Find Out When Your Issuer Reports Payment History

Theres something called a credit utilization ratio. Its the amount of credit youve used compared to the amount of credit you have available. You have a ratio for your overall credit card use as well as for each credit card.

Its best to have a ratio overall and on individual cards of less than 30%. But heres an insider tip: To boost your score more quickly, keep your credit utilization ratio under 10%.

Heres an example of how the utilization ratio is calculated:

Lets say you have two credit cards. Card A has a $6,000 credit limit and a $2,500 balance. Card B has a $10,000 limit and you have a $1,000 balance on it.

This is your utilization ratio per card:

Card A = 42% , which is too high.

Card B = 10% , which is awesome.

This is your overall credit utilization ratio: 22% , which is very good.

But heres the problem: Even if you pay your balance off every month , if your payment is received after the reporting date, your reported balance could be high. And that negatively impacts your score because your ratio appears inflated.

So pay your bill just before the closing date. That way, your reported balance will be low or even zero. This lowers your utilization ratio and boosts your score.

How To Get Extra Help With Your Credit And Debt

If your debt is manageable, consider consolidating it via a personal loan or balance transfer credit card.

In some cases, debt consolidation loans can provide lower interest rates and reduced monthly payments, as long as you qualify and stick to the program terms. With a balance transfer card, you can typically get an introductory 0% APR promotion, during which you can pay down the balance interest-free. Just be mindful not to continue charging on the original card once the balance is transferred.

If your debt feels overwhelming and your credit isn’t good enough to get a balance transfer card or a low-interest personal loan, it may be valuable to seek out the services of a reputable credit counseling agency. Many are nonprofit, and you can typically get a consultation with personalized advice for your situation at no cost.

You can review more information on selecting the right reputable credit counselor for you from the National Foundation for Credit Counseling.

Credit counselors can also help you develop a debt management plan with unsecured debt like credit cards. With this arrangement, you’ll make your monthly debt payments to the credit counseling agency, and it will disburse the funds to your creditors. The agency may also be able to negotiate lower monthly payments and interest rates.

Use Secure Credit Cards

Its also a good idea to use a secured credit card when you can.

These cards require a deposit upfront, which is usually about the amount of the credit limit. You use it typically from there, but these cards are generally better for your score. Youll also need to ensure that you make your credit payments for secure cards on time.

That way, the odds of your credit score steadily increasing are much higher.

Secured v.s Unsecured: The Differences

A secured card needs a deposit before you can start using it, which reduces the risks for creditors, making them a better option for people with lower credit. If you dont pay the credit bill, the issuer can take money from the deposit instead.

Overall, secured cards are suitable for people who need to build their credit. Youll want to have good credit to apply for credit cards, which isnt possible for everyone. Secured cards are a great way to work up to that point.

Unsecured cards dont use a deposit system. However, that means its riskier for lenders. These creditors will be pickier about who they give their cards to. Luckily, building your credit with a secured card shouldnt take more than a year or two.

Once you do that, you can apply for an unsecured card.

Don’t Miss: 824 Credit Score

Never Miss A Repayment

Showing that you can repay on time and stay within the credit limit you’ve been given will help convince lenders you’re a responsible borrower.

Inform your lenders as soon as possible if your debts are proving too difficult to handle. Its better to seek their help than to repeatedly miss loan or credit card repayments with no explanation.

If you are late with a payment or miss one, it will show up on your report within a month. One late payment on a credit card or loan can dent your score by as much as 130 points, according to Experian.

To help people struggling financially during the coronavirus pandemic, lenders have been offering payment holidays of up to three months which shouldn’t impact your score.

A missed payment will show on your report for six years, although its effect will lessen. If youve missed only one payment, your score could start to recover after around six months and should be fully recovered after a year.

Important: Your Credit History Impacts Your Creditworthiness But You Don’t Have A Uniform Credit Score Or Credit Rating

Don’t fall for the misconceptions, as in the UK, there’s no one credit rating or score that is a market-wide judge of your creditworthiness, and there’s no blacklist of banned people.

