Why Is My Score Different On Different Credit Bureaus

Depending on what type of loan you are applying for, the lender has the option to use many different companies that access risk. Some of the most used bureaus are FICO, Experian, TransUnion, and Equifax.

Each bureau assesses your payment history, credit utilization, credit history, credit mix, and inquires at a different weight thus a slight deviation in score from each company. Lenders also have the choice to report to their preferred credit bureau which can affect your credit score either positively or negatively.

Why Does Your Credit Score Change

Your credit score changes for a variety of reasons, many of which are completely under your control. Credit ratings generally shift because:

- Your credit utilization changes.

- You make on-time payments or miss payments.

- Your mix of credit usage changes.

- You had a hard inquiry into your report.

While it can be difficult to anticipate how your score will change, it is wise to pay off debts, pay bills on time and keep balances low. Additionally, try to have a mix of credit lines that include your mortgage, car payments, credit cards and perhaps a small personal loan. If your credit mix becomes too heavy in one particular area, the credit bureau might lower your score.

How To Qualify For A Credit Builder Loan

Qualifying for a Credit Builder Loan starts with linking your checking account to the MoneyLion app. You must be at least 18 years old, a US citizen or permanent resident, have a social security number, and have a bank account. You are eligible with the following criteria:

- The checking account has been open for at least 60 days and is in good standing. You cannot use a savings or money market account.

- You must have a clear income stream .

- Your personal information must match your linked checking account.

- The account has a reasonable balance and transaction history

Not everyone qualifies the first time around. If your income wasnt consistent or you had a negative balance in your checking account, wait a few months and reapply.

Don’t Miss: Capital One Authorized User

Increases The Risk Of Defaulting On Current Obligations

When you have back taxes, you are going to feel more pressure to meet payment deadlines. If you miss deadlines because you cant afford to make the payments, you may end up paying more, as penalties and interest will start to pile up over time.

You may have to overextend your finances to make up for the fees youve accrued as a result of delaying your payments, which can lead to debt in other parts of your life, too. This continues the cycle of debt, making it hard for you to pay back everything you owe.

Its common for people to charge their unpaid taxes to their credit cards or secure a loan to pay off their outstanding taxes. While this can help you in the moment, it will result in a higher credit utilization status, which can further lower your credit score.

Why Moneylion Stands Out From Other Credit Builder Loans

If your credit needs work and you also need money immediately for an emergency, a loan through MoneyLions Credit Builder Plus membership might be a great option if its available in your state.

MoneyLion is different from our other picks because it offers the potential for faster access to cash, unlike typical credit-builder lenders where you must wait until all payments are complete.

Another added benefit for those with little to no credit or bad credit is that MoneyLion doesnt check your credit when deciding whether to approve you or how much immediate cash access you get.

Instead, MoneyLion assesses your checking account, which must meet certain eligibility requirements.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

