How Credit Derivatives Are Assessed

There are several different types of credit derivative instruments. The most widely used credit derivative is called a credit default swap . In The End of the Beginning for the Global Credit Crisis, the authors explained how banks can use CDSs to insure against default of mortgage-backed securities. In a CDS, two parties enter into an agreement whereby one party pays the other party a periodic premium over the life of the contract in exchange for a larger payment should a credit event occur. A credit event is a specified event that materially affects the cash flow of the referenced debt such as bankruptcy or insolvency. If the credit event does not occur, the other party does not have to pay any amount. Essentially, a CDS is a form of financial default insurance.

Pricing credit derivatives accurately is a huge challenge. Pricing credit derivatives is more difficult than pricing other types of derivative instruments such as equity derivatives because the underlying asset for credit derivatives is not a traded security. Furthermore, prior to default, it is difficult to distinguish firms that will default from those that will not. Since credit risk is a matter of probabilities, assessing the probability of bankruptcy is difficult:

How Can A Low Credit Rating Affect My Life

Users Of Credit Ratings

Credit ratings are used by investors, intermediaries such as investment banksList of Top Investment BanksList of the top 100 investment banks in the world sorted alphabetically. Top investment banks on the list are Goldman Sachs, Morgan Stanley, BAML, JP Morgan, Blackstone, Rothschild, Scotiabank, RBC, UBS, Wells Fargo, Deutsche Bank, Citi, Macquarie, HSBC, ICBC, Credit Suisse, Bank of America Merril Lynch, issuers of debt, and businesses and corporations.

- Both institutional and individual investors use credit ratings to assess the risk related to investing in a specific issuance, ideally in the context of their entire portfolio.

- Intermediaries such as investment bankers utilize credit ratings to evaluate credit risk and further derive pricing of debt issues.

- Debt issuers such as corporations, governments, municipalities, etc., use credit ratings as an independent evaluation of their creditworthiness and credit risk associated with their debt issuance. The ratings can, to some extent, provide prospective investors with an idea of the quality of the instrument and what kind of interest rate they should be expecting from it.

- Businesses and corporations that are looking to evaluate the risk involved with a certain counterparty transaction also use credit ratings. They can help entities that are looking to participate in partnerships or ventures with other businesses evaluate the viability of the proposition.

Recommended Reading: Is 779 A Good Credit Score

Essel Propacks Credit Ratings Reaffirmed By Care

CARE has reaffirmed the credit ratings of Essel Propack. The reaffirmed credit ratings are as follows: For long-term bank facilities, rating of CARE AA; for short-term bank facilities, credit rating of CARE A+; for short-term/long-term bank facilities, credit rating of CARE A1+/CARE AA; for non-convertible debentures of the company, the rating is CARE AA.

7 October 2019

Best Paid Credit Monitoring Services

If you want a more comprehensive credit monitoring plan, consider one of the paid plans below. By paying a monthly fee, you’ll get more comprehensive protection, including triple-bureau credit monitoring, extensive fraud alerts and identity theft insurance up to $1 million which aren’t available with free plans.

Also Check: Paypal Working Capital Phone Number

They Help Good Institutions Get Better Rates

Institutions with better credit quality are able to borrow money at more favorable interest rates. Accordingly, this rewards organizations that are responsible about managing their money and paying off their debt. In turn, they will be able to expand their business at a faster rate, which helps stimulate the economys expansion as well.

Nbfc Funding From Securitisation Up 25 Times At Rs26200 Says Icra

In a time of tight liquidity, NBFCs and Microfinance institutions managed to raise around Rs.26,200 crore via securitisation, according to ICRA. The credit rating agency revealed that the growth was 2.5 times higher as against the amount that was secured in FY18 which stood at Rs.9,700 crore. A key reason for the increase in securitisation deals was State Bank of Indias decision to buy portfolios worth Rs.45,000 crore from NBFCs.

The NBFC sector suffered a major setback following the IL&FS crisis in Septembe-October 2018. IL&FS defaulted on several of its loan obligation following which SBI announced that it was buying the portfolios of NBFCs to ease the liquidity situation. As per ICRA, out of the 18-20% of the overall loan disbursements, 37% of loan disbursed in Q3 was mainly due to securitisation. This number is expected to increase to 50% in FY 2019.

Earlier in January this year, a total of 18 NBFC-MFIs, for the first-time pooled assets worth for securitisation, in order to collectively overcome the liquidity issue in the sector quickly. In FY 2018, the securitisation was on account of direct assignment , added ICRA. Vibhor Mittal, Group Head Structured Finance Ratings at ICRA told Business Standard that securitisation is an important funding tool for NBFC-MFIs, but the dependence has been particularly high during the second half of fiscal 2019.

19 April 2019

Recommended Reading: Credit Report Without Ssn Or Itin

Issuers Should Evaluate The Need For Obtaining One Or More Credit Ratings And Develop Appropriate Policies And Procedures For Selecting And Managing Credit Rating Agencies

State and local governments often engage one or more credit rating agencies with respect to the issuance of debt.; A rating reflects the independent opinion of a particular agency on the credit worthiness of the issuer to make timely payments of principal and interest on the debt.; If engaged, a credit rating agency will assign its rating to a particular debt issue and also to all the outstanding debt issued under the same security or credit pledge.; In addition, institutional investors are often restricted from purchasing unrated debt or debt below a certain rating threshold.; Accordingly, obtaining one or more credit ratings may provide a material benefit to an issuers cost of borrowing.

