What If My Rental History Report Is Inaccurate

The first thing youll want to do is carefully analyze the report to make sure that everything on it is accurate. While rental history reports and credit reports are different animals, its worth noting that the Federal Trade Commissions survey showed that 1 out 5 people have mistakes on their credit reports. The same could be true of rental history reports, which is another major benefit of acquiring your report before youre out looking for a new apartment. If there are inaccuracies on your report, this gives you time to dispute them and have them removed.

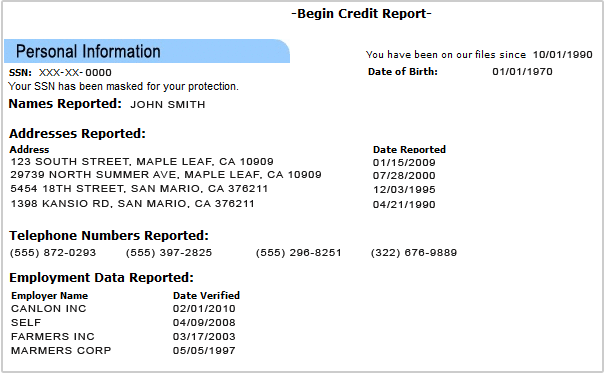

Dispute Errors On Your Credit Report

If your credit report has wrong information, you can dispute the error so that it is fixed. Here is how to dispute an error:

First, write a letter to the credit reporting companies that have the wrong information to ask them to fix the information. Include all of the following:

- Your name and address

- The specific information in your credit report that is wrong

- Why that information is wrong

- Copies of any receipts, emails, or other documents that support why the information is wrong and

- Ask that the information be deleted or corrected.

You may use the Federal Trade Commissions sample dispute letter to credit reporting companies and attach a copy of your credit report with the wrong items circled. Send the letter by certified mail or priority with tracking, and keep a copy of the letter and receipt.

If you cannot get the disputed information corrected or deleted, you may ask the credit reporting companies to add a statement noting your dispute in your file and in future credit reports.

So How Do I Get Rid Of Negative Public Records

Unfortunately, its not that easy.

The three major credit bureaus wont accept certain poorly sourced public records, and theyre proactively removing some tax liens and civil judgments if they cant verify whos responsible for repayment, along with some recent medical debts.

But theres no legal recourse for you to remove other, accurate public records from your credit reports.

If you spot an error on your TransUnion® credit report, Credit Karmas Direct Dispute tool may be able to help you challenge it. Since 2015, weve helped members remove more than $7.9 billion in erroneous debts.

You may also dispute errors on your Experian® and Equifax® credit reports directly through their websites.

Read Also: How To Remove Repossession From Credit Report

How Long Does A Bankruptcy Or Consumer Proposal Stay On My Credit Report

How long bankruptcy stays on your credit report in Canada will depend on the credit bureau that is reporting.

The largest credit bureau in Canada, Equifax, maintains this record on your credit report for a period from the date of your discharge or last payment:

- A first bankruptcy for six years from the date of your discharge.

- A second bankruptcy for 14 years.

The TransUnion web site states that they keep a bankruptcy on your credit file for six to seven years from the date of discharge or fourteen years from the filing date .

At this point the bankruptcy will leave the credit report and you will need to start to rebuild your credit.

How long a consumer proposal stays on your credit report again depends on the credit bureau that is reporting.

With Equifax, a consumer proposal is reported for three years after your last payment.

Submit A Dispute To The Credit Bureau

The Fair Credit Reporting Act is a Federal law that defines the type of information that can be listed on your credit report and for how long . The FCRA says that you have the right to an accurate credit report and because of that provision, you can dispute errors with the credit bureau.

are easiest when made online or via mail. To make a dispute online, you must have recently ordered a copy of your credit report. You can submit a dispute with the credit bureau who provided the credit report.

To dispute via mail, write a letter describing the credit report and submit copies of any proof you have. The credit bureau investigates your dispute with the business that provided the information and removes the entry if they find that is indeed an error.

You May Like: When Do Companies Report To Credit Bureau

Public Record Removal Letter Template

Letter template detail: public record removal letter template How to Remove a Public Record from Your Credit Report. Source: pinterest.com

See also these collection below:

Cover letter ideas for new graduates

Fire up your post-college work search with a tailored cover letter that reveals your enthusiasm, possible as well as motivation. Belows just how.

New graduates, you have a great chance of landing a task if you release a hostile search. A well-crafted cover letter must become part of this proactive method professionals say that tailoring your letter can open doors to brand-new possibilities. Right here s how.

Know the employer

While distributing the very same cover letter to every company saves time, you won t stand out from the group of applicants doing the same point.

Research the company, find out about their society and organisation demands, as well as talk directly to those needs, says Kim Mohiuddin, accreditation chair for the National Resume Writers Association as well as head of state of Movin On Up Resumes, a resume-writing firm in San Diego. This individualized strategy reveals that you care about and also are gotten approved for the chance.

