Is It Better To Pay Off One Credit Card Or Reduce The Balances On Two For Credit Score

Paying down the card with the highest utilization ratio could help your credit scores, as the individual account utilization is considered by credit scoring models. Paying down the card with the lowest balance could help you decrease how many of your accounts have a balance, which may also improve your credit scores.

Derogatory Remarks On Your Credit Reports

Since your based on information in your credit reports, negative information can drag your score down. For example, if you have a bankruptcy listed on your reports, it can have a negative effect on your score for a long time. A Chapter 7 bankruptcy remains on your credit report for up to 10 years while a Chapter 13 bankruptcy remains on your report for up to seven years.

Some other examples of derogatory remarks that can lower your credit score include collection accounts and foreclosures. An original debt creditor usually sends your account to collections after failing to collect a debt from you. A foreclosure happens when you default on your mortgage. These negative remarks remain on your credit reports for up to seven years.

Although a derogatory remark can stay on your credit report for up to ten years, its impact lessens over time. Also, practicing good credit habits can help you rebuild your credit faster.

Why Did My Credit Score Drop 30 Points For No Reason

Asked by: Leonel Osinski

If you’ve made a late payment or have other derogatory information listed on one of your credit reports, it could cause your score to drop at least 30 points. Also, using more of your available credit or closing one of your oldest credit card accounts could cause a large drop in your score.

You May Like: Is 689 A Good Credit Score

Your Credit Utilization Ratio Has Increased

If youve made a large purchase recently using credit, this can cause your credit score to fall. Thats because it can increase your , which accounts for 30% of your FICO score. In general, the lower your credit ratio utilization, the better your credit score.

Your credit utilization ratio measures how much credit you use versus how much you have available. For example, if you have a $5,000 balance and your total credit limit is $20,000, your ratio is 25% .

Although its often recommended to keep your credit utilization ratio at or below 30%, keeping it closer to 0% could help you improve your score or build credit.

Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at

Don’t Miss: How Long Are Things On Credit Report

Increased Credit Utilization Rate

To explain, if your credit limits across your cards are $20,000 and your total balance is $2,000, your credit utilization ratio will be 10%. You must keep this ratio below 30%, as 30% and below is considered good credit score utilization. The closer to 0% you are, the better. A low ratio not only helps to improve your score, but it can also build it.

Your ratio increases when you make a large purchase or max out your cards. Even if you pay your balance in full, your credit score could still drop. Your credit issuer is unlikely to send credit reports when your credit utilization rate is 0%. On the last day of the billing cycle, your credit issuer reports your balance this could cause a dip. A high ratio may show potential lenders that you are financially overstretched.

You could request a higher credit limit to lower your credit utilization ratio. This is useful if you pay your bills in full but still get close to the 30% mark. Sometimes, it might also help to pay your bill twice a month if you plan on making an expensive purchase. You could also set up an automatic credit balance alert that can notify you when you are close to 29%. This way, you can avoid making big purchases on one card and crossing the 30% threshold.

Paying A Collection Account Helps Improve Your Credit Score

You will have to be patient with improving your credit score because the process takes time. There are different ways to deal with a collection agency. Once you have established that you are dealing with a reputable company and the debt is yours, you can reach a payment plan or a negotiated settlement. Your credit report will take approximately two months to show that the account was paid off. The collection activity can stay on your credit report for up to 7 1/2 years from when you stopped paying on the account.

In rare instances, collection agencies that buy debt will agree to delete the tradeline from your credit report once you pay the negotiated amount in full. Once the bureau deletes the tradeline, your credit score should slightly increase.

Recommended Reading: How To Report Death To Credit Bureaus

When You May Have Cause For Damages

When you file a dispute with a credit bureau, they have a limited amount of time to respond and take action. If you have taken all the required steps to communicate with them and they have failed to respond, you may have cause to sue for damages. If you have reached the end of your rope with a credit bureau, call me to discuss your options. I help Californians exercise their consumer rights.

|

Related Links: |

What To Consider When Your Credit Score Changes

The next time your credit score changes, ask yourself the following questions:

- Have you spent more or less money this month compared to previous months?If so, your credit utilization ratio may have changed.

- Did you miss a payment in the past few months?If so, you could have a delinquent payment thats hurting your score.

- Did a missed payment or derogatory mark from several years ago fall off your credit report?If so, your credit score may be going up.

