Your Interest Rate Goes Up

If you are more than 60 days late on your credit card payment, your bank can increase the interest rate on your account. Youre now paying higher interest expenses on that balance you cant get rid of. Between late fees, missed payments and higher interest rates, that balance can grow at an alarming rate.

Back in the days of universal default, you could miss a payment on one card, and suddenly all your credit card interest rates might go up. Universal default was ended by the federal .

The interest rates on the existing balances on your other credit card accounts, on which you have remained current, cannot go up without notice because of this missed payment. However, credit card companies may raise your rate with 45 days notice and let you pay off your balance under the old terms.

If your credit score goes down, you also may have trouble getting new credit, or you may have to pay a higher interest rate when you do.

Many people dont realize the negative impact one payment exceeding 30 days late can have. Not only does it hurt their credit score, but it remains on their credit report for seven years.

Chane Steiner, CEO of Crediful

What Is Payment History

Payment history is the record of all your past payments and whether they were paid on-time or late. Payment history can also include missing payments if no payment was ever made. Your payment history typically includes payments for all your credit cards, installment loans , retail accounts , and home mortgage loans.

Since payment history is so critical to having a great credit score, it is important to understand how your Payment history is defined and calculated.

What If Your Payment Is Only A Few Days Late

Being even a day late with your monthly payment can have different consequences depending on the type of loan or credit card and your agreement with the lender. For example, mortgages and car loans often have a grace period, during which you can still make your loan payment without paying a late fee. A typical grace period on a mortgage is 15 daysbut check your loan agreement for details about the grace period your lender may extend.

Credit cards don’t usually offer this type of grace period: If you’re as little as one minute late, you may be subject to a late fee and may be switched to a higher interest rate as well. When on their accounts, they’re usually referring to the period before you’re charged interest on a credit card purchase. So, if you buy a sofa for $2,000, and pay the entire $2,000 balance before your grace period ends, you don’t owe the credit card company any interest.

How does a payment that’s just a few days late affect your credit report? A payment that’s not yet 30 days lateor one full billing cycleprobably won’t be reported to credit bureaus if it’s brought current before 30 days are up. Until that point, your late payment is an issue between you and your creditor. You may be subject to fees or higher interest rates, but you shouldn’t suffer a hit to your credit score.

Don’t Miss: Does Sprint Report To The Credit Bureaus

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Securitisation Market Records Rs50300 Crore In Q1 2019

Public sector banks continue to remain the largest investor segment demonstrating strong appetite for acquiring both priority sector lending and non-PSL assets through retail loan portfolio buyouts. Mortgage loans constituted the largest asset class with around in direct assignment market and around 46% share in Q1 FY20. Meanwhile, other asset classes like micro loans had a share of around 20% and vehicle loans constituted for around 17% share. Investors continued to invest owing to priority nature of these assets, added ICRA The credit rating agency revealed that the Indian securitisation market, in the June FY20 quarter recorded the highest issuance volumes seen in the first quarter of any financial year at Rs.50,300 crore, registering a year-on-year growth of 56%. Meanwhile, in Q1FY19, the securitisation volumes were Rs.32,300 crore and Rs.1.99 trillion for the entire FY19.Other dominant asset classes include mortgage loans, small business loans, micro loans and tractor loans.

18 July 2019

Also Check: Affirm.com Walmart Apply On Your Phone

What Happens When A Payment Is Late

If we are talking about one late payment against an otherwise clean report, you might lose a lot of credit score points, but it may take less time to recover. And since a clean credit report generally implies a high credit score, even a big drop could leave you in reasonably good shape.

However, multiple late payments will hurt you more and for longer. Its also important to note that any adverse actions, whether we are talking about late payments or other actions like collections, are far more damaging to someone with a thin credit file than someone with a fat file and an excellent credit score. These two categories are the easiest to damage and repair.

If you are in the middle of the pack in terms of your score, you may not see a huge difference . A middle-of-the-pack score indicates that there is already some level of uncertainty built into your score, hence the smaller drop in points versus someone who is either new to credit or rated as very low risk.

