How Can I Get An Eviction Off My Record

Removing an eviction from your public record actually isnt that difficult. If you have an eviction record that will show up in your background check, you can petition the court in the county where the case was filed to have the record expunged, or sealed. This typically requires filing a petition with the court and paying a filing fee . Your chances that a judge will agree to expunge a case are higher if the case did not result in an eviction. If you still have an outstanding balance from an eviction case, you should pay the balance before petitioning the court for an expungement.

How To Rent With An Eviction On Your Record

Renting after you’ve been evicted can pose some real challenges. Almost all property managers rely on screening to decide whether a potential renter is a good risk, and a prior eviction raises a red flag. If you weren’t able to clear an eviction from your record, these tips can make renting after an eviction easier.

Where Do Evictions Show Up In Your Records

In order to evict you, your prior landlord must have first obtained a civil judgment against you in court. Those court records are available for public search by anyone, including credit reporting companies. Since its impractical for most landlords to search out individual court records, most often they will see your eviction record in the Public Records section when they pull your credit report, for which you must first sign over your permission under the terms of the U.S. Fair Credit Reporting Act .

Also Check: Trimerge Report

Your Rights With Landlords And Eviction Notices

Many states require the landlord to send an eviction notice alerting the tenant of the issue that may trigger an eviction. Then the tenant has a short period of time before the eviction process is in full effect â typically anywhere from three days to one month â to resolve it. During this phase of the legal process, the tenant should seek legal advice if thereâs an interest in challenging the eviction.

If the tenant canât catch up on rent payments or otherwise fix the problem, the landlord files the eviction paperwork in housing court. The housing court then provides a hearing date to both the landlord and tenant.

At the eviction lawsuit hearing, the landlord and tenant can present their cases and provide supporting documentation, including the original lease, correspondence between the landlord and tenant, etc.

If the landlord wins the eviction lawsuit, the renter will receive a court order to move out. The deadline to move out varies by state but is usually anywhere from a couple of days to a few weeks.

How Much Does Filing An Eviction Dispute Cost

You shouldnât have to pay anything to file a dispute directly with the credit bureaus. Filing a dispute should be free, as itâs your right to file a dispute if you see anything that you believe is wrong on your credit report.

There may be fees from your bank for supporting documentation, such as retrieving old bank or credit card statements.

Read Also: Is 575 A Good Credit Score

Attend The Ex Parte Hearing

At the hearing, the judge will review the paperwork for accuracy. If the parties have signed a stipulation and all the correct court procedures have been followed, there is no reason why a judge would not grant the application. Following the judges determination, the court will issue an order pursuant to the requests made in the ex parte application.

After this process is complete, soon after, the tenants judgment will be vacated, and the record will be masked.

Our law firm vacates unlawful detainer judgments. To speak to one of our tenant lawyers, please contact us at 415-504-2165.

