File A Dispute With The Credit Agency

If you take the time to look at your free yearly Canadian credit report, theres a fair chance youll find some reporting errors. Perhaps a past credit card is listed as delinquent despite the fact that you paid off the entire account, and then closed it.

If you do notice inaccuracies in your credit report, you can challenge it via Transunion or Equifax creditors will have 30 days to respond. Be prepared to furnish proof of your claims if youre right, the incorrect items could be removed from your report entirely.

Follow These Tips To Repair Your Credit And Remove Negative Credit Items

While bad credit can be very difficult to deal with, its not the end of the world. With this handy guide, youll have all the knowledge you need to deal with negative credit items, and improve your credit score!

Got bad credit? Need transportation in Winnipeg or anywhere else in Canada? Come to Ride Time now! If you can give us proof of employment for 3 months, show us a pay stub proving an income of $1,500/month before deductions, and have a valid Canadian licence, we can help you find a fantastic used car for a reasonable rate!

Our network of 15+ lenders specializes in lending to Canadians with sub-par credit. So dont trust anyone else come to Ride Time today, and browse our selection of reasonably-priced, reliable used vehicles now!

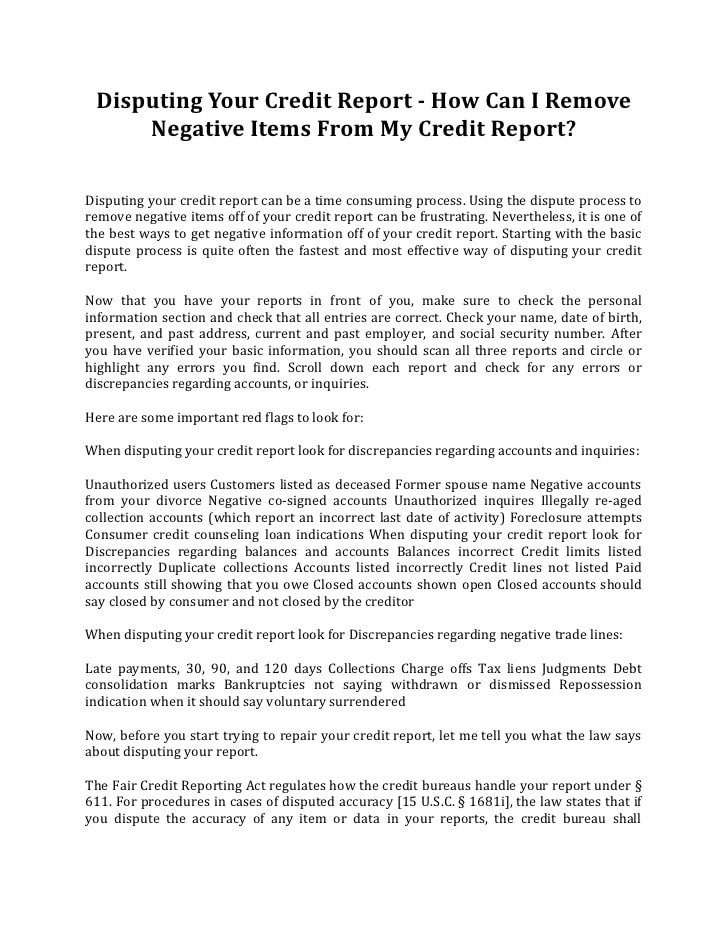

Submit A Credit Dispute Letter

Youll want to write a detailed dispute letter that outlines all the inaccuracies you have found.

You will send this letter to the credit bureaus asking them to correct the inaccuracies or remove the negative information altogether.

The federal Fair Credit Reporting Act requires credit bureaus to report only accurate information on your credit report.

Many times the credit bureaus cant verify each detail about the negative entry, so it has to be removed.

You will have to send the same dispute letter to all three major credit bureaus Experian, Equifax, and TransUnion if the negative information appears on all three of your credit reports.

If this sounds overwhelming, you might want to reach out to a credit expert. It costs some money but is far less expensive than you might think considering you are getting your own lawyer to fight on your behalf.

Read Also: When Does Open Sky Report To Credit Bureau

Consult With A Professional

There are many independent credit repair agencies in Canada. These agencies use the aforementioned techniques along with a deep knowledge of the Canadian credit system to help you remove negative items from your credit score.

However, the buyer should beware there is no guarantee that your credit repair agency will succeed in removing negative items.

If you dont know where to start when rebuilding your credit, it can be a good idea to partner with a credit agency, but make sure you do your research, and pick a Canadian credit repair agency with a history of good outcomes and great customer feedback.

