How To Raise A Credit Score In 30 Days

While it typically takes a few months to make a significant difference in your credit score, there are things you can do right now that can help you raise your score in a matter of weeks. Here are some suggestions to help give your credit score a quick boost:

Fix any mistakes on your credit report Perhaps the fastest way to increase your credit score is to identify any errors on your credit report and have them rectified. Youre entitled to pull your from credit bureaus like Equifax or TransUnion and go through it to see if there are any mistakes that could be pulling your score down. If there are, fixing them can give you an immediate boost to your score.

Need to dispute an error on your credit report? Heres how you can do it.

Increase your available credit Asking for a higher credit limit from an established creditor can not only increase your available credit line but also raise your credit score.

Negotiate with creditors You may be able to ask creditors to accept partial payments for debt that is currently in collections in exchange for reporting the debt as paid.

Be an authorized user on someone elses account If you have any family members with good credit, adding you as an authorized user on their account can help increase your credit score. Each one of their timely payments will boost your record.

Understanding Credit Score Ranges

The credit score you see if youre signed up for TransUnion Credit Monitoring or if you purchased a credit score with your credit report is based on the VantageScore® 3.0 model. Scores in this model range from 300 to 850. A good score with TransUnion and VantageScore® 3.0 is between 720 and 780. As your score climbs through and above this range, you can benefit from the increased freedom and flexibility healthy credit brings. Some people want to achieve a score of 850, the highest credit score possible. Having this perfect score may feel like a win, but it isnt necessary to enjoy the benefits of strong credit.

In TransUnion Credit Monitoring, you may also see a letter grade with your credit score. For VantageScore® 3.0, an A score is in the range of 781850, while a B score is 720780. A score of 658719 is labeled a C. Think of these rankings and ranges as guides, not hard-and-fast rules for what good credit is. You can use them to help stay on the right track, but they dont necessarily indicate if you will or wont be approved for credit.

Think of these rankings and ranges as guides, not hard and fast rules for what good credit is.

How Do You Get A Home Loan First Time Buyer

If you are applying for your first home loan through a program supported by the Federal Housing Administration, you must complete the Uniform Home Loan Application Form 1003. Lenders have a checklist that you can use to make sure you meet all the requirements to make the loan process go smoothly and get you approved for your first home.

Recommended Reading: How To Get A Repossession Off Credit Report

How Long Does It Take To Improve Credit Score

How fast youre able to increase your credit score depends on why its the number that it currently is. For instance, if youre just starting to build credit after not having any at all, you can raise your credit score rather quickly by just using credit and making payments on time and in full every month. As you add more credit cards and dont use them or only make small charges with them your total debt compared to the amount of available credit lowers, thereby increasing your credit score.

Will paying off your credit card help raises your credit score? Find out here.

Also, if you currently have a lot of debt on the books, you can increase your credit score more quickly if you pay down that debt because your debt-to-credit ratio improves.

However, if your score is low as a result of a history of missed payments, bankruptcy, or another financial misstep, it will take longer to increase your credit score. In this case, it can take many months and sometimes even years depending on how badly you damaged your score.

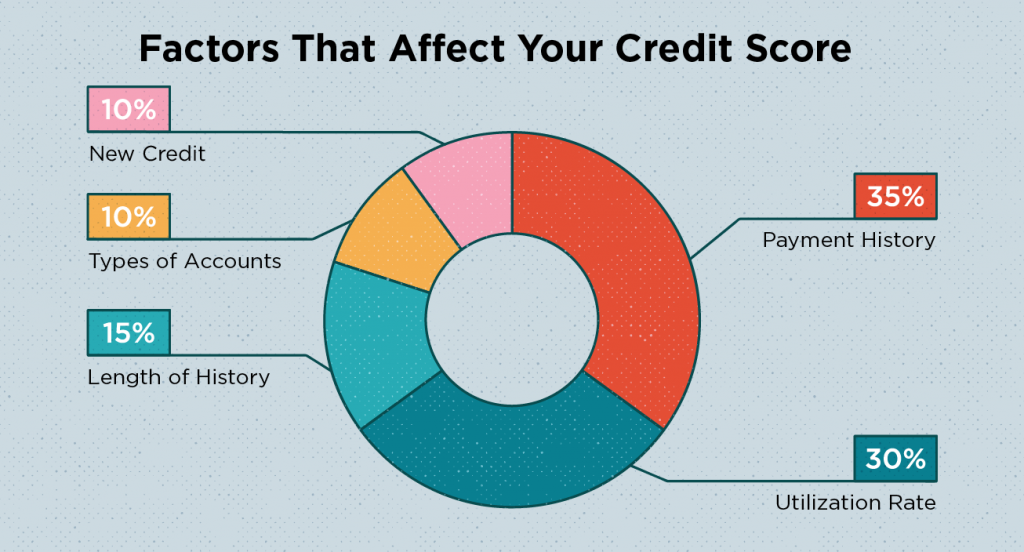

Check out this infographic for a visual look at how your credit score is calculated.

