information to credit bureaus. Your credit score isnt helped by timely payments on your utility or cell phone bills. However, if your account becomes past due, it may be passed on to a collection agency who would then list the account on your credit report leading to a credit score drop.

Don’t Miss: How To Dispute A Charge Off On Credit Report

How To Remove Late Payments From Your Credit Report

An accurately reported late payment can remain on your credit report for up to seven years. Even if you bring the account current and aren’t late anymore, your credit report is telling an accurate story of your history with the account.

If a creditor reports your payment late when you actually paid on time, however, you can dispute the late payment with the credit bureau. You can file your dispute for free by mail, over the phone or online, and explain why you believe the late payment is an error. You can also send, attach or upload supporting documents, such as bank statements or cancelled checks showing when you paid the creditor.

After receiving a dispute, the credit bureau will investigate your claim and either confirm the late payment was accurate or update your credit history to reflect what actually happened.

How Does Payment History Impact Your Credit Score

The overall impact of late payments depends on a few factors, including how often you pay late, and how severe or recent it is. If you miss your deadline by a few daysactually up to 29 days and pay the amount due, nothing will be reflected on your . This does not mean youll be off the hook on paying a late payment fee to your creditor, though. Those usually kick in after a payment is one day late.

But missed payments are not reported to the credit bureaus until theyre at least 30 days late. Multiple late payments will seriously damage your score. Remember that in the FICO model, payment history makes up a whopping 35 percent of the total.

If you see a late payment fee for just a few days past due and youre a good customer, you can call customer service and ask them to waive the fee. Most will waive it for a good customer.

How a delinquency will affect your score also depends on a few factors. These include the severity of the delinquency , as well as how much positive data you have in your credit report and your credit score.

There are two categories of consumers likely to see a more serious drop in their score over a late paymentthose with excellent credit and those with poor credit or thin credit files. The same applies to the amount of damage done by collections, as noted above.

Read Also: How Long To Get A Credit Score

Use Credit Monitoring To Track Your Progress

are an easy way to see how your credit score changes over time. These servicesmany of which are freemonitor for changes in your credit report, such as a paid-off account or a new account that youve opened. Also, they typically give you access to at least one of your credit scores from Equifax, Experian, or TransUnion, which are updated monthly.

Many of the best credit monitoring services can also help you prevent identity theft and fraud. For example, if you get an alert that a new credit card account that you dont remember opening has been reported to your credit file, you can contact the credit card company to report suspected fraud.

How Late Payments Are Factored Into Your Credit Score

Not all late payments on a credit report are created equal when it comes to how they affect a credit score. The extent of the damage depends on several factors:

- Recency. If the late payment appeared recently, which is usually perceived as in the past year or two, the impact of a late payment on your credit score will be much greater than if the late payment occurred six or seven years ago.

- Frequency. A single 30-day late payments affect on your credit score will be far less than if you have many 30-day late payments on multiple credit accounts peppering your credit report

- Severity. Being behind on a credit card with a $100 balance is less damaging to your credit score than being late on one with a $10,000 balance.

- Overall credit history. Credit scoring companies also take into account the full breadth of your credit history. If you skipped a big payment recently but you have a long and robust pattern of using many credit accounts responsibly, it may not hurt your scores as much as if you didnt. According to FICO, a person who started with a 710 score but missed two payments might see a 180-point decrease, though a person who began with a score of 607 may see a 47 point decrease.

So how long do late payments affect credit scores? For as long as they appear on your credit reports, though the impact will diminish over time. After seven years late payments fall off credit reports. When the notification is no longer listed it will not be factored into your credit scores again.

You May Like: Do Payday Loans Ruin Your Credit Rating

Will Paying The Minimum On My Cards Improve My Credit Score

No. This is a widespread myth. You need to pay at least the minimum payment due on your credit card every month so that your cards have an on-time payment history. You do not have to pay a single cent in interest to improve your credit score. In fact, paying your credit card balances in full every month will have the greatest positive impact on your score, because it will improve your credit utilization percentage.

What Happens When You Make A Late Payment

It depends on how much you owe and how late your payment actually is, but theres no getting around it: Late payments can hurt your credit.

If you can, pay off the overdue account in full within 30 days of missing the payment. This will keep your account from going into default. If the account continues to go unpaid for 60 days, you could see another negative impact to your scores. And after 90 days, your account might be reported as delinquent, which will continue to have a negative impact on your overall credit health.

Here are some things you might encounter after making a late payment on a credit card or other line of credit.

The consequences of making a late payment can feel harsh. But dont let it discourage you from working toward future financial goals. Credit scores can bounce back with time, hard work and patience. The best thing you can do is start working on rebuilding your on-time payment streak if possible even if that means making the minimum payment each month. Making more and more on-time payments and actively reducing the amount you owe can diminish the impact on your scores over time.

And, as best you can, dont let future payments become delinquent or get sent to collections. An account reported in collections could stay on your credit reports for up to seven years and cause even more damage than a late payment.

Don’t Miss: How Remove Charge Offs From Credit Report

Does Paying Off A Loan Help Or Hurt Credit

Paying off a loan frequently hurts credit because it impacts your credit history and your credit mix. If the loan that you have paid off is your oldest credit line, then the average age of your credit will become newer and your score will drop. If the loan that you pay off is your only loan, then your credit mix suffers.

How Do Late Payment Affect Your Credit Score

Among the things, most people strive to keep positive in life is their credit performance. You will never know the importance of a good credit performance until you reach out to your bank for a loan, and you cant get an approval. Therefore, meeting your financial obligations early enough as expected should at all times be on your priority list.

Among the things that can affect your credit performance is late payment. When you approach any lender seeking a loan, among the things that will determine whether the loan is advanced to you or not is your payment history. Lenders look at various factors regarding your finances before considering your loan request, and payment history account for 35% of your credit score.

While some late payments are a genuine error on your end e.g., forgetfulness, others could be failing to make payments due to financial shortcomings. Therefore, the question that you could be battling with is how do late payments affect your credit performance?

Also Check: When Does An Account Come Off Credit Report