Ways To Get Something Removed From Your Credit Report

Before you get started, note that if your negative information wasnt the result of an inaccuracy or crime, neither Equifax or TransUnion will remove it from your credit report prior to the designated date. Otherwise, there are 6 different ways to get an error or other negative incident removed from your credit report:

Wait For It To Go Away Naturally

Normally, timely payments and other positive incidents will stay on your credit report indefinitely and will improve your credit score over time. On the other hand, negative information will remain in your credit history for several years, the length of which depends on the incident. Common examples of negative information include:

- Late/missed payments = 6 years

- Consumer proposals = 3 years

- Bankruptcies = 6 7 years

In these cases, the simplest way to deal with the negative information is to wait until Equifax and/or TransUnion clears it from your report. As mentioned, whether the incident was intentional or accidental, neither bureau will remove it immediately, because it was technically your responsibility to pay your debts on time.

File a Dispute

Although waiting for the negative information to be removed is the most convenient option, remember that it can damage your credit score while its on your credit report. You may not want to wait for years, during which you could get denied for new credit.

- For the dispute to have grounding, be sure to provide any proof you have that shows that the incident was not your fault

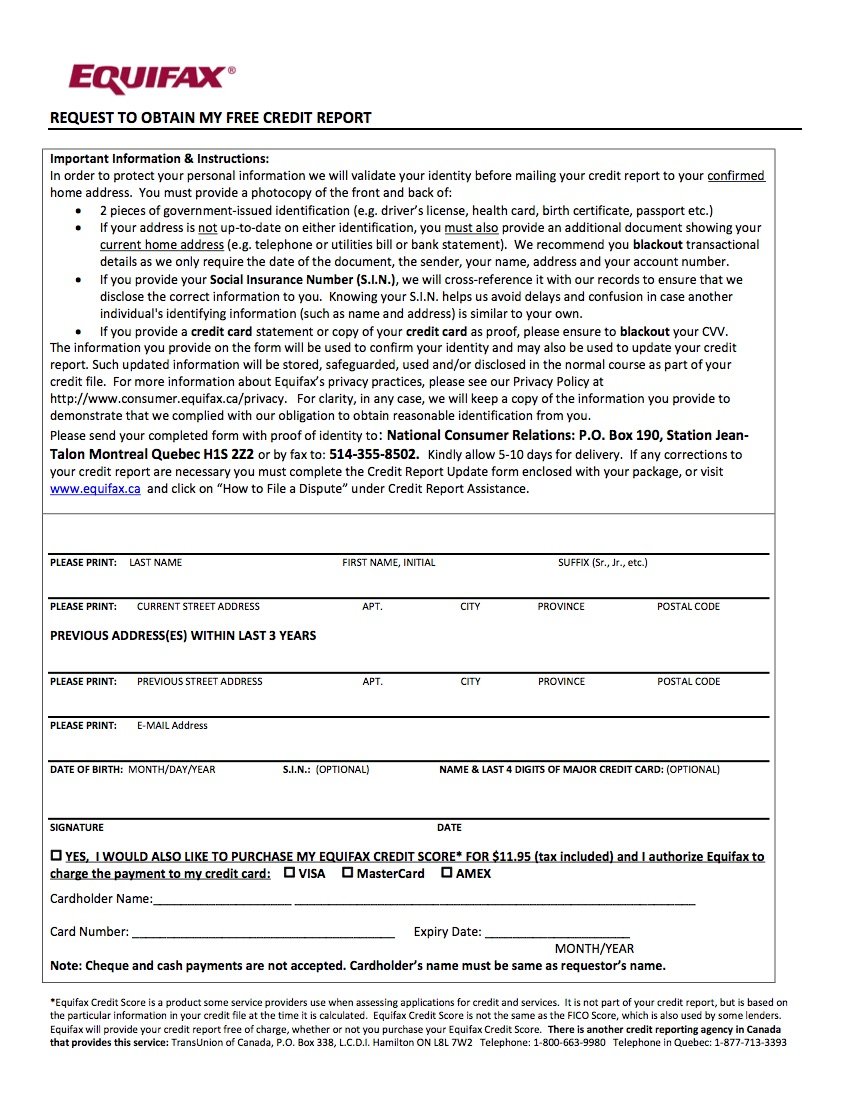

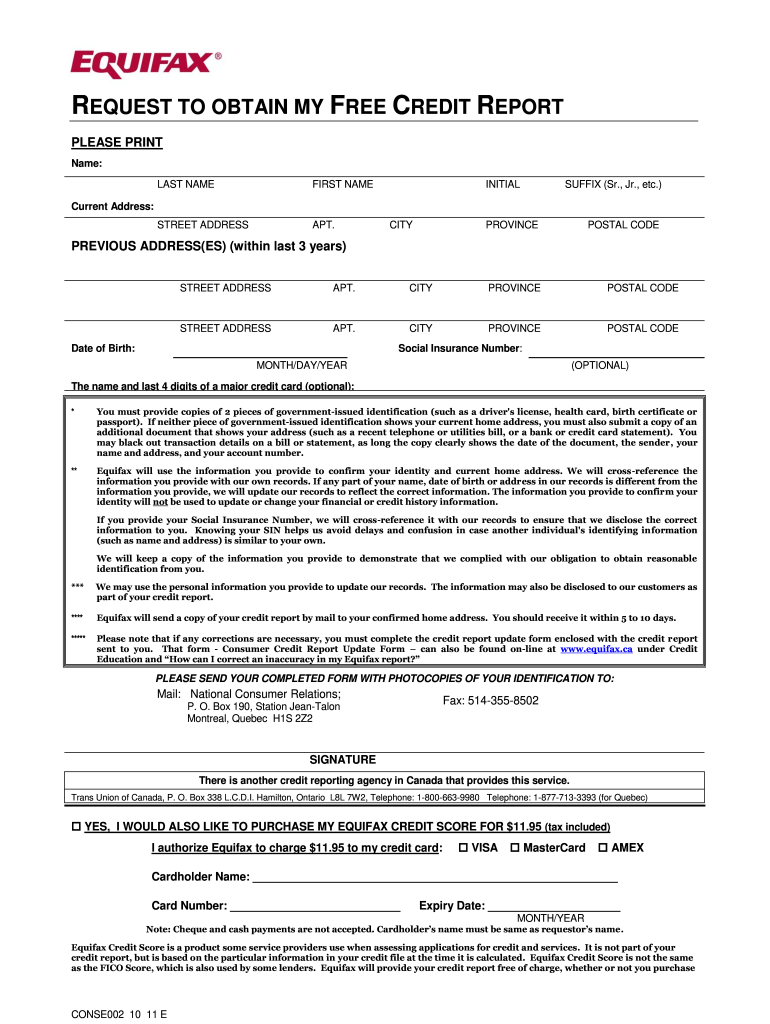

Option : Request Your Free Credit Report By Filling Out A Form

Quick Links to Equifax and TransUnion Credit report forms

You can also request a free copy of your credit report from Equifax and TransUnion by filling out an Equifax form and/or a TransUnion form. You can then mail the completed forms to Equifax and TransUnion and they will mail you a free credit report.

For all the options listed above, when your credit report arrives by mail, certain personal and identifying details will be blocked out. If this is your own report, there is enough information there for you to know whats going on. If someone should get your report in error, or take it out of the mail, there isnt enough information there for them to harm your identity.

Correct An Inaccuracy On Your Equifax Credit Report

If you find any information that you believe is inaccurate, incomplete or a result of fraud, you have the right to file a dispute with Equifax Canada. You will need to complete the enclosed with your package. You can also review how to dispute information on your credit report for additional details on the Equifax dispute process.

