Do Different Types Of Debts Like Medical Collections Get Treated Differently

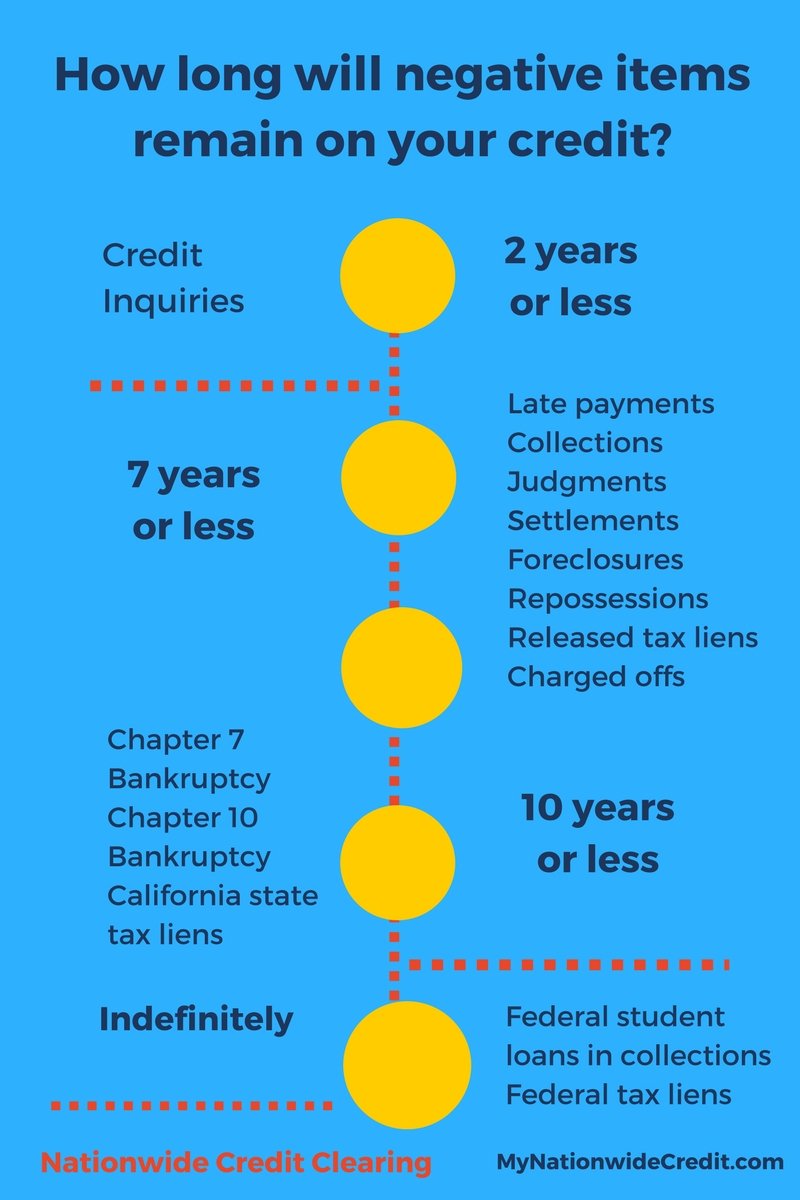

Debts that enter into collections are generally treated the same and play by the same rules. In most cases, theyll all take up to seven years to fall off your credit reports.

However, medical collections do have a few quirks in terms of how theyre reported. As part of the National Consumer Assistance Plan, medical debts wont be reported until after a 180-day waiting period to allow insurance payments to be applied. The credit reporting agencies must also remove previously reported medical collections that have been or are being paid by insurance.

Medical collections may also impact your credit scores differently than other types of collection accounts, depending on the credit scoring model. Thats because newer credit scoring models such as VantageScore 4.0 and FICO® Score 9 de-emphasize the impact of unpaid medical collection accounts on consumer credit scores.

Collection Agencies Dont Always Play By The Rules

Collection agencies can sometimes be pushy, and some may even violate the Fair Debt Collection Practices Act, which prohibits debt collectors from using abusive or deceptive practices in an attempt to collect from you.