Louise Kursmark, co-author of Cover Letter Magic also recommends graduates to tailor their letters. Show your excitement and attach your understanding, experience and profession passions to the specific company and also task possibility, she says.

Just what to Include.

Be passionate.

Cover letter layout.

Public Records Could Plague Your Credit For The Better Part Of A Decade

Even if you repay the money you owe, public records with negative information typically remain on your credit reports for seven to 10 years.

Public records with adverse information may even occasionally wind up on your credit reports by mistake. According to a 2012 study by the Federal Trade Commission, one out of five consumers had an error on at least one of their three credit reports that was corrected by a credit reporting agency after it was disputed.

The good news is, in some cases, you may qualify for relief.

Experian®, Equifax® and TransUnion® have begun removing unverifiable public records from about 12 million credit reports.

The three major consumer credit bureaus recently adopted stronger public record data standards for consumer credit reports, requiring tax liens and civil judgments to include your name, address and either Social Security number or date of birth.

Millions of old public records dont contain all of this information, so the credit bureaus are removing them from consumer credit reports.

Theyre also removing medical collection accounts that have been or are being paid by insurance.

If you spot an error or an unverifiable public record that doesnt belong on your credit report, Credit Karma may be able to help you dispute it. And if all else fails, we can show you ways you can rebuild your credit.

Just remember, youre not alone. Were here to help.

Don’t Miss: How To Remove Repossession From Credit Report

Public Records And Your Credit Reports

Not all public records are included on credit reports. In fact, some types of public records were included in the past but have since been removed thanks to policy changes.

Heres an overview to help you understand which types of public records might show up on your reports now and cause potential credit damage.

How Removing Public Records Differs From Filing A Dispute

If youve ever had to remove a fraudulent address, account, or activity from your credit report, you probably already know the relatively simple process of filing a dispute with an individual credit bureau. The major credit bureaus, Equifax, Experian, and TransUnion, each have simple ways to file minor disputes online or over the phone. But, its always best to send a dispute letter.

When it comes to public records, things are a little bit more complicated because the court is involved as well as the credit bureaus. Because financial disputes that come through the court system are public record , they almost always appear on your credit reports, as well.

So if youre trying to remove a public record entirely, youd need to reach out to the court directly and ask them to expunge the record. This can be a time-consuming and effort-intensive battle.

The easier option is to attempt to remove the public record from your credit report. This is done by disputing the public record directly with the reporting credit bureau. The Fair Credit Reporting Act allows you to dispute any record on your credit report that you believe is inaccurate or even questionable. However, keep in mind that even if you successfully remove a public record from your credit report, itll still be on file with the court system.

Read Also: Does Opensky Report To Credit Bureaus

How Can I Get A Lien That I Paid Off Removed From My Credit Report

Its hard enough to maintain a good credit score without having old or erroneous public records on your credit report. This can happen for a variety of reasons, but you have a right to have certain records removed when they shouldnt be there in the first place. Find out which public records may appear on your credit report and how to get them off when they dont belong there.

Why You Won’t Find Tax Liens Or Civil Judgements On Your Credit Report

Before 2015, tax liens and civil judgments were regularly included in the public records section of your credit report.

In 2015, however, Equifax, Experian, and TransUnion entered into a settlement agreement called the National Consumer Assistance Plan with attorneys general in over 30 states. A major component of the settlement agreement required the three major credit bureaus to change their standards for reporting on public records.

As of July 1, 2017, any public record on your credit report must include your name, address, and your social security number or your birth date before the credit bureaus can include it on your credit report. If a public record is missing any piece of this information, the credit bureaus can’t report it.

When the settlement first took effect, the credit bureaus removed some tax liens and civil judgments here and there. As of April 2018, however, the credit bureaus no longer include any tax liens or judgments on credit reports. If you noticed a jump in your credit score around this time, the NCAP changes could explain why.

While the NCAP may be a source of relief, you might still have cause for concern if you have an old tax lien, foreclosure, or judgment lurking in your past. These public records might not show up on your credit report anymore, but mortgage lenders can still search for them when you apply for a loan. This is why it’s still good to know the steps for removing these public records.

Recommended Reading: Does Cashnetusa Report To Credit Bureaus

Can I Get A Judgment Removed From My Credit Report

I had a Judgement entered on feb/2012 for a $400 medical bill. It increased to $800 once it was sold to a debt collector. The collector reached out to me to make payments but I could not due to lack of funds. Long story short. A judgement was served to my then boyfriend at the time because he opened my door and confirmed I lived at that residence. Missed court date so the collector received a default judgement against me. Started making payments of $100 every month until I lost my job again. I haven’t heard from them since. I made 2 or 3 payments total after the judgement was in place.

