Fastest Ways To Improve Your Credit

It’s unlikely you’ll be able to get your credit score to where you want it in just 30 days, but there are some actions you can take that can improve your score more quickly than others:

Again, improving your credit can be a long process, but taking these steps can give you a head start and give you the chance to see improvements early on in the process.

Check Your Credit Report For Errors And Remove Them

According to the Federal Trade Commission, one in five people had errors in at least one of their credit reports. This can be anything from reporting late payments that werent late to including fraudulent accounts in the report, which all can impact your credit score negatively.

Thats why its important to regularly check your credit reports. You can request one free report a year from each of the credit bureaus through annualcreditreport.com. Even more important, if you find anything that is inaccurate or fraudulent, dispute it immediately and have it removed.

What Factors Influence How Long It Takes To Improve Your Credit Score

The amount of time it takes to build your credit score varies, depending on a few factors:

- Length of time youve had credit. If youre just starting out, it may be easier to improve your credit score by doing things like opening a credit card and paying it off responsibly. These things can have a bigger impact if youre new to using credit than if you have a more established credit file.

- Your current credit score. If youre rebuilding your credit score after a dip, itll take longer to rebuild a high credit score back to its former glory than if youd started with a lower credit score.

- Any negative impact and the type. Not all negative marks are created equal. Paying 30 days late wont impact your credit score as much as paying 90 days late, for example. Declaring bankruptcy or going through a foreclosure can also have larger negative impacts on your credit score.

In general, most negative information stays on your credit report for seven years. Chapter 7 bankruptcy can even stay on your credit report for a full 10 years. The good news is that as time passes, the negative impact of these scores will lessen. Its possible that by the time the negative marks fall off of your credit report, theyll barely have an impact.

Also Check: How To Unlock Your Credit Report

Have Rent And Utility Payments Reported

There are unique ways to boost your credit score fast, such as having your rent and/or utility payments reported to the credit bureaus. This raises your credit score without you having to do much of anything, outside of signing up for a service and continuing to make payments on things you’re already paying.

Rent is one of the largest expenses for many people. It only makes sense that your credit score reflects that you keep up with it. Our trusted partner will report your rent payments to the three credit bureaus so you can get the credit you deserve.

How To Improve Your Credit Score

Improving your credit score is a big step on the road to reaching some of life’s big milestones. But first, it helps to know what credit scores are and how they affect your life. Here are the basics:

are three-digit numbers calculated by a variety of different companies. Your score is used by lenders, landlords, phone companies, insurance companies and other creditors to determine how risky it is to do business with you. It can determine whether you can rent an apartment, lease a car, get a cell phone plan, and any number of other things you need and want in life.

