How Long Do Disputes Stay On Credit Report

If the account reflects the first variation of account disputed,’ then the dispute comment may stay on the credit report indefinitely. However, if a re-investigation is in the process, it indicates the credit bureaus are conducting an investigation and within 30 days, they will either update or remove the account.

A Guide To Credit Report Disputes

Reading time: 4 minutes

- Regularly checking your credit reports can help ensure information is accurate and complete

- If you believe information on your credit reports is inaccurate or incomplete, contact the lender

- You can also file a free dispute with the three nationwide credit bureaus

When reviewing your credit reports, its important to make sure all of the information is complete and accurate. This includes everything from the account information to the other personal information thats on your credit report such as your home address, name, and Social Security number.

Here are some steps you can take to address information you believe is inaccurate or incomplete:

What information can I dispute on my credit reports?

What should I expect after filing a dispute?

Why You Should Never Pay A Collection Agency

On the other hand, paying an outstanding loan to a debt collection agency can hurt your credit score. … Any action on your credit report can negatively impact your credit score – even paying back loans. If you have an outstanding loan that’s a year or two old, it’s better for your credit report to avoid paying it.

Read Also: Does Fingerhut Report To Credit Bureaus

Two: Determine Whether You Should Or Shouldnt Dispute

After youve reviewed a recent credit report, consider the following reasons to dispute items on credit report to help you decide if its worth a shot:

- There is incorrect personal information on your credit report, such as your name or Social Security Number

- There is a negative item that is beyond the statute of limitations for reporting

- The report shows that you carry a debt balance which you have already settled

- There is duplicate information shown on your credit report

- You have a duplicate credit report or mixed information for yourself and another person

- There are fraudulent items on your report, like a new credit card or loan that you did not open or apply for

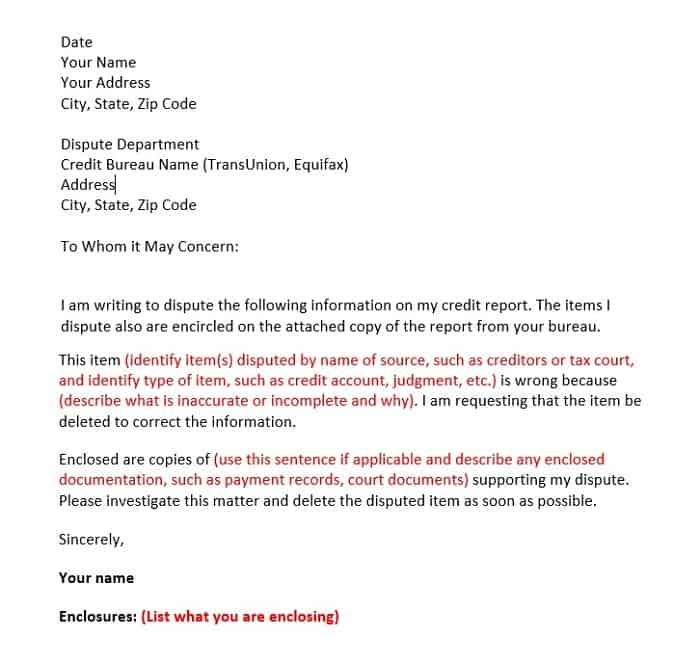

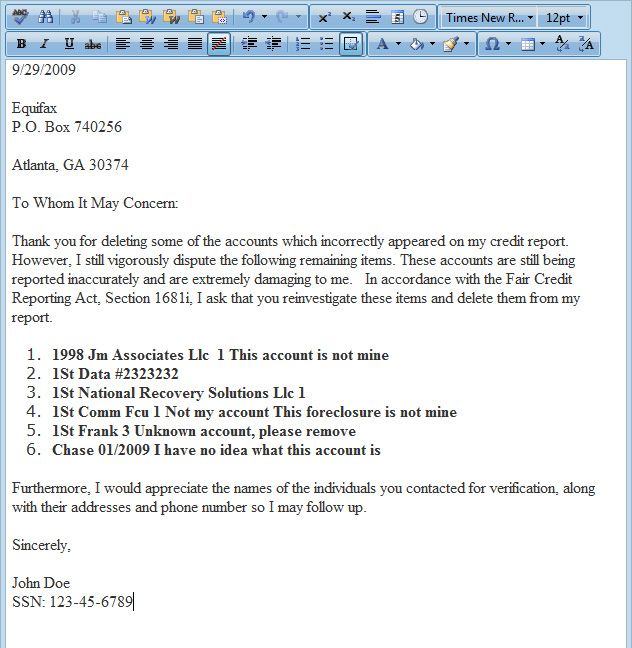

Send A Credit Dispute Letter

The Consumer Financial Protection Bureau recommends that you contact the credit bureaus that are reporting the errors. The best way to do that is in writing. Its important to note that filing a dispute does not hurt your credit scores.