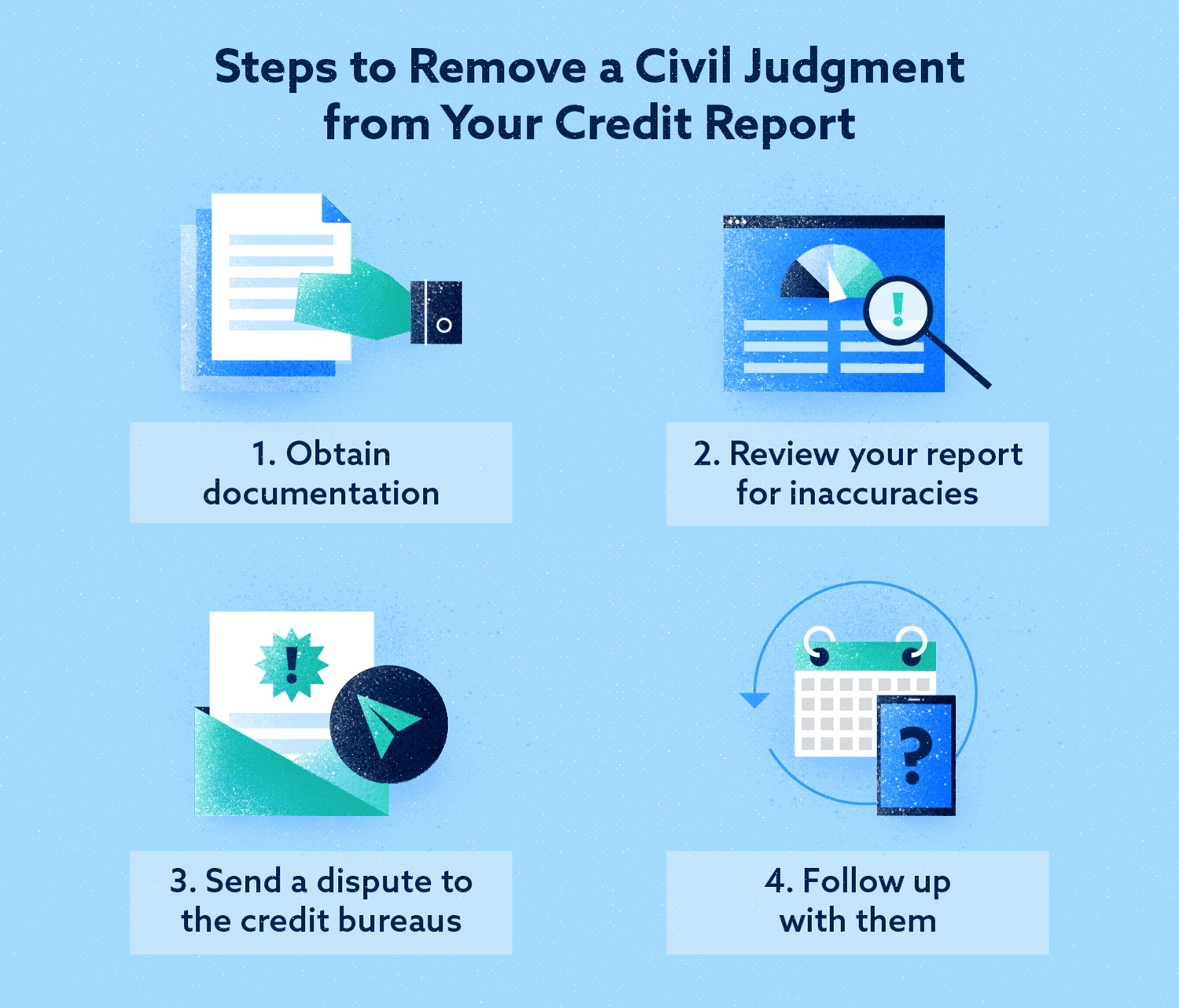

How To Dispute An Eviction On Credit Report

You can submit a dispute with the credit bureaus if theres some eviction-related information on your credit report that you believe isnt supposed to be mentioned. Youll have to submit a dispute to each credit bureau separately.

To do this, you can send a letter to the respective credit bureaus, including your complete information, proof of your claim, and an explanation of why you believe the information is disputed.

It must include requests to remove the information from your credit records. In addition, submit copies of documents provided by the courtcivil judges expungement records, debt settlement receipts, and eviction suitattached with the letter.

Recommended Reading: Does Opensky Report To Credit Bureaus

What Is An Eviction In Legal Terms

While the situations above describe reasons for a tenants removal from the property, eviction from a technical standpoint entails the landlord suing a renter for refusal to leave.

A few places allow landlords to employ self-help eviction tactics, like changing the locks on the property, but this is illegal in most places. If your landlord does this to you, make sure you check to see if this is legal. Otherwise, its time to contact the authorities.

Instead of locking you out, the landlord must usually go through the court system to file a lawsuit against you and obtain a writ of possession.

A law enforcement officer then posts the eviction notice on the property, giving a specific deadline of when it must be vacated. If the tenant is still there on the posted date, the law enforcement officer will physically remove the tenant and their belongings.

You May Like: How Long For Things To Fall Off Credit Report

Impact Of Eviction On Credit And Future Housing

House & Apartment

Having an eviction in your past can make it more difficult to find housing in the future.

Eviction is a legal process where a landlord removes a tenant for breaking their lease agreement. Breaking the lease agreement is called a breach. A breach can be because of nonpayment of rent, repeatedly late payment of rent, having too many people inside the residence, subleasing without permission, damaging the property, having pets where prohibited, or any other conduct that the lease does not allow.

To be evicted, you must first have an eviction hearing. The hearing will be at your local Justice of the Peace court. The judge must decide against you and in favor of your landlord before you can be evicted.