Monitor Your Credit Report

Youre entitled to a free copy of your credit report every year from each of the three major credit bureaus: Experian, Equifax, and TransUnion. Visit AnnualCreditReport.com to access a free report and familiarize yourself with it. Check for inaccuracies and signs of fraud, and if you find something amiss, report it immediately.

You May Like: Is Ic Systems A Legitimate Company

When Is A Payment Considered ‘late’

The longer your payment is past due, the more your credit score will drop so it’s important to know when you’ve gone past your deadline.

From the perspective of your credit, a late payment is not considered missed or late until it is at least 30 days past the due date. Say you simply forgot to pay your bill on the due date, but you make the payment in full a few days later . You may be subject to a late payment fee , but it will not be reported as late to the credit bureaus.

The impact to your credit score depends on how late that payment is and the terms of your credit card. You’ll likely get hit with a penalty APR, and the impact on your score could be “even more dramatic once you get 60 and 90 days past the due date,” Muscadin says.

Average Credit Score By Income

According to American Express, the average credit score by income are as follows4:

- $30,000 or less per year: 590

- $30,001 to $49,999: 643

- $50,000 to $74,999: 737

The correlation between lower average credit scores and lower-income may be associated with factors like higher-income individuals being able to pay back credit card debts more easily as well as being able to maintain a lower credit utilization ratio.

Those with higher income may also have higher credit limits in comparison to those with lower income.

That being said, income is not the most accurate measurement of scores. Income is only one factor that plays a role in your score. You can still have a low income and have good credit. If you fall into a lower income bracket, dont worry. Your income doesnt determine your score.

Don’t Miss: Does Acima Report To Credit Bureaus

What To Do If You Don’t Have A Credit Score

For FICO® Scores, you need:

- An account that’s at least six months old

- An account that has been active in the past six months

VantageScore can score your credit report if it has at least one active account, even if the account is only a month old.

If you aren’t scorable, you may need to open a new account or add new activity to your credit report to start building credit. Often this means starting with a or secured credit card, or becoming an .

Dont Needlessly Cancel Credit Cards

Since credit history is an important metric, in most cases you wont want to close a credit card, even if you dont use it regularly. Thats because holding a credit card for a long time can have a positive effect on your credit score. If the credit card issuer encourages you to use it occasionally, consider charging it with smaller expenses or set it up as the card where you have a small subscription automatically billed. Just dont forget to make your payments.

Recommended Reading: How Long To Raise Credit Score 50 Points

Your Credit Score Can Fluctuate

You may see some short-term movement in your credit score. This happens as information is added or falls off your report, which can happen frequently. Our latestConsumer Pulse revealed one-third of consumers monitor their credit at least weekly. Its encouraging to see people take an active approach to managing their credit health. But when it comes to your credit score, theres no need to obsess over minor, day-to-day changes. Nor is it necessary to achieve a perfect score. Trying to stay within a certain credit range is a smart, less stressful way to monitor your score.

Also, your credit score may not be the only thing a lender looks at when making a lending decision. For example, if you apply for a mortgage, lenders may also verify your income, personal assets and employment history. Because lenders look at multiple factors, its important to strive for overall financial wellness in addition to any credit score goal you may have. Building an emergency savings account and creating a plan to pay down debt, if you have any, will help you be more financially secure and can reflect positively in your credit health.

Why Is My Credit Score Low

Lower credit scores arent always the result of late payments, bankruptcy, or other negative notations on a consumers credit file. Having little to no credit history can also result in a low score.

This can happen even if you had established credit in the past if your credit report shows no activity for a long stretch of time, items may fall off your report. Credit scores must have some type of activity as noted by a creditor within the past six months.If a creditor stops updating an old account that you dont use, it will disappear from your credit report and leave FICO and or VantageScore with too little information to calculate a score.

Similarly, consumers new to credit must be aware that they will have no established credit history for FICO or VantageScore to appraise, resulting in a low score. Despite not making any mistakes, you are still considered a risky borrower because the credit bureaus dont know enough about you.

Read Also: What Credit Score Does Usaa Use For Credit Cards

How Can I Check My Credit Scores

Under the Fair Credit Reporting Act, youre entitled to get a free credit report each year from each of the three main credit bureaus. You are not, however, entitled to free credit scores you can request your credit scores from the bureaus, but youll pay a fee for them.

One of the easiest ways to get a free credit score is through a credit card company. Many major credit card issuers make credit scores available to their cardholders. Discover gives a free FICO score to anyone who signs up, cardholder or not, while Capital One and Chase give free VantageScore 3.0 scores.

Theres another way to get free credit scores, but you need to have applied for some type of credit, such as a mortgage loan or credit card, in order to do so.

Under federal law, a mortgage lender must show you the credit scores pulled during the application process. Other types of lenders must also give you the credit scores used in the decisions if you were denied credit or given less favorable credit terms because your scores fell below the lenders acceptable credit score range.