If you suspect youre being harassed or treated unfairly, its important to know your legal rights. We recommend consulting with a legal professional as a matter of course, but you can start by checking out our guide to your debt collection rights.

What Are Debt Collection Agencies Vs Credit Reporting Companies

If you have a debt in collection, you are sure to want to know who you are dealing with.

Collection agencies and lawyers who regularly collect debts that are owed to others are categorized by the CFPB as debt collectors. So too are companies that buy past-due debts from other businesses or original, first-party creditors. They are also known as debt buyers and debt collection companies.

Read Also: Is 706 A Good Credit Score

Dont Call The Debt Collections Agency Yet

It may be that you become aware of a collection account either by receiving a phone call or a letter from a collection agency.

If you do, avoid the human inclination to respond or to provide additional information. When collection agencies make contact with consumers, its often a fishing trip.

That is:

They may be trying to tie a debt to you that isnt yours, or to convince you to pay a very old debt thats no longer legally enforceable.

If you receive a letter, dont respond immediately.

And if its a phone call, provide no information whatsoever.

Before contacting the collection agency, first do your homework. Youll need to verify for yourself that the debt is, in fact, your obligation. If its not, but you in any way confirm to the collection agency that it might be, you may be legally obligating yourself to make payment.

Be aware that any time a collection agency calls you the phone conversation is almost certainly recorded.

That recording can be used in court, so be very careful what you admit or agree to.

Can Paying Off Collections Raise Your Credit Score

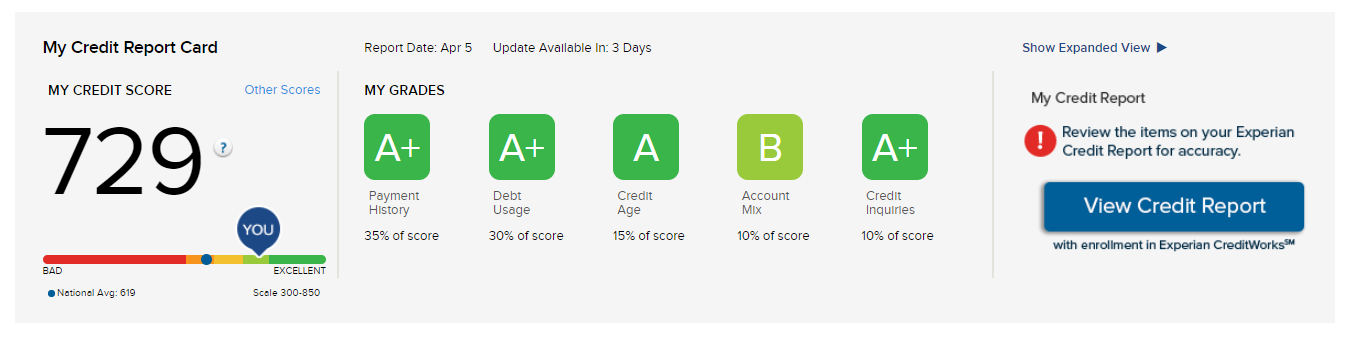

In the past, paid collections on your credit report were treated the same way as unpaid collections. However, FICO has updated its credit scoring to ignore paid collection accounts. Similarly, VantageScore has recently updated its algorithm to ignore paid collections of all types.

With these new updates to the credit scoring models, paying off a collection does now help your credit score. However, since it takes time for new credit scoring models to be rolled out in financial institutions, it may take time for you to see a result when applying for credit.

You May Like: Does Getting Married Affect Your Credit Score

If You Determine The Debt Is Yours

There are a few ways to take care of a debt in collections, including paying it off in full, establishing a payment plan and settling the debt for less than what is owed. If you disagree with the exact amount owed, straighten that out with the debt collector first. Be prepared to provide documentation proving your case.

In all cases, request written confirmation that you have satisfied the debt. Once the debt is resolved, you may be able to remove the collections account from your credit report before the seven-year mark.

