What Is A Soft Inquiry

Soft inquiries typically occur when a person or company checks your credit as part of a background check. This may occur, for example, when a credit card issuer checks your credit without your permission to see if you qualify for certain credit card offers. Your employer might also run a soft inquiry before hiring you.

Unlike hard inquiries, soft inquiries wont affect your credit scores. Since soft inquiries arent connected to a specific application for new credit, theyre only visible to you when you view your credit reports.

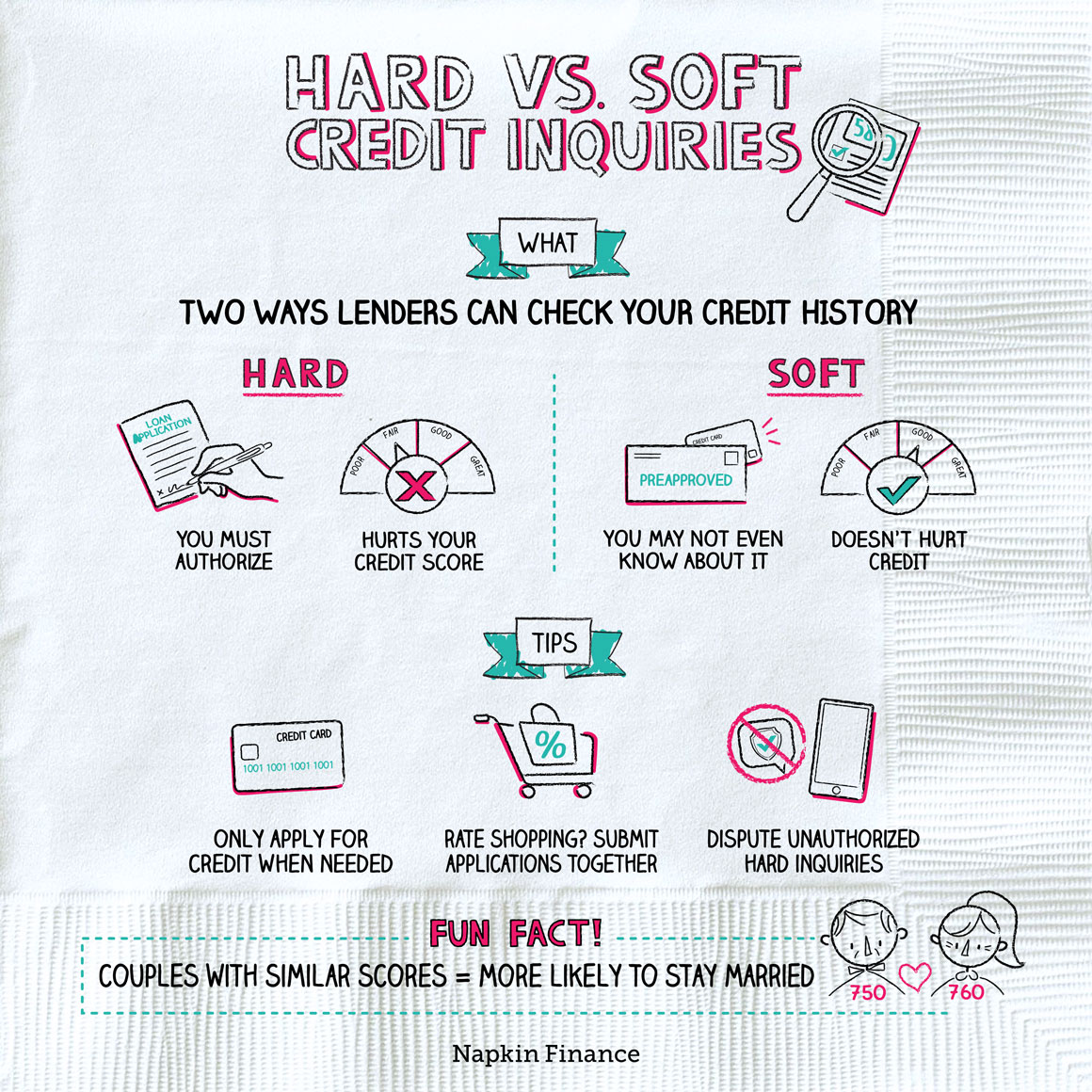

Hard Vs Soft Credit Inquiry

A credit inquiry is a request that potential lenders, employers, and landlords send to consumer agencies to check your credit score. Credit inquiries or credit pulls help lenders assess your creditworthiness based on your previous usage of credit.