While individual credit reference agencies may give you a score, that is simply their view of your history, sometimes as a means to sell you that verdict as part of a subscription service.

Yet the agencies just collect data that they share with lenders. It’s lenders that make decisions whether to give you credit and each lender scores you differently and secretly, and their scores are far more important.

Here are our nine other credit rating need-to-knows:

Recommended Reading: 819 Fico Score

Never Miss Or Be Late On Any Credit Repayments It Can Have A Disproportionate Impact

Sounds obvious? Well, it is. Even if you’re struggling, try not to default or miss payments because it can have a disproportionate impact. Doing this once or twice could cause problems that can cost you for years. Defaults in the previous 12 months will hurt you the most.

The easy solution is to pay everything by direct debit, then you’ll never miss or be late. While we normally caution against only making minimum repayments on debts one technique is to set up a direct debit to just repay the minimum, purely as a vehicle to ensure you’re never late. Then manually pay more each month on top.

If you are in difficulties, the cliché “contact your lender” is a good one. Hopefully it will try to help. Changing your repayment schedule is preferable to you defaulting and though it will hit your credit score, it’s better than a county court judgment or decree against you.

The Mogo Visa Platinum Prepaid Card

Fees: None

The Mogo Visa Platinum Prepaid Card allows you to have better control over your spending. Plus, its unique features help you reduce your carbon footprint when you spend. Indeed, Mogo has just launched a new program: for each transaction made with the card, the company will plant a tree. Mogo estimates that each tree absorbs 550 pounds of CO². Like any other prepaid credit card, using your money instead of relying on credit will result in you spending only what you can afford. This card charges no monthly interest and no interest on purchase transactions or the initial purchase of the card. It charges $1.50 for ATM transactions in Canada and $3 for ATM transactions abroad.

The maximum card balance is $10,000 with a maximum single purchase amount of $5,000. You can make up to ten money transfers in a 24-hour period. You can top up your Mogo card via the mobile app or at a Canada Post office. The mobile app will send you balance updates and notifications every time you spend money. An automatic transfer feature is available to help you set how much you want to spend and for how long. This card also offers a Visa Zero Liability feature to protect you against any fraudulent use. You can block your card at any time and order a new one directly through the mobile app. Another cool feature of Mogo is MoneyClass that provides tips and advice on the optimal moves to make with your money.

Don’t Miss: Repo Removed From Credit Report

Open A Secured Credit Card

Having no credit is hard. Having bad credit is harder. A secured credit card can be a worthwhile option for how to build credit fast in either situation.

For the most part, secured credit cards operate just like regular unsecured credit cards. Secured cards report to the credit bureaus the same as any credit account. In fact, the only real difference is that secured cards require a cash security deposit.

Like the security deposit for an apartment, the deposit required by a secured credit card is there just in case. To open a secured card account, you’ll be asked to put down a cash deposit. That deposit lives in a locked savings account while your credit card account is open. As long as you pay your balance in full, the issuer will return your full balance when you cancel or upgrade your secured card.

You’ll make purchases and pay the secured card off every month like any other card. But if you default on your balance — i.e., stop paying — the issuer can close the account and use your deposit to cover its losses.

While this is a common tip for how to build credit fast, going this route is hardly an instant fix. It can take 30 days or more for your new account to be reported to the credit bureaus. If it’s your first credit account, it takes up to six months of credit history to qualify for a credit score.

Not sure which type of credit card to open? Check out our list of the Best Credit Cards For Bad Credit.

Build Credit With A Secured Credit Card

An excellent method for building or rebuilding credit is to create a history of on-time payments. Remember, timely payments account for a whopping 35% of your credit score!

But, what if you cant get a credit card because of poor credit or no credit history? A secured credit card can be just the thing.

To get one, you pay a deposit, which is usually equal to the cards credit limit. Lenders are happy to issue these cards since they take on no risk. They are essentially lending you your own money. It seems silly, but this method allows you to prove your credit-worthy status by building a history of on-time payments.

