Can You Get A Personal Loan With A Credit Score Of 591

Very few personal loan lenders will approve you for a personal loan with a 591 credit score. However, there are some that work with bad credit borrowers. But, personal loans from these lenders come with high interest rates.

Its best to avoid payday loans and high-interest personal loans as they create long-term debt problems and just contribute to a further decline in credit score.

To build credit, applying for a may be a good option. Instead of giving you the cash, the money is simply placed in a savings account. Once you pay off the loan, you get access to the money plus any interest accrued.

Fha Home Loans And Dmps

FHA mortgage guidelines do mention consumer credit counseling payment plans, and its OK to be in one and get a home loan if:

- You are at least 12 months into the plan

- Youve made all required payments in full and on time

- You have written permission from the counseling agency

This is nearly identical to the FHAs stance on Chapter 13 bankruptcies, which are actually court-ordered debt management plans.

Cons Of A Credit Card For Fair Credit

- Less-than-friendly terms. As a way to hedge their risk in accepting lesser credit scores, credit cards for fair credit will often come with high APRs and penalizing fees. As a new cardholder, its essential to pay off as much of your balance as possible to avoid the slippery slope of interest payments and extra charges.

- Lack of welcome offers. Though you can find cards that come with a sign-up bonus or a 0% intro APR window, most of the cards here dont feature any sort of bonus incentives to apply.

- Low credit limits. Some cards for average credit will take a bit of time to trust you with a high credit limit. This may hurt your spending power and your , but most card providers will give you a longer leash after displaying the right habits for a bit.