Not all credit checks affect consumers credit scores. Theres a difference between hard inquiries and soft inquiries.

Should You Be Worried About Hard Inquiries

If this question – How much does a hard inquiry affect credit? – still wakes you up at night, you should know that hard credit inquiries account for the smallest percentage of your overall credit report. In the FICO scoring model, only 10% of your credit score is reserved for hard pulls. In most cases, its less than 10%. VantageScore is also flexible when it comes to hard inquiries. Altogether, they are not an essential category in the total score.

Of course, it doesnt mean you should be less cautious with hard inquiries. Multiple hard inquiries in a short period can impair your credit. If youve just got a personal loan and plan to apply for a mortgage, expect another hard inquiry. The points on your credit score will drop for a few more, and you might have difficulties qualifying for better rates. To avoid this situation, you might consider applying to lenders who offer loans without hard credit checks.

Read Also: How To Report Credit Card Theft To Police

Lets Learn About: Hard Credit Inquiries

Any hard credit inquiry may affect your credit score negatively, and regular hard inquiries increase this likelihood.

The reason hard inquiries may affect your score is because credit bureaus audit your credit usage and accounts over the span of your credits lifetime.

Good credit habits are the best way to stay ahead of negatively impactful credit activity.

Hard Credit Inquiries Best Practices

Remember, hard inquiries only affect your credit score for one year and typically its a much shorter period of time than that .

Look over your current goals. If you have no large plans on the near horizon, such as applying for a small business loan or mortgage, then there really is no need to worry about any hard inquiries on your report because theyll all have dropped off before theyd be an issue.

Just make sure to review the rest of your credit report for the potential of credit fraud as an unauthorized hard inquiry may be an indication of this.

As Experts in the financial field, Excel Capital knows the importance of asking ones self How Long do Hard Inquiries stay on your credit report. This is something that every consumer and business owner must know before applying for credit. When an Underwriter evaluates someones credit they take into consideration the number of times in a given time period that a credit hit was made.

See What Your Business Qualifies For

Also Check: Does Rent A Center Report To The Credit Bureau

Review Your Credit Reports

To improve your credit, it helps to know what might be working in your favor . Thats where checking your credit history comes in.

Pull a copy of your from each of the three major national credit bureaus: Equifax, Experian, and TransUnion. You can do that for free once a year through the official AnnualCreditReport.com website. Then, review each report to see whats helping or hurting your score.

Factors that contribute to a higher credit score include a history of on-time payments, low balances on your credit cards, a mix of different credit card and loan accounts, older credit accounts, and minimal inquiries for new credit. Late or missed payments, high credit card balances, collections, and judgments are major credit score detractors.

How Long Does Improving Your Credit Score Take

There is no set minimum, maximum, or average number of points by which your credit score improves every month, and there is no set number of points that each action will gain. How long it takes to boost your credit depends on the specifics for why your credit score is low. If the major negatives on your credit score are credit utilization, and then you pay off your balances, your score can improve drastically in a single month. If your credit is low because of multiple collections and poor payment history, then it will take several months of on-time payments to see any positive movement in your score.

Recommended Reading: What Credit Score Do You Need To Lease A Car

Read Also: How To Put A Lock On My Credit Report

How Can I Get Rid Of Hard Inquiries Fast

If you find an unauthorized or inaccurate hard inquiry, you can file a dispute letter and request that the bureau remove it from your report. The consumer credit bureaus must investigate dispute requests unless they determine your dispute is frivolous. Still, not all disputes are accepted after investigation.