It will take time to see a big impact on your score, but this type of charge card affects your credit score by building both good habits and good credit history.

Don’t Miss: Does Aarons Help Build Credit

What’s The Fastest Way To Boost My Credit Score

Generally, the best answer for how to build credit fast is to improve your utilization ratio. You can do this by paying down credit card debt. You can also decrease your utilization rate by asking your credit card issuer for higher credit card limits.

If you’re building credit for the first time, being an authorized user is usually the fastest way to boost your credit score. Old accounts with positive payment histories are best for building credit as an authorized user.

Ask For Credit Limit Increase

If your credit limit is increased and you do not make any additional charges, this will help your credit utilization ratio, which in turn will improve your credit score. Ask if you can obtain an increase without the creditor doing a hard credit inquiry which could result in your score dropping down a few points.Here is a list we have compiled of some short-cuts that will help to increase your credit score rapidly. It is up to you to implement them.

Don’t Miss: Ccb/mprcc

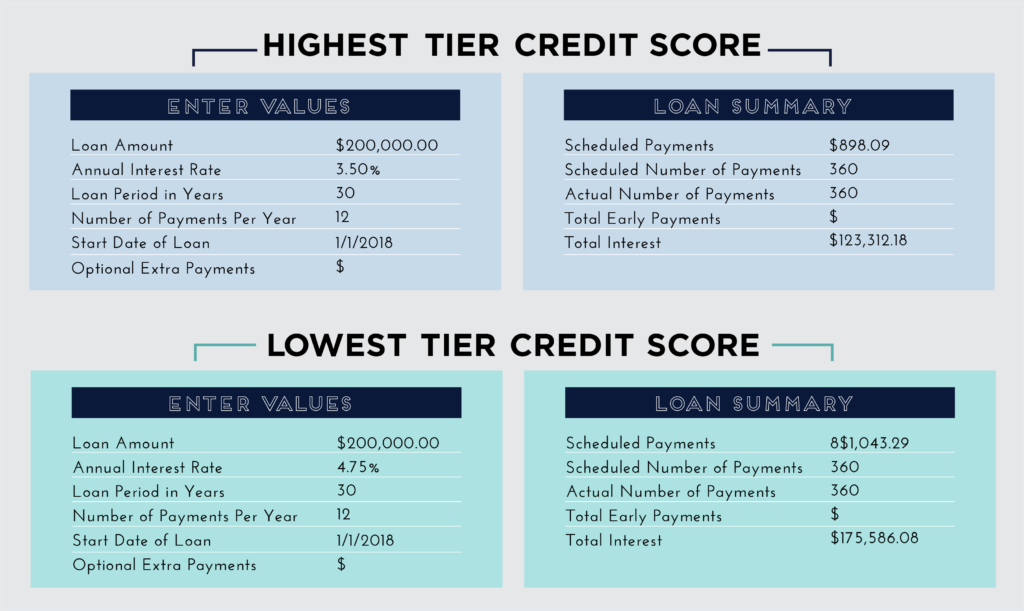

Why Does A Good Credit Score Matter

A good or excellent credit score will save most people hundreds of thousands of dollars over the course of their lifetime. Someone with excellent credit gets better rates on mortgages, auto loans, and everything that involves financing. Individuals with better credit ratings are considered lower-risk borrowers, with more banks competing for their business and offering better rates, fees, and perks. Conversely, those with poor credit ratings are considered higher-risk borrowers, with fewer lenders competing for them and more businesses getting away with criminally high annual percentage rates because of it. Additionally, a poor credit score can affect your ability to find rental housing, rent a car, and even get life insurance because your credit score affects your insurance score.

Check Your Credit Reportson A Regular Basis To Track Your Progress

No matter where you turn for your credit check-in your bank, or one of the major consumer credit bureaus its important to keep an eye on your credit. And if you find any mistakes or inaccuracies, we can help you file a dispute. If your dispute is approved by the credit bureaus, you may see the error corrected as soon as within 30 days, which can help raise your credit scores.