Read Also: Is 603 A Good Credit Score

Credit Score: Good Or Bad

At a glance

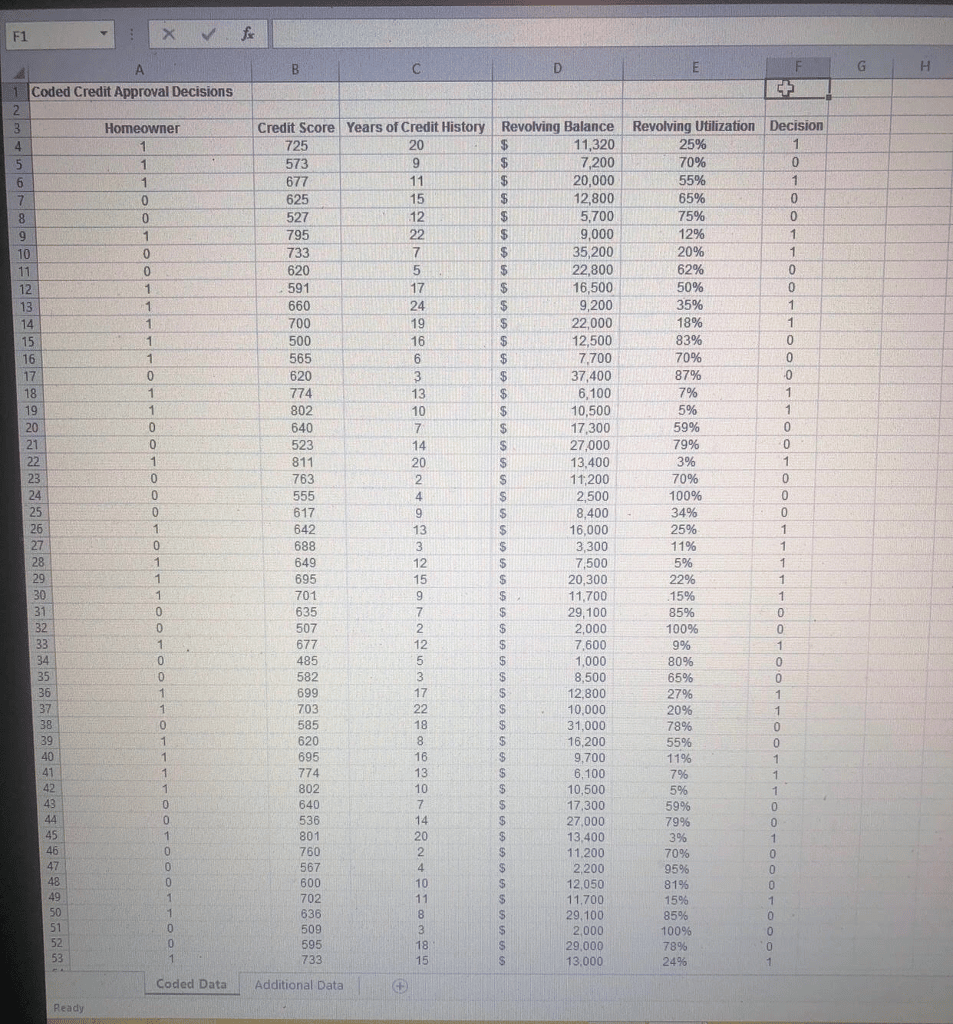

591 is a below-average credit score. Its considered fair or poor by every major credit scoring model. Scores in this range are high enough to get a mortgage, but any loans or credit you’re eligible for will come at relatively high interest rates. Well explain how to get financed with a score of 591 and what you can do to improve your credit score.

Get all 3 credit reports and FICO score monitoring, or book a FREE 5-minute credit repair consultation.

Fresh advice you can trust

We promise to always deliver the best financial advice that we can. Our writers and editors follow strict editorial standards and operate independently from our advertisers and affiliates. Learn more about how we make money.

Steering Clear Of Bankruptcy

Bankruptcy is a highly feared word in the world of finances. Its something that we all hope we will never have to endure the mere thought or possibility of it is enough to make us quiver in fear.

Bankruptcy is definitely not something that should be underestimated. It will be one of the biggest blows not only to your finances, but to your state of mind and well-being as well. Plain and simple, a bankruptcy is something that you want to avoid at all costs. And as you may have guessed, a bankruptcy is not going to look good on your credit report .

But while it is universally acknowledged that bankruptcy is something that you should try to avoid at all costs, there are still many mistaken beliefs that surround how to avoid it, too. A bankruptcy will immediately lead to a huge drop in your credit rating and will be visible on your report for over ten years at least. This means that if your credit score has already fallen thanks to late/missed payments or defaults, with a bankruptcy, things arent exactly going to look so sunny.

What if you are forced to file for bankruptcy? Is it still possible to rebuild your credit?

Yes, it still is. Even though your bankruptcy will be listed on your report for ten years, you can still slowly but steadily rebuild your credit by paying each of your bills when you need to. In this scenario, however, its vitally important that you repay each of those bills without exception.

You May Like: How To Raise Your Credit Score 100 Points

The Most Important Features Of Credit Cards If Your Score Is 500

Searching for a credit card when your credit score is in the 500 zone is different than shopping for credit cards for good credit. The emphasis is far less on factors like rewards points or cash back, travel perks, or a 0% introductory balance transfer offer.

With a score below 500, your main objective is to just get a credit card with the most basic features. The primary purpose is to enable you to either establish or improve your credit score. Only when you can do that will the more attractive credit cards be available to you.

When shopping for a credit card when your FICO score is below 500, the following features are most relevant:

What Does Not Count Towards Your 591 Credit Score

There are many things that people assume go into their 591 credit scores but that actually dont. Examples include how much money you earn, your age, your marital status, your child support payments , how much money you have donated to charity, where you work or live, or your employment history.

None of these things or anything like them do anything at all to your credit score, so instead, focus on the five primary factors that we outlined and discussed above.

Now that you know what counts towards your overall credit score and what does not, you should know exactly what you need to pinpoint in order to enhance your score. For example, maybe one reason your credit score is low is because youve opened several new accounts of credit.

Regardless, its important at this stage for you to positively identify what it exactly is that is lowering your credit rating. Once you have identified what that is, you can start to formulate a plan.

Recommended Reading: What Is A Good Credit Score To Refinance A House

Capital One Spark Classic For Business

Our pick for: Small business

The rewards rate on the Capital One® Spark® Classic for Business isn’t going to wow anyone there’s no sign-up bonus and the APR is high. What makes this card valuable is that it’s available to business operators with fair credit , who don’t have a lot of options in business credit cards and it has no annual fee. Read our review.

By Kenley Young, NerdWallet

Key Things To Know About A 591 Credit Score

- Is It a Good Credit Score? No, 591 is considered a bad credit score.