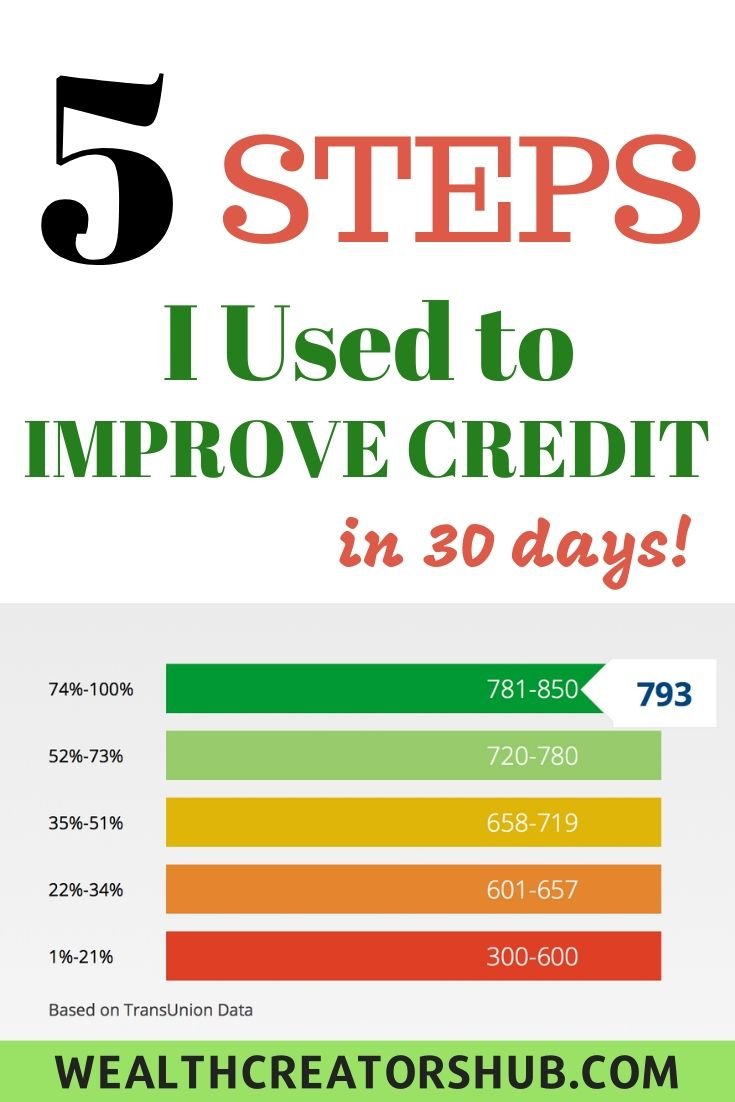

The most common score is FICO , but VantageScore is another popular scoring model. These scores are calculated by the three national credit bureaus: Experian, TransUnion and Equifax. To determine your credit score, they look at a host of factors, particularly your bill-paying history and whether you deal with credit responsibly.

You May Like: When Does Opensky Report To Credit

Open A Secured Credit Card

Having no credit is hard. Having bad credit is harder. A secured credit card can be a worthwhile option for how to build credit fast in either situation.

For the most part, secured credit cards operate just like regular unsecured credit cards. Secured cards report to the credit bureaus the same as any credit account. In fact, the only real difference is that secured cards require a cash security deposit.

Like the security deposit for an apartment, the deposit required by a secured credit card is there just in case. To open a secured card account, you’ll be asked to put down a cash deposit. That deposit lives in a locked savings account while your credit card account is open. As long as you pay your balance in full, the issuer will return your full balance when you cancel or upgrade your secured card.

You’ll make purchases and pay the secured card off every month like any other card. But if you default on your balance — i.e., stop paying — the issuer can close the account and use your deposit to cover its losses.

While this is a common tip for how to build credit fast, going this route is hardly an instant fix. It can take 30 days or more for your new account to be reported to the credit bureaus. If it’s your first credit account, it takes up to six months of credit history to qualify for a credit score.

Not sure which type of credit card to open? Check out our list of the Best Credit Cards For Bad Credit.

Take Advantage Of The 30

Credit scoring models make exceptions when you apply for certain types of loans. For example, if youre trying to get preapproved for a mortgage or a car loan, you can make multiple applications that will be considered one hard inquiry. Lenders know borrowers want to shop around for the best rates, especially when making expensive purchases. Keep in mind that this is only the case if you do all this within a certain timeframe, typically about 30 days.

Read Also: Carmax Auto Finance Rates

Always Check Your Credit Report Information

You can get your credit report from one of the national credit bureaus or personal finance companies like . Knowing your credit information can help you point out what actions have helped or hurt your credit score.

Checking your credit information doesnt hurt your score. Therefore, it would help if you look, to get insights on areas to work on for a credit boost.

How To Boost Your Score

Always make at least the minimum payment by the due date. You can set up payment reminders and automatic payments within your accounts so you never accidentally miss a due date. Just make sure you have enough money in your accounts to cover your bills. Also, check your credit reports at least once a year and correct any inaccurate information.

Recommended Reading: Aargon Agency Hawaii

The Truth About Raising Your Credit Scores Fast

While a lucky few may be in a situation where they can raise their credit scores quickly, the bottom line for most of us is that building credit takes time and discipline, especially if youre trying to rebuild bad credit. Thats because your credit scores are complex and made up of several interconnected factors .

So trust us: While some credit repair agencies may promise to raise your credit scores fast, theres no secret that will help boost your credit scores quickly.