Always go to your hearing. If you do not attend, you almost always lose. If you lose, you will have to move out, pay any rent that you owe, and may have to pay court fees.

However, just having an eviction case can make it harder to find housing. This is true even if you win.

You May Like: Notify Credit Agencies Of Death

Why Should You Dispute The Eviction On Your Credit Report

If you arent paying your bills on time, the eviction will show up on your credit report for 7 years, just like any other negative account. Suppose you are trying to get back into the housing market after being removed from ones rental property, where rent is paid monthly. In that case, an eviction will have a negative impact to any potential landlords on your ability to get back in because of all the previous debts that were left unpaid before being evicted from properties.

Having an account with late payment history can affect your ability to get back into credit-related matters such as applications for new lines of credit at local bank branches or even apartment rentals!

To avoid having issues with creditors down the road when applying for a mortgage loan and other types of loans, its important to take steps towards understanding how to dispute an eviction on ones credit report.

Suppose youve been served with a lawsuit and your landlord sends the account into collections. In that case, it will be even more important that you understand how to dispute an eviction on ones credit report as opposed to disputing an eviction alone!

Furthermore, it helps to understand your credit and do everything you can to increase your credit score. Make sure you run a credit check on yourself . In many cases you can get a free report at no charge.

Getting A Proper Resolution

If the bureau investigates and doesn’t agree with you, tell the bureau to include a record of the dispute in your report. After you ask the landlord for a correction, he also has to acknowledge the dispute if he provides information about you to credit bureaus again. If the bureau fails to remove clearly incorrect eviction data, you can take the bureau to court. If you win, you may be able to collect court costs, legal fees and damages for pain and suffering.

Should you have trouble navigating the legal system on your own, you can contact and hire an eviction removal lawyer. Keep in mind that eviction removal services only benefit you if there was an error in the reporting, or you’ve paid off any debts in full.

You May Like: What Credit Score Does Comenity Bank Use

Why Use Donotpay To Remove Evictions On Your Credit Report

The thought of being homeless because of an eviction in your credit report can be frightening. If you’ve cleared all the debt, but your credit report still lists the eviction, DoNotPay is your best chance at having it removed. We’re confident we can help you do. Below is a quick rundown of why you should use DoNotPay.

- Fast You don’t have to spend hours trying to solve the issue yourself. We’ve simplified the process, helping you save time and agony of doing it yourself.

- Easy You don’t have to struggle to fill out tedious forms or keep track of all the steps involved in solving your problem.

- Successful You can rest assured knowing we’ll make the best case for you to get the best results.

How To Get An Eviction Off A Credit Report

Evictions don’t always show up on credit reports. The Experian credit bureau says it doesn’t report evictions except when they involve certain elements, such as money disputes. Having an eviction on your report can hurt you, as other landlords will see it as a warning sign you’re a bad tenant. Your ability to scrub the eviction off your report depends in part on how long ago it was and whether the report is accurate.

Don’t Miss: What Does Leasing Desk Score Mean

Im Having Problems With My Former Landlord Not Updating The Eviction On My Credit Report

Unfortunately, this is something youll need to handle directly with your landlord as neither nor any other service can make them update the information on your account. The best advice we can offer here would be to pay off what remains owed and have them note it as paid in full. This way, they wont continue reporting the debt until it gets to a point where it has been paid off.

Ask To Have Collections Removed From Your Credit Report

Even after you’ve paid or settled a debt, the collection activity may remain on your credit report. When you make payment in full or negotiate a settlement, ask the collection agency or property manager to request removal of the collection from your credit report. Be sure to get this agreement in writing. If the collection isn’t removed, the documentation will be helpful in filing a dispute with the credit bureau.

Recommended Reading: Syncb Ppc Card

Leverage Letters Of Reference

A fantastic letter of reference is a powerful way to gain your prospective landlords favor. Landlords are looking for reliable tenants who will pay the rent and respect the property, so if you can provide glowing references, it could be enough to offset the eviction on your record. If you cant provide positive references from former landlords, ask your boss, a colleague, or someone from your church or volunteer organizations to provide one.