- What Borrowing Options Are Available? Most borrowing options are available, but the terms are unlikely to be attractive. For example, you could borrow a small amount with certain unsecured credit cards or a personal loan for damaged credit, but the interest rate is likely to be high.

- What is the Best Way to Improve a 591 Credit Score? Apply for a secured credit card and pay the bill on time every month.

Below, you can learn more about what a 591 credit score can get you and, even more importantly, how you can get a higher credit score. To that end, you can also check out your personalized credit analysis to see where you need to improve and exactly how to do it.

You May Like: How To Print Out My Credit Report

How To Improve Your 595 Credit Score

Think of your FICO® Score of 595 as a springboard to higher scores. Raising your credit score is a gradual process, but it’s one you can begin right away.

83% of U.S. consumers’ FICO® Scores are higher than 595.

You share a 595 FICO® Score with tens of thousands of other Americans, but none of them has that score for quite the same reasons you do. For insights into the specific causes of your score, and ideas on how to improve it, get copies of your and check your FICO® Score. Included with the score, you will find score-improvement suggestions based on your unique credit history. If you use those guidelines to adopt better credit habits, your score may begin to increase, bringing better credit opportunities.

Can You Get A Credit Card With A 591 Credit Score

Credit card applicants with a credit score in this range may be required to put down a security deposit. Applying for a secured credit card is probably your best option. However, credit card issuers often require a security deposit of $500 $1,000. You may also be able to get a starter credit card from a credit union. Its an unsecured credit card, but it comes with a low credit limit and high interest rate.

If you are able to get approved for a credit card, you must make your monthly payments on time and keep your balance below 30% of your credit limit.

See also:7 Best Secured Credit Cards

You May Like: How To Remove A Repossession From My Credit Report

Upgrade Cash Rewards Visa

Our pick for: Cash back + flexibility

The $0-annual-fee Upgrade Cash Rewards Visa® is a cross between a credit card and a personal loan, and it can offer the best of both worlds: flexibility, but with predictable terms from month to month. The card also lets you see what terms you’d qualify for before officially applying. And on top of all that, it earns cash back, too. Read our review.

How Long Does It Take To Get A 591 Credit Score

It depends where you started out.

If you have poor credit starting out, this score may be easy to reach, once you remove any bad marks on your credit. Three collection accounts, for example, could drop a 800 credit score well below 600.

If you started out with weak credit , a single negative mark could lower you well below the 500s.

Don’t Miss: What Is My Credit Score Free

The Basis For Your Credit Score

Here’s a more detailed breakdown of the specific factors that influence your FICO® Score:

Public Information: If bankruptcies or other public records appear on your credit report, they can have severe negative impacts on your credit score.

Among consumers with a FICO® Score of 591, the average credit card debt is $5,908.

Payment history. Delinquent accounts and late or missed payments can harm your credit score. A history of paying your bills on time will help your credit score. It’s pretty straightforward, and it’s the single biggest influence on your credit score, accounting for as much as 35% of your FICO® Score.

. To determine your , add up the balances on your revolving credit accounts and divide the result by your total credit limit. If you owe $4,000 on your credit cards and have a total credit limit of $10,000, for instance, your credit utilization rate is 40%. You probably know your credit score will suffer if you “max out” your credit limit by pushing utilization toward 100%, but you may not know that most experts recommend keeping your utilization ratio below 30% to avoid lowering your credit scores. Credit usage is responsible for about 30% of your FICO® Score.

Total debt and credit. Credit scores reflect your total amount of outstanding debt you have, and the types of credit you use. The FICO® Score tends to favor a variety of credit, including both installment loans and revolving credit . Credit mix can influence up to 10% of your FICO® Score.

What Is Considered Fair Or Average Credit

Fair credit, also referred to as “average” credit, is a step up from bad credit but a notch below good credit. It typically means your credit scores fall in the range of 630-689 on a scale that runs from 300 to 850.

Credit scores indicate your level of risk to potential lenders and are based on several factors, including your payment history, the amount of available credit that youre using, how long youve had credit, and more.