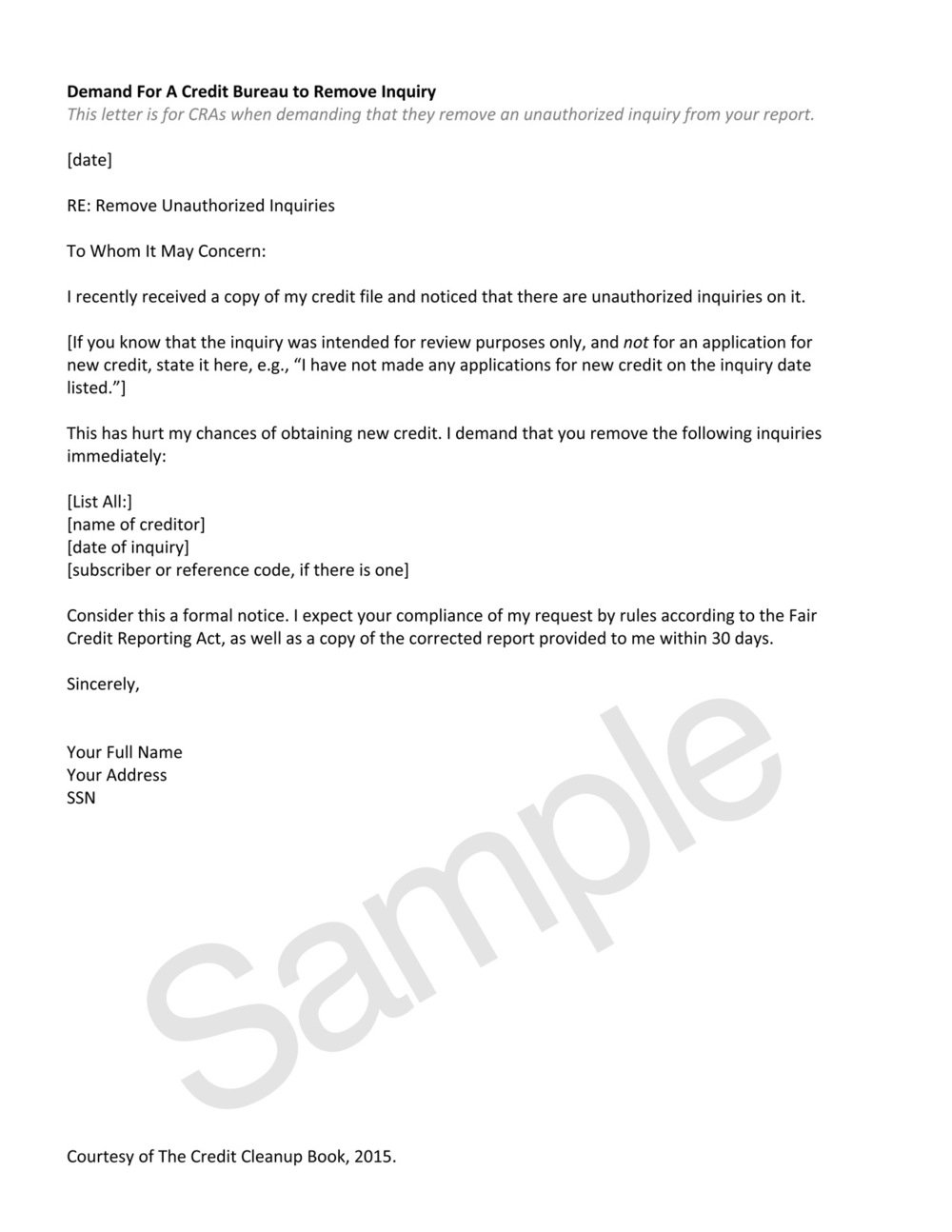

Sample Letter To Remove Bad Credit

Consumers Name

City, State, Zip Code

To Whom It May Concern:

I have reviewed my credit report and am disputing a late payment claim. Attached is the report with the disputed item circled.

The disputed item is an incorrect late payment claim from NAME OF SOURCE. I made the payment on time and attached is a copy of my receipt of payment. I am requesting that this inaccurate information be removed from my credit report.

Enclosed are copies of my payment records for the above NAME OF SOURCE inaccurate late payment and drivers license as proof of identity. Please re-investigate this late payment claim and remove it from my record.

Sincerely,

Read Also: Does Paypal Credit Affect Your Credit Score

How Resolve Can Help

If youre dealing with debt and not sure what to do, were here to help. Become a Resolve member and well contact your creditors to get you the best offers for your financial situation. Our debt experts will answer your questions and guide you along the way. And our platform offers powerful budgeting tools, credit score insights and more.Join today.

Which Credit Report Errors Aren’t Worth Disputing

Small errors that dont affect your score like a misspelled former employer name or an outdated phone number dont hurt anyones assessment of your creditworthiness and aren’t worth disputing.