The Government Finance Officers Association recommends that issuers evaluate the need for obtaining one or more credit ratings and develop appropriate policies and procedures for selecting and managing credit rating agencies.

Evaluating the Need for a Credit Rating

If an issuers outstanding debt already has one or more credit ratings, it is common practice to request a new rating on any subsequent debt issued under the same security or credit pledge.; However, some issuers have elected not to have their subsequent debt issues rated.; Issuers should consider the following factors in evaluating the need for a credit rating:

Selecting and Managing Credit Rating Agencies

References:;

A Brief History Of Credit Rating Agencies

provide retail and institutional investors with information that assists them in determining whether issuers of bonds and other debt instruments and fixed-income securities will be able to meet their obligations.

When they issue letter grades, provide objective analyses and independent assessments of companies and countries that issue such securities. Here is a basic history of how the ratings and the agencies developed in the U.S. and grew to aid investors all over the globe.

Recommended Reading: Does Klarna Build Credit

About India Ratings And Research

About India Ratings and Research:;India Ratings and Research is India’s most respected credit rating agency committed to providing India’s credit markets accurate, timely and prospective credit opinions. Built on a foundation of independent thinking, rigorous analytics, and an open and balanced approach towards credit research, Ind-Ra has grown rapidly during the past decade, gaining significant market presence in India’s fixed income market.;

Ind-Ra currently maintains coverage of corporate issuers, financial institutions , finance and leasing companies, managed funds, urban local bodies and project finance companies.;

Headquartered in Mumbai, Ind-Ra has seven branch offices located in Ahmedabad, Bengaluru, Chennai, Delhi, Hyderabad, Kolkata and Pune. Ind-Ra is recognised by the Securities and Exchange Board of India, the Reserve Bank of India and National Housing Bank.;

India Ratings is a 100% owned subsidiary of the Fitch Group.

For more information, visit;www.indiaratings.co.in.

Other Places To Check Your Credit Score

Although other scores arent used as often by lenders, they are still useful for tracking changes to your credit and are offered for free.

If you dont have a credit card or other product that provides free access to your score, it doesnt hurt to track one of the other scores, even though it isnt a FICO score.

You can also use these scores to check if you are making progress on your credit, and if there is a major decline or suspicious activity on your credit report, you can catch it right away. Then, you can at least investigate the activity and fix any issues.

Some of the other credit scores you might want to keep an eye on include the following:

You May Like: How To Check Credit Score Without Social Security Number

What Is A Corporate Credit Rating

A corporate is a numerical or quantified assessment of a company’s creditworthiness, which shows investors the likelihood of a company defaulting on its debt obligations or outstanding bonds.

Corporate credit ratings are issued by rating agencies. A or company helps investors decide how risky it is to invest in a specific country, security, or bond by providing independent, objective assessments of the creditworthiness of companies and countries.

They Warn Investors And Consumers Of Risky Companies

Investors always want to know the level of credit risk associated with lending to a company. Few people would buy a corporate bond unless they believed theres a good chance theyll get their money back. This makes rating agencies important because many people base their investment decisions on the potential risk.

Many consumers also look at the credit rating of insurance companies before buying insurance. If the insurer has poor credit, it might not be able to pay out on a policy as promised.

Also Check: When Does Paypal Credit Report To Credit Bureau

How To Get A Free Credit Report

Order a copy of your credit report from both Equifax Canada and TransUnion Canada. Each credit bureau may have different information about how you have used credit in the past. Ordering your own credit report has no effect on your credit score.

Equifax Canada refers to your credit report as credit file disclosure.

TransUnion Canada refers to your credit report as consumer disclosure.

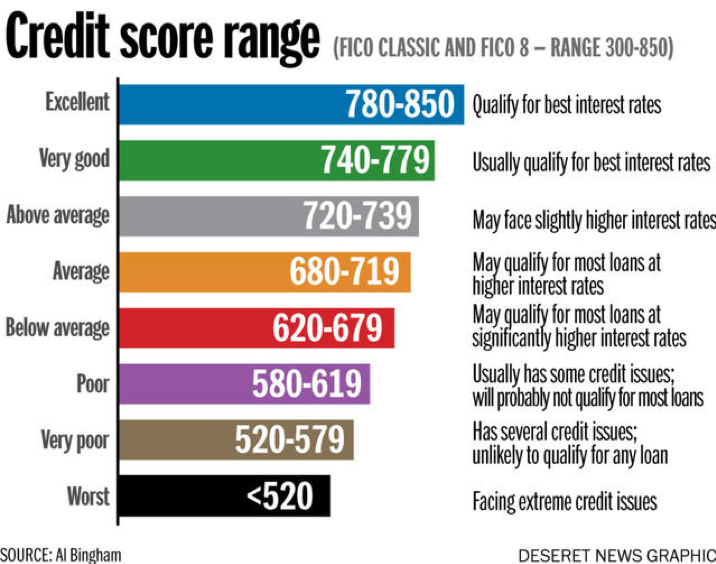

Is Your Fico Score The Most Important Score

Although there are many different scores and numbers floating around, there is one primary score that you should keep an eye on, and thats your FICO score.