You May Like: Navy Federal Internal Score

How Is Credit Established

Its important to build up your credit history because a favourable credit report will help you get credit cards, mortgages and personal loans with better interest rates. You automatically establish credit every time you take out a loan or use a credit card. But if youre finding it hard to get approved for loans or credit cards because you dont have a long or well-established credit history, consider these other ways to establish credit:

- Get a secured credit card.Secured credit cards are ideal for people who can manage a credit card responsibly but dont yet have a long enough credit history to be approved for a conventional credit card. With a secured credit card, you provide the issuer with a deposit that then becomes the cards credit limit. So, if you give a deposit of $1,000, you can then spend up to $1,000 on the card. Secured cards are easier to get because the card provider isnt at risk of losing any money it can access your deposit if you default on payments.

- Apply for a secured loan. As with a secured credit card, a secured loan guarantees repayment of the loan by providing an asset like a car or home as collateral.

- Get a co-signer. If you cant get a loan and build your credit report on your own, you can try to get a co-signer. A co-signer essentially guarantees repayment of the loan. If you fail to make payments, however, your co-signers credit rating would be negatively affected, so you have to be sure youll repay the loan.

Go To Annualcreditreportcom Or Call 1

You can only request your credit report through AnnualCreditReport.com or by calling the verified phone number 1-877-322-8228. If another source claims to have your credit report in exchange for personal information, its probably a fraud.

Requesting your credit report wont negatively affect your credit, but again, youre limited to three reports per 12 months under federal law.

Dont Miss: Tri Merge

Recommended Reading: Open Sky Not Reporting

What Is A Good Score

Typically, the higher the score the better. Each lender decides which credit score range it considers a good or poor credit risk. The lender is your best source of information about how your credit score relates to their final credit decision. Your credit score is only one component of the information that lenders use to evaluate credit risks.

Where Should I Get My Free Credit Score From

Did you know that you can get a different credit score number even if your free credit score source uses the same credit bureau? Thats because each source can use a different method of scoring your credit, even if they use the same information from the same credit report.

If you already have an account with RBC, Scotiabank, CIBC, or BMO, then you can easily access your free credit score without having to signup or provide any additional information. However, youll only get your credit score from one credit bureau, and youll only get updates once per month. In the case of CIBC, your credit score is only updated once every three months.

For more frequent updates, and if youre not a customer of any of these banks, then the free credit score providers can offer updates as frequently as every week and is open to anyone. Using both Credit Karma and Borrowell will allow you to receive your credit score from both Equifax and TransUnion once every week.

To get a better idea of your credit score, you may want to consider checking your credit score from more than one source. Using multiple credit score sources can allow you to get a better idea of what range your credit score is in.

Recommended Reading: 779 Fico Score

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

Does Checking My Credit Report Hurt My Credit Score

Checking your credit report is a soft credit check so it doesnt affect your credit score. A soft credit check occurs when you check your own credit report or a creditor or lender checks your credit for pre-approval. A hard credit check occurs when a company checks your report when you apply for a line of credit.

Annualcreditreport.com is the only website legally authorized to fill orders for your free annual credit report. Any other website claiming to offer free credit reports could be falsely claiming to be part of the free annual credit report program. Be mindful of websites trying to trick you with subtle differences.

Also Check: Removing Repossession From Credit Report

Read Also: Free Credit Report Usaa

Option : Get Instant Access To Your Free Credit Report By Phone

The second fastest way to obtain a free copy of your credit report is to call each of the credit reporting agencies toll free numbers. If you call these numbers, a computer will ask you some questions about your personal information so that it can verify your identity. Then the automated system will mail you a copy of your credit report. It can take up to 3 weeks for your credit report to arrive by mail. You can obtain your free credit report by calling the numbers below:

- Equifax – 1-800-465-7166

- TransUnion – 1-800-663-9980

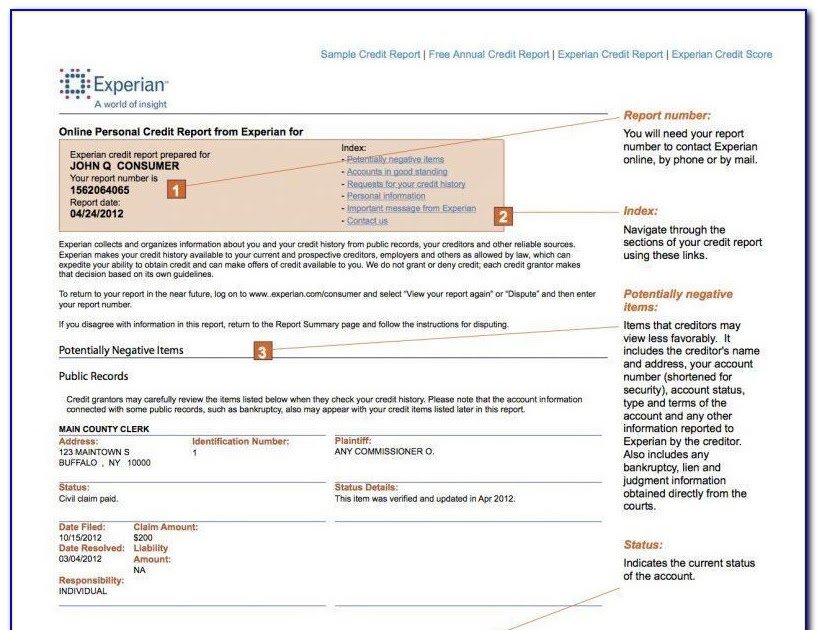

What To Look For On Your Credit Report

Lenders use codes to send information to the credit bureaus about how and when you make payments.

These codes have two parts:

- a letter shows the type of credit you’re using

- a number shows when you make payments

You may see different codes on your credit report depending on how you make your payments for each account.

| Letter |

|---|

You May Like: How To Remove Repo From Your Credit Report

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

How Credit Reports And Credit Scores Are Affected By Inaccuracies

While it might not seem like a big deal at first, even a single error can cause a lot of problems for your credit report. If left uncorrected, it can even lead to a significant drop in your credit score .

Once your is between 300 600 its considered to be poor. With poor credit, it can be difficult to get approved for large amounts of credit, favourable term conditions and low interest rates, since lenders might think its because you havent paid your debts in the past. Plus, it can take a lot of time and effort to get your score back to the good range .

All this to say, if you do find some kind of inaccuracy on your credit report, its extremely important to resolve the situation as fast as you can. Although there are relatively fast and easy ways of doing this, the longer the error goes uncorrected, the worse your credit and approval chances will be.

Recommended Reading: How Long Does Repossession Stay On Your Credit

What If I Find An Error In My Credit Report

Well, you won’t be the first. In millions of files and hundreds of millions of reported entries, there are bound to be mistakes. Some are minor data-entry errors. Others are damaging whoppers. For example, we’ve heard of instances where negative credit files from one person got posted to the file of someone who had a similar name .

What Makes Up Your Credit Score

It is important to know how your credit score is calculated if you want to improve it. In Canada, a credit score is impacted by these factors:

Payment history : Lenders want to know whether you pay your bills on time. If you have missed or late payments, they affect your credit score negatively.

Amounts owed : This refers to your credit utilization ratio which is how much of your credit balance is currently in use. For example, if you have a $10,000 credit limit and are owing $4,000, your credit utilization ratio is 40%. Aim to keep your account balance at 30% or less of your credit limit.

: The longer your credit history, the better. When closing credit accounts, consider keeping the older ones as they may fetch you more points.

New credit inquiries : If you have multiple hard inquiries on your credit file within a short period of time, lenders may think you are desperate for cash and this could affect your ability to pay back debt. Dont apply for credit if you dont need it.

: A combination of different types of credit accounts can strengthen your credit profile. For example, a mix of a credit card, personal loan, mortgage loan, and line of credit in good standing can build up your credit score. They show how well you can manage credit.

Also Check: How To Remove Hard Inquiries Off Your Credit Report

How To Get Your Credit Report

If youve ever borrowed money from a lender you should have a credit file. Whether youve applied for a credit card or taken out a mortgage to purchase your dream home, you should have a credit report with the credit rating agencies. Its important to regularly review your credit report to ensure its accurate and you havent been the victim of fraud. Heres how to request your credit report from the credit bureaus.