A credit score tries to predict the likelihood of the consumer defaulting in the near future. On-time payments indicate all is well. Late payments create uncertainty and may be an indication of trouble to come.

Missing a payment could cost you in the following ways:

What To Expect If You Are One

While missing payments by one day probably wont affect your credit score, it isnt the only thing you should be worried about. Its not very surprising that your lender wants their money back and theyll do everything in their power to get their money from you. Dont be surprised if you start getting. These calls and messages might be very frequent and extremely annoying. They may hound you until you pay.

If you continue to fail to pay your lender back, debt collectors and lenders might threaten you with arrest. This can be very frightening for you. However, this is not possible and it is an empty threat. While you still need to pay, a threat of arrest is not supported by any law and they are just doing it to scare you! On the other hand, depending on your loan and how late you are on payments, you might receive a summons to appear in court to resolve your debt. This is not an empty threat and you will need to appear in court or else the judge will make a default decision and your lenders will automatically win the case.

Read Also: How To Get A Repo Off Your Credit Report

When Does A Late Payment Show Up On Credit Reports

All of your payments to lenders and creditors are recorded on your credit report. Late payments are categorized as either 30, 60, 90, or 120 days late. Charged off accounts are also listed on your credit report.

Lenders use standard codes when reporting your payments to credit bureaus. Each payment on your credit report includes a rating between 1 and 9 that indicates when you made the payment.

Hereâs how payments with ratings between 1 and 9 show up on your credit report.

-

1 – Paid in full as agreed, within 30 days of billing

-

2 – Late payment 31-59 days late

-

3 – Late payment 60-89 days late

-

4 – Late payment 90-119 days late

-

5 – Late payment more than 120 days late, but not yet ratedâ9â

-

6 – This code is not used

-

7 – Regular payments under a consolidation order, Orderly Payment of Debts, consumer proposal, or Debt Management Program with a credit counselling agency

-

8 – Repossession of property

-

9 – Charged-off account written sent to a collection agency, or bankruptcy

Having payments on your credit report with a rating of 1 will help you achieve and maintain a strong credit score. Payments on your credit report with ratings higher than 1 will hurt your credit score. The higher the rating, the larger the impact on your credit score.

What Is A Goodwill Adjustment

Sending a goodwill adjustment letter can be an effective way to persuade a creditor to remove the derogatory mark from your credit report.

The letter should be written in a positive and courteous tone and in simple terms explain what led to your missed payment. For example, if you lost your job or needed a costly medical procedure, the letter should provide this information so the creditor can get a better understanding of your situation. Explain why protecting your score is important to you, so the creditor can see that you are thinking about a financially responsible future.

Don’t Miss: Coaf Credit

What Is Late Payment

The date of due date for loans and credit cards payments is set for banks and financial institutions. The default or late payment of credit and card bills shall be recorded as delayed payment in CIBIL on the due date. With every delay in payment the score falls, but it takes much longer, even after a consistent record of due payments.

Late payments harm personal and business creditworthiness and become a barrier to future credit approvals. A persons loan approvals with a low CIBIL score are seen as a risky offer by lenders, while a good credit score gives them some assurance that the debt is recovered.

How Long Will A Late Payment Stay On My Credit

A single late payment can stay on your credit report for around 7 years if it is more than 30 days late. Ouch is right. Theres a silver lining that comes with this, though. If you miss your payments your lender reports that your credit account is failing to make payments and is not in good standing. If you make your payment and continue to make your future payments on time, your lender will not be allowed to report this anymore. They will have to report that you are now in good standing with your payments. Instead of the negative report showing up right on your credit report, it will be moved to a different section that will say something like historical payments.

Read Also: Procedural Request Letter To The Credit Bureaus

Payments More Than 30 Days Late

Once a late payment hits your credit reports, your credit score will likely drop from 90 to 110 points. Consumers with high credit scores may see a bigger drop than those with low scores.

The first delinquency impacts FICO Score more than a different consumer who might have multiple delinquencies on credit history, said Tommy Lee, principal scientist at FICO.