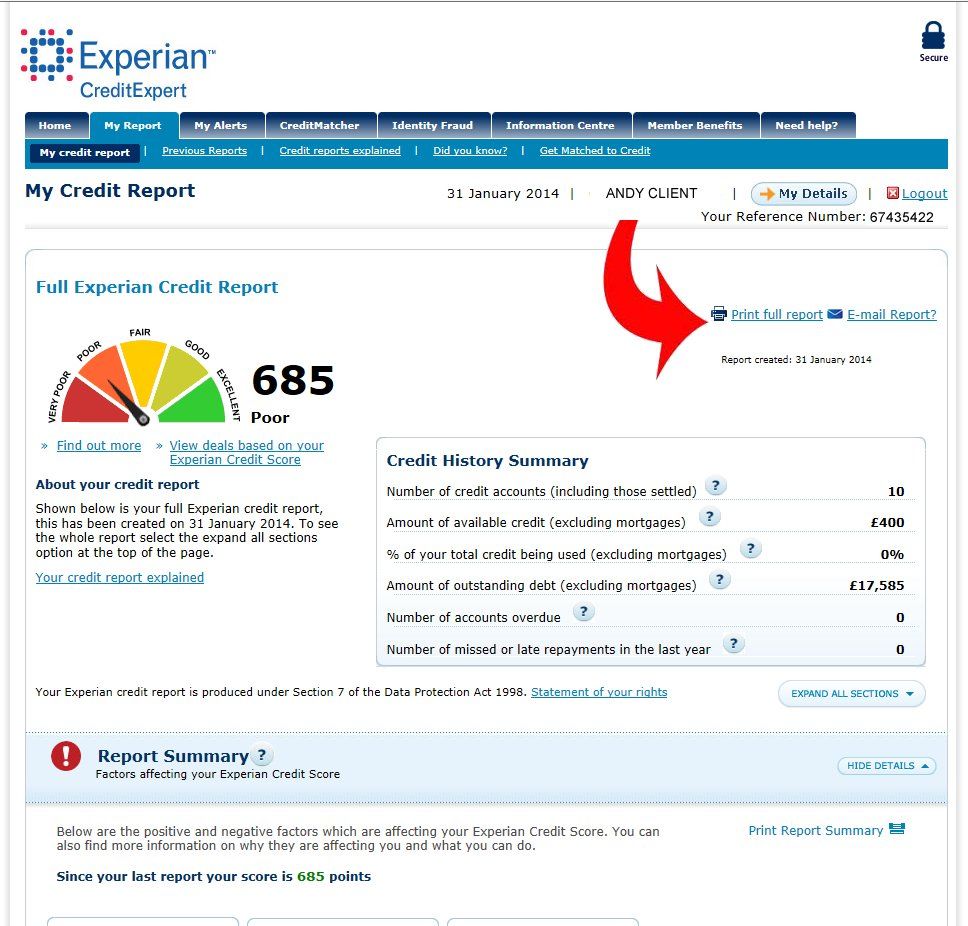

Monitor Your Credit For Progress

Monitoring your credit score is always a must whether youre concerned about unusual activities in your account or when youre trying to work towards a better credit rating.

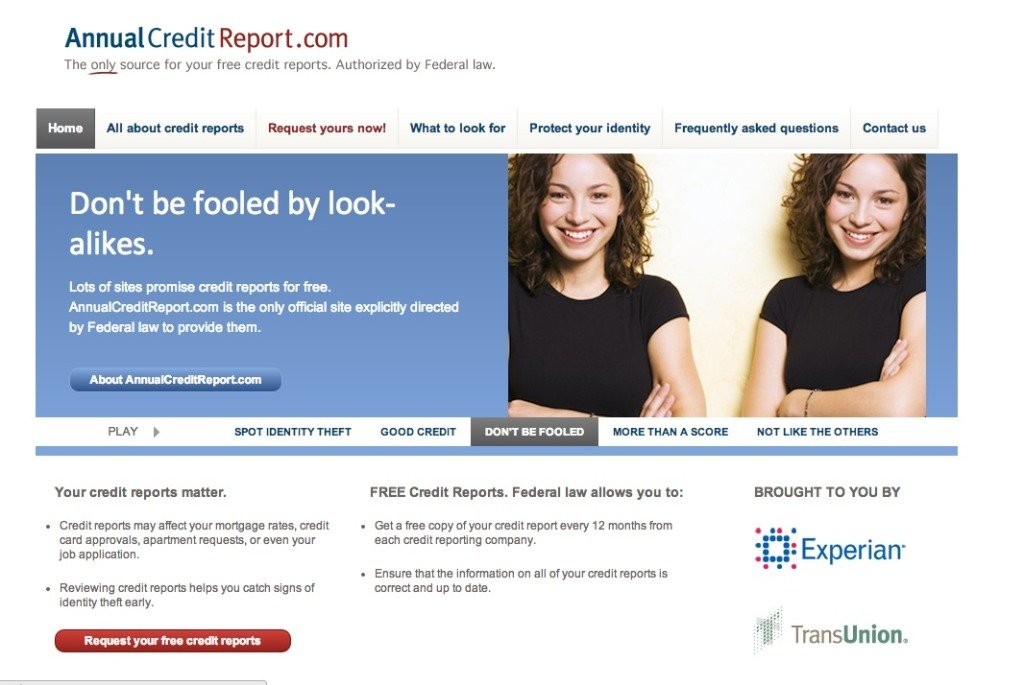

You can get a free credit report from each credit bureau every 12 months, but you can also track and monitor your progress 24/7 using products like RoarMoney.