Don’t Miss: Does Paypal Credit Report

Tips To Boost Your Creditworthiness

The better your creditworthiness, the more ways youâll have to get ahead.

We have previoulsy looked at why creditworthiness matters. We learnt that law changes in March 2014 altered what information is collected for your credit fileâand how this âpositiveâ reporting can help you.

But your credit score isnât fixed. Here are our top 10 tips to improve it.

Be Careful When Applying For New Credit

Youll need to be careful when applying to new credit accounts.

Youll probably need to open more accounts to build your credit history, but you dont want to submit a lot of applications at one time. When you do, your credit receives a hard inquiry that can impact your score slightly.

The more inquiries you have, the more they harm your credit score, so youll want to open new accounts carefully. Plus, opening another account lowers the average age of your credit, which can potentially damage your credit score.

Also Check: Can Someone Check Your Credit Without Permission

Deal With Collections Accounts

Paying off a collections account removes the threat that you will be sued over the debt, and you may be able to persuade the collection agency to stop reporting the debt once you pay it. You can also remove collections accounts from your credit reports if they aren’t accurate or are too old to be listed.

Impact: Varies. An account in collections is a serious negative mark on your credit report, so if the collector agrees to stop reporting the account it could help a great deal.

If the collector keeps reporting the account, the effect depends on the scoring model used to create your score. The FICO 8 model, which is most widely used for credit decisions, still takes paid collections into account. However, more recent FICO models and VantageScores ignore paid-off collections.

Time commitment: Medium. You’ll need to request and read your credit reports, then make a plan to handle collections accounts that are listed.

How fast it could work: Moderately quickly. On credit scores that ignore paid collections, such as VantageScore and newer FICOs, as soon as the paid-off status is reported to credit bureaus it can benefit your scores. In other cases, such as disputing a collection account or asking for a goodwill deletion, the process could take a few months.

Option 1 Request A Credit Limit Increase

Another way to reduce your credit utilization ratio if youre carrying high balances is to bump up your credit limits.

For example, if youre carrying $700 in debt on a card with a $1,000 credit limit, your credit utilization is 70%. If youre successful in increasing your credit limit to $2,000, then your utilization rate drops to 35%.

Some issuers make it easy to request a credit limit increase via your online account. For example, Citi allows cardholders to make such a request on the Credit Card Services page:

You can also call the number on the back of your card to make the request. Know that some issuers may conduct a hard pull on your credit before granting you a higher credit line, which can ding your credit score a few points. Your score will recover, but inquire exactly how your request will be handled before you allow them to proceed so you know what to expect.

Note: If youve only had the card a few months, have a history of late payments or are carrying really high balances, your request may be denied until youre seen as a less risky customer.

How much will this action impact your credit score?

The impact a credit line increase could have on your credit score depends on much of an increase you get. If its enough to bring your utilization under 30%, you should see a reasonable increase in your score. However, it wont improve your score as much as paying off your balance and bringing your utilization to or near zero.

Recommended Reading: Credit Report Serious Delinquency

Option 3 Pay Your Card Off With A Personal Loan

A quick way to zero out your credit card debt and boost your credit utilization ratio could be achieved by paying it off with the proceeds from a debt consolidation or personal loan. Personal loans are issued by banks, credit unions and online lenders.

Using a personal loan to pay off high-interest credit card debt has the benefit of giving you a set monthly payment and a set repayment time period. It also reduces your credit utilization, because a personal loan is considered installment credit rather than revolving credit and doesnt count toward your utilization rate.

Plus, having a personal loan as well as a credit card can improve your credit mix, which accounts for 10% of your credit score.

The interest rate for a personal loan typically ranges from 5% to 36%. Note that some lenders may charge fees for example, an origination fee when you take out the loan, or a prepayment fee if you pay the loan off early.

How much will this action impact your credit score?

Applying for a personal loan does generate a hard inquiry, which typically decreases your score anywhere from 5 to 10 points. However, the inquiry will fall off your credit reports in two years and once the loan funds have been used to pay off all or most of your credit card balance, having a decreased utilization rate should improve your credit score significantly.