Procedure For Removing Past Eviction From Record

Court records showing rental eviction cases are usually available for viewing to the public for 10 years. Oftentimes, landlords perform background checks on new, prospect tenants, and sometimes landlords take a peek on court records just to check on previous rental eviction cases that their tenants have been involved in. There are certain screening companies, too, that offer this service for a charge. It can therefore be difficult but very possible, to have one’s eviction record sealed or expunged so that screening companies or landlords will not be able to view the record of the cases,

Don’t Miss: How To Unlock My Transunion Credit Report

How Do You Find A Rental After A Recorded Eviction

If you have a recorded eviction on your credit report, it may make it harder to find a place to rent. When looking for a place to rent, here are some steps you should consider when working with potential landlords:

-

Be honest with the new landlord

-

Offer references

-

Show you can afford the rent

Be honest with the new landlord

Honesty is the best policy, as the saying goes. Itâs best to be honest with the new landlord about the eviction and provide a valid explanation.

Offer references

You could provide personal and work references to prove to any prospective landlords that youâre a responsible tenant, and that it was just a one-off incident.

Offer to pay more up front

Get a co-signer

A co-signer, such as your parents, can provide your landlord reassurance that you have every intention of paying the rent on time.

Watch your credit

Show you can afford the rent

Sydney Garth Credit Cards Moderator

You can get an eviction off your credit report by waiting until 7 years have passed, at which point it will fall off naturally. If more than 7 years have passed, you can file a dispute to have the eviction removed.

Bear in mind that evictions do not appear on your credit report directly, but only after your landlord sends your debt to a collection agency. Once your debt has been reported to the credit bureaus, it stays there for 7 years, whether or not the debt is paid.

It’s possible that a credit repair company may try to convince you to attempt to get rid of your eviction through a concept called pay-for-delete. But this should be avoided, as it is often a scam that will cost you money without much of a result .

Instead, try to pay off your past-due balance and then request that your landlord update the status on your account to paid. The collection account may still be on your credit report, but the paid status will look a lot better to creditors.

You can learn more from our guide about how long things stay on your credit report.

How long does an eviction stay on your credit report?

I have an eviction on my record. What can I do to find a place to live?

In either case, if there is any way you can save up extra money, then you could offer the new landlord that you will pay a few months rent ahead of time, which will make you a safer renting bet.

Again, I am sorry this is giving you trouble, and I hope that things improve soon.

You May Like: Is Paypal Credit Reported To The Credit Bureaus

What Does An Eviction Look Like On A Credit Report

There’s no direct relationship between an eviction judgment and a credit card score. So, it shouldn’t appear on a credit report right at the gate. According to the Experian credit bureau, one way an eviction appears on a credit report is when there’s a money dispute.

This occurs when you can’t settle your rent arrears and your landlord hands you over to debt collection agencies. It’s the debt collection agencies that include the eviction judgment in their report. Another way it happens is when you’re sued for contravening the lease agreement.

How Can You Remove An Eviction From Your Record

The only way to remove an eviction from your record is by petitioning the court to remove it and winning the case. Follow the steps below if you wish to dispute your eviction:

1. Petition the court. You’ll need to go to the county where the case was filed and petition the local court to remove eviction from your record.

2. Prove you didn’t violate the terms of your lease. It’s essential to prove that you paid your rent on time and left the property in good condition.

3. Prove the landlord didn’t follow the due process of eviction. State laws vary when it comes to eviction processes. Ensure you familiarize yourself with the legal procedure governing eviction suits in your state, then prove to the court that the landlord failed to follow the due process.

If you can prove that you didn’t violate the terms of your lease or the proper eviction processes weren’t followed, you’ll have a good chance of winning the case. The eviction will be removed from your record if you convince the judge there was no wrongdoing on your part.

Recommended Reading: Does Aarons Report To The Credit Bureau

Property Damaging And Misconduct

In the cases of misbehavior, damage caused to the rental property, or complaints by other tenants and neighbors, the best way to resolve the issue is to apologize and rectify your mistakes.

This can be done by offering to pay for fixing the damage, keeping your behavior in check, and abiding by the rules.

Next Steps For Removing Evictions From Your Credit Report If You Can’t Do It Yourself

There are only two things you can do if you can’t remove evictions from your credit report. You can give up and forget about maintaining a clean credit history or find someone to help you work it out. However, the last thing you want to do is give up when you can find help elsewhere. This is where DoNotPay comes in handy.

Read Also: Apple Card Experian