Dont forget to check the details in your credit report and dispute errors if necessary. If your credit report lacks financial information, consider linking your rent payments to Rent Track or using Experian Boost so rent and utility payments would be considered in your FICO score.

Recover Your Credit Score Today

MoneyLion is a financial technology company, not a bank. RoarMoney demand deposit account provided by, and MoneyLion Debit Mastercard® issued by, MetaBank®, National Association, Member FDIC. RoarMoney is a service mark of MoneyLion. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International. Funds are FDIC insured, subject to applicable limitations and restrictions, when we receive the funds deposited to your account.

Investment advisory services provided by ML Wealth, LLC. Investment Accounts Are Not FDIC Insured No Bank Guarantee Investments May Lose Value. For important information and disclaimers relating to the MoneyLion Investment Account, see Investment Account FAQs and FORM ADV. Broker-Dealer may charge a $0.25 withdrawal fee, among other fees. Accounts are subject to an administrative fee of $1 per quarter.

Instacash is an optional service offered by MoneyLion. Your available Instacash Advance limit will be displayed to you in the MoneyLion mobile app and may change from time to time. Your limit will be based on your direct deposits, account transaction history, and other factors as determined by MoneyLion. See Membership Agreement and help.moneylion.com for additional terms, conditions and eligibility requirements.

Read Also: Will Paypal Credit Report To Credit Bureaus

Moneylion Plus Subscription Service

Launched in December 2017, MoneyLion Plus brings investing, borrowing, and checking accounts into a single, subscription-based, membership. MoneyLion automatically withdraws $79 from a consumer’s account per month, depositing $50 into their investment accounts and taking $29 as a monthly fee. Users get $1 cashback for every daily login, meaning that users who remember to sign on every day and scroll through a few screens essentially get the service for free. Its managed investment account moves saved money into a portfolio of ETFs and does not charge management fees.

Why Do I Need A Good Credit Score

Lenders will also take note of a great credit score. This gives borrowers two major perks. First, a borrower with a great credit score is more likely to qualify for most loans. Second, theyll get much lower rates than borrowers with less than perfect credit. That means, not only do you have more access to credit with your great credit score, but your cost of borrowing also drastically decreases. Thats especially true for big loans, like a mortgage, that take years to pay off. Those differences in interest rates will really add up!

Luckily, if your credit isnt great yet, it can be. You can apply for MoneyLions program, which helps you improve your credit score while putting some money in your pocket. Most MoneyLion borrowers see a 60-point increase in their score in about 60 days.

Being aware of your credit and finances can help improve your score, too. Check to see what your credit limit is every month, make all your payments on-time, and check any interest rates before accepting new loans so you dont end up with debt you cant afford to pay off.

Investment advisory services provided by ML Wealth, LLC. Investment Accounts Are Not FDIC Insured No Bank Guarantee Investments May Lose Value. For important information and disclaimers relating to the MoneyLion Investment Account, see Investment Account FAQs and FORM ADV. Broker-Dealer may charge a $0.25 withdrawal fee, among other fees. Accounts are subject to an administrative fee of $1 per quarter.

Read Also: Does Loan Me Report To Credit Bureaus

How Long Will It Take To Raise My Credit Score

70% of users saw an increase of 60 points within 60 days of having their loan. To raise your credit by 200 points, it might take several months of monitoring and building your credit profile. Fifteen percent of your credit score is based on the length of time you have had open lines of credit.

Although building credit can be a slow process, having an above-average credit score can guarantee you will get better rates on credit cards, mortgages, auto loans, and more.