Is There Any Way To Avoid Hard Inquiries While Searching For The Best Loan Or Credit Card Offer

Finding the right lender can get you a more suitable deal, including benefits like flexible repayment plans or competitive interest rates. But this may mean submitting multiple applications, which can affect your credit score quite significantly. Instead, with some careful research, you can identify lenders who offer terms that are suitable for your circumstances without making multiple applications.

Read Also: Is 631 A Good Credit Score

Do Mortgage Quotes Affect Credit Scores

- You can request free mortgage quotes from lenders without them pulling credit

- This will have absolutely no effect on your credit scores since youre only giving them a verbal estimate

- They may tell you that your credit scores could differ but its a perfectly fine starting point

- Once youve gathered several quotes you can take things a step further and let them run your credit if you wish to move forward

Weve discussed mortgage inquiries, but what about simple mortgage quotes?

Well, as long as the lender doesnt actually pull your credit, or uses a service that only results in a soft inquiry, it wont affect your credit in the slightest.

Assuming youre just calling around and comparing rates from lender to lender, or broker to broker, your credit will remain untouched.

Theres nothing wrong with just giving these folks a ballpark FICO score and seeing what rates they quote you.

Sure, your actual credit scores may fluctuate if and when you apply, but its pretty easy to check your credit for free these days and use that as an estimate.

Your actual scores shouldnt be too different since these free services come straight from the credit bureaus, so this is a fine alternative to shop without letting lenders dig into your actual credit report and scores.

Once you have a better idea of which mortgage lender you want to move forward with, you can let them pull your actual credit report and lock in pricing.

How Many Points Does A Hard Inquiry Affect My Credit Score

A hard inquiry can typically drop your credit score by 5 8 points, but not all inquiries count the same. Understanding how hard inquiries work can help you shop for credit more confidently.

Get your full credit picture in one spot

Nav brings your personal and business credit together in one FREE account so you can monitor your full credit picture.

Shopping for credit can be smart. But it can also affect your credit scores. If you are someone who takes the time tomonitor your credit report and scores, losing a few points can be stressful.

There are benefits to maintaining a high credit score. Youll often get approved for credit faster and easier, and you can qualify for the best interest rates, including zero percent offers. That means you can borrow money cheaply, or even free. You may also be in a better position to negotiate a price on, say, a home or car if you have a high credit score.

To keep you from losing sleep over losing points, weve created this quick guide to help you understand hard inquiries and their impact on your scores. So here goes:

You May Like: What Credit Score Do You Need For A Conventional Loan

What Is A Hard Inquiry Vs A Soft Inquiry

- Soft Inquiry. Soft inquiries will not affect your credit score. An example of a soft inquiry: you interview for a job and your potential employer pulled your credit report as part of its screening process.

- Hard Inquiry. This type of inquiry can affect your credit score. An example of a hard inquiry is applying for a credit card. In this case, the issuer pulls your credit report to help evaluate the risk of approving your application.

Per FICO, each hard credit inquiry can have a small impact on your FICO® Score1, and several inquiries over a short time period can have a greater impact on your score than just one. So, if youre trying to open several credit accounts in a short period of time , your FICO® Score will likely be affected.

But, if youre shopping for the best rate on a single auto, mortgage, or student loan over a short period of time, those inquiries are typically counted as one, minimizing their impact on your score.

Effect On Credit Score

When it comes to your credit score, the only type of inquiry you have to worry about is a hard inquiry. A soft inquiry does not affect a credit score at all, since its not an application for credit. Generally speaking, its a good idea to limit the number of hard inquiries you make. A typical hard inquiry could knock up to five points off a credit score.

Don’t Miss: When Does Chase Sapphire Report To Credit Bureaus

Reporting Fraudulent Hard Inquiries

If you think that someone has access to your personal information and may be trying to open credit accounts in your name, immediately follow these steps:

You may also want to freeze your credit or get a to stop fraudsters from triggering any more credit inquiries. Make sure to carefully monitor your credit reports over the next few months for further signs of fraudulent activity.

