If Warranted File A Dispute With The Corresponding Credit Bureau

If you dispute errors in your credit reports, including unauthorized hard inquiries, the credit bureaus are required to investigate. Theyre also required to correct information thats found to be inaccurate.

You can file a dispute with any of the three major consumer credit bureaus Equifax, Experian and TransUnion that has an inaccurate hard inquiry recorded for you on its corresponding credit report. Credit Karma members can dispute errors on their TransUnion® report through the tool.

You may be able to dispute inquiries online, but consider mailing your dispute. Look for sample credit dispute letters online, like the one available from the Federal Trade Commission, to help you draft your dispute letter.

If the credit bureau in question investigates and finds that the inquiry wasnt authorized, it should remove the inquiry from your corresponding credit report.

Will Crapping Off The Credit Inquiries Help You

As afore-mentioned, hard inquiries can tamper with your score negatively. You, therefore, need to remove them so as to improve your score. Unfortunately, if the hard inquiries are genuine, your score might not improve.

Whats the way out in such a case? After two years, the inquires will automatically get scrapped off. So, wait for the two years to elapse.

What About Inquiries From Fraud

If youve found an inquiry on your credit report that you believe to be fraudulent, submit your request to dispute the fraudulent inquiry with the correct credit bureau and then request for them to place a security freeze or a fraud alert on your account. A fraud alert typically stays on your credit report for six years, while a security freeze will put a stop on any new accounts from opening under your name and prevent inquiries without your permission.

Don’t Miss: 586 Credit Score

Can I Remove An Inquiry From My Credit Report

You cant remove a legitimate inquiry from your credit report.

The only inquires that can be removed from your credit report are those that are incorrect or erroneous, such as if a lender made a hard pull on your credit without proper authorization from you. In these cases, you can submit a request to have the inaccurate details removed from your report.

How long do credit inquiries stay on my credit report?

For a legit credit inquiry, youll usually have to wait three years to have a hard inquiry taken off your credit report though itll only impact your credit score for a few months if you make on-time payments. On the other hand, a soft pull on your credit report can only be seen by you and has no effect on your credit score whatsoever.