- Have you applied for credit?An inquiry may have been placed on your report, which can negatively impact it.

- Have you recently paid off a loan or closed a credit card?If so, your credit history may have been impacted.

After looking closer, you may find something has changed that could influence your credit score that you werent initially aware of. The best way to monitor changes in your score is to check your credit report monthly, so youre up to date on all the changes that impact your score.

Recommended Reading: Can You Remove Hard Inquiries From Your Credit Report

You Applied For Multiple Credit Products

When you apply for credit, a lender usually performs a hard credit check to review your creditworthiness. Each credit inquiry can temporarily drop your credit score by up to five points for one year, according to FICO. So if youve applied for multiple credit products over a long period of time, this can cause your credit score to experience a pitfall.

However, if youre rate shopping for a mortgage, student loan or auto loan within a 14- to 45-day window, FICO only counts it as one hard inquiry.

To reduce the impact on your credit score, apply for credit only when needed.

A Recent Hard Inquiry

A hard inquiry on your credit report can also temporarily lower a score. Hard inquiries happen when a lender or company reviews your report with the intent to make a lending decision. For example, applying for a credit card, mortgage or car loan will all result in a hard inquiry. If you requested a credit line increase for one of your existing credit cards, it may also trigger a hard inquiry. This account would already be on your report, and because its a minor change, it could be easy to miss on a quick read-through.

Soft inquiries on your credit report can only be seen by you and do not impact your credit score. If you see a soft inquiry on your credit report, it simply shows that you or another company checked your report. Its important to note that to be considered a soft inquiry its usually for a background check, credit monitoring you signed up for or something similar.

As you can see, there can be multiple answers to the question: Why did my credit score drop? There is a lot of information on a credit report. Remember, a changing score often means changing information. Carefully read your credit reports again. You may have to dig for some clues to account for a fluctuating credit score.

If youd like help reading through your credit report, weve created an interactive guide that explains each important section and how the information may impact your credit score.

Don’t Miss: How Long Are Charge Offs On Credit Report

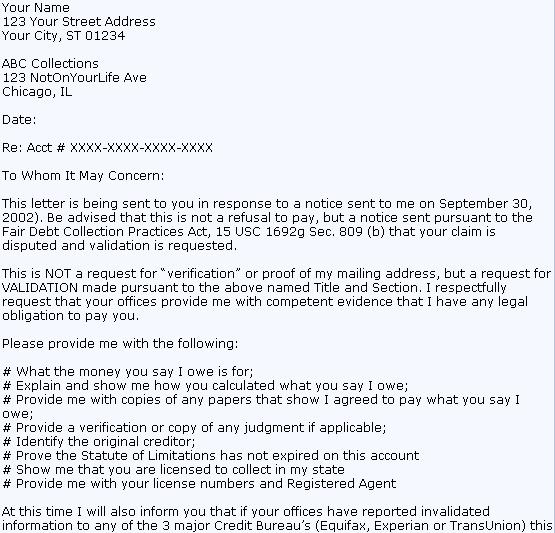

Finding An Error On Your Reports

The reason you should be checking your reports every year is that there are often mistakes and inconsistencies on them. Some mistakes are minora previous address is incorrect, or there is a strange phone number listed. But there can also be accounts that are not yours, payments reported as missed when they were paid on time, and old debt that should have been removed. When you see a mistakewhether it is minor or majoryou should file a dispute with the credit bureau. Instructions for doing this are on each bureaus website.

Disputes Related To Accounts Or Public Records

- This can mean a couple different things, such as:

- The information you disputed has been updated

- The information you disputed might have been verified as accurate by the financial institution, but other information on your account unrelated to your dispute has been updated.

Read Also: How To Get Official Credit Report

How Long Does It Take To Improve Your Credit Score

When you spot a piece of incorrect information or see an item you don’t recognize on your credit report, you need to dispute the information with all three credit bureaus: Experian, Equifax and TransUnion. Some disputes immediately alter your credit report during the dispute period and over the long-term if the dispute is proven valid.

TL DR

The length of time it takes to see a change in your credit rating after submitting a dispute varies, but you can expect the investigation of the dispute to take up to 30 days.

What If The Item Is Still Being Disputed

If you were not successful getting the offensive credit entry removed or changed, then you can still have it shown as being in dispute for as long as it remains on your credit reports. But, that is not the same as an item thats in dispute AND being investigated.