If you arent able to access your score with one of the free opportunities, you can also rely on some of the other scoring models to manage your credit and detect any problems right away.

If you are working on improving your credit or maintaining good credit, you can use any of the scoring models that are available and at least, get an idea of where you stand.

However, when you are ready to apply for a credit card, auto loan, or mortgage, it might be a good idea to go with the score most used by lenders and head straight to your FICO score first.

Also Check: Is 739 A Good Credit Score

Telecom Industry Needs To Migrate To Optic Fiber Cable Network Says Icra

ICRA credit rating agency has stated that the Indian telecom industry needs to migrate from traditional copper-based networks to dense optic fiber cable networks as the country has more than a billion mobile phone users. Moreover, the mobile data consumption has recorded a substantial increase in the past two years, added ICRA.

As per the latest numbers, the country has 539 million wireless internet subscribers thanks to the easier availability of affordable smartphones, low data tariffs, increase in speeds of delivery and enhanced content. People in the country are consuming 418,330 terabytes of data. ICRA reported that data consumption is expected to grow further in the long term thanks to the rise in applications, improving technology and more content. As a result, the telecom networks need to be robust and have the capacity to carry large amounts of data and deliver it quickly.

Currently, India has around 5 lakh towers of which only 22% have fiber network, in comparison China has 80%. India has 110 million km of fiber deployed as against 420 million km in the United States and 1,090 million km in China. The credit rating agency estimates the present market value of fiber assets owned by major private telecom operators is about Rs.1.2 lakh crore. The extent of fiber rollout over the next few years will require investments of Rs.2.5 lakh crore to 3 lakh crore.

3 April 2019

Sme Rating Agency Of India Ltd

SMERA established in the year 2005 carries its headquarter in the economic capital of India, Mumbai in Maharashtra. The Credit Rating Agency works in combination as a joint venture with SIDBI that is the collaboration of different private state and national based banks. The Rating Agency also checks credits for Dun and Bradsheet Information Services, SMERA in a period of more than a decade has registered and rated the credits worth 23,000 MSMEs in India.

Recommended Reading: Speedy Cash Credit Check

What Is A Credit Rating Agency

A credit rating agency is a company that reviews the of an entity that is in the process of or has already issued debt. The resulting are used by investors to evaluate whether they should invest in debt securities.

If the agency issues a high credit score, then investors will likely accept a lower effective interest rate on the debt, since there is a reduced risk of default. Since debt issuers pay the credit rating agencies, there is a perceived conflict of interest in their credit scores.

The best-known credit rating agencies are Moody’s, Standard & Poor’s, and Fitch.

The 5 Best Credit Repair Agencies Conclusion

, mainly thanks to many special features like free tiers available today, thanks to fierce competition in this market. Quality companies like Sky Blue Credit offer unrivaled services .

Be sure to do your research on which company to choose before deciding!

Remember that there are many scams out there, and its essential to do your research before deciding on one. An excellent way to start is by reading reviews of the agencies online. You should be informed about what services they offer, how much their packages cost, what others have said about them, and whether or not they provide actual results. For this reason, we constantly offer guides like this one, so make sure to go over one of these because an educated choice can change your life!

Affiliate Disclosure:

The links contained in this product review may result in a small commission if you opt to purchase the product recommended at no additional cost to you. This goes towards supporting our research and editorial team and please know we only recommend high quality products.

Disclaimer:

Talk to us

Please share your story tips by emailing .

To share your opinion for publication, submit a letter through our website . Include your name, address and daytime phone number. Please keep letters to 300 words or less.

Recommended Reading: Why Is There Aargon Agency On My Credit Report

How Does Chinas Social Credit System Work

The program initiated regional trials in 2009, before launching a national pilot with eight credit scoring firms in 2014. It was first introduced formally by then Chinese Premier, Wen Jiabao, on October 20th, 2011 during one of the State Council Meetings. In 2018, these efforts were centralized under the Peoples Bank of China with participation from the eight firms. By 2020, it was intended to standardize the assessment of citizens and businesses economic and social reputation, or Social Credit.Wikipedia

Chinas social ranking system is very much like the Western idea of karma. In China, you are rewarded for being a good person and punished for being bad. There are consequences to your actions in life, including how well youre ranked on societys scale. The rankings arent just based on money or other material things but also ones moral behavior such as volunteering, charity work, good deeds, and even showing up to school/work on time.

Chinas social ranking system is an intricate and complex system that has been set up to rank the population based on their economic, social, political, cultural, and environmental performance. In other words, it ranks people according to how they are performing in society. It determines your place in Chinas new socialist market economy. A Chinese person can have a higher or lower score for different aspects of their life, such as jobs, education level, and personal connections.

Hmmm350? Is that just a coincidence?