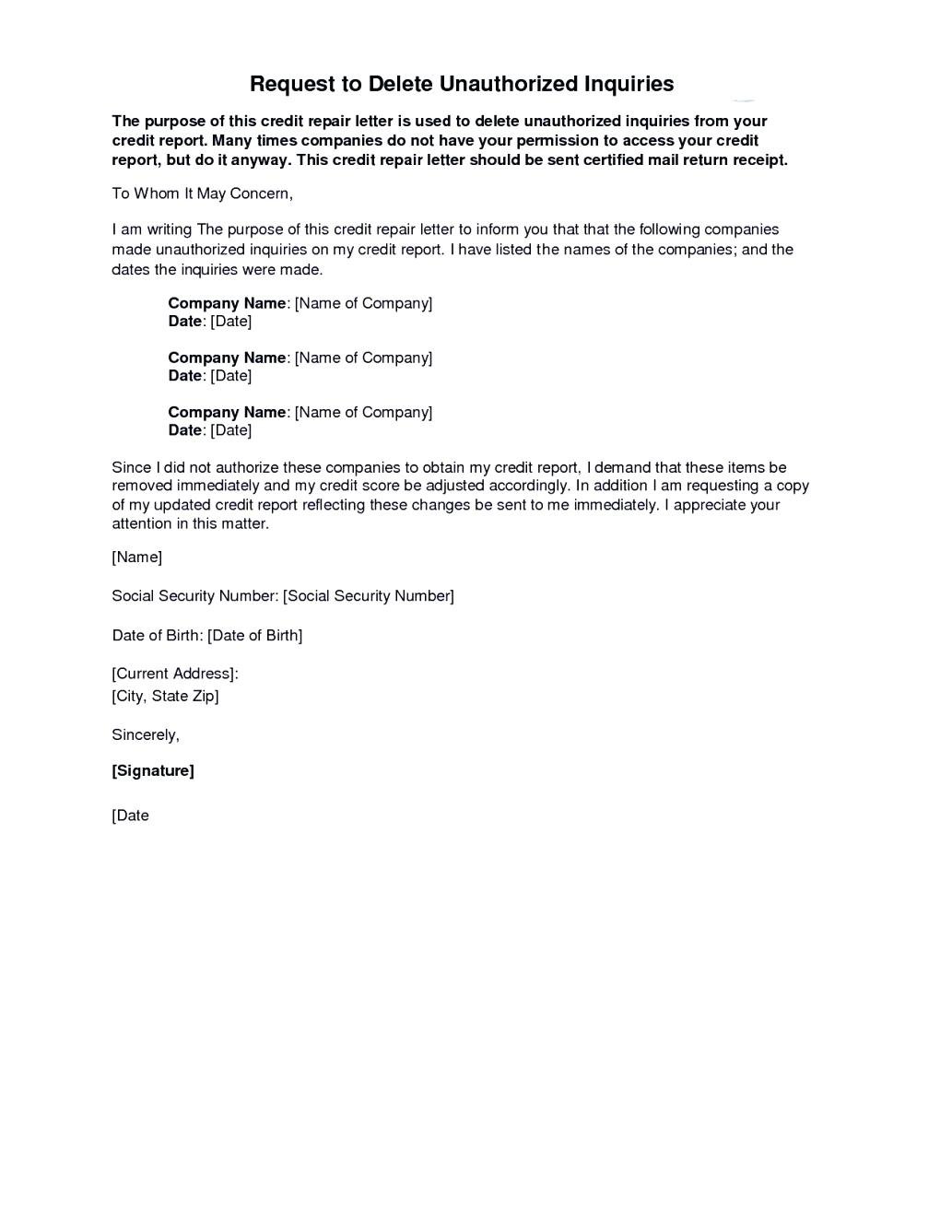

What Is A Credit Inquiry Removal Letter

A credit inquiry removal letter is used to dispute an unauthorized inquiry. It is sent to the credit bureaus to request that a credit inquiry be removed. Once the credit bureaus receive your letter, they are obligated to investigate your claim with the creditor who placed the hard inquiry on your credit report. Under the Fair Credit Reporting Act, the information provider has 30 days to report back to the credit bureau with proof that you authorized the credit inquiry. If they fail to respond or provide proof, the credit inquiry must be removed from your credit report.

Don’t Miss: What Is Cbcinnovis On My Credit Report

How To Find And Evaluate Inquiries

You’re entitled to free credit reports direct from the three major credit bureaus at least once every 12 months. Request them by using AnnualCreditReport.com.

Look over the section labeled inquiries. Youre concerned with hard inquiries, the kind that happen when you apply for credit. Those can cause a small, temporary drop in your score. Soft inquiries, such as when you check your own credit or a marketer screens you for a pre-approved offer, dont affect your score.

Each credit bureau or website presents information in its own way, but all will label any inquiries that might affect your score. If you dont recognize something, its worth investigating. Reasons you might not recognize the entry range from benign to worrisome:

-

A store credit card you applied for may be issued through a financial institution with a different name.

-

Your car loan application may have gone to multiple lenders .

-

Debt collectors are allowed to check credit under the Fair Credit Reporting Act, although most often these are soft inquiries.

-

You may have fallen victim to identity theft and someone is opening fraudulent accounts in your name.

Will Removing Inquiries Increase Credit Score

Removing inquiries will not increase your credit score. The score will not change but there will be other benefits to consider. If the inquiries ended in denial, the creditors will not be able to see that anymore.

Credit seeking behavior is considered to be high risk and an inquiry is a quick way for a creditor to identify whether you are credit hungry or not. The top credit monitoring services can inform you about any suspicious activity. There might be no change in the score but there will be an improvement in the content of the report.

You May Like: What Is Factual Data On Credit Report

What Comes After That

The effect of a hard inquiry on your credit scores is dependent on your particular circumstances. For some, they have the potential to lower scores and make credit qualification more difficult, while for others, they hardly make a difference.

In any case, monitoring your credit reports for unauthorized hard queries is a smart practice. If you discover an illegal or incorrect hard inquiry, you may submit a dispute letter and ask the bureau to delete it from your report.

Unless they decide that your disagreement is baseless, consumer credit bureaus must examine your dispute request. Nonetheless, not all disagreements are resolved following an inquiry. If your credit dispute doesnt work, you can always try a reputable credit repair company that offers a hard inquiry removal service.

How Do Inquiries Affect Your Credit Score

FICO scores range from 350 to 800. It is in your interest to keep your score as close to 800 as possible. Hard pulls will almost always decrease your score temporarily by a couple of points. The extent of this dip will vary based on who you work with though, as many institutions have their own formulas for calculating scores. Once your challenged credit inquiries drop off, you should see an immediate improvement in your score.