How Long Can A Creditor Pursue A Debt In Canada

The straight answer is that a collection agency can try to collect on a debt forever, but they only have a short window to pursue you legally to recover any money. Specifically, a limitation period sets a time limit during which a creditor can commence legal action by filing a claim with the court to collect on a debt.

Canadas base limitation period is six years however, many provinces have lowered that time limit to 2 years.

Is it legal for a debt collector to pursue a 20-year-old debt? Unfortunately, the answer is yes. A collection agency or creditor can try to collect an outstanding debt in perpetuity however, through provincial statutes of limitation, you have a defense against any legal action once the limitation period has expired.

This means that even though a collection agency can continue to call and try to collect the debt, any legal action they might suggest after the time limit is up is an empty threat. Moreover, you have the right to file a complaint with the consumer protection office if you feel that the debt collectors are harassing you.

You May Like: Does Affirm Report To Credit

Removing Negative Items After 7 Years

Check your credit report to learn when negative items are scheduled to be deleted from your credit report. When the seven years is up, the credit bureaus should automatically delete outdated information without any action from you.

You can get at least one free annual credit report each year at AnnualCreditReport.com.

However, if there’s a negative entry on your credit report and it’s older than seven years, you can dispute the information with the credit bureau to have it deleted from your credit report.

The Credit Reporting Life Cycle

When you open a line of credit, its added to your credit report as whats called a trade line. Creditors may report to the three major credit bureaus each month like clockwork, they may send reports intermittently, or they may only report if you make a late payment. If your payment is 31 days late, a creditor may report the skipped payment to the credit bureau.

Typically, theres a certain period of time during which an original creditor will use its own employees and resources to continue to try and collect on a debt. While the time period varies, its standard for businesses to try and collect in-house for 60, 90, 120, or 180 days. After that point, the company charges off the debt, and may turn the debt over to a debt collection agency. On your credit report, the trade line from that creditor will be reported as charged off.

Once the debt collection agency has your account, your debt can be reported in a separate section of your credit report, the public records and collection section. If the third-party collection agency doesnt succeed in collecting the debt, then the original creditor may sell your debt to a debt buyer. A debt buyer may purchase thousands of accounts for pennies on the dollar. Once a debt buyer purchases the debt, it can again be reported in the trade line section of your credit report.

Also Check: What Credit Score Do You Need To Rent An Apartment

Do Your Research & Check All Credit Reports

To get details on your collection account, review all of your credit reports. You can do this by visiting AnnualCreditReport.com. Normally, you can only get one free copy of each report annually. However, due to the Covid-19 pandemic, you can check your reports from all three credit bureaus for free weekly until April 20, 2022.

Your credit report should list whether the collection is paid or unpaid, the balance you owe and the date of the accounts delinquency. If you dont know who the original creditor is and its not listed on your report, ask the collection agency to give you that information.

Afterward, compare the collection details listed on the credit report against your own records for the reported account. If you havent kept any records, log into the account listed to view your payment history with the original creditor.