Whats A Utilization Ratio Or Debt

According to Equifax, your debt-to-credit ratio, also known as your utilization ratio, is the amount of your debt compared to your credit limit.5 Your debt-to-credit ratio is important because if your ratio is high, it can indicate that youre a higher-risk borrower.5 Thats because lenders see borrowers who use a lot of their available credit as a greater risk.5

For example, imagine you have a couple of credit cards and a line of credit with a total debt of $14,000 and a combined limit of $20,000. Your debt-to-credit ratio would be 70%.

According to the Government of Canada, a ratio of 35% or below on credit cards, loans and lines of credit is recommended.3

Read Also: Free Credit Report Usaa

How Do I Increase My Credit Score Dramatically

- The fastest way to improve your credit score is to withdraw your credit card balance.

- Ask the collection agency to remove the claim from your tax return when you pay it.

- Ask a family member to add you as an authorized user on their credit card.

- Apologies to the creditor.

- Aim for simple mistakes in your credit report.

What Is The Average Credit Score

Data provided by Experian revealed that the average FICO credit score for Americans was 711 in 20202.

According to Experian, this average FICO score may be a result of credit scoring factors such as fewer late payments or delinquencies on credit cards, shrinking debt , and a decrease in credit utilization.

There are other credit scoring models such as VantageScore, but the majority of lending decisions are made using FICO scores, so this review is focused only on FICO scores.

You May Like: Syncb/ppc On Credit Report

What Is The Quickest Way To Increase Your Credit Score

According to Forbes, ways to quickly improve creditworthiness include increasing credit limits, opening accounts and paying bills on time. According to Experian, increasing credit limits and keeping accounts open lowers the limit balance-to-consumer ratio, which is an important factor in calculating creditworthiness.

Keep Your Credit Utilization Rate Low

Both scoring models weigh this factor heavily. To determine your current utilization rate, begin by adding up the credit limits of all your credit cards.

Lets say you have two credit cards one with a limit of $2,000 and another with a limit of $3,000. This gives you $5,000 of total available credit.

Next, divide your current total balances by your available credit and multiply it by 100 to get the percentage. Imagine you have $1,000 in outstanding balances $1,000 divided by $5,000 is 0.20 so, in this example, your utilization rate would be 20%.

As you spend less of your available credit, your credit utilization rate goes down. In the above example, if you reduced your credit card spending to $500, your utilization rate would drop to 10%.

What credit utilization rate should you aim for? Using no more than 30% of your available credit is a great start.

Read Also: How To Dispute Old Addresses On Credit Report

What Is The Highest Credit Score

This content is not provided or commissioned by the issuer. Opinions expressed here are author’s alone, not those of the issuer, and have not been reviewed, approved or otherwise endorsed by the issuer. This site may be compensated through the issuer’s Affiliate Program.

The highest credit score you can achieve is 850 using the FICO model. However, any score over 740 is generally considered to be great and puts you in range for the best interest rates on things like credit cards, mortgages, and car loans.

How A High Credit Score Could Save You Money

Lets say, for example, you plan to get a 30-year fixed-rate mortgage for $300,000. Heres what your loan could look like if you had a credit rating in the 760 to 850 range, compared with one in the 620 to 639 range. Not only would your monthly payment be lower, but you could save $95,680 on interest over the life of the loan.

| 760-850 credit score |

|---|

1 APRs are based on national averages and do not reflect Bank of Americas rates. Source: myFICO.com, October 2021.

This example is provided for comparison purposes only and does not constitute a commitment to lend nor is intended to guarantee that you currently qualify for the example APRs above.

Also Check: Report Death To Credit Bureau

Fewer Hurdles For Getting A Job

This is a newer trend that is arising, but its affecting more and more people. Some employers are choosing to check candidates credit scores before offering them a job.

Their theory is that a persons credit score gives them insight into how responsible the person is. While there havent been studies that show a concrete connection between job performance and credit, employers want all the information they can get about a person.

In this way, a poor credit score can even affect your ability to get the job you need in order to pay down your debt and improve your credit. Its a harsh cycle but its true.

Keep A Close Eye On Your Credit

The second most important factor for credit bureaus is the amount of credit you have compared to the amount you use. This is known as your credit utilization ratio, and it accounts for the next 30% of your credit score. If you want to reach the excellent credit score range, its vital to reduce the amount of credit you use and keep it below 30%. The closer the figure is to 0%, the better your credit score.

Recommended Reading: 820 Fico Score

The Ultimate Guide To Your Credit Score

9 minute read

Part of achieving financial wellness is understanding your credit score, what it means, how its calculated and learning practical strategies to improve it.

Understanding debt utilization ratio and the difference between hard checks and soft checks or between revolving credit and installment credit are just a small part of the story when it comes to seeing the full picture of your credit.

There are simple steps people can take to improve their credit score but before we explore some of those strategies, were going to look at what makes a good score, how its calculated, where you can check yours, and why it all matters.