Although credit reporting agencies have different methods of calculating your score, they all consider hard pulls and the time frame in which they took place. Nobody wants to discourage the practice of hunting for good deals. If you authorize a couple of different hard pulls for the same type of credit within a few days of each other , this will only count as a single pull. If on your report you notice that you have multiple hard pulls that should have been treated as only one, you can get rid of the extra hard inquiries.

Just because you have a check of a hard nature on your profile, it does not mean you have to take any action against it. In fact, most of the time, you will still be viewed as a trustworthy applicant despite having made a few pulls. Companies know that doing so is just part of everyday life. Where you can run into problems is when these pulls do not seem as though they were conducted in a responsible nature, or if they somehow indicate that you are in distress.

Don’t Miss: What Is Cbcinnovis On My Credit Report

Is It Important To Remove Credit Inquiries

Many people tend to overfocus on removing inquiries when their reports are full of late payments, collection accounts, or even a foreclosure. In these cases, you might want to hold off on your efforts to remove inquiries until after you have successfully removed some of the bigger problems on your credit report. But, if you are tackling your other credit issues, it doesn’t hurt to tackle this problem, too. On a scale from 1 to 10, with 10 being the worst thing on your report, credit inquiries are a mere 1 on the problem scale.

How To Remove A Credit Inquiry From Your Credit Reports

If you’re trying to improve your credit score, check your credit report. If there are incorrect hard inquiries on your credit report, you may be able to get them removed.

If youre wondering how to remove a credit inquiry from your credit report, there are a few points to think about before you start the process.

First, it helps to know there are two types of : hard and soft. Both types of inquiries will appear on your credit report, but hard and soft inquiries are different: Only hard inquiries can affect your credit score soft inquiries dont.

So, when you want to remove an inquiry from your credit report, its the hard inquiries youll be focused on.

Youll be looking for issues like reporting errors or unauthorized hard inquiries which can indicate an identity thief has used your Social Security number or other personal I.D. to determine if you can remove inquiries from your report and whether its worth doing so.

You can seek to remove inaccurate hard inquiries from your credit report by filing a dispute or a credit inquiry removal letter with the three major credit bureaus.

But you cant remove hard inquiries from your credit report if theyre accurate. In these cases, youll have to wait for any accurate information about hard inquiries to fall off your credit report, which usually occurs automatically after two years.

Read Also: How Accurate Is Creditwise Credit Score

How To Monitor Your Business Credit And Personal Credit

Its wise to claim your free credit reports once every 12 months from the consumer credit bureaus. But an annual credit check may not be enough to alert you if a problem arises . Instead, youll be better off checking your credit more frequently perhaps on a quarterly or even monthly basis.

Theres also no law that currently gives you free access to your business credit reports. You can, however, keep a closer eye on your credit historybusiness and/or personalif you sign up for a credit monitoring service.

Some credit monitoring services give you access to one or more of your personal credit reports. Others may allow you to access one or more of your business reports. With Nav, you can review business and personal credit information in one location.

Navs Final Word: Removing Inquiries from Your Report

The best way to prevent inquiries from hurting your credit scores is to apply very carefully, and only for loans or credit cards you think you are likely to get. If you are shopping for a vehicle, for example, get preapproved for a car loan ahead of time from a reputable lender. Dont let the dealership shop your credit application to dozens of lenders unless you want the risk of multiple inquiries on your credit reports.

On the other hand, unauthorized inquiries can be a sign of a serious problem. If you suspect that someone has been applying for new credit in your name or your companys name without your permission, its critical to take action right away.

Look For Any Inaccurate Hard Inquiries

Once youve received your credit report, there will be a section for Hard Inquiries. Youll want to scan over the entire report to make sure its accurate, but pay close attention to the inquiry section. If there are any hard inquiries listed here, make sure that you recognize them.

Its important to note that sometimes the company listed that made the inquiry doesnt match exactly with who you did business with. This often happens if a retailer partners with a bank to manage its credit card program.

For example, while you may have thought you were applying for a card with Victorias Secret or Sportsmans Warehouse, you may have a credit inquiry from Comenity Bank, which manages the credit cards for these two retailers. Thus, you may have to do a bit of Google sleuthing to make sure an inquiry is legitimate.