What Is A Payday Loan

What is a payday loan, anyway? The conventional description is simple, though it might not be that easy to understand with just one quick glance. A payday loan takes your current income into consideration and disburses an amount of money based on what you could potentially pay back.

Payday loans are often used as a safety net for individuals who could incur more expenses if their bills arent paid. Unfortunately, payday loans keep these individuals in a constant cycle of payday loan borrowing often with no end in sight.

Its important to consider your options before taking any sort of loan, whether its a payday loan or a personal loan.

Read Also: Is 672 A Good Credit Score

Comparing Credit Monitoring Services

Premium credit monitoring service providers charge subscription fees to provide alerts to credit changes. The major credit bureaus tend to focus on identity theft protection while MoneyLion has a Credit Builder service designed to help improve credit.

Heres a quick comparison of credit monitoring services.

| Service | |

| Monthly report from all three credit bureaus Alerts on attempted credit inquiries Identity theft monitoring and | |

| $19.95 per month | Credit file monitoring for all three bureaus Lost wallet assistance Credit report locking Automatic fraud alerts Identify theft insurance up to $1 million |

| Reporting to all three credit bureaus Weekly credit updates on inquiries, score, and other factors Capable of building your credit by 60 points in 60 days Creates a savings plan Convenient app with daily money-saving offers and tips |

As part of MoneyLion Credit Builder Plus membership benefits, you receive weekly updates on the top four factors that affect your credit score positive payment history, credit age, credit utilization, and credit inquiries.

You are also eligible for a Credit Builder loan of up to $1,000. Since theres no credit check requirement, you dont have to worry about a credit inquiry affecting your credit score. In fact, you can get a loan with a low score or no credit profile.

Its never too late to start building your credit and understanding what your credit report means.

Fico Auto Score Vs Regular Fico Score

FICO auto scores are ultimately derived from your regular FICO score. The main difference is that FICO adjusts the calculation based on auto-industry-specific details. In other words, your auto loan payment history will weigh more heavily on your FICO auto score than your regular FICO score.

However, the same factors that influence your regular FICO score, including credit utilization rate, overall payment history, and more, will still affect your FICO auto score.

You May Like: Is 626 A Good Credit Score

Consider A Secured Credit Card

If your credit score is low, you may run into difficulty trying to open a new credit card. You may have to face higher interest rates, and some lenders may reject you altogether.

A secured credit card is a lot easier to qualify for and can actually help you raise your credit score. Secured cards require you to put down a cash deposit in order to access a credit line.

For example, if you open a secured card with $500, youd have a $500 line of credit. The credit card company holds your deposit until youre able to close the card. A secured card works exactly the same as a normal credit card. You make purchases, pay your bill off every month, and the credit card company reports your payments.

Its a win-win for both you and the provider. You get to see an increase in your score and your lender gets to earn interest with less risk. Consider opening a secured card to push your credit to the next level.

How Is Moneylion Regulated

MoneyLion is not a bank but a fintech company, or a so-called neobank, or even a challenger bank. That doesnt mean that its not regulated in fact, according to the SEC, MoneyLion is regulated by the U.S. Security and Exchange Commission and incorporated in the state of Delaware.

ML Wealth LLC, a subsidiary of MoneyLion, which handles your investments, is an SEC-Registered Investment Advisor regulated by FINRA and the SEC.

And MetaBank, MoneyLions partner bank that issues your MoneyLion Debit Mastercard and holds the funds in your RoarMoneySM account, is Member FDIC.

Read Also: Does Speedy Cash Report To Credit Bureaus

Moneylion Loans And Credit Builder

MoneyLion offers a Personal Loan through their Credit Builder Plus Membership Program, with a minimum loan amount of $500 and a maximum of $1,000.

The APR for a Credit Builder Plus loan varies from 5.99% to 29.99%. When you apply for , you will be able to review your loan amount and rate before deciding whether to accept the loan offer.

The minimum credit score applicable for a personal loan is 640, making this a valuable option for borrowers who currently have a lower credit score.

What Is Credit Monitoring

Your credit report paints a picture of how often you pay back loans and credit cards on time.