There are good credit cards designed for people with fair credit, but you’re unlikely to get approved for the best credit cards until you can improve your credit.

Get your credit score for free

» MORE:

Don’t Miss: What Does A Judgement Mean On Your Credit Report

Who Should Skip A Credit Card For Fair Credit

- The rewards chaser. Cardholders on the hunt for lucrative rates and uncapped rewards should look elsewhere if your credit score allows it. Our best rewards cards come with some exciting offers, and while a fair credit score may not be sufficient, one of the cards here might be the best way to make a top option a future possibility.

- The debt consolidator. If youre someone with outstanding credit card debt that youre ready to tackle, a new card can be a great choice. Unfortunately, most cards for fair credit wont offer the features you need in order to consolidate debt. Instead, a balance transfer credit card gives those in debt a long window with 0% intro APR so they can transfer balances and pay them down while avoiding interest.

- The traveler. There arent any travel redemption options here, so frequent flyers and road trippers looking for award flights, hotel stays and other travel perks should look to travel credit cards. If your credit score doesnt yet allow you to obtain a travel card, a card for fair credit might be item one on the itinerary.

Upgrade Bitcoin Rewards Visa Credit Card

Our pick for: Crypto rewards + flexibility

This card earns rewards in the form of Bitcoin when you pay your bill . It works like a combination of a credit card and a personal loan, allowing you to make purchases and then pay down your balance in equal monthly installments at a fixed interest rate. Read our review.

Read Also: Why Does Credit Score Drop

What Credit Score Do You Need To Buy A House

Your credit score is a very important consideration when youre buying a house, because it shows your history of how youve handled debt. And having a good credit score to buy a house makes the entire process easier and more affordable the higher your credit score, the lower mortgage interest rate youll qualify for.

Lets dive in and look at the credit score youll need to buy a house, which loan types are best for certain credit ranges and how to boost your credit.

Can I Make Balance Transfers With A Secured Credit Card

On most credit cards for people with bad credit, you are able to make balance transfers. Those transfers are complicated by very low credit limits, and the higher interest rates that are typically charged on such transactions. In addition, there is usually a balance transfer fee of at least 3% of the amount transferred.

You May Like: How To Improve Your Credit Report

Why Your Credit Score Matters

There are real benefits to staying on top of your credit score.

Thats because a strong credit score can translate into real perks, like access to a wider range of products and services including loans, credit cards and mortgages. You could also enjoy better interest rates and more generous credit limits. Meanwhile, if your credit score isnt quite where you want it to be, knowing the score is the first step to improving it.

Either way, it pays to know your credit score. Its your financial footprint the way companies decide how financially reliable you are. A higher credit score means lenders see you as lower risk.

Buying A House With Bad Credit

Having bad credit is different than having no credit.

If your low credit score comes from collections, write-offs, and late and missed payments, bad credit will get your loan denied.

If your credit score is low because youve failed to make loan payments on time, or you keep all your credit card balances maxed out, a lender isnt likely to overlook these issues.

Youll probably need to take a year or so and work on improving your credit score before you can get serious about buying a house.

Don’t Miss: How To Add Rental History To Credit Report

How To Establish Or Maintain A Good Score

If you’re trying to build credit from scratch, there are a few ways to get started. The first, and most common, is to open a credit card. That can help you establish an official line of credit and begin building a good credit history, which is reported to the three credit bureaus.

If you’re just getting started, you may not be allowed to open a new card on your own, in which case you could, with permission, use someone else’s. This process is called credit card “piggybacking” and involves becoming an authorized user on someone else’s card: The primary cardholder agrees to add you as a secondary user so you can reap the benefits of good credit.

The card’s payment history then becomes part of your own credit report, NerdWallet explains: “So, even if you were 19 years old and couldn’t qualify for credit on your own, you could have a credit card.”

This method is useful if your goal is to gain experience using plastic, or if you lack enough credit history for a specific goal. It isn’t intended to dispel or rehabilitate poor credit.

Another option: Getting a , which is intended to teach young adults and children good credit habits by allowing them to use a card connected to an adult’s account.

Any misstep on behalf on the junior cardholder is reflected on the adult’s account, though. And charge-offs, late payments and debts sent to a collection agency remain listed for seven years.