You May Like: Speedy Cash Credit Check

When Should You Not Focus On Removing Inquires

If your credit score is below 680, it is probably due to prior negative payment history, collections or public records. You would need to address these items first with credit bureau disputes and either debt validation or pay for deletions for collections and engaging creditors for late payments.

Additionally, other factors linked to high credit utilization, the age of your credit accounts and lack of revolving credit may also be suppressing your score

The Difference Between Hard And Soft Inquiries

- Soft inquiries have zero impact on your personal credit score. They only show up on credit reports you check yourself. When a lender pulls your credit report, soft credit checks arent even included.

- Hard inquiries have the potential to impact your credit score in a negative way. But the impact of hard inquiries is typically minor or nearly nonexistent. Although inquiries may stay on your credit report for up to 24 months, they will only affect your FICO Score for 12 months. VantageScore credit scores may consider hard inquiries for even less time than FICO.

Read Also: Speedy Cash Collections

Negative Credit Report Entries That Impact Your Score The Most

Accurate items will stay on the credit report for a determined period. Fortunately, their impact will also diminish over time, even if they are still listed on the report. For example, a collection from a few years ago will bear less weight than a recently-reported collection. If no new negative items are added to the report, your credit score can still slowly improve.

Example Letter For Inquiry Removal

Re: Unauthorized Credit Inquiry

To whom it may concern:

This letter is a request for the removal of unauthorized credit inquiries on my credit report. According to my most recent credit reported dated , there are credit inquiries listed that I did not authorize.

Specifically, I would like to dispute the following inquiries and respectfully request that they be removed from my credit report.

Please remove credit inquiries, which are not authorized, from my credit report within the next 30 days. If possible, please forward a copy of my updated credit report once this step is complete.

Thank you for your help in this matter. It is much appreciated.

Sincerely,

Step 5: Send a dispute letter to the appropriate agency. For each unauthorized hard inquiry, youll need to send a hard inquiry removal letter to the credit bureau that has the item on your record. Make sure you send the letter via certified mail with a return receipt request to ensure they receive it.

Heres a quick reference of the credit reporting agencies addresses:

Equifax

Chester, PA 19016800-916-8800

Step 6: Consider sending your dispute letter online. Not only does this method work faster to remove inquiries, but you can also track the dispute process in real-time via the credit reporting agency dashboard. Dont worry theres no technical skill required for this step! As long as you know the basics of using a computer, youll be able to do this easily.

Recommended Reading: How Accurate Is Creditwise Credit Score

Remember Inquiries Play A Small Role In Your Credit

While recent hard inquiries can hurt your credit scores, theyre generally not the leading reason for having poor credit scores. Removing hard inquiries may increase your credit scores by a few points, but you want to focus on the bigger factors when youre trying to build good credit.

At , we take a holistic approach to credit restoration. We can closely review your credit reports, help remove inaccurate negative information that may be hurting your scores, and guide you on the best ways to build your credit moving forward.

Applying For Business Credit Hard Inquiries

When you apply for a business credit card or business loan, the potential lender will generally check your credit history as part of the application process. Depending upon the type of business financing you apply for, the creditor may want to review your business credit report, personal credit report, or both.

If a lender pulls your personal credit, a hard inquiry will be added to your consumer credit report with Experian, TransUnion, or Equifax. Business credit checks may also be recorded on your business credit reports, like those sold by Dun & Bradstreet, Experian, and Equifax.

Hard credit inquiries might impact your business credit score, depending on the business credit reporting agency and business credit score used. But a hard credit inquiry is typically less important when it comes to business credit scores than it is where your personal credit history is concerned. In fact, many business credit scoring models dont even take inquiries into account.

Recommended Reading: Why Is There Aargon Agency On My Credit Report

What’s In Your Credit Reports

A credit report may include basic information about a consumer’s debts, creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living. The data in the reports from the different credit reporting agencies can vary to some degree, depending on which company produces the report.

What Is A 609 Dispute Letter

Section 609 is a section of the Fair Credit Reporting Act and it speaks about your rights to get copies of your credit reports and information that appears on the credit reports. However, it does not have anything to do with your right to dispute information on the credit reports.

There is no 609 dispute letter in the Act. However, information about the right to dispute information you believe is incorrect is in section 611.

Read Also: How To Get A Bankruptcy Off Your Credit Report