Each credit bureau has its own data points they use to display a credit score that represents an individuals creditworthiness and ability to repay loans. Credit scores play a significant role in determining whether you can open up more lines of credit.

Credit scores are three-digit numbers ranging from 300-900. While each lender defines a good credit score differently, the average score is around 704 and anything above 670 is decent.

Watching your credit helps you flag suspicious activities, including identity theft. According to reports filed with the FTC, consumers lost $1.9 billion in 2019 to fraud and identity theft. The most common cause of fraud was identity theft. Personal information is extremely vulnerable to data breaches.

Even if you simply google your name, you can find much of your personal information online and publicly available. Once an imposter has access to stolen data like your Social Security number, opening a new credit card is easy.

You can try to monitor your own credit by checking each credit card and loan statement regularly, but that doesnt help you catch accounts opened by hackers.

Once youre monitoring credit, its also important to know how to review your credit report.

Read Also: Does Paypal Working Capital Report To Credit Bureaus

Create A Household Budget

If youve racked up large amounts of debt, its time to direct your finances towards paying off what you owe. This will help boost your credit score and allow you to save money on interest rates and fees.

If you dont already have a household budget, sit down with your finances and create a plan to tackle your debt. Assign a job to every dollar in your paycheck and ration your money as soon as you get your next deposit. Even a single extra payment a month can do wonders when it comes to reducing what you owe.

It helps to visualize where your money is going. MoneyLions RoarMoney bank account features built-in spending tracking tools and automated reports to help you understand your spending habits and find ways to make cutbacks.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: Why Is There Aargon Agency On My Credit Report

What Does The Credit Builder Plus Membership Do

A is more than access to a loan the program teaches you about credit and can help improve your credit score.

With your membership, you may be eligible for a loan of up to $1,000 without a credit check. By making timely payments, your credit score can see a boost of up to 60 points in just 60 days.

Finally, membership helps you keep track of your credit score with updates every week through the MoneyLion app. Youll also get access to 0% APR Instacash advances.

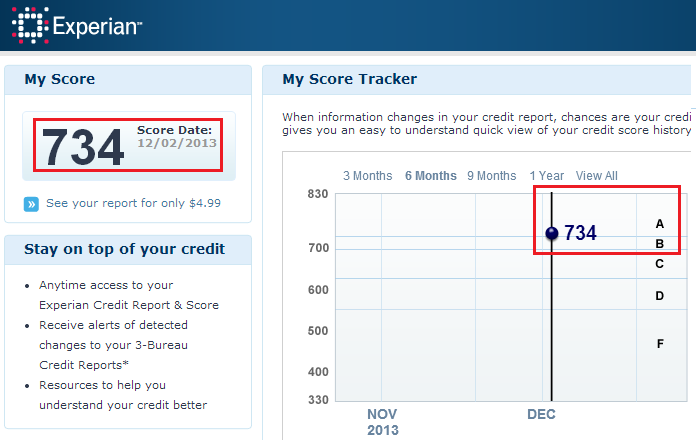

Variations In Your Credit Score

Its possible for your credit score to vary day to day this is normal, and typically not cause for concern. Small actions such as buying groceries with your credit card or paying down your bill by $100 may make your credit score fluctuate.

Its also possible for your across the three credit bureaus. This, too, is a normal occurrence, commonly caused by creditors sending out the same updated credit information at different times. For instance, the bank that services your car loan might report all credit information to Experian at the start of the month, Equifax in the middle, and TransUnion at the end.

Other factors such as whether a creditor uses the FICO® Score vs VantageScore® credit model or errors on your credit report may impact your credit score, too.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

What Is Your Credit Score

Its worth noting that not everyone has a credit score. Some people are credit invisible. But for many, building credit is an essential part of engaging in the modern economic system.

Simply put, your credit score reflects how creditworthy you are. The more creditworthy you are, the more likely a creditor will lend you more money at better interest rates. Your creditworthiness is rated on a numeric scale from 300 to 850, with a score of 670 or higher considered good credit.