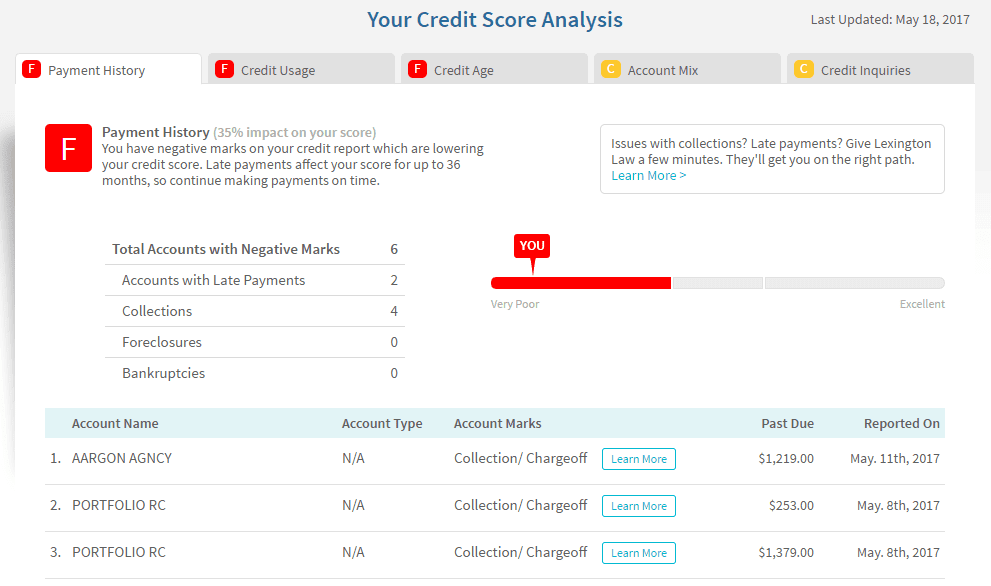

How Much Do Collections Affect Your Score

Although there’s no formula to calculate how much a collections account affects your credit score, it’s important to know there is little difference between a paid collection account and those that remain unpaid regarding your credit score.

In fact, paying old collections accounts can activate them again and further impact your score. If you want to remove a collections account for the purposes of borrowing, check with your lender to find out the best approach for your loan approval.

The type of debt does play a part in how it affects your score. Medical collections, for instance, are given less weight in the latest FICO scoring models.

Also Check: What Is The Role Of Credit Rating Agencies

How To Avoid Debt Collections

There are several popular debt reduction strategies, including Dave Ramseys debt snowball method that focuses on paying off outstanding balances in order, small to large, and debt avalanche, which prioritized high interest accounts first. Look into these and other debt payoff strategies to eliminate the possibility of collection actions on overdue accounts.

Another way to avoid collections is to seek out debt consolidation options before you get behind on your monthly payments. This can help you lower interest rates and payments, not to mention avoiding the negative Fico score changes that come from missed payments. Those stay on your credit report for seven years also, though their impact decreases over time.

Taking out a debt consolidation loan and using it to pay off credit card balances wont have an immediate positive effect on your credit report. You might even see a slight after paying off debt in this manner. Be patient. After a few months, your credit score should increase, even if the late payments are still showing on your credit report.

Dont Miss: Chase Sapphire Preferred Score Needed

S To Take When You Receive A Notice That Your Debt Is Transferred To A Collection Agency

If you receive a notice that your creditor will transfer your debt to a collection agency, contact your creditor as soon as possible.

You may be able to:

- pay a portion of the amount or the full amount owed to avoid having the debt transferred to collections

- make alternate arrangements with your creditor to pay back your debt

Recommended Reading: Is 819 A Good Credit Score

What Steps Must Collection Agencies Take Before They Report Debts

Debt collection agencies cannot report a debt to a credit reporting company or credit bureau until they have spoken to you and/or communicated with you in writing. Their choice is to:

- Discuss the debt with you in person.

- Talk to you about the debt by telephone.

- Mail a letter about the debt.

- Send an email or other electronic communication about the debt.

If collection agencies opt to put the information in writing, they must wait a reasonable length of time in case they receive a notification that the letter or electronic message wasnt delivered.

If a collection agency sends you a debt collection validation notice that contains all the required information about the debt, unless you dispute the debt, they can begin the reporting process after the requisite 30 days.

Never Make A Payment On A Time

If the statute of limitations on a collection account expires, under the laws in some states either making a payment or acknowledging your debt in writing can restart the statute of limitations.

For example, lets say the statute of limitations in your state is six years. The debt is now considered time-barred. But in year seven, the collection agency contacts you and convinces you to make a partial payment on your debt.

Once you make that payment, the statute of limitations will restart, and the collection agency will be once again able to bring legal action against you for another six years.

If you are persuaded to make a payment on a collection account thats exceeded the statute of limitations in your state, make payment in full.

Otherwise, make no payment at all.

Read Also: Do Removed Collections Show On Credit Report

Wait Until It Falls Off

When the debt in question is legitimate and you cant convince the debt collector to delete it from your report, your only remaining option is to wait. After seven years from the date the account first became delinquent, the collection should fall off of your credit report.