But if you start developing healthy habits now, you can build credit over time all by yourself.

Dont Cancel Old Accounts

Whatever you do, try to maintain your oldest accounts. Older accounts can help improve credit scores since they establish when you first began building your credit history. Length of credit history can help show lenders that you have a long track record of using credit responsibly. That means the older the account is, the better it is to hang on to and not cancel your credit card.

One of the biggest mistakes people make is closing all their old credit accounts. It’s okay to cut up the cards, burn them, and stomp on the ashes , but dont close the account. Credit age makes up 15% of your total credit score and closing old accounts could bring down your score. Even if you never use a line of credit, keeping it open could help mature your credit age over time.

Also Check: What Is Syncb/ppc Credit Card

Do Not Remove Old Accounts From Report

Some people tend to remove old accounts or deactivated accounts or accounts with negative history from their credit report to make it look good. Some even try to get their old debts removed from their reports once they pay them. This may not be a very smart thing to do. Agreed that negative things are bad for the score, but they are automatically removed from the credit report after a period of time. Getting old accounts removed may harm your score a lot as they may have a good repayment history. Also, if you have paid your debts, then you should keep them in your report as they will improve your score and also show your creditworthiness.

Check Your Cibil Report For Mistakes And Rectify Them

In certain cases, CIBIL may make mistakes when it comes to updating your records, note incorrect information against your report, or delay recording details. This will also bring down your score. So, ensure that you check your CIBIL report from time to time. This will help you identify any errors and correct them by submitting a CIBIL dispute resolution form online. As a result, your credit score will improve. You can get your free credit score by simply adding some basic details.

Read Also: Does Care Credit Go On Your Credit Report

Avoid Pay For Delete And Late Payment Adjustments

There are some suggestions for how to improve your credit score in 30 days that, while they look interesting, are less than reputable.

Pay for delete and late payment adjustments are two credit cleanup methods where borrowers ask debt collectors to report information that may not be entirely true to the credit reporting bureaus.

Pay for delete is a process in which a borrower offers to pay the debt they owe only if the creditor will remove the negative account history from their credit report.

Late payment adjustments also known as goodwill letters are letters written by borrowers to lenders asking them not to report late payments.

Both these methods might be a violation of the Fair Credit Reporting Act , which requires fair and accurate credit reporting.

According to the FCRA unfair credit reporting methods undermine the public confidence, which is essential to the continued functioning of the banking system.

Accounts in collections and late payments stay on your credit report for seven years. If you pay off an account in collections, it should be reported as paid collection. If its not, ask your debt collectors to send a letter stating that the debt has been paid in full.

Even if your creditors follow through with pay for delete or late payment adjustments, theres no guarantee it will occur in 30 days.

How Can I Improve My Credit Score

can influence a number of financial matters, such as your ability to successfully get loansand credit, as well as the terms you are offered if your application is successful.

However, they can also be affected by several factors â your repayment history, any currentdebt, and even if you are on the electoral register, could all impact your .

You May Like: Syncb Ppc Closed

How Does Credit Card Balance Impact Your Credit Score

The main idea behind reducing your credit card balance is to keep you well below your limit.

On average if you have utilized between 40-50% of your limit, your score will be below 700 but above 660. However, just making payments to less than 30% of your limit will significantly improve your credit score. On average, a person with a score of 770 has a balance thats between 15-25% of their credit limit.

Sell Unwanted Assets To Generate Quick Cash

If you are planning to improve credit score in 30 days, then, there are a lot payments, that you will be completing. Hence, sell off anything that is unwanted in the house. Simple things such as a garage sale, selling it off to a junk yard, or simply scrapping it would get you decent amount of money.

Don’t Miss: Section 611 Fcra Rapid Rescore

These Two Things Hurt Your Credit Score The Most

One of the most useful features of a credit card is the convenience of paying as well as getting the security. Thanks to these two factors, we have been witnessing a massive growth of credit cards. However, even though credit cards come with the convenience of buy now pay later, you have to make sure to be particular the repayments. A bad repayment history takes a toll on your credit score in a big way. Letâs understand how is your credit score calculated:

⢠35% – Payment History

⢠15% – Age of Credit History

⢠10% – Type of Credit

⢠10% – Credit Inquiries

All the aforementioned factors affect your credit score but the payment history and credit utilisation hamper your credit score the most. Let us now understand how credit cards impact these two factors.