Take a look at our sample dispute letters and follow the instructions. You may also include a copy of your credit report or any other documentation if you think it will help, but its unnecessary.

After the creditor receives notice of a dispute from the credit reporting company, it must investigate, review the relevant information, and report the results back to the credit reporting company.

If the creditor finds inaccurate or incomplete information within the disputed account, it must notify all three credit reporting companies so they can correct the error on your credit report. Occasionally, the creditor simply fails to respond to the credit bureau. In that case, the credit bureau must remove it from your credit report.

You will hear back from the credit bureau about 30 days after they receive the letter. Often you will receive the results of your dispute sooner than that.

Recommended Reading: What Credit Score Do You Need To Buy A Home

Three: Decide Which Credit Dispute Method To Use

File a report with the credit bureau: This is the most common method consumers use to dispute credit reports. Each of the credit reporting bureausExperian, Equifax, and TransUnionhave dispute forms on their website which you can fill out.

Heres where you can find them:

If the error appears across each of the credit bureaus reports, youll need to file a separate report for each. Each of the credit dispute processes vary slightly, but in general, youll need to include the dispute form with an explanation of the error as well as a copy of your report with the same error notated.

Report the error to the furnisher: Another method you can use to dispute a debt on your credit report is to go directly to the sourcethe lender, bank, credit card company, or collection agency that misreported information. When you dispute the item, the furnisher will then be required to report the dispute to each of the credit bureaus, making your job a little easier.

Why Is There An Error On My Credit Report

Checking your credit reports and finding an error can be a frightening experience, though it isnt an uncommon one. The most recent study by the Federal Trade Commission found some 26 percent of participants spotted errors on at least one of their credit reports. You may be wondering how or why an error found its way onto your credit report. There are several reasons why an error may end up on your credit profile, varying from the more benigna creditor that didnt send updated info to the three credit bureaus, for exampleto the severe, like fraudulent activity captured on your credit reports.

Some errors that could have a significant impact on your credit score include:

- Incorrect balances on accounts

- Derogatory marks that are older than seven years

- Incorrect credit limits

- Bills reported as late or delinquent when your account should be in good standing.

Errors on your credit reports that lead to lower credit scores can impact your approval odds for home loans, auto loans and credit cards. Even if you are approved, youll be burdened with higher interest rates. To be sure your credit reports are accurate, check them consistently and quickly dispute any errors.

Recommended Reading: How To Clear A Judgement On Your Credit Report

Consider Suing The Credit Reporting Agency Or Creditor

If you were seriously harmedsay, the credit reporting agency continued to give out incomplete or inaccurate information after you requested correctionsconsider filing a lawsuit. Under the Fair Credit Reporting Act , you may sue a credit reporting agency for negligent or willful noncompliance with the law within two years after you discover the harmful behavior or within five years after the harmful behavior occurs, whichever is sooner. Depending on the violation, you might be able to win actual damages, statutory damages, punitive damages, court costs, and attorneys’ fees.

You might also consider suing the creditor that supplied the inaccurate information. But these types of lawsuits are complicated, and the FCRA provides creditors with many ways to avoid liability. You’ll need to consult a lawyer if you want to pursue this type of lawsuit.

Send Your Dispute To The Credit Bureau

In order to learn how to dispute a credit report and win, youll likely want to include as much information as possible to support your case. That said, youll need to include some items in addition to your dispute claim and your credit report.

Depending on what type of things you want to dispute on your credit report, your case may require different documents. For example, if you are trying to remove a closed account from your score, you might include a record of the closed account with your documents. If you want to dispute a collection amount, you should provide proof of the settled debt or a receipt that shows you made the required payments.

Once you have all of your documents put together, there are a few ways you can approach the dispute process:

- Online: For many, the easiest way to go through the dispute process is by simply uploading your dispute and relative documents online .

- Equifax: 1-866-349-5191

- TransUnion: 1-800-916-8800

Experian

Chester, PA 19016

Don’t Miss: When Do Credit Companies Report To Bureaus

Reasons You May Not Have A Medical History Report

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

Review Your Reports For Mistakes Inaccuracies Items That Shouldn’t Appear

After you get your credit reports, be sure to review them and dispute any inaccurate information you find. If you’re planning to make a big purchase, like a house or a car, or a significant financial commitment, such as refinancing your mortgage, you might want to review information from all three agencies well in advance.

You May Like: What Is My Transunion Credit Score

Get A Free Copy Of Your Credit Report

Its important to check your credit report frequently at the very least annually, if not more often to catch any irregularities early on.

Under federal law, you have the right to obtain a free credit report from all three major once a year. However, because of the pandemic, all three bureaus are offering free weekly reports through the end of 2022.

You can request yours through AnnualCreditReport.com, the only free credit report website authorized by the federal government. Make sure to check your reports from all three bureaus since each one can include different information from creditors and lenders.