That is to say, lenders will still likely consider the item when evaluating your credit score since the XB code has been removed.

If you still disagree with an item you can have a label added to your credit reports showing as much. But, thats not going to cause the score to reflect that label for Payment History and Debt measurements.

Also Check: What Is Considered A Good Credit Rating

Two: Determine Whether You Should Or Shouldnt Dispute

After youve reviewed a recent credit report, consider the following reasons to dispute items on credit report to help you decide if its worth a shot:

- There is incorrect personal information on your credit report, such as your name or Social Security Number

- There is a negative item that is beyond the statute of limitations for reporting

- The report shows that you carry a debt balance which you have already settled

- There is duplicate information shown on your credit report

- You have a duplicate credit report or mixed information for yourself and another person

- There are fraudulent items on your report, like a new credit card or loan that you did not open or apply for

When Can I Dispute A Credit Report

When you file a dispute with the credit reporting agencies, they are required by the Fair Credit Reporting Act to show that the item is in dispute. They accomplish this by placing the code XB on the offensive credit entry.

The XB code is whats referred to in my world as a Compliance Condition Code. When its placed in your credit report, it reads as Consumer disputes, investigation in process or some derivative of that wording.

Essentially, it means that the credit bureaus received your dispute and are actively investigating the information.

Read Also: How To Raise My Credit Score

Your Recent Payment History May Affect Your Credit Scores

Making payments on credit accounts is a common cause of fluctuation in credit scores, as payment history is often the largest factor used to calculate credit scores. If you make payments on your credit cards or installment loans, your payment history may be reported to one or more of the three nationwide CRAs, which may cause changes in your credit scores.

You Closed An Account

Closing a credit card account can affect your credit score in a couple ways. If you close one account, maybe one you havent used in a while, but still have a balance on other cards, it can increase your utilization.

Lets say you have two credit cards, both with a $1,000 credit limit. One card has a $500 balance, and the other, a card you never use, has no balance. Your current utilization rate is 25% . Thats below the 30% threshold lenders like you to be at. But if you close the second card that has no balance on it, youll increase your utilization up to 50%! You have to be mindful when closing credit cards for this reason.

Closing a credit card can also impact your score by changing the average age of all your accounts. Lenders like to see that you have accounts with a long history of on-time payments. Generally speaking, the older the average age of your accounts is, the better your score will be. If you close an account thats been open for a long time, it could bring down that average. Think carefully about closing old accounts, especially if you want to limit any negative impact to your score.

Other types of debt can play a role too. Did you recently pay off an installment loan? Those are loans with fixed terms and payment schedules accounts like auto loans, mortgages and student loans. Sometimes, paying off these loans may cause a score to drop slightly, which may seem counterintuitive.

Read Also: Does Pre Qualify Affect Credit Score

Does Credit Repair Work

Many home buyers often hire a credit repair company prior to getting ready to apply for mortgage. Going through credit repair prior and/or during mortgage process can often do more damage then good. Credit Repair does work but any credit disputes during mortgage process will halt the loan approval process:

- I have seen charge offs, collection accounts, bankruptcies, foreclosures, late payments, tax liens, and judgments be removed from credit reports

- There are many savvy creative credit repair consultants who know the ins and outs of loopholes and can get derogatory items completely removed from credit reports

- However, if home buyers planning on purchasing a home or refinancing in the near short term, there are strict policies on credit dispute

- FHA, VA, USDA, Fannie Mae, Freddie Mac do not allow dispute during mortgage process

- The mortgage process will be suspended until all disputes have been retracted

- There are times where it is difficult to remove a dispute

Investigate Your Credit Report

Depending on how you found out about your credit score dropping, youll have to do some detective work.

Your first step is to get a copy of your credit report, which is free once a year from the three major credit bureaus . Look for any errors or unexpected potentially negative items that you may have thought were resolved or in good standing. If youve found a discrepancy, contact the institution to determine what proof/documentation you need to file a dispute.

If you havent found any errors on your credit report, then its time to turn your attention to your recent credit-related behavior

Read Also: Why Does Your Credit Score Drop When You Check It

Is It Bad If Your Credit Score Goes Down

Good scores will help you qualify for more credit products at lower interest rates. Bad scores, on the other hand, may prevent you from qualifying for certain types of credit or may result in getting approved for credit products at higher interest rates, since your profile presents a bigger risk to the lender.