Why Do I Need A Credit Report

Both your credit report and your credit score are valuable financial tools that can help you in various ways as you make your way through life. In fact, a solid record of responsible credit usage will allow you to secure loans of all kinds. Lenders and creditors want to know, first and foremost, that their clients have the ability to pay them back. They can verify this by looking at your credit report and seeing that you dont have a history of debt or bankruptcy problems. Similarly, having a good credit report and score can help you not only secure those loans but get the best possible interest rates. So, its important to keep up to date and check your credit report and credit score regularly, so that you can have a healthy and happy financial future.

Rating of 5/5 based on 6 votes.

Recommended Reading: Raise Credit Score 50 Points In 30 Days

Check And Monitor Your Credit Reports And Credit Scores

Now that you know why your credit is so important, you can see why itâs a good idea to check and monitor your credit. But how do you do it?

How to Request Free Copies of Your Credit Reports

You can get a free copy of your credit report from each of the three major credit bureausâEquifax, Experian and TransUnionâby visiting AnnualCreditReport.com. Youâll need to provide your:

- Legal name.

- Social Security number.

- Current address.

If youâve moved in the past two years, you may need to include your previous address as well. There may be a limit on how often you can obtain your reportâcheck the site for details.

Once youâve provided the information above, youâll pick which credit reports you want before answering a few additional questions that help verify itâs really you. âThese questions are meant to be hard,â according to AnnualCreditReport.com. âYou may even need your records to answer them. They are used to ensure that nobody but you can get your credit information.â

How to Check Your Credit Scores for FreeâWithout Hurting Your Credit

Keep in mind that your credit scores donât actually appear on your credit reports. So what do you do if you want to check your scores?

Depending on your lender, you may be able to find your scores by checking your statement or by logging in to your account online. You can also get your scores directly from the credit bureaus and credit-scoring companiesâbut you might have to pay for them.

Related Content

Why Is It Important To Check My Credit Report

Its important to check your credit report because credit reporting mistakes happen. They can be the result of a creditor reporting inaccurate information or a sign of identity theft. If the error lowers your , it can decrease your approval odds when applying for a loan and it could prevent you from securing the best rate.

Also Check: Does Aarons Do A Credit Check

What Is An Inquiry

Provincial and federal laws outline the requirements for what organizations may access your personal credit information. As part of the credit application process, organizations ask for your consent to access information about you. They may also request a credit report when they are looking to collect on a debt, or if you have applied for employment, tenancy, or insurance. Finally, you also have the right to access your credit report.

How Do I Build A Good Credit History

A credit reporting agency needs a track record of how youve managed credit before it can calculate a credit score. Typically, six months’ worth of activity will provide enough information to generate a score. Your score is dynamic and may rise or fall over time, based on how consistently and promptly you pay your bills. Establishing a good credit history takes time. Each creditor has different.requirements for issuing credit. If you are declined credit, contact the lender to determine the reasons why.

You May Like: Carmax Credit Requirements

Other Ways To Get A Free Credit Report:

The free annual credit report is available to everyone in the United States. However, in addition to that, you can also get a free credit report directly from a credit reporting agency if youve been denied credit.

You have 60 days from the time you are notified of the denial to request your credit report. Your request must also be with the credit reporting agency that was used to check your credit.

If you are ordering a free state report, or you are getting a free credit report due to any of the other factors weve talked about, youll need to contact the nationwide credit reporting agencies directly. Equifax and TransUnion make it easy to order these free credit reports online, but to get your free Experian credit report, you may need to call.

The contact information and links for each are here:

- Free Experian Credit Report call 1 866 200 6020 to confirm eligibility and get your credit report by mail or use this link.

- Free TransUnion Credit Report order online through this link.

Remember: Keep track of when you order your credit reports and from which bureau so that you know when youll be eligible to order your next credit report for free.