What Is A Hard Credit Inquiry

A hard inquiry is requested from a consumer agency every time you apply for a loan, credit card, or other financial product. A hard credit check will impact your credit score. Hard inquiries are performed by lenders, banks, or other financial institutions that want to check your financial behavior and see whether you are a risky borrower or not. These credit checks will show up on your credit report, but legally they cant be performed before your approval.

Although a credit score drop can be only a few points, it can influence the repayment terms, especially if you already have bad credit. Of course, there are personal loans for borrowers with bad credit that still come with slightly more affordable monthly rates.

Read Also: What Credit Score Do You Need To Finance A Car

Does Paying Off Collections Boost My Credit Score

Historically, paying off your collections does not improve your credit score because a collection stays on your report for seven years. Newer ways of calculating credit scores no longer count collections against you once they have a zero balance, but it is not possible for you to predict which method your lender will use to calculate your score.

How Do Hard Pulls Affect Your Credit

Hard pulls show up as an inquiry on your credit report. These inquiries are reflected in the new credit factor of your credit score, which makes up 10% of your score.

FICO scores, developed by the Fair Isaac Corporation, are the scores most lenders use when making approval decisions. Altogether, the average person can have more than four dozen FICO scores.

Along with hard inquiries, your FICO score is calculated using these factors:

Don’t Miss: What Is The Minimum Credit Score For An Fha Loan

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Why Credit Reports Matter

Potential creditors use your credit report to decide whether they want to lend to you and what APR theyll offer you. Avoiding unnecessary damage to your credit report is essential if you want to apply for new credit any time soon whether its a credit card, personal loan or anything in between.

Employers and landlords may also look at your credit report.

You May Like: What Score Does Credit Karma Use

What Are Hard And Soft Credit Score Inquiries

There are two types of lenders and others can make on your credit score: a “hard inquiry” and a “soft inquiry.” The difference between the two is that a soft inquiry won’t affect your score, but a hard inquiry can shave off some points.

Here’s what hard and soft inquiries are all about: why there’s a difference, and who makes them.

Avoid Unnecessary Applications Prior To Applying For Home Or Auto Loan

While a single hard inquiry on your credit report can cause a small, short-term decline in your credit score, it shouldn’t have a major negative impact, especially if you have good credit. Having several hard inquiries for different types of credit in a short time, however, could cause a more significant dip in scores and cause lenders to worry that you are having financial difficulty or that you could become overextended.

If you’re seeking a loan for a big purchase like a home or a car, first get a copy of your and review it. Avoid applying for new credit until you apply for your mortgage or auto loan. And consider signing up for free credit monitoringit will help you stay on top of your credit situation and can also help alert you to signs of fraud or identity theft, including unauthorized hard inquiries.

Also Check: How To View Credit Score

How Do Credit Inquiries Affect Your Credit Score

When you apply for a personal loan, mortgage or , lenders inquire about your financial capacity before they approve your application. Too many hard inquiries may suggest that youre in some kind of financial trouble and need a large amount of credit. People with frequent inquiries on their credit report are also typically more likely to declare bankruptcy than those with hardly any inquiries. This is why every hard inquiry translates into a 5-10 point reduction in your credit score. Lenders see people whove had multiple hard inquiries as more of a risk when deciding to lend them money or offer credit.

Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at

You May Like: Does Refinancing Hurt Credit Score

How To Minimize The Number Of Hard Inquiries You Have

Hard inquiries aren’t bad to have even if they may cause a slight temporary dip in your credit scores but it can be good practice to know how to minimize the number of inquiries on your credit report.

Below, CNBC Select rounded up some general guidelines to keep track of your hard inquiries:

- Don’t apply for several credit cards within a short timeframe. Experts generally recommend only applying for a credit card every six months.

- Only apply for credit cards you would actually benefit from using.

- Make sure you check your credit score beforehand . You can do so for free with most card issuers, using apps such as Discover’s Credit Scorecard and Chase’s Credit Journey .

- Before applying for a credit card, shop around with prequalification tools, which allow you to check your likelihood of qualifying for a card without damaging your credit.