You can also request them by:

Phone: 322-8228

Mail: Download, print, and complete the request form and mail to:

Annual Credit Report Request Service

P.O. Box 105281

Other ways to get your credit report

In addition to your annual report, you can request additional free copies if:

- You were denied credit, insurance or employment in the past 60 days based on your credit

- There are sudden changes in your credit limit or insurance coverage

- Youre receiving government benefits

- You’re a victim of identity fraud

- Youre unemployed and/or will apply for employment within 60 days from the date of your request

To request additional copies, contact the bureaus directly. Heres how to do it:

For a more detailed guide on how to request copies, make sure to read our article on how to check your credit report.

Equifax Must Provide Free Copies Of Your Credit Report

A data breach at Equifax in 2017 compromised the personal information of at least 147 million consumers. As part of a court settlement related to the hack in 2020, which was finalized in 2022, everyonewhether they were affected by the breach or notcan get six more free credit reports from Equifax each year for seven years.

Don’t Miss: Do Credit Checks Affect Your Credit Score

Negative Credit Report Entries That Impact Your Score The Most

Most accurate negative items stay in your file for around seven years. Fortunately, their impact diminishes as time goes by, even if they are still listed on the report.

For example, a collection from a few years ago will carry less weight than a recent one especially if there arent any new negative items in your history. Improving your debt management after receiving a derogatory mark can show lenders you’re unlikely to repeat the issue and help increase your score.

These are the most common items that can lower your credit score:

Multiple hard inquiries

Multiple hard credit checks over a short amount of time are a red flag for lenders, as it tells them that you are applying for credit too often and, potentially, being denied.

However, there are some exceptions to this. For example, if youre looking to buy a home and want to compare interest rates between several lenders, you can. FICO and VantageScore, the two most commonly used credit scoring models, give consumers a window of around 14 to 45 to compare rates this is known as rate shopping. All credit inquiries done between this period of time will show up on your file as one item.

Delinquency

Foreclosure

Foreclosure can also cause a credit score to drop substantially. According to FICO, a score can drop up to 100 points from a foreclosure, depending on the consumers starting score. Foreclosures stay on your record for seven years.

Charge-offs

Repossessions

Judgments

Collections

Reporting Suspicious Activity To Chase Bank

You can report fraudulent activities to Chase, but the bank also recommends alerting governmental agencies. Chase works with domestic and international law enforcement authorities to shut down servers sending fraudulent content and arrest responsible parties. To ensure your accounts safety:

Dont Miss: How Long Do Credit Card Inquiries Stay On Your Report

Recommended Reading: Which Credit Report Do Car Dealers Use

How Does A Dispute Affect Your Credit

Filing a dispute has no effect on your credit, although the outcome of a dispute might. If, for example, you successfully dispute a late payment because you actually paid on time, removing that entry from your credit report will likely raise your credit score. Personal information such as a name or address on your credit report won’t impact your credit score, but you may still choose to reach out to the creditors reporting the information to see if they can update it.

Dispute The Information With The Credit Reporting Company

If you identify an error on your credit report, you should start by disputing that information with the . You should explain in writing what you think is wrong, why, and include copies of documents that support your dispute. You can also use our instructions

If you mail a dispute, your dispute letter should include:

You may choose to send your letter of dispute to credit reporting companies by certified mail and ask for a return receipt, so that you will have a record that your letter was received.

You can contact the nationwide credit reporting companies online, by mail, or by phone:

Read Also: A Credit Score Is Based In Part On

What Happens After Heres What To Expect From The 3 Credit Bureaus

You should dispute information on your credit report if you think its not accurate.

Finding a mistake on your credit report can be frustrating. Those errors can have a negative impact on your credit score. Submitting a credit dispute to the reporting bureaus is the first step in the process of correcting inaccurate information and improving your score.

But what comes next? How do credit bureaus fix the error? What effect does a dispute have on your credit score? Heres the whole story on what happens when you submit a TransUnion dispute or a dispute at one of the other credit bureaus.

How do you dispute an inquiry or other negative item on your credit report?

You have the right to a fair and accurate credit report. And you can dispute information on your credit report if you think its not accurate. You can follow steps for DIY or work with professionals to get the job done. Typically, the process starts with a .

What happens after you open a dispute?

While disputed information is being reviewed by a credit bureau, it is not typically labeled as disputed on your credit report. And each of the three credit bureaus has their own process for dealing with disputes. They all reach out to the creditor or entity that provided the information in dispute as part of the investigation.

Experian disputes

+2.76% the agency reaches out to the entity that provided the information. Typically, thats the creditor.

TransUnion dispute

Equifax disputes

Fraudulent Or Unauthorized Credit Card Charges

Follow these steps to dispute a fraudulent or unauthorized credit card charge:

Also Check: Why Do You Need A Credit Report

Also Check: How To Improve Your Company Credit Rating