And sometimes a negative mark might surprise you but is not an error. If its accurate, don’t use the dispute process. Instead, try to resolve the problem directly with the creditor. For example, if you accidentally missed a payment, contact the creditor, arrange to pay up and ask if it will rescind the delinquency so it no longer appears on your reports.

The credit agencies are not obligated to investigate “frivolous” claims.

Recommended Reading: Does Paypal Report To Credit Bureaus

How To Get A Closed Account Off Your Credit Report

Many people close credit accounts they no longer want, thinking that doing so removes the account from their credit report. The Fair Credit Report Actthe law that guides credit reportingallows credit bureaus to include all accurate and timely information on your credit report. Information can only be removed from your credit report if it’s inaccurate or outdated, or the creditor agrees to remove it.

What Is A Charge

When you stop making payments on a debt, the lender may eventually stop trying to collect payments from you. When they choose to do this, they charge off the debt. This means they write the loan off as a loss for the company, cancel your accounts and may report the charge-off to the credit bureaus. The lender is marking your debt as uncollectable.

A charge-off usually only occurs after several months of missed paymentswhen a loan has been delinquent for a while. Experts suggest it takes an average of 120 180 days of missed payments before a lender will proceed to a charge-off. However, the time frame can differ for each lender.

A lender can declare a charge-off for any type of credit loan, including credit cards, auto loans, personal loans, student loans and more.

Its important to note that your debt being charged off doesnt mean its forgiven. Instead, its simply handed to someone else. You still have to pay your debts, and now you have to contend with the consequences of a charge-off on your credit report.

Read Also: What Is Syncb Ntwk On Credit Report

What If You Already Have A Mortgage In Process

Your lender may be able to help you correct your credit history within a few days. Only your lender has access to rapid re-score companies. Its not something you can do on your own. But they can fix problems with your credit report very quickly as long as you can prove the items are wrong or fraudulent.

Use a rapid re-score to qualify for a mortgage

What Will Help Improve Your Credit Score

- Your Payment History: Delinquencies and missed payments hurt your credit score more than most other factors. In fact, the FICO scoring model ranks payment history as most important in your credit profile.

- Your Credit Utilization Ratio: If youre using a lot of your available credit on your credit cards, expect your credit score to suffer. For best results, pay down your credit card balances to 25%. Never exceed 30% of your available credit lines. Often, keeping an account or two open after youve paid them off can decrease your credit utilization ratio and increase your score.

- Other Factors: Keeping a mix of different types of credit a student loan, a couple credit cards, a car loan, and a mortgage, for example will help your credit score some. Limiting new credit applications can help, too.

Developing these good habits will help a lot, but lets be clear: a major negative entry like bankruptcy, foreclosure, or repossession on your credit file will cause bad credit.

The good news: Even if you cant get them removed using the four strategies I outlined above, these negative items on your credit report hurt your score less and less as they age.

So by making good credit decisions now, youre adding positive information to your credit history thats newer than your negative information.

Your good decisions will help your score eventually!

You May Like: Removing Repossession From Credit Report

Get A Free Copy Of Your Credit Report

The Fair Credit Reporting Act promotes the accuracy and privacy of information in the files of the nations credit reporting companies. Monitoring your credit report is a necessary practice to keep in check any negative information. Consumers should obtain their free credit report and review it at least once a year to catch any irregularities on time and keep track of disputed items.

Consumers are entitled by law to a free annual credit report from each of the three main reporting bureaus: Equifax, Experian, and TransUnion, and you can access all three of them through one single website:

AnnualCreditReport.com is the only authorized website through which you can gain free access to your credit report from the three major bureaus. Be wary of other sites that promise the same, as they may have hidden fees, try to sell something, or collect personal information.

| Mail: Download, print, fill out, and mail to: |

| Annual Credit Report Request Service P.O. Box 105281 Atlanta, GA 30348-5281 |

Equifax made headlines in 2017 due to a massive data breach, but it remains one of the top 3 services to get your credit report. The company provides a few different service levels if you want to monitor your credit score monthly . Monitoring packages start at $14.95 per month, and the $19.95 per month options include, ironically, a host of identity-theft protection options.

How Long Can A Debt Collector Pursue An Old Debt

![How to Remove a Bankruptcy from Your Credit Report [See Proof]](https://www.knowyourcreditscore.net/wp-content/uploads/how-to-remove-a-bankruptcy-from-your-credit-report-see-proof.jpeg)

Each state has a statute of limitations about how long a debt collector can pursue old debt. For most states, this ranges between four and six years. These statutes govern the amount of time that a debt collector can sue you, but there is no limit to how long a collector has to try and collect on a debt. If you are being contacted about a debt that you believe is not yours or is outside the statute of limitations, do not claim the debt instead, ask the company to validate that the debt is yours.