Some lenders dont report a payment late until its 60 days past due. However, you shouldnt count on this when planning your payment. The later you pay, the worse the impact on your credit score. Late payments show on your credit report as 30, 60, 90, 120 and 150 days late.

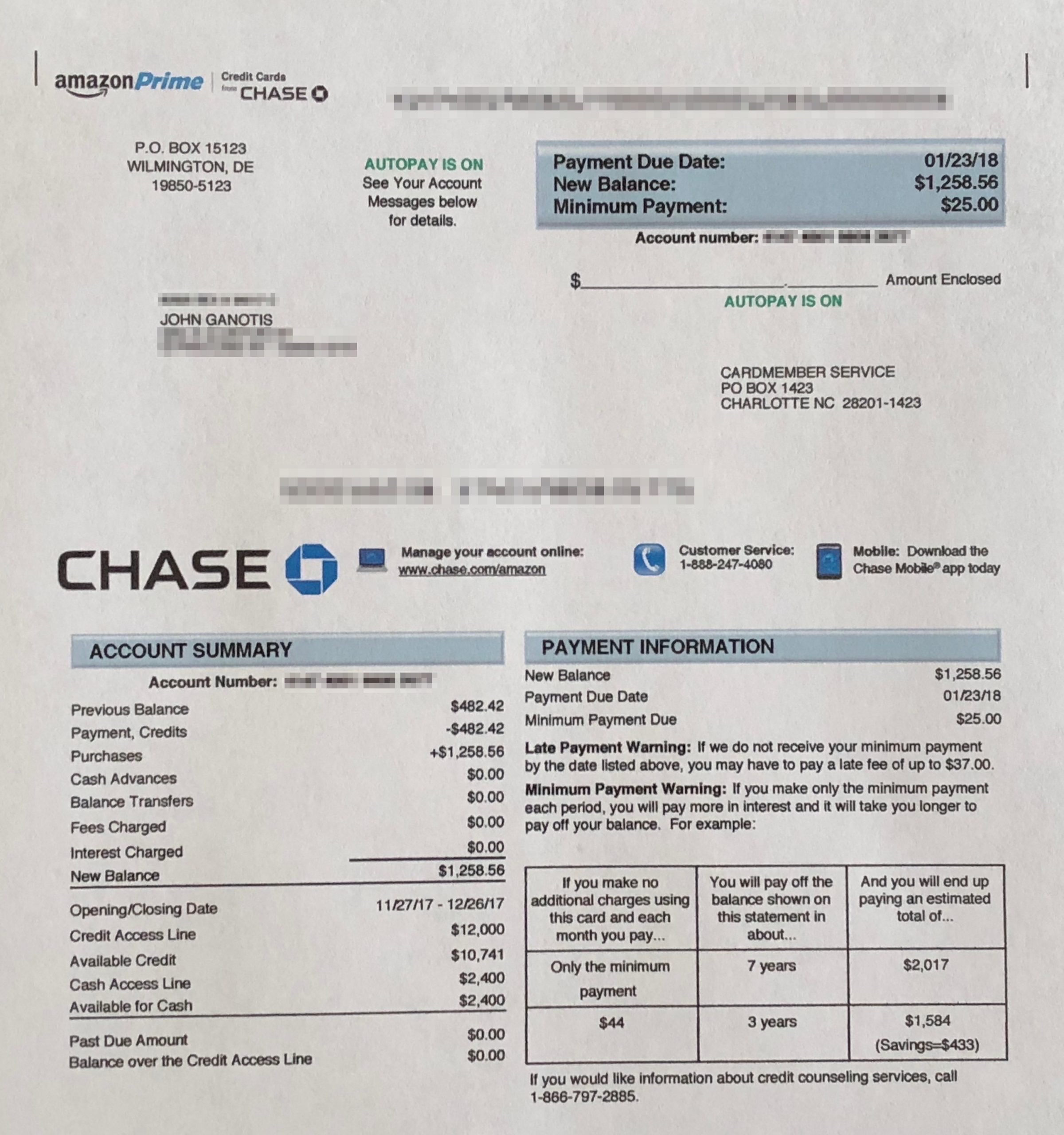

Heres an example of the effect a 30-day delinquency has on two different consumers:

| 30-day delinquency |

| 90-110 |

*Note this study was done on selected consumer profiles, and there are a wide range of profiles so results may vary.