Although this means the collection will continue to impact your credit score its impact will lessen as time passes.

What Is A Credit Report

A credit report is a summary of your credit history. Credit bureaus compile your credit reports based on the information reported to them from your lenders and creditors. Then potential lenders, creditors, landlords, and insurance companies use your credit reports as part of their approval process.

While your credit reports do represent a good portion of your , the information is not saved for the total duration of your credit using life. Your credit information will no longer appear on your credit reports after a certain period of time .

But how long does this credit information stay on your credit report?

Recommended Reading: What Information Can Help Your Credit Rating

If The Collection Hasnt Been Paid Continue Paying On Time

Assuming the steps above dont work, then you want to take measures to prevent further damage to your credit score. You will need to continue paying the debt until the creditor responds to your validation request or until youve paid the entire balance off.

Chances are, you dont have much room in your budget to make extra payments on a debt you didnt expect to go to collections in the first place. In this case, try to make a payment arrangement with the creditor. Pay as much as you can with the frequency that work for your budget.

To make sure the collector doesnt violate any part of the Fair Debt Collection Practices Act ask them to put the payment agreement in writing. Then, be sure to pay according to the agreement.

Also, avoid giving any debt collector direct access to your debit or credit card or even your bank account, as they could withdraw more money than you agree to. Make your payment by check or money order. In some cases, you may be able to pay online.

Use Solosuit To Make Your Debt Validation Letter

SoloSuit can take care of all of this for you. Our Debt Validation Letter is the best way to respond to a collection letter. Many debt collectors will simply give up after receiving it. Just answer a few questions online, and well create your letter for you.

Fight Back with SoloSuit

“You’d be silly not to drop a few bucks and possibly save yourself thousands in the process. I can’t thank you all enough for making an overwhelming situation something handleable.” Daniel

You May Like: How To Repair Credit Score

When Do Debt Collections Fall Off Your Credit Report

The Balance / Theresa Chiechi

Any type of financial account can be sent to a collection agency if you become delinquent on the payments. When an account goes to collections, it will typically also be listed on your credit report and used to calculate your credit score. Unfortunately, debt collections bring down your credit score and can continue to affect it even after you pay off the balance.

Some newer versions of credit scoring calculations dont consider debt collections under $100 and dont ding you as much for medical debt collections. Even so, these blemishes can follow you around for years, hurting your ability to get approved for new credit cards, loans, and other credit-based services.

Thankfully, debt collections wont be on your credit report forever. The Fair Credit Reporting Act requires that debt collections fall off your credit report after seven years. In the past, court judgments against you for debt collection appeared on your credit report as long as an individual state’s statute of limitations. However, the major credit bureaus no longer include these civil judgments in your report.

What Happens To Your Credit Score

Once your creditor transfers your debt to a collection agency, your credit score will go down.

A low credit score means:

- lenders may refuse you credit or charge you a higher interest rate

- insurance companies may charge you more for insurance

- landlords may refuse to rent to you or charge you more for rent

- employers may not hire you

Don’t Miss: What Is A Good Credit Score For My Age

How To Remove Collections From A Credit Report Canada

Note that the tips included here assume that a collections account assigned to you is accurate. If you find a collection account on your Canadian credit report that isnt yours or that has incorrect information, youll want to dispute it with the credit bureau thats reporting the information before doing anything else.

If you want to remove accurate collections from your credit report in Canada, follow these steps:

- Ask for debt validation. Once you are contacted by a debt collector, send them a letter requesting that they validate the debt. Ask them to verify the name of the original creditor, the amount owed and whether the debt is still within the statute of limitations for your province. Debts that are outside the statute of limitations are no longer considered collectable.

- Request pay for delete. Pay for delete is essentially an agreement in which you ask the debt collector to remove a collection account from your credit report in exchange for payment. Whether they agree to this usually depends on how old the debt is, how much is owed and your past account history. Keep in mind that if youre asking for pay for delete, its with the expectation that youll pay the full amount owed, including the original balance as well as interest and any fees charged by the collection agency.