You May Like: Does Paypal Report To Credit Bureaus

Wait For The Account To Be Sold To Another Agency And Dispute It

Debt is continually being sold and re-sold from collection agencies. When one collection agency cant get a payment on a debt, they may choose to sell the debt to another collection agency to try and collect.

At this point, the creditor listed on your credit report no longer has your account information, so you can dispute it and may have luck having it deleted.

Request A Goodwill Deletion If You Have Paid The Debt

The first step, if you have paid the collection account, or have been making regular on-time payments, is to mail the collection agency a goodwill letter that explains your situation.

Dont go into too many details, but let the debt collector know if youre trying to buy a house but cant because of the negative information on your credit report.

Then kindly ask the debt collector to remove collections from your credit report out of goodwill.

With some newer scoring models of FICO and VantageScore, they ignore a collection marked as paid, though many lenders still utilize older formulas that will still weigh a paid collection account against you.

If this sounds overwhelming, you might want to reach out to a credit expert.It costs some money but is less expensive than you might thinkconsidering you are getting your own lawyer to fight on your behalf.

You May Like: Does Opensky Report To Credit Bureaus

Getting The Error Corrected

How Long Do Collection Accounts Stay On Your Report

Paid or unpaid collection accounts can legally stay on your credit reports for up to seven years after the original account first became delinquent. Once the collection account reaches the seven-year mark, the credit reporting companies should automatically delete it from your credit reports.

If your collection account doesnt fall off of your credit report after seven years, you can file a dispute with each credit bureau that lists it on your report.

You May Like: What Is Syncb Ntwk On Credit Report

Get Any Agreement In Writing

A pay-for-delete arrangement is legal under the Fair Credit Reporting Act. However, the lender isnt legally obligated to honor the request and remove a charge-off from your account. So, while you may ask for the arrangement, the lender can say no.

For this reason, you want to ensure you get the pay-for-delete arrangement in writing. You should get the details of the arrangement written out on the companys letterhead. This includes the amount youre going to pay, that you wont owe any more after you make the payment and that the creditor intends to remove the charge-off from your credit reports.

How To Monitor Your Credit To Detect Inaccuracies

Along with inaccurate information about you, that debt collectors may report to Experian, Equifax, and TransUnion, you should also lookout for signs of identity theft on your credit reports.

Identity theft happens more and more now as data breaches and scams keep exposing our sensitive financial data.

Heres how to monitor your credit to make sure its in good standing with all three reporting bureaus:

Don’t Miss: How Long Does Repo Stay On Credit Report

Dispute Mistakes With The Credit Bureaus

You should dispute with each credit bureau that has the mistake. Explain in writing what you think is wrong, include the credit bureaus dispute form , copies of documents that support your dispute, and keep records of everything you send. If you send your dispute by mail, you can use the address found on your credit report or a credit bureaus address for disputes.

Equifax

Pay For A Credit Monitoring Service

TransUnion, one of the major credit bureaus, offers a that requires a fee. I have used this service myself.

You can find a lot of other fee-based credit monitoring systems out there.

So why would you pay for credit monitoring when you can get it free?

Paid services have more elaborate tools, but they also have ways to help you recover from identity theft rather than simply detect it.

You May Like: How To Check Credit Score Without Ssn

Write A Goodwill Letter

If disputing the negative entry doesnt work because you couldnt find errors, or because the credit bureaus fixed them, your next step should be asking for a goodwill adjustment.

Write a letter to the original creditor or collection agency and ask them to remove the negative entry from your credit history as an act of goodwill.

This is most effective when youre trying to remove late payments, paid collections, or paid charge offs.

A goodwill letter is really easy to write. You can use my goodwill letter template as a starting point.

You will basically explain your situation to the creditor or collection agency. Explain how youre trying to get a mortgage and the negative entry means youre struggling to get approved.

While this may seem like a long shot, youd be surprised how often creditors make goodwill adjustments. This is especially true if youre a current customer because the creditor wants to keep your business.

This strategy wont work as well if you have a long history of keeping past due balances. It works best if your negative entry is an anomaly and if youve paid off the balance due.

Original Creditor Vs Collection Agency

Sometimes the same debt can appear twice on your credit report, which can multiply its negative impact.

For example, this can happen when the original creditor sells the debt to a collection agency, which then reports the same debt to the major credit bureaus.

When youre struggling to make on-time payments, try to resolve the debt before it goes into collections, if possible.

Many lenders have relief programs, flexible payment options, or even programs allowing you to skip a payment.

If youre already being contacted by a debt collector, its too late to fix the problems with your original creditor.

But you can still resolve the issue using one or more of the options above.

You May Like: Creditwise Score Accuracy