Why Do Late Payments Impact Your Credit

Payment history is one of the key details that banks and issuers consider when deciding whether or not to approve you for credit.

A long-standing history of on-time payments suggests that youre a responsible and reliable borrower a poor history of on-time payments suggests to banks and issuers that you may not repay debts and could result in a costly loss to their business.

Because of this, payment history is one of the most important factors that goes into calculating your credit scores. So when you miss a payment or make a late payment, it can have a more dramatic impact on your scores than something like a hard inquiry.

Recommended Reading: Does Les Schwab Report To Credit

Will Late Payments Hurt My Score The Same As Someone Elses Or Is It All Relative

How late payments will affect your credit score is somewhat unpredictable. Because the FICO formula and similar credit-scoring models are proprietary, we can only guess how any one event will affect a persons credit score. We know that payment history makes up the lions share of your credit score, but just how it plays out can depend on a huge number of factors, including how much other information you have in your credit file.

However, we know that one major factor in this equation is, surprisingly, how high your credit score is right now.

That’s right! The higher your credit score today, the larger the negative impact of a late payment is likely to be!

According to Experian, a single 30-days-late ding could cause a consumer with a 780 credit score to drop by 90 to 110 points. But if youre starting out with a score of 680, you could expect a drop of more like 60 to 80 points.

How Do You Improve Your Credit Score After A Late Payment

Get current on payments and stay current

If youve missed a payment, the best thing you can do for your credit score is to bring the account current and make all future payments on time. If youre struggling financially, you may even be able to work something out with your lender many credit card issuers, for example, offer hardship programs for people dealing with situations like job loss, medical bills and natural disasters.

Follow theSE steps for building good credit

Once youre back on track with timely payments, know that the impact of one late payment will fade over time as you add more positive information to your credit reports. At its core, building good credit is a straightforward process. These steps will keep you on track:

Read Also: Freeannualcreditreport Com Official Site

B: Identity Any Extenuating Circumstances Or Errors That Led To Late Payments

If you can prove that a third party mistake or some extenuating circumstances led to the late payment AND the late payment was not due to your financial inability to pay, then youre in luck.

But beware, creditors will never remove a late payment due to financial hardship or job loss.

However, if you can show documented proof of the extenuating circumstances that led to the late payment along with a copy of a bank statement showing a healthy balance of a few thousand dollars, then creditors may agree to remove late payments under the following circumstances:

Examples of Circumstances:

If you are able to prove a scenario like the one listed above, you will need to ask for the address, fax, or email for the creditors Credit Bureau Department, to whom youll fax this information for review.

How Much Does My Credit Score Drop If I Miss A Payment

How much a late payment impacts your credit score depends on several factors, including:

-

How large the late payment was

-

How long the payment was overdue

-

How recent the late payment was

-

How often youâve made late payments

Thereâs no exact answer to how much your credit score could drop by, as Equifax and Transunion use different scoring models to calculate your score. If you have a good credit score of 713 or above, a 30-day overdue payment could cause your credit score to drop by 90-110 points. If you wait another 30 days before making that payment, your score may drop even further.

Not sure what your credit score is?

You can check your credit score for free by signing up for Borrowell. Find out if a late payment is negatively impacting your credit score.

The key takeaway is that the longer a bill goes unpaid, the more potential damage it can have on your credit score. Hereâs how your credit score and credit report are impacted based on how long your late payment goes unpaid for.

If your payment is less than 30 days late

If your payment is less than 30 days past-due, you wonât see a hit on your credit score. You might be charged a late fee by your lender or see your interest rate increase if you miss your bill, but your credit score wonât be impacted.

If your payment is more than 30 days late

If your payment is more than 120 days late

If you make multiple late payments

Recommended Reading: What Credit Score Do You Need For Chase Sapphire Reserve