It must be noted that improving your credit score take time and patience and it cannot happen overnight. You have to follow certain discipline and work towards your financial goals to achieve the desired credit score.

Refrain From Spending And Make Important Provisions

The focus should be on smaller, short term accounts, debt and loans. Since these debt are small and short term, they can be paid off pretty quickly, and it also reduces negative reporting. Due to these two reasons, it is essential to focus on such accounts to raise credit score in 30 days.

In the long run, however, larger more essential and important loans have to be managed in a better way. An easy precaution is to make a provision in the bank such as, a fixed or a recurring deposit beforehand. Keep the sum accumulated in the account till the due date of the installment. This way you never fall back on installments, plus you also get a bit of an extra interest. This process, when executed in a very disciplined manner, will help you to get a really good credit score in the long run.

How to raise your credit score, has become a common question after the recession, as unhealthy economic situations led to the fall of reports to some really bad credit score ranges. The best way to come out of such a mess is to have a simple approach to repayment, spend less and borrow thoughtfully.

Also Check: Paypal Credit On Credit Report

How To Build Credit Fast

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Although you can build credit with any credit product, credit cards are usually the easiest and quickest way to establish or improve your . In fact, most of the tips for how to build credit fast revolve around credit cards. Read on for seven simple ways you can build your credit and increase credit score growth.

Reducing The Amount Of Debt You Owe

One good step is to start a debt reduction plan to clear up your financesâand set you on the path to a better score. Start by paying off your high interest rate cards: put all your effort into paying off a higher rate card, while maintaining payments on all other cards on auto pay. Once you’ve paid off the balance, don’t cancel your card! Keep it open, even if you don’t use it, so you can boost your credit utilization.

You May Like: Credco Inquiry On My Credit Report

Making Full Repayments On Time

When you take out credit, missed payments are recorded on your . This may show lenders thatyoure financially stretched, or that youre having difficulty managing debt, which maynegatively affect your chances of applying for credit in the future.

Making your repayments in full and on time can help prove to lenders that you are sensible with yourmoney and can pay back what you borrow. If lenders see evidence that you have previously managed yourcredit accounts well, this may also help improve your .

Heres How Professional Help Will Come In Handy

Youll need to get a written commitment from the collection agency or the creditor that theyll fulfill their end of the bargain payment in exchange for deleting the debt. However, collection agencies and creditors often try and wiggle their way out of the words pay for delete and youll need expert help to ensure the commitment is foolproof.

Once you have a written commitment, make the payment and follow up to ensure that they expunge the record from your credit history. Again, most creditors will only do it if you clear the entire balance. They may also add some extra fees.

You can hack it. But if you take action now!

Also Check: Paypal Credit Card Credit Score

Pay Off Or Consolidate High

Your , which is your total credit card balances divided by the credit limit on your credit cards, accounts for 30% of your FICO Score. If your credit utilization ratio is more than 30%, it may negatively impact your credit score.

If you can make lump-sum payments and bring your overall credit utilization rate below 30%, you might boost your credit score within 30 days.

If youre unable to make large payments, a debt consolidation loan may help. A debt consolidation loan is a personal loan you use to pay off credit card debts. If you’re approved for a consolidation loan large enough to bring your credit utilization ratio under 30%, you may see a credit score increase in 30 days.

The reasons debt consolidation loans help are twofold:

-

A personal loan doesn’t count against your credit utilization ratio

-

A personal loan is an

, which FICO views more favorably than revolving credit, like a credit card

Opening a debt consolidation loan will add a new credit account to your credit report and potentially shorten your credit history. However, the positive impact of improving your credit utilization ratio will likely outweigh the negative of adding a new account and new credit inquiry.

If your credit report is filled mostly with credit cards and other revolving debt, adding a personal loan brings in a new type of credit installment credit and may improve your credit mix. Your credit mix accounts for 10% of your FICO Score.