I want to fix this debt but I want the judgement to be removed from my credit report. Called the collector 2 months ago informing them I would make two split to pay balance in full within 1 month. They declined saying they would gladly accept the payment but will not remove the judgement they will only said judgement settled on my cr. The firm is a building not far from home maybe 20 min ago with an office of like 5 ppl. Not sure if i can go in face to face to make arrangement again with my same terms or speak to another agent and or person in charge. Not sure if its something i can do on my own to meet my terms or if i need to get my own attorney to do the negotiating for me. Really want to take care of this before it increase any higher than it already is or worse/wage garnishment. btw I live in M0.

Jai

Do Public Records Affect Your Credit Score

Having a public record on your credit report negatively impacts your credit score. Public records can be a deciding factor when a lender is making a financial decision.

Having a tax lien, civil judgment, or bankruptcy removed once they are on is a time-consuming job. If you have public records dragging your credit score down, get professional help to have them removed. If youre able to remove any kind of negative information from your credit report, it should definitely improve your credit score.

Don’t Miss: Can Lexington Law Remove Repossessions

How To Remove A Tax Liens On Your Credit Report

They say that of all the lenders in the world, the one you least want to owe money to is the government. And considering that unpaid tax liens can stay on your credit report indefinitely, that wisdom certainly seems to ring true. If youve got unpaid tax bills from a state, local, or federal agency, the very first step to take is to pay them in full immediately.

However, whether the tax lien on your credit report is paid or unpaid, you can file an IRS Form 12277, which is an application for the withdrawal of a federal tax lien. There is space on the form to explain to the IRS why youre filing for withdrawal. If you mention the financial hardship caused by your low credit score, it may incentivize them to give you a break in the future.

Be sure to specify that you do wish for the IRS to contact the credit bureaus directly on Form 12277 when you file it. Keep in mind that outstanding debt will still remain on file at the courthouse and must be paid.

Understanding The Updated Public Record Policy

In 2017, the National Consumer Assistance Plan went into effect and changed how data is collected for civil judgments and tax liens before these entries appear as public records on credit reports. The act was initially launched in 2015 by the three major credit bureaus to modify credit reporting rules and set stricter standards. These new standards would ensure that the data found on credit reports are more accurate and up to date.

There are two primary ways this act affects how credit bureaus obtain and report tax lien and court judgment data on consumer credit reports. First, for either of these types of entries to appear on a credit report, the public record must contain a persons:

- Name

- Social Security number or date of birth

This standard applies to both new and existing records that are already on credit reports.

Secondly, public records reported on credit reports must be checked by the credit bureaus for updates every 90 days to ensure their accuracy. If the records are not checked, they should be removed from the credit report.

Bankruptcy records already hold these strict requirements, which is why the changes dont impact this type of public record. However, many tax liens and civil judgments do not uphold these standards, in large part due to different standards of record-keeping at various courthouses.

Don’t Miss: Jefferson Capital Systems Verizon

Public Records On Your Credit Report

Your credit reports are supposed to provide information to potential lenders about your finances and credit history so they can decide if they want to issue you a loan or a credit card or rent you an apartment. It makes sense that your credit card payment history, bank account balances, and employment history are on the report, but other public records may also appear. For example, if you have been through bankruptcy proceedings, have had tax or other liens placed on your property, or have had judgments against you in civil court, these records could also be on your credit report. However, once the issue has been resolved, the entry should be removed from your credit report. An exception to this general rule is that bankruptcies will stay on your credit report for 7-10 years.

The Public Record Entries

First, its essential to understand the three types of public record entries that can impact your credit report.

A tax lien is a law-imposed lien upon property for the payment of taxes. Typically, a tax lien occurs when a person fails to pay taxes owed on property , income taxes or other forms of taxes.

A civil judgment is a legal ruling against a defendant in a court of law. It refers to a judgment on a noncriminal legal matter and often requires the defendant to pay monetary damages.

Bankruptcy is a legal process in which people or other entities who cannot repay debts to creditors try to seek relief from some or all of their debts. In most jurisdictions, bankruptcy is usually imposed by a court and is often initiated by the debtor.

Read Also: Credit Score 766

What Threats Do Online Public Records Create

Before states started putting public records online in the mid-1990s, accessing these records meant either mailing out written requests or going to government offices in person. This was a daunting and time-consuming task therefore, not many people viewed public records, and the information on any single record was generally not sufficient to cause an individual any harm.

However, over the past few years, numerous data brokerage firms have used online public records to compile detailed personal profiles about you. They then flesh out these profiles with data gathered from social media, news stories, and elsewhere, and sell them to anyone who wants access. Consequently, anyone can quickly and easily find personal information about you online, and this information is very comprehensive, covering many areas of your life.

These online profiles leave you exposed to numerous risks. The following are only a few exampleswith